kodda/iStock via Getty Images

I have written many articles about midstream operators as I have been bullish on what was an unloved sector not too long ago. Midstream operators are critical to our economy and our way of life. The reality is that no matter how many billions go into renewable energy projects, fossil fuels and renewable energy will coexist for decades to come. Midstream operators can be looked at as toll booths for the energy sector as they collect fees for storing and moving natural gas, crude and refined products. One of my favorite aspects of this sector is the gigantic moat which causes immense barriers to entry. Unlike Software as a Service (SAAS) companies, starting a midstream operator from scratch is not practical. If you were to raise $10 billion, you could build out the human capital and infrastructure to create a SaaS company without much friction. If the company succeeded is another story, but the startup would be completely feasible. If you took the same $10 billion, you couldn’t just build out an energy infrastructure company. There is a reason why Berkshire Hathaway (BRK.A) (BRK.B) decided to purchase Dominion’s (D) natural gas pipelines rather than go through the trials and tribulations of building out 7,700 miles of additional pipeline in their energy business. With all BRK.A’s cash and political clout, it was more advantageous to acquire existing pipelines than to try to build new ones. The amount of planning, connectivity to existing systems, environment studies, zoning laws, permitting, and other red tape makes it next to impossible for new competitors to enter the midstream space.

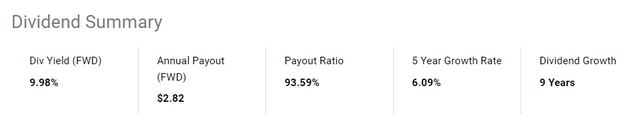

MPLX LP (NYSE:MPLX) may be the most talked-about midstream operator that I have never invested in. I am currently a shareholder of Energy Transfer (ET), Enterprise Products Partners (EPD), Kinder Morgan (KMI), ONEOK (OKE), and Enbridge (ENB), as I believe energy infrastructure companies are undervalued and present phenomenal income-producing opportunities. Over the previous 8 days, MLPX has declined by -17.56% as it lost -$6.02 per unit in value. This has pushed MPLX’s yield to 9.98%, as it pays $2.82 per unit. This is a midstream operator with strong distribution growth and a reliable track record which is certainly catching my attention. On the surface, MPLX looks like an enticing investment, and in this article, I will determine if MLPX meets my criteria for a new investment. The combination of the sector, yield, and recent decline make me want to love MLPX, but prior to giving it the nod, I need to conduct my analysis.

MPLX LP The Corporation

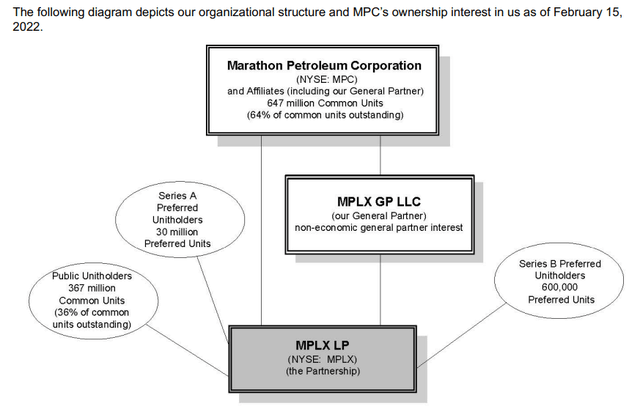

Unlike many other MLPs, MPLX was formed by Marathon Petroleum Corporation (MPC), which operates a $53 billion integrated downstream energy company. MPC formed MPLX in 2012 to own, operate, develop, and acquire midstream energy infrastructure assets. MPLX generates its revenue from gathering, processing, and transporting natural gas. MPLX performs the same functions in the Natural Gas Liquids (NGLs) market in addition to providing fractionation and storage capabilities. On the crude oil and refined products side of its business, MPLX provides transportation, storage, distribution, refining logistics, and fuel distribution services.

One critical aspect of MPLX is its strategic relationship with MPC. MPC is one of the largest crude refiners in the United States based on capacity, as they own and operate 13 refineries in the Gulf Coast, Mid-Continent, and the West Coast. MPC utilizes MPLX to provide midstream services which include transportation, storage, distribution, and marketing services for their products. MPC also owns approximately 64% of MPLX’s common units, which enhances the chances of MPC continuing to support MPLX as they execute its future endeavors. MPLX is in a unique situation as MPC is basically an untouchable backer. MPC generated $119.98 billion of revenue in 2021 and has limited competition as not a single new refinery has been built since 1976. Unlike many of the other midstream operators, MPLX has an energy heavyweight in its corner, and while ET and EPD have strategic partnerships with the largest exploration and production companies, it’s different when a company of MPC’s stature has a 64% ownership position and is strategically aligned with the midstream operations.

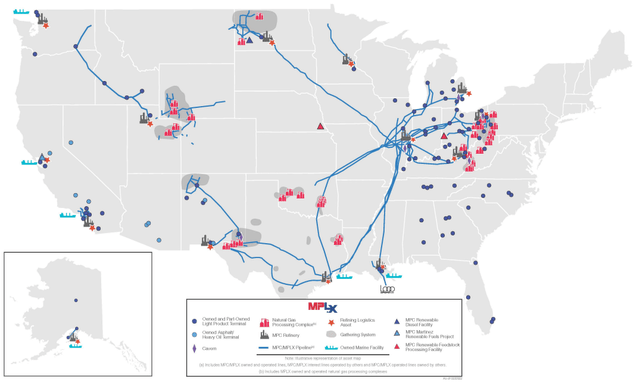

MPLX operates 8,752 miles of crude and 6,464 miles of refined products pipelines. These pipelines are strategically positioned to support diverse and flexible crude oil supply options for MPC’s refineries, which receive imported and domestic crude oil through a variety of sources. These assets are positioned to act as feedstocks to MPC refineries and transport refined products from certain MPC refineries to MPC and MPLX operations in addition to third parties. MPC owns and operates 94 terminals while having a marine fleet consisting of 297 inland tank barges and 23 towboats. MPLX’s marine fleet supports MPC through an associated transportation service agreement. These marine assets transport light products, heavy oils, crude oil, renewable fuels, chemicals, and feedstocks to and from refineries and terminals owned by MPC in the Mid-Continent and Gulf Coast regions. MPLX’s gas processing facilities have a total capacity of 11,627 MMcf/d of throughput, of which 72% of the designed capacity is utilized from 8,231 MMCF/d of natural gas. MPLX’s operations have 498 mbpd of designed throughput capacity in their fractionation facilities and are utilizing 73% through 366 mbpd of throughput. MPLX operates 843 miles of NGL pipelines and has 9,365 MMcf/d of throughput capacity in its natural gas gathering system.

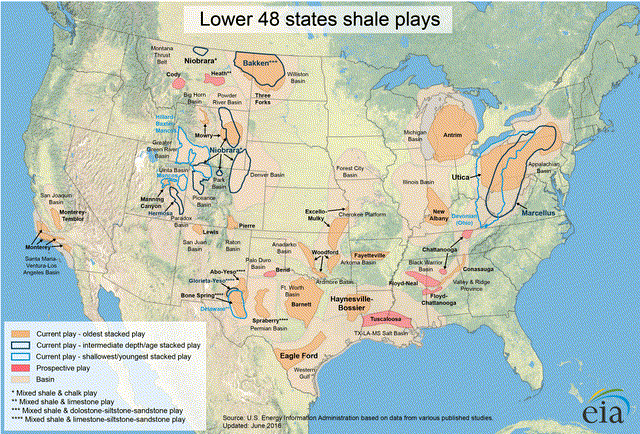

MPLX LP and the energy landscape

MPLX operates critical infrastructure in some of America’s largest basins. MPLX is one of the few midstream operators which has extensive infrastructure connecting the Bakken shale basin in North Dakota and Montana to assets in middle America and the Gulf Coast. When you look at MPLX’s infrastructure above, and the map of America’s basins below, it’s clear that MPLX’s assets play a critical role in America’s energy landscape. While the energy sector has once again become tremendously politicized, the facts remain that fossil fuels are not being displaced by renewables anytime soon.

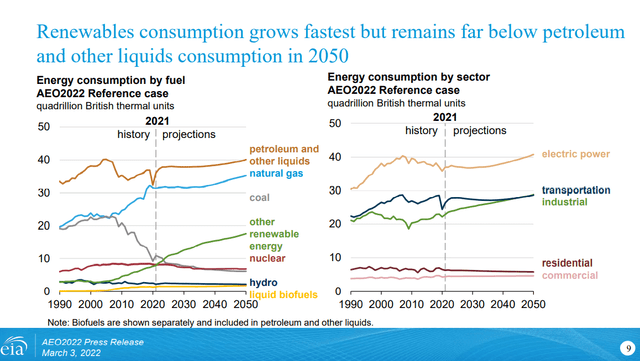

MPLX is set up for success as fossil fuels will continue to fuel America and its allies for decades to come. In the 3/3/22 Annual Energy Outlook 2022 report, the EIA projected that in 2050 the USA would be dominated by fossil fuels. Coal is expected to decline while oil climbs back to its previous highs of the early 2000s and natural gas continues to increase. Both see increased demand over the next 3 decades. Renewables will experience the fastest rate of adoption and growth on a percentage basis, but from a consumption standpoint, they will remain a fraction of natural gas or petroleum’s consumption.

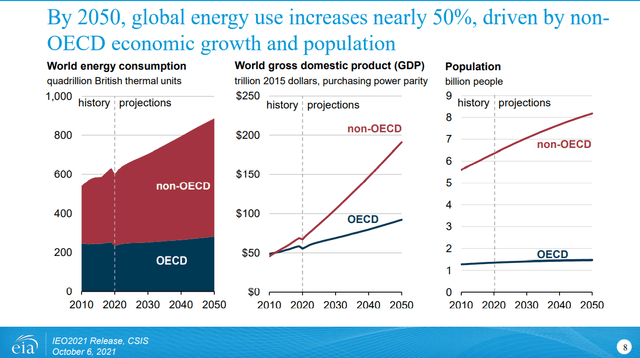

The EIA released its international energy outlook on 10/6/21. In their baseline case, the global energy demand would increase by 50%, growing from 600 quadrillion BTUs in 2020 to 900 quadrillion BTUs in 2050. In a low economic growth environment, there would be a 25% increase to 750 quadrillion BTUs, and in a high economic growth rate scenario, the global energy demand would increase to 1,100 quadrillion BTUs (83.33%). The EIA is also projecting that liquid fuels will remain the largest source of primary energy by 2050. Renewables will experience the most growth and increase their share of primary energy consumption by source, but petroleum and other liquids and natural gas.

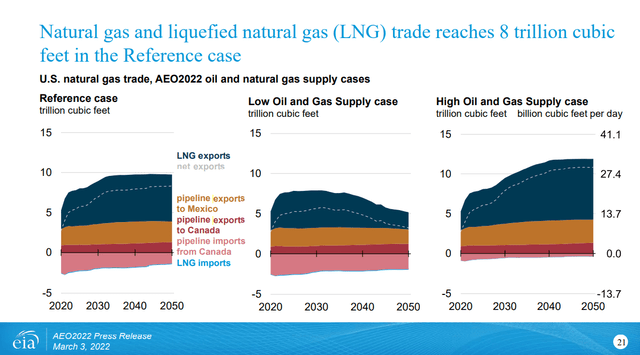

The U.S. is the largest producer of natural gas, and natural gas is projected to increase on a utilization basis over the next 3 decades. The EIA is projecting that the U.S natural gas and LNG trade will reach 8 trillion cubic feet in 2050 as our exporting capability will more than double. Looking at the chart from the EIA, pipeline exports to Mexico and Canada slightly increase, while our LNG exports experience significant growth. In 2021, the U.S averaged 9.7 Bcf/d of LNG exports which is the equivalent of 3.54 TCF. In the reference case on the left, LNG exports increase to roughly 5 TCF, and in the high oil and gas reference case on the right, LNG exports increase to roughly 8 TCF.

These are not my projections, these are the projections from the United States Government and published while President Biden has been in office. I am not against renewable energy as I believe renewable energy is critical to the future for both the domestic and global energy mix. There is nothing wrong with developing a plan to reduce our dependence on traditional energy sources, but people should be realistic in those expectations. The experts are indicating that renewables will displace coal, not oil & gas, by 2050 domestically. My feeling is that oil & gas and renewables will live in harmony for decades after the currently projected timelines expire. I like to position investments on raw data and what I am seeing come out of the EIA and IEA is that oil & gas will play a crucial role in the global energy mix well past my investment timeline. I believe MPLX is uniquely positioned to facilitate the growth which is projected to occur in energy utilization as it connects and provides integral services throughout America’s energy sector.

MPLX MP compared to the other energy infrastructure companies I am invested in

After determining that MPLC’s infrastructure would provide a complement to my current energy infrastructure holdings based on their asset map and services, I wanted to see how they are valued compared to ET, EPD, and KMI. On a valuation basis, I look at several factors, which include:

- Adjusted EBITDA to Market Cap Ratio

- DCF to Market Cap Ratio

- Debt to Adjusted EBITDA

Steven Fiorillo, Seeking Alpha

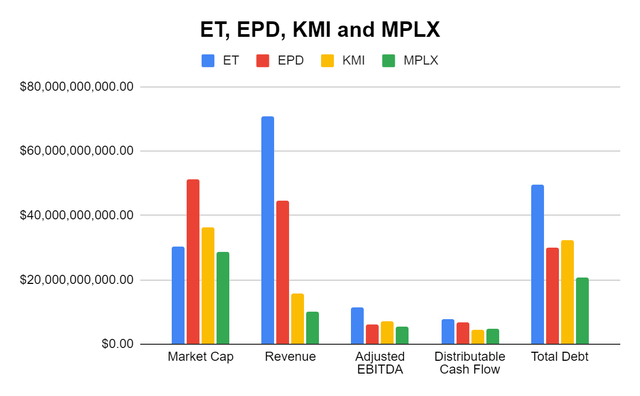

MPLX is a $28.62 billion company that generates $5.6 billion in Adjusted EBITDA, $4.86 billion in Distributable Cash Flow (DCF), and has $20.58 billion in total debt. Operationally I am impressed with MPLX, but prior to adding MPLX to my portfolio, I want to make sure I am not paying too much.

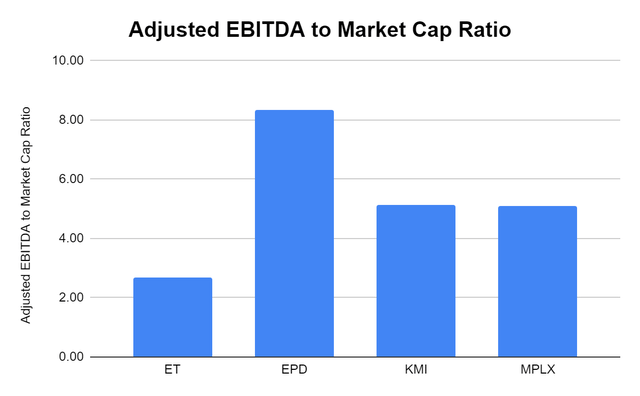

From following the midstream sector closely for years, I have an opinion that ET is hated and unfairly valued, so I will take ET’s numbers with a grain of salt as they will look disproportional to MPLX. MPLX has a 5.11x Adjusted EBITDA to Market Cap Ratio ($28.62B Market Cap / $5.6B Adjusted EBITDA) compared to 2.67x for ET, 5.13x for KMI, and 8.33x for EPD. I believe ET is a buy all day at these levels, so I have to really look at EPD and KMI for this comparison. MPLX looks to trade at a nice discount to EPD and in line with KMI. In this line item, I would consider MPLX a buy.

Steven Fiorillo, Seeking Alpha

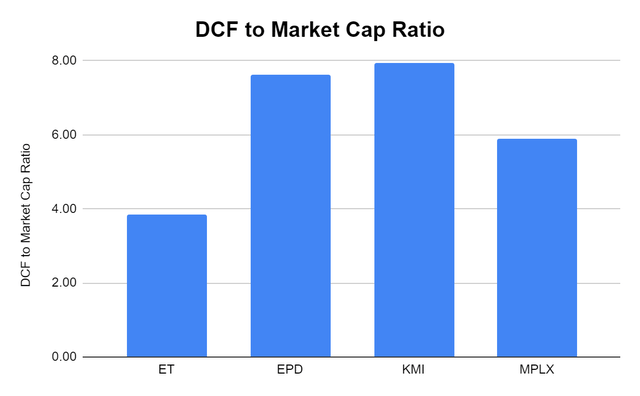

DCF is one of the most important metrics for MLPs and energy infrastructure companies that report on a form 1099. This is the pool of capital which distributions are paid from, and capital is retained. I want to pay the lowest multiple for a company’s DCF as this signals value. MPLX is trading at a 5.89x DCF to Market Cap ratio while KMI trades at 7.94x and EPD trades at 7.62x. Putting ET aside once again as 3.84x is crazy, in my opinion; MPLX looks to provide a great value based on this metric.

Steven Fiorillo, Seeking Alpha

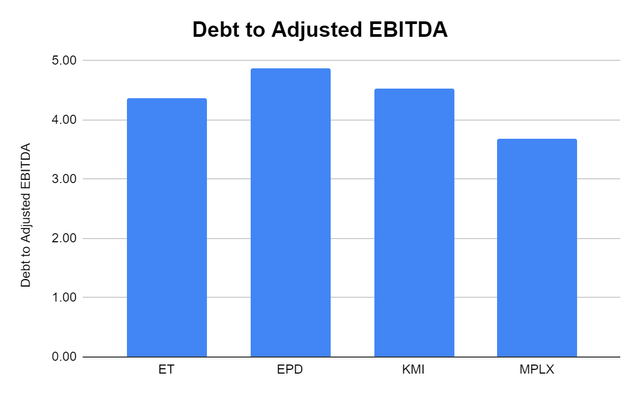

I look at Debt to Adjusted EBITDA because I want to make sure the company is generating enough earnings to service its debt load and ensure its debt level isn’t detrimental. MPLX is the hands-down winner with a 3.67x ratio, while ET comes in at 4.37x, EPD at 4.87x, and KMI with a ratio of 4.53x.

Steven Fiorillo, Seeking Alpha

After looking at these metrics, I believe MPLX’s current valuation is attractive. MPLX trades at a great DCF to Market Cap multiple, has the lowest debt to Adjusted EBITDA multiple, and has a good Adjusted EBITDA to Market Cap multiple. I don’t believe you would be paying too much for MPLX at today’s prices based on other valuations in the sector.

MPLX’s 9.98% Dividend is very interesting

There are not many investments that are generating enough income to keep up with or outpace inflation. Granted, MPLX has declined in price, which pushed its yield to 9.98%, but even at its $34.29 level on June 9th, MPLX yielded 8.22%.

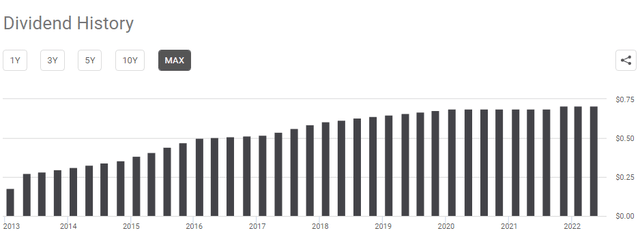

MPLX has been rewarding its investors with a growing distribution and a huge yield that has outpaced inflation for most of the past decade. MPLX has increased its distribution for 9 consecutive years and has a 6.09% average growth rate over the previous 5-years. There isn’t much not to like with MPLX as it returns large amounts of DCF to its investors.

Many investors are investing in MPLX for its large yield as energy infrastructure isn’t synonymous with growth in capital appreciation. Some may think this yield is too good to be true, but MLPs are required to distribute 90% of their income to their investors. Therefore, many income investors hold MLPs in their portfolios. MPLX’s distribution shows nothing but strength, and I would suspect there will be more annual increases in its future.

Conclusion

After conducting my analysis, I am surprised I don’t own MPLX in my portfolio. I wasn’t in the market to add a sixth energy infrastructure company to my income portfolio, but I am now very interested in MPLX. The current valuation placing MPLX’s yield at 9.98% may be too good to pass up, especially in an environment where we need more fossil fuels. The combination of MPLX’s relationship to MPC, where their assets are placed, and its current valuation metrics make me believe this is a buy. I don’t own MPLX yet, but I am considering starting a position in them.

Be the first to comment