Cristian Martin/iStock via Getty Images

Love it or hate it, there’s no denying that we live in a dangerous world. The activities that many of us engage in have varying degrees of danger to them. For some activities, the level of danger is so significant that it warrants specialized products aimed at reducing our potential exposure to harm. One company that has fared particularly well in this market as of late is MSA Safety (NYSE:MSA). According to management, the company is a global leader in the development and sale of safety products such as its own branded self-contained breathing apparatus, fixed gas and flame detection instruments, fall protection equipment like harnesses, firefighter helmets, and so much more. Although many companies are experiencing a great deal of pain in the current economic environment, MSA Safety is handling the situation quite well. Sales and profits are rising nicely year over year. At the same time, however, the stock is not exactly the cheapest out there. Given where shares are, I do think that upside in the near term is limited. And as such, I have decided to keep the ‘hold’ rating I had on the company previously.

I misjudged this one

Back in September of this year, I wrote an article discussing the investment worthiness of MSA Safety. In that article, I talked about the volatility the company had experienced over the prior few years. Even so, I found myself encouraged by its overall trend for revenue and profits. My ultimate conclusion was that the company should probably do quite well for itself over the long term. But given where shares were priced at the time, I believed that upside was probably limited. Unfortunately, this led me to rate the business a ‘hold’ to reflect my view at the time that shares should generate returns that would more or less match the broader market. Looking back, I believe that I was overly conservative on the company at that time. And so far, the market seems to agree with that. While the S&P 500 is up 7.6% since the publication of the article, shares of MSA Safety have generated upside of 19.7%.

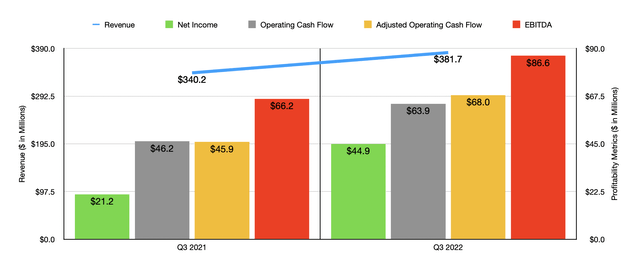

Author – SEC EDGAR Data

In my prior article, we only had data covering through the second quarter of the 2022 fiscal year. Today, that data now covers through the third quarter. During that time, the picture has been quite solid. Revenue in the latest quarter totaled $381.7 million. That represents an increase of 12.2% over the $340.2 million the company generated only one year earlier. Over 100% of this growth came from its Americas operations, with sales they are climbing from $229.1 million to $276.1 million. By comparison, international sales actually dropped by 5.5%. In the Americas segment, the sales increase for the company, totaling 20.5% in all, would have been higher had it not been for foreign currency fluctuations. On a constant currency basis, revenue was actually up by 21.1%. Management attributed this to strong demand and higher pricing for its breathing apparatus and firefighter protective apparel. But due to ongoing supply chain pressures, the company did see some weakness in the portable gas detection side of its operations. It’s also worth noting that as the company is now into the final quarter of the year, it sees strong order growth, with the expectation that backlog should grow further.

This increase in revenue brought with improved profitability. Net income, for instance, more than doubled from $21.2 million to $44.9 million. Other profitability metrics followed suit. For instance, operating cash flow popped up from $46.2 million to $63.9 million. If we adjust for changes in working capital, the increase would have been even greater from $45.9 million to $68 million. Another metric that improved nicely was EBITDA. Based on the data provided, this increased from $66.2 million in the third quarter of 2021 to $86.6 million the same time this year. The company benefited from improvements in its gross profit margin, which rose from 43.9% of sales to 44.4% as price increases more than offset inflationary pressures. Selling, general, and administrative costs actually decreased year over year to the tune of $4.7 million thanks to a combination of foreign currency fluctuations and higher acquisition costs that the company experienced the same time last year. There were also other factors involved here as well, such as a $2 million favorable non-recurring adjustment in the latest quarter.

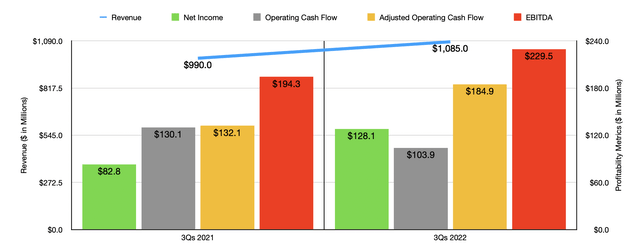

Author – SEC EDGAR Data

For the first nine months of 2022 as a whole, revenue for the company was also positive, coming in at $1.09 billion. That’s 9.6% higher than the $990 million reported the same time last year. For the most part, the firm’s profitability metrics followed suit. Net income, as an example, grew from $82.8 million to $128.1 million. Yes, operating cash flow did worsen, falling from $130.1 million to $103.9 million. But if we adjust for changes in working capital, it would have risen from $132.1 million to $184.9 million. And over that same window of time, we also saw EBITDA expand, rising from $194.3 million to $229.5 million.

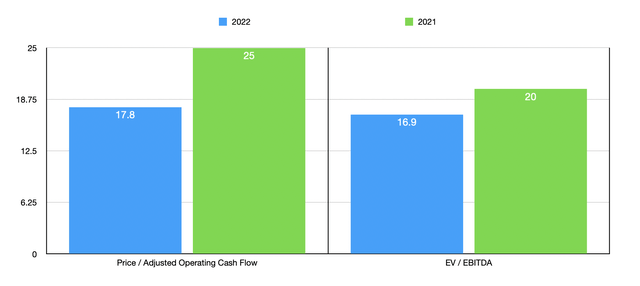

At this time, we don’t really know what to expect for the rest of 2022. But if we annualize results experienced so far, we would anticipate adjusted operating cash flow of $295.6 million and EBITDA of $337.8 million. Based on these numbers, the company is trading at a forward price to adjusted operating cash flow multiple of 17.8 and at a forward EV to EBITDA multiple of 16.9. By comparison, if we were to use the data from the 2021 fiscal year, these multiples would be 25 and 20, respectively. Generally speaking, I like to see how companies are priced compared to similar firms. But this is a particularly tricky enterprise. The category the company fits in largely consists of furniture manufacturers and office supply companies. While I can understand how this might have some similarities to those enterprises, I don’t feel it’s a close enough match to utilize here.

Author – SEC EDGAR Data

Takeaway

Based on all the data provided, I will say that I am currently impressed by how MSA Safety is performing in the current market. I did not think that sales and profit growth would continue like it has. At least not in the near term because of inflationary pressures and reductions in corporate and consumer spending. But from what data we have available, the company is doing quite well. If I could go back in time, I would have rated the company a ‘buy’. Frankly, it is somewhat tempting to do that now. But given how much shares have risen and how they are priced at the moment, I do think now the ‘hold’ rating on it is appropriate.

Be the first to comment