AndreyPopov/iStock via Getty Images

Pests can serve as a nasty nuisance that affects our everyday lives. Whether they be at our home or place of business, or somewhere else entirely, they have the potential to increase the risk of illness and disease, to increase the risk of harmful bites, and more. One company dedicated to addressing the pest issue that can occur anywhere is Rollins (ROL). In recent years, the company has exhibited a steady and positive growth rate on both its top and bottom lines. Ultimately, the firm’s prospects in the long run are likely positive. And over an extended period of time, it likely will create attractive value for its investors. But even such a high-quality business is only worth so much. And at this time, shares of the enterprise look drastically overpriced.

Making money off of pests

The operating history for Rollins dates back to 1964. Since then, the company has expanded into a massive player in the pest control space with operations spread across 70 countries. Through these operations, the company provides pest and wildlife control services and protection against creatures such as rodents and insects, with a special emphasis on addressing termite damage. The company has over 2 million residential and commercial customers spread across the more than 800 locations it operates, with that location count including both company-owned and franchised facilities. When it comes to the franchise side of things, the company has 135 agreements in place domestically, followed by another 103 internationally.

Although the Rollins brand may not be a household name, it’s likely that you have heard of the company’s key brand. This is Orkin Exterminating Company. In addition to that, the company also has other brand names that include HomeTeam Pest Defense, Clark Pest Control, Western Pest Services, Critter Control Wildlife, and Northwest Pest Control. Operationally, meanwhile, the company has three business lines that it manages under its sole operating segment. The first of these is the Residential line, which is responsible for providing pest control services for residential properties. Next in place we have the Commercial line, which provides workplace pest control solutions for customers in markets such as the healthcare space, food service, logistics, and more. And finally, we have the Termite line. Through this, the company provides both traditional and baiting termite protection services, as well as other related services, for both its residential and commercial customers.

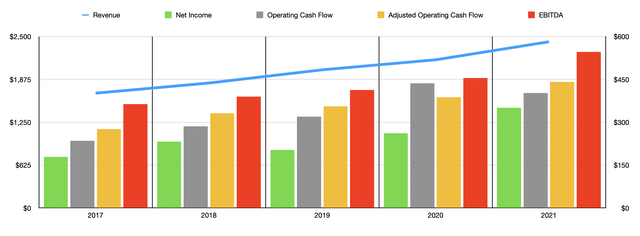

Over the past few years, management has done exceptionally well in growing the business. Between 2017 and 2021, for instance, revenue climbed consistently, rising from $1.67 billion to $2.42 billion. The increase, on an annualized basis, comes out to 9.7%, with growth between 2020 and 2021 registering an impressive 12.2%. The growth in the latest fiscal year was driven by a mixture of all three business lines rising at a similar pace. Residential pest control revenue increased by 13%, while the Termite business line reported a 14% revenue increase. The slowest growth came in the Commercial line, with revenue climbing by 10%. By the end of the company’s 2021 fiscal year, 46% of its sales came from its Residential line. This was followed by 34% under the Commercial line and then 20% under the Termite line. Geographically, the company is still largely focused on the domestic market, with only 8% of revenue attributable to foreign operations in 2021.

As revenue has risen, so too has profitability. Net income has jumped almost each year over the past five years, climbing from $179.1 million in 2017 to $350.7 million in 2021. Operating cash flow has exhibited a similar trend, rising from $235.4 million in 2017 to $435.8 million in 2020. But then, in 2021, it pulled back slightly, registering at just $401.8 million. Having said that, if we adjust for changes in working capital, the trend for operating cash flow would be much more consistent, claiming year after year from $276.1 million in 2017 to $387.9 million in 2020 before leaping to $441 million last year. The other metric to pay attention to is EBITDA. Based on the data provided, this metric for Rollins expanded from $363 million in 2017 to $546.4 million in 2021.

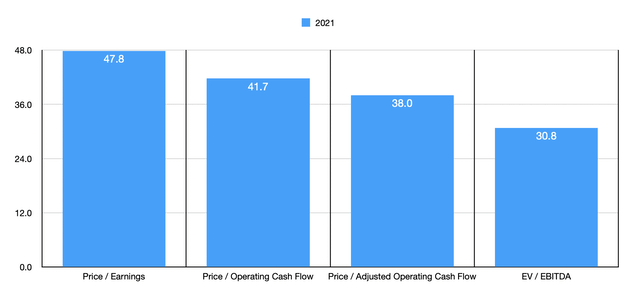

By all accounts, the 2021 fiscal year represented an all-time high for Rollins. And as such, the market has applied a significant multiple on the enterprise. For instance, using the 2021 figures, shares of the business are trading at a price to earnings multiple of 47.8. The price to operating cash flow multiple is 41.7, while the adjusted equivalent is 38. Finally, the EV to EBITDA multiple of the firm is 30.8. To put the valuation of the company into perspective, I decided to compare it to five similar firms. On a price-to-earnings basis, four of these companies had multiples ranging from 26.8 to 145.2. Two of the four companies that had positive multiples were cheaper than our prospect, while the other two were more expensive. Using the price to operating cash flow approach, the range was 10 to 24.6. Our prospect was the most expensive of the group. The same was also true when looking at it through the lens of the EV to EBITDA multiple, with a range of 11.1 to 26.2.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Rollins | 47.8 | 38.0 | 30.8 |

| GFL Environmental (GFL) | N/A | 14.9 | 21.1 |

| Tetra Tech (TTEK) | 35.9 | 24.6 | 26.2 |

| Stericycle (SRCL) | 145.2 | 17.6 | 23.3 |

| Clean Harbors (CLH) | 26.8 | 10.0 | 11.1 |

| Casella Waste Systems (CWST) | 98.5 | 22.2 | 24.1 |

Takeaway

Operationally, I would call Rollins an excellent company. Financial performance continues on at an attractive pace and, given the industry in which it operates, I fully suspect that this trend will continue. Cash flows are robust, with an adjusted operating cash flow multiple of 18.2% and a net profit margin of 14.5%. With net debt of just $49.7 million, the overall risk to this $16.8 billion juggernaut is virtually non-existent. But this doesn’t mean that it makes for a compelling investment opportunity at this time. Shares of the company look incredibly pricey from a cash flow perspective relative to the peer group that I looked at. And on an absolute basis, shares look pricey no matter which way we look at them from.

Be the first to comment