canakat

Introduction

Upon entering the new year, unitholders of MPLX (NYSE:MPLX) saw very desirable prospects to see their capital returned during 2022, as my previous article highlighted. Whilst the first half still only saw their usual high 8.51% distribution yield, if looking ahead towards the second half, it seems that higher distributions should only be months away, likely accompanied by unit buybacks and possibly another special distribution, as discussed within this follow-up analysis that also reviews their recently released results for the second quarter of 2022.

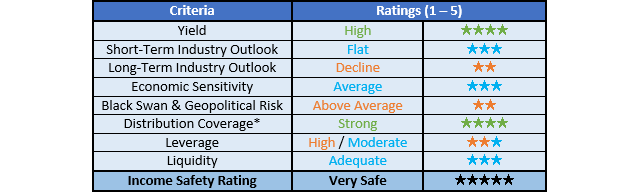

Executive Summary & Ratings

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing distribution coverage through distributable cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

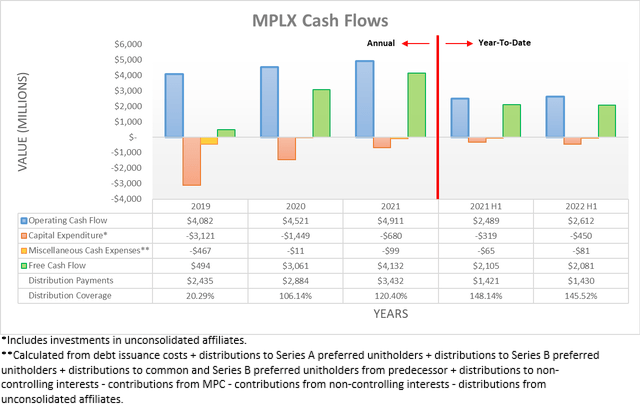

It was positive to see their strong cash flow performance from recent years continued into the first half of 2022 with their operating cash flow at $2.612b and thus a handy 4.94% higher year-on-year versus their previous result of $2.489b during the first half of 2021, which does not materially change if removing their temporary working capital movements. Even though this increase is less than what unitholders have been accustomed to seeing during 2020 and 2021, it should not be a surprise given their capital expenditure has been far lower across the last two years with their level of $680m during 2021 being a massive reduction from their previous level of $3.121b back in 2019, as they leave their high growth days in the past.

Despite lowering their growth, thankfully their lower capital expenditure also boosts their free cash flow with the first half of 2022 seeing a result of $2.081b and thus providing strong distribution coverage of 145.52% to their $1.43b of distribution payments, thereby leaving excess free cash flow of $651m. Since their capital expenditure of $450m during the first half was exactly half their guidance of $900m for 2022, as per my previously linked article, it means this was not materially influenced by temporary high or low capital expenditure. It was also positive to see that their capital expenditure guidance is still unchanged, despite the inflationary pressure hitting the economy.

If their operating cash flow during the first half of 2022 persists into the second half, which I see no reason to doubt, the full year should see twice as much excess free cash flow after distribution payments as the first half, which equates to circa $1.3b. Since their unit buybacks were only a minimal $135m during the first half, this leaves at least $1b of potential for the second half, which as an important reminder, sits atop their existing distribution payments. Following the payment of their recent quarterly distribution, unitholders have now enjoyed four quarters at their record $0.705 per unit rate and thus as we approach their next distribution review after the third quarter, it seems that higher distributions are on the cards, as per the commentary from management included below.

“…so in addition to unit repurchases, right, we’ll reassess our base distribution as we did last year and certainly any change there would be subject to board approval.”

-MPLX Q2 2022 Conference Call.

In my view, when management says they will “reassess” their distributions, it seems almost certain that higher distributions are coming, as their continued strong cash flow performance current strong operating conditions make a reduction unthinkable. When they last reviewed their distributions after the third quarter of 2021, not only did they boost their quarterly distributions but they also declared a special distribution of $0.575 per unit. Since they sport strong distribution coverage, it makes increasing their quarterly distributions by another 2% to 5% very easy and thus almost certain, similar to their 3% increase in 2021. The bigger question is the extent these will be accompanied by additional unitholder returns and the mixture between unit buybacks and special distributions. Whilst I am hopeful they will be weighted towards the latter, it seems that only time will tell with no clues being released, as per the commentary from management included below.

“I would say people are very convicted that, some tell us very, very strongly that unit buybacks is the way to go and others tell us very, very strongly, please send me a check, that’s the way I’d like to see return of capital. So our approach has been to look at market conditions, look at where we stand as far as our projections, evaluate our ability to invest capital, because we keep saying it’s a return of and return on.”

-MPLX Q2 2022 Conference Call (previously linked).

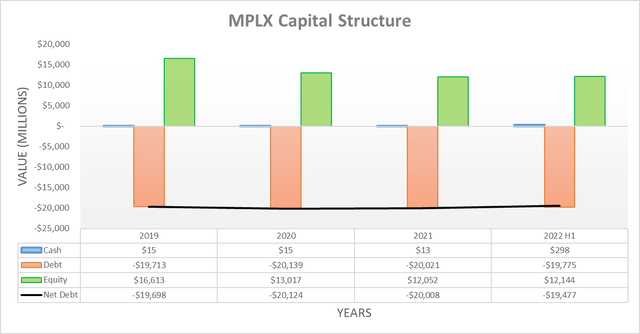

Thanks to their continued strong distribution coverage during the first half of 2022 and minimal unit buybacks, their cash balance increased significantly to $298m versus its previous level of only a mere $13m at the end of 2021. Meanwhile, their total debt decreased in tandem and thereby resulted in their net debt falling $531m to $19.477b versus its previous level of $20.008b across these same two points in time. Interestingly, this is the first time in recent history that they have increased their cash balance, which was intentional as they evaluate growth opportunities or particularly opportunistic unitholder returns, as per the commentary from management included below.

“…you might see us maybe holding some level of cash as we look to evaluate growth opportunities and really opportunistically look to return capital.”

-MPLX Q2 2022 Conference Call (previously linked).

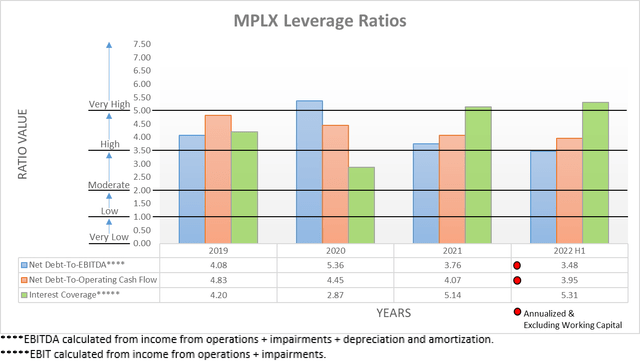

Due to their lower net debt and continued strong financial performance, it was not surprising to see their leverage edge lower following the first half of 2022 with their respective net debt-to-EBITDA now down to 3.48 versus its previous result of 3.76 at the end of 2021. Apart from representing another solid improvement, it also now sits beneath the upper limit for the moderate territory of between 2.01 and 3.50. Meanwhile, their net debt-to-operating cash flow also saw an improvement, albeit to a lesser extent with their latest result of 3.95 only down marginally from their previous result of 4.07 at the end of 2021, thereby staying within the high territory of between 3.51 and 5.00.

When looking elsewhere, the leverage ratio as utilized by management also decreased comparably to 3.50 versus its previous result of 3.70 at the end of 2021, as per their second quarter of 2022 results announcement. This is now even further below their target of 4.00 than was the case at the end of 2021, as per my previously linked article. At the time, I floated the possibility that given this material difference below their leverage target, they may borrow upwards of circa $2b to fund bonus unitholder returns to realign their leverage to their target. This topic arose during their second quarter of 2022 conference call but alas, this possibility appears to be ruled out, as per the commentary from management included below. They have not ruled out further special distributions or a faster rate of unit buybacks, although these will have to remain funded via excess free cash flow and not lean upon their strong financial position.

“…the reason we’re at 3.5 times is basically because we’ve kept that flat and we’ve grown earnings. So as a result of that we’ve said this for a while that our leverage is going to decrease as a result.”

“We’re going to manage the business such that we’re going to generate free cash flow, invest capital in a more disciplined way, such that we’re not adding to debt.”

-MPLX Q2 2022 Conference Call (previously linked).

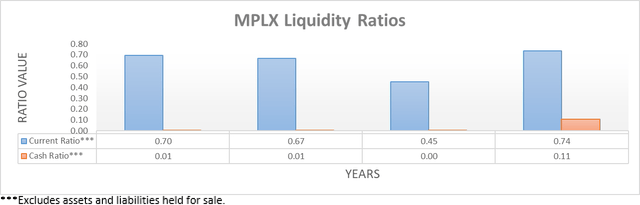

After seeing their cash balance jump during the first half of 2022, it helped lift their current ratio and cash ratios higher to 0.74 and 0.11 respectively, which were previously on the low side at only 0.45 and 0.00 respectively at the end of 2021. Whilst representing a sizeable improvement and reaffirming their liquidity is adequate, whether it lasts for a prolonged length of time depends if management finds a suitable way to deploy their cash balance, as quoted earlier. Although due to their large operational size and continued strong cash flow performance, this is not necessarily required to keep their liquidity adequate, especially with $2b available under their new credit facility that does not mature until July 2027.

Conclusion

Even without the scope for debt-funded bonus unitholder returns, they still offer a very safe high 8.50% distribution yield that is supported from both strong distribution coverage and a strong financial position. They are only months away from their next distribution review after the third quarter of 2022 and given these strong fundamentals and supportive commentary from management, it makes higher distributions almost certain. Whilst already very desirable given their existing high yield, the prospects for a combination of another special distribution and unit buybacks are the icing on the proverbial cake and thus unsurprisingly, once again I believe that my strong buy rating is appropriate.

Notes: Unless specified otherwise, all figures in this article were taken from MPLX’s SEC filings, all calculated figures were performed by the author.

Be the first to comment