Scott Olson/Getty Images News

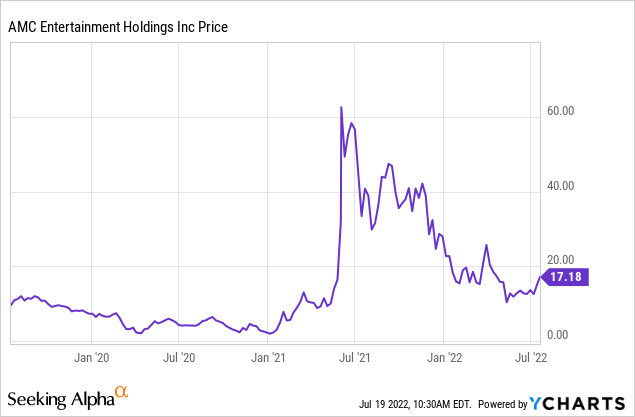

AMC Entertainment (NYSE:AMC) has surged over the last month without any solid business reason that I can see. There are press releases, there are NFTs, calls for a stock split, and a speculative gold mine investment, but the losses continue unabated. “So what,” you say, “it will keep going up because it’s a meme stock!” Not so fast.

AMC is indeed a meme stock, but it’s also a cash-hungry business with more than 17,000 employees on its payroll. AMC now has $10.3 billion in assets and $12.5 billion in liabilities. Under current economic conditions, AMC loses about a billion dollars a year and has a credit rating of ~CCC, depending on the issuer.

From Standard & Poor’s guide to credit ratings.

An obligation (debt) rated ‘CCC’ is currently vulnerable to nonpayment, and is dependent upon favorable business, financial, and economic conditions for the obligor to meet its financial commitment on the obligation. In the event of adverse business, financial, or economic conditions, the obligor is not likely to have the capacity to meet its financial commitment on the obligation.

If you read AMC’s annual report, they only have enough estimated liquidity to last the company through March or so of 2023.

From AMC’s March 2022 10-K:

To remain viable beyond the next twelve months, the Company will require additional sources of liquidity, reductions or abatements of its rent obligations and/or significant increases in attendance levels..

AMC’s underlying business is no longer viable for equity holders. They’ve borrowed money far in excess of what they earn, and most of the assets they do have are illiquid and unprofitable. The reason why AMC is still around is that despite losing money for years on end, the company has been able to borrow money in the junk bond markets and sell stock via equity offerings. Every time the company does this, the position of the equity shareholders gets worse.

But Will AMC Strike Gold?

AMC’s Hail Mary gold mine play with Hycroft Mining (HYMC) is unlikely to yield any actual profit. The obvious question is why a theater chain would be investing $28 million in a gold mine. Why were none of the miners in the industry interested? Then there’s the history of massive share dilution from Hycroft. Hycroft is publicly traded so we would know if their mine’s potential had suddenly skyrocketed. Instead, it appears to have sucked a bunch of investors in after AMC announced they were taking a stake and now is back on the verge of being a penny stock. Never say never, but I haven’t seen anything to make me optimistic.

Can AMC Borrow More Money?

Can AMC sell junk bonds and kick the can down the road to cover ongoing losses? Not really. AMC’s unsecured bonds are now yielding over 21% annualized. Accordingly, this is roughly the market’s view of what AMC would be borrowing for if they went to raise money by selling junk bonds. You can’t run a marginally profitable business paying 21% interest. AMC was able to take advantage of historically easy liquidity conditions in 2021 to give the company new life, but with the Fed hiking rates and market participants enforcing discipline on credit risk as credit spreads widen, there’s no easy out.

Can AMC Sell Equity?

Ideally, if you had a company that was losing a ton of money but an army of meme investors backing you, you could keep your business running indefinitely. But the reason why I don’t think this will work is the same reason that selling junk bonds won’t work. The liquidity surge that we saw in 2021 is done. The Fed is hiking rates, the stimulus is long gone, and jobless claims are starting to rise while companies freeze hiring. Money that would have been used to speculate on meme stocks in 2021 is now going to gas, rent, and food for millions of Americans who participated in the meme stock boom.

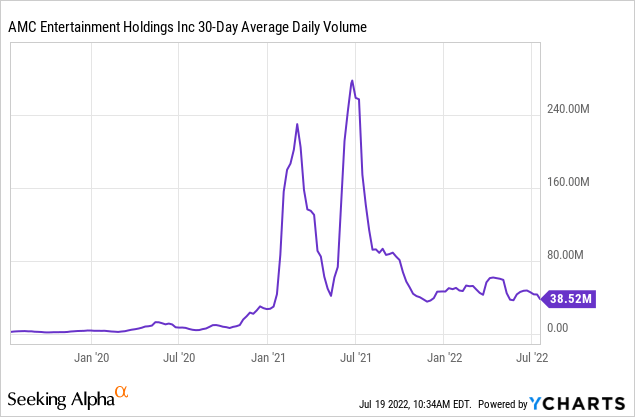

Here I’m using the 30-day average volume as a proxy for retail interest in AMC. As you can see, volume went to the moon during the GameStop (GME) mania of January 2021, and then spiked again in May/June when the Dogecoin (DOGE-USD) and meme craze had its second act.

Volume has steadily fallen since June 2021, and in my opinion, it’s going to keep falling as liquidity drains away. This means that if AMC tries to hit the market with a big equity offering, it’s going to crush the stock. And with massive supply/dilution, AMC could survive for a bit longer, but the stock would go down a lot in the process if the company is forced to flood the market with newly-issued stock.

The Trade

Given compounding business problems and AMC’s deteriorating ability to fix them via selling equity and debt, I think you should short AMC via put options. Since the stock is up close to 40% over the last month while the business situation has gotten worse, you’re getting quite good compensation for doing so.

AMC January 20 ‘2023 puts are the play here. As of my writing this, the asking price is $7.80 and the bid is $7.50. You can put a limit order in the middle and get your trade filled. AMC trades for roughly $17 as of my writing this. Therefore, your option has about $3 of intrinsic value and about $4.50 of time premium. I personally think AMC will trade for under $5 by January on its way to zero, giving you the chance to double your money with upside of nearly 3x in the worst-case scenario.

Your downside is ~$765 if AMC trades above $20 in January (not likely), while your max upside is $2,000 if it trades to zero. You can scale the trade up or down accordingly. This isn’t something to bet the farm on, but there really aren’t many outs for AMC, while put option holders have limited downside and max upside of nearly 3x.

CCC-rated credit means that the company isn’t completely gone yet, and if business conditions dramatically improve, the stock could hang on longer. But the theater industry has been in secular decline for a long time now, and even big box office hits like Top Gun are unlikely to turn things around.

Bottom Line

Fade the rally in AMC stock by buying some put options. You can get into the trade for less than $800 but can scale it up as much as you like. This trade is especially good because it’s likely to be negatively correlated with the long positions in the rest of your portfolio. AMC has held on for years by refinancing debt and raising equity, but with debt prohibitively expensive and trading volume steadily declining in the stock, their only out in my view would be to massively dilute the stock, which would flood the market with freshly-issued AMC shares and push your puts deep in the money. It’s not a 100% probability, but it’s a pretty solid bet.

Be the first to comment