AsiaVision

Investment Thesis

DoorDash, Inc. (NYSE:DASH) connects consumers and local businesses in 27 countries across the globe. DASH is experiencing a robust demand after Covid-19. Also, the company has recently announced its partnership with top grocers and retailers such as Sprouts Farmers Market (SFM), EG America, Big Lots (BIG), and many more. I believe these partnerships can help the company accelerate its sales growth and further expand its profit margins.

About DoorDash

DoorDash provides the technology platform and logistics to local businesses, facilitating them to serve their customers’ needs. The company’s business comprises two services: Marketplace and Platform Services. The Marketplace focuses on addressing the needs of three key constituents: merchants, consumers, and Dashers. The company facilitates the merchants with local logistics platforms to help them establish an online presence and widen their customer reach.

As a part of the Marketplace, the company offers various services to the merchants, making it possible to solve the challenges of acquiring customers, generating demand, fulfilling orders, merchandising, processing payments, and customer support. It aims to increase the variety and quantity of merchants to cater to the increasing consumer demand. It helps the merchants address their customers’ needs through delivery facilitated by a local logistics platform. The merchants are also provided with an advertisement platform to promote their products, which can help them acquire new customers and increase incremental sales.

The Marketplace consists of over 25 million active users. This platform enables them to discover and purchase goods from merchants. The Platform services consist of Drive and Storefront. Drive is a white-label logistic service that facilitates the merchant to fulfill the customer demand generated through their channels with the help of using the company’s local logistics platform. Storefront provides a turnkey solution to merchants, enabling them to create their own branded online ordering experience without investing in engineering and logistics capabilities. The Marketplace and Platform services provide opportunities to the dashers by giving them options of when and where to dash. The company also provides earning transparency to the dashers, which can help them to choose the deliveries to make. The company earns 99.8% of its revenue from clients from the USA, and only 0.2% of the total revenue is generated from international clients.

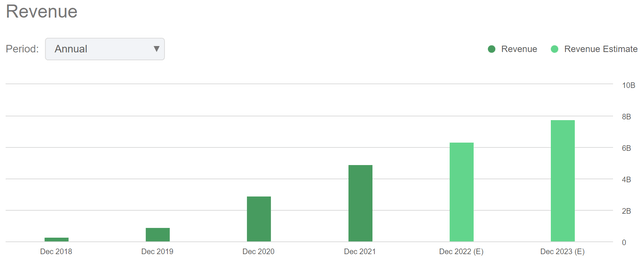

Revenue Trends

As we can observe in the above chart, the company has experienced robust growth in the past. The revenue has grown from $885 million in FY2019 to $4.89 billion in FY2021, resulting in a 3-year CAGR of 156.10%. The company generated $885 million, $2.9 billion, and $4.9 billion in revenue in 2019, 2020, and 2021, respectively, reflecting 226% and 69% YoY growth rates in 2020 and 2021.

I believe the reason behind this strong growth was the circumstance of Covid-19, which accelerated the use of e-commerce and digital platforms. The company experienced significant growth in total orders and marketplace GOV. I know Covid-19 is not influencing our choices anymore. But I believe people will continue the use e-commerce in the coming years, as everyone has become accustomed to e-commerce. Hence, I think the growth caused by Covid-19 is sustainable in the coming years, and the company is also experiencing strong client retention in the current year, which supports my thesis.

DASH is a loss-making business, which is normal for a growth company. The company is expecting its core USA restaurant business to grow, which can expand EBITDA margins and earnings. After considering the growth of the core USA restaurant business, I think the company can become a profitable business in FY2022.

New Strategic Partnerships

In the United States, the online delivery market has almost doubled since the Global Covid-19 Pandemic. This growth was driven by physical distancing requirements, changing consumer preference in food, and the user-friendly apps which have made it convenient for customers to order food and other products at a single click. Looking at the convenience factor, rapid change in consumer taste, and vast product offerings from the market, I believe this growth can be sustainable in the future and further expected to grow if customers get easy delivery options from all the areas of services.

Identifying this opportunity, the company has recently announced its partnerships with top grocers and retailers. As an example, it has recently announced its partnership with Sprouts Farmers Market. As per the partnership deal, consumers will be able to make purchases from more than 375 Sprouts Farmer Markets and can order fresh and organic food directly to their doorstep. It has also made a partnership deal with EG America. Consumers can order convenience essentials from EG convenience brands, including Cumberland Farms, Fastrac, Kwik Shop, Loaf N’ Jug, and Sprint. On-demand delivery is available from over 800 EG brands and is expected to expand to more than 1300 EG brands by the end of October. This partnership can facilitate the company to acquire more customer base as it is expanding the product portfolio of DASH with all of its brands.

The company has also announced its partnership with Big Lots, America’s leading home discount retailer. According to this partnership, consumers can purchase and have access to more than 36,000 products, including cleaning essentials, seasonal decors, pantry staples, and snacks. This partnership can give customers a wide range of product offerings at the convenience of their doorstep.

Also, the company has recently announced the partnership with DICK’S Sporting Goods (DKS), per which consumers can order products such as sports equipment and apparel from more than 700 stores across 47 states. As demand for DICK’s Sporting Goods is high, being the market leader for a long time, I believe it can significantly help the company to grow its sales volume and further increase its profit margins.

In addition, the company has also made a partnership deal with Raley’s Company, which will make it convenient for the customer to order groceries from over 213 locations across northern California, Nevada, and Arizona. I believe this partnership can help the company to drive its sales as consumers now prefer online grocery shopping due to wide product offerings and convenience. To address the consumer need for grocery shopping, the company has also expanded its partnership with Weis Market, which is a Mid-Atlantic grocer. It has also announced its partnership with Giant Eagle, which is a leading regional food retailer on DoorDash Marketplace. It will initially begin with stores in Columbus, Ohio.

According to DoorDash Economic Impact Report 2021, 77% of the surveyed customers used DoorDash to try a new restaurant, and 77% of those customers subsequently placed orders from the same restaurants. This data shows that the company has connected merchants to new customers at a very high rate. I believe these partnerships can help the company to drive its sales and further expand its profit margins in the coming years, as all of these partnerships can contribute significantly to DASH’s goal of becoming a one-stop shop and broadening its product portfolio, resulting in an expanded customer base.

As the company aims to be a one-stop shop to fulfill all the local commerce needs, I believe these partnerships can significantly help them to connect every grocery, convenience, and retail store to every local consumer. This solid network might also help DASH provide various services to its existing customers as the company is penetrating deeper into the market and providing a wide range of product offerings. The strong network of grocery, convenience, and retail affiliations can provide a competitive advantage to DASH in the long term. As the product offerings of the company increase, it can also help them to reduce the risk from competitors and create a strong presence in the market.

What is the Main Risk Faced by DASH?

Intense Competition

The markets in which DASH competes are highly fragmented, fiercely competitive, and characterized by a constant influx of new products and services. Local food delivery logistic is dispersed and fiercely competitive, the company’s main business segment today. DASH competes in the United States against other local food delivery logistics companies like Uber Eats, Grubhub, and Postmates, chain restaurants with their online ordering systems, pizza delivery services like Domino’s, other retailers with their delivery fleets, grocers and grocery delivery services, point of sale software providers, and merchant delivery services.

DASH may face competition from big Internet businesses like Amazon.com (AMZN) and Google (GOOG, GOOGL) as it continues to diversify into industries besides food and acquire users and customers. The corporation will also face competition from local incumbents in these regions as it continues to extend its presence abroad. DASH also faces competition from more conventional offline ordering methods, including takeaways, phone orders, paper menus, and advertisements that shops post in regional periodicals to draw customers. If the use of e-commerce keeps increasing, it might attract more new entrants. The increasing competition might force the company to give discounts on products to retain customers, which might result in a margin contraction.

Valuation

The significant growth in total orders after Covid-19 and the expansion of the customer base with the help of new strategic partnerships can drive the company’s growth in the coming years. The company expects its core USA restaurant business to grow, which can expand EBITDA margins and earnings. After considering all these factors, I think the seeking alpha’s EPS estimate for FY2023 is accurate. According to the seeking alpha, DASH’s EPS for FY2023 might be $0.50, which gives the forward P/E ratio of 98.78x. According to my analysis, the company is overvalued, as the forward P/E ratio of the company is significantly higher compared to the sector median of 12.27x. At the current valuation, the forward P/E ratio of the company is 705.05% higher compared to the sector median.

Conclusion

The online delivery market has seen rapid growth after the pandemic, and to address this increasing demand, the company has recently announced its partnership with top grocers and retailers. DASH has entered into multiple strategic partnerships, which can help the company in providing a variety of products under one platform and expand its customer base resulting in revenue and earnings growth. The company has strong growth prospects as it plans to be a one-stop shop in the coming years.

However, according to the relative P/E ratio analysis, DoorDash stock is significantly overvalued at its current valuation. The forward P/E ratio of the company is 705.05% higher compared to the sector median. After considering all these factors, I think the company has strong growth prospects, but staying invested in the DASH at the current valuation for short-term growth is not advisable. Only long-term investors who are ready to invest for 5-10 years should hold this stock.

Be the first to comment