MF3d

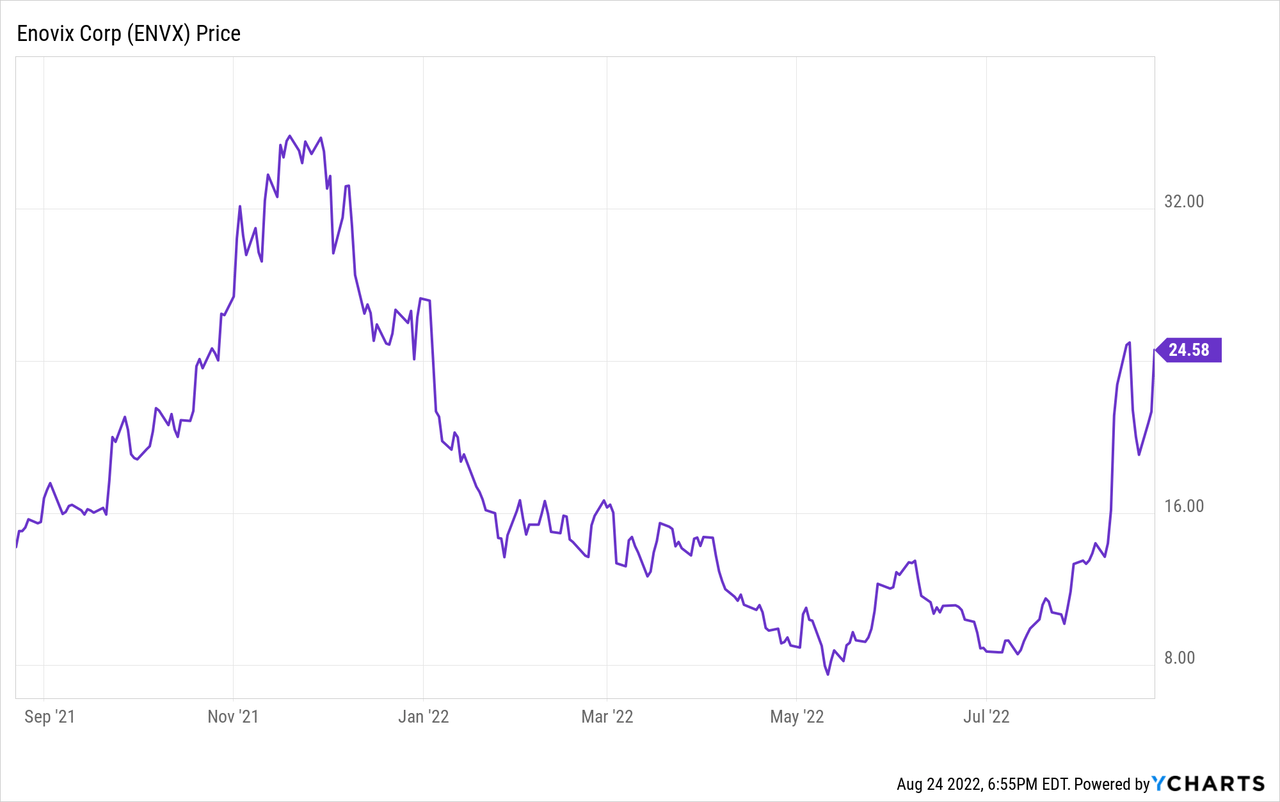

Enovix (NASDAQ:ENVX) has bucked the downward stock market trend over the last few weeks with an upward rip that has positively stunned its bulls. The Fremont-based company is up around 240% from all-time lows following the publication of fiscal 2022 second-quarter results and a positive research note from Loop Capital. The note put an extremely bullish $100 price target, implying more room for shares to run.

Behind the renewed bullishness is the company’s new generation of advanced silicon-anode lithium-ion batteries. Enovix has developed a proprietary 3D cell architecture that comes with a higher energy density than current battery technologies and is meant to solve a number of issues including battery swelling. Whilst the battery has been in development for years for a number of OEMs and Enovix shareholders like Intel (INTC) and QUALCOMM (QCOM), the company only just started realizing revenues following the commercial launch from its Fab-1 facility.

Common shares are now trading hands at $24.61 with momentum still building as realized revenues are set to soar on the commencement of sales. Enovix has announced that it is working with the US Army on a contract to build wearable battery cells for soldiers. It is also working with Apple (AAPL) on technology qualifications. Hence its batteries could make an appearance in a select number of Apple products as soon as 2024. The company could also see its batteries powering the next generation of AR glasses and VR headsets being developed by Meta Platforms (META) as the parent of Facebook is also testing Enovix’s batteries.

Revenues Start To Come In As Shares Run Hot

The company reported earnings for its fiscal 2022 second quarter which saw revenue come in at $5.1 million, a beat of $4.78 million on consensus estimates. For some context, Enovix guided for full year 2022 revenue to be $11 million when it went public via a blank check firm in 2021. That said, the bulk of revenue constituted service revenue from a single customer following the achievement of certain milestones. Battery cells made a negligible contribution as they only just began shipping.

Adjusted EBITDA came in negative at $18 million, up from $11.7 million in the year-ago quarter with negative free cash flow coming in at $24.6 million. However, this was against cash and equivalents of $385 million at the end of the quarter. This provides enough runway for the company to reach cash flow breakeven which management anticipates will happen sometime in 2025. It will also enable to company to fully realize its revenue funnel, which grew to reach $1.5 billion during the quarter. Overall, Enovix sees cash burn for fiscal 2022 not being less than $160 million with half of this going towards capital expenditure.

The company expects revenue to be between $6 million and $8 million for fiscal 2022, both lower than initial guidance due to a near-term focus on optimising operations over shipments at Fab-1. With Enovix having guided for revenue to rise to $176 million in fiscal 2023 and $410 million in fiscal 2024, the company is pencilling in hyper growth over the next few quarters as manufacturing from its Fab-1 facility ramps up. Enovix anticipates entering the EV space sometime from 2025 with the completion of its Fab-3 facility that year.

After just over a year since becoming a public company and fifteen years since its founding, Enovix now stands at the cusp of fully realizing the opportunities posed by supplying enhanced battery technology to the electronics and EV markets. Loop Capital’s material $80 billion market cap price target by the end of the decade has galvanised bullish sentiment and made the stock hot even as the broader market remains weak. With the macro background still punctuated by so much uncertainty, I’d advise caution on buying at these levels. A higher-than-expected increase in interest rates, an official recession, and a further inversion of the yield curve are distinct possibilities in a future that now seems to be heading towards a full-blown energy crisis that continues to drive up inflation.

Making Batteries Of The Future

Enovix is developing batteries that will have a 27% to 110% higher energy density with a dramatically reduced likelihood of combustion than standard market technologies. The company has a potential customer pipeline consisting of several blue-chip technology companies and stands to realize revenue from electronics ranging from laptops to smart watches to VR headsets.

Whilst the current run-up could very much peel back as sentiment moderates, the overall long-term direction seems bright. The $1.5 billion revenue funnel is a strong testament to the potential the company holds to build a great future that touches on the growth of multiple industries. But I’d recommend shares only as a buy on a partial retracement from current levels.

Be the first to comment