SHansche/iStock via Getty Images

Sector Outlook

The sell-off sweeping through the container shipping market has been brutal. Freight rates have fallen a dramatic 80% from the top, even if they remain higher than pre-covid. In 2021, the extraordinary surge in demand for consumer durables during the reopening, together with the persistence of anti-covid restrictions in China, propelled the FBX to over $11,000 per day. The index is currently standing at around $2,500 per day.

Freightos Baltic Index (FBX): Global Container Freight Index (freightos.com)

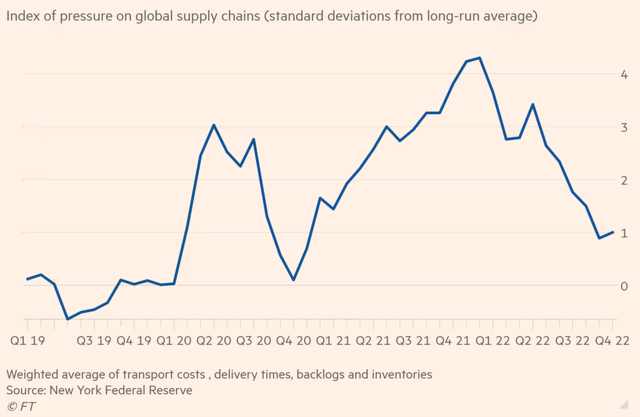

The main drivers for the recent leg down has been the gradual easing of supply chain congestion and the anticipated slump in demand on the back of global recession fears. All indicators related to the supply chain crunch, such as delivery times, freight rates, and wait times in ports, have significantly relaxed.

Index of pressure on global supply chains (Financial Times)

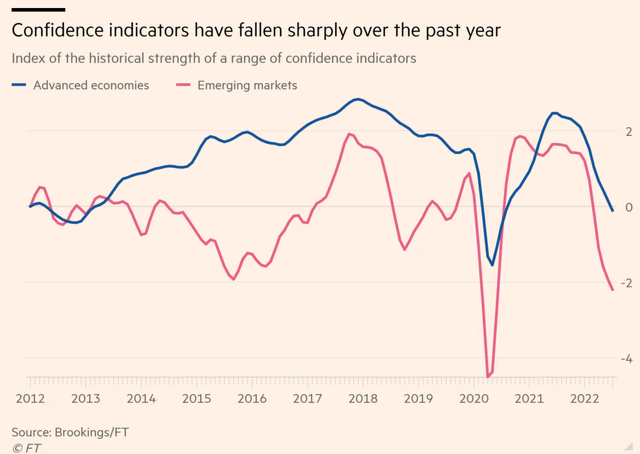

At the same time, the global economy appears fragile, with many countries on the brink of recession and confidence indicators plunging.

Confidence has fallen sharply over the past year according to the Brookings-FT Tracking Index for Global economic recovery indicator (Financial Times)

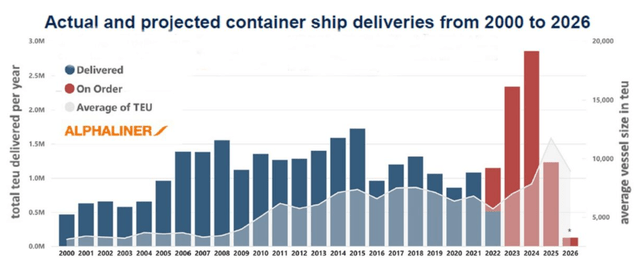

To compound bad news on top of bad news, the order book for container ships is at record-high levels. Shipowners have used the extraordinary profits of the last two years to order new vessels. So, even as freight rates decline, the global fleet will continue to expand for at least the next two years. The current order book stands at a record 7 million TEUs (twenty-foot equivalent units). In nominal terms, this is higher than the previous peak of 6.6 million TEUs in 2008 (however, as a percentage of total current on-water tonnage, it is lower: 30% vs. 60%).

Container ships orderbook (alphaliner)

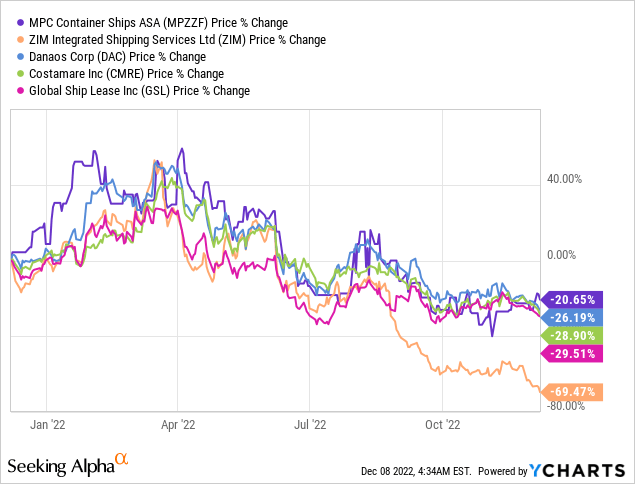

Despite the several headwinds for the overall market, it is necessary to take into consideration that the stocks have already been battered down to oversold levels.

The real question, therefore, is whether the valuations are overly pessimistic, and thus offer a sufficient margin of safety. In addition, while I have only mentioned the negative forces that are pulling rates down, there are important caveats, and even reasons for cautious optimism.

First of all, there is still the risk that congestion measures and rates will move higher from here, especially as China gradually loosens its covid policies and reopens its economy. The initial rumors of a relaxation of its zero-covid strategy have been confirmed, and it now appears that it is too late to reverse it. On the one hand, the Chinese reopening is expected to increase demand for durable goods; on the other, it will probably cause a significant increase in new covid cases, with the potential for new disruptions to supply chains. Since the collapse in freight rates can be attributed more to a reduction in demand than to an improvement in port efficiency, there is the potential for new bottlenecks and hence spiking rates. This is particularly true considering that the decline in freight rates has mostly been a China story up to now.

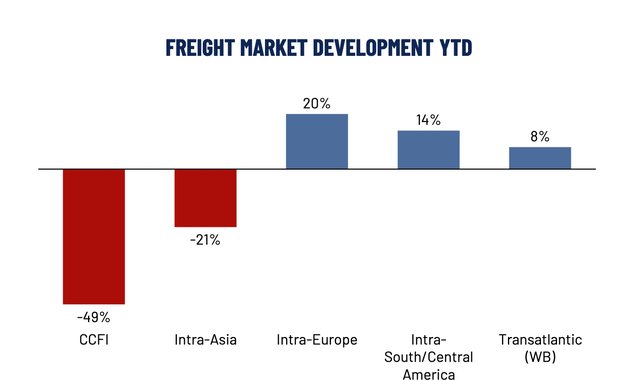

Freight rates changes YTD exhibit large regional differences (company presentation, Q3 2022)

In addition, the record-high order book does not take into account the other side of the equation: the scrapping of old vessels. Almost no container ships were scrapped in the last two years because freight rates were high, but 2023 is expected to be a record year for scrapping, partially counterbalancing the increase in supply via new builds.

Finally, new environmental regulations are expected to support rates in the medium-to-long term. Regulations will force lower sailing speeds, in order to save fuel and reduce emissions. This is effectively equivalent to a reduction in supply via longer voyages, which is estimated to be of the order of 5-15% of the global fleet. Higher environmental standards will also force shipowners to scrap older vessels that become uneconomical to maintain.

To summarize, the above-mentioned points partially offset all the doom and gloom about the sector. Given the predominant extreme negative sentiment, the severe drawdowns in the stocks of most companies, the considerable margin of safety many of them now offer, the likelihood of having already touched the cyclical bottom, and the prospect of a China reopening, I am cautiously getting long.

MPC Container Ships (OTCPK:MPZZF, MPC.OL) ticks all my boxes: it’s a well-managed company, with a robust balance sheet, cheap, with a high margin of safety thanks to its strong backlog, and is committed to returning capital to shareholders. I should clarify that this is still a small position (~1% of my portfolio); besides, I am ready to exit it quickly should the economic outlook worsen, and find a better entry point later. Nonetheless, the current risk/reward ratio is very attractive, so it is worth it to begin dipping my toes back in.

Why MPCC

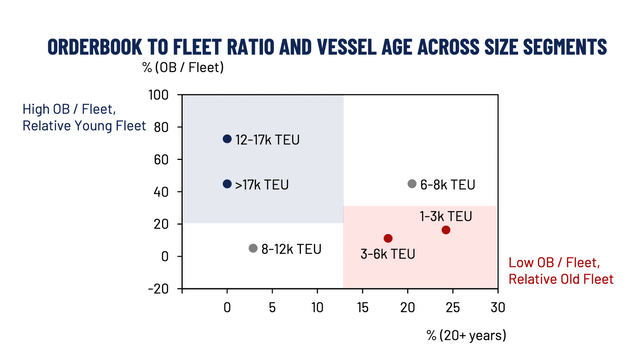

MPCC focuses on small to mid-size container ships, mostly serving intra-regional trade lanes on fixed-rate charters, a segment that should prove more resilient to de-globalization fears. Besides, the margin of safety is greater in this segment, since the supply/demand dynamics are not as bad as in the overall sector. In fact, below 6k TEUs, the average fleet age is high, the orderbook is relatively small, and new-build deliveries are going to contribute a modest 0.9% CAGR to supply over the period 2021-2025. At the same time, demand is projected to remain strong, growing at an average 4.1% CAGR over the same period. In fact, demand is expected to exceed supply in both 2023 and 2024.

Order book to fleet ratio across different segments (company presentation, Q3 2022)

The company’s fleet consists of 63 vessels, for a total capacity of around 137 thousand TEUs, with an average age of 15 years (below most peers) and average TEUs of 2.5 thousand per ship. Vessels are well prepared for the coming into effect of new environmental regulations (e.g., CII, EEXI). Four new ships will be delivered in 2024, totaling 13.6 thousand additional TEUs. The corresponding CAPEX expenditure is already covered by the contracted EBITDA backlog, thus reducing value risk.

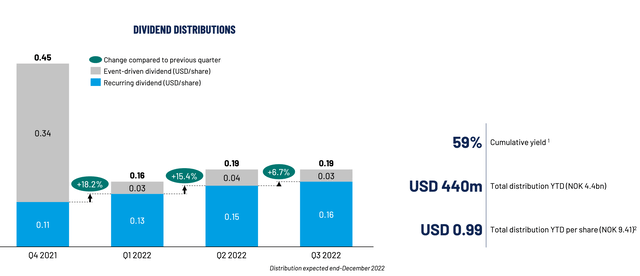

MPCC is definitely cheap based on current financial metrics, even if the near future is not going to be as rosy as the recent past. Currently, the company has a market capitalization of around USD 800 million and a net debt position of USD 48.5 million. It has put the bonanza of the last two years to good use, by paying back its debt and reducing its leverage. This has allowed MPCC to return significant capital to shareholders via dividends: since the beginning of the year, MPCC has paid out more than 50% of its market capitalization in dividends.

Dividend payments for FY 2022 (company presentation, Q3 2022)

Recent Q3 results were very strong, with operating revenues of USD 160.1 million, EBITDA of USD 145.8 million, adjusted EBITDA (excluding gains from vessel sales) of USD 115.3 million, and net income of USD 124.5 million. These results are up 35%, 98%, 52%, and 168% year-on-year (YOY), respectively, compared to Q3 2021, a result of the higher average TCE of USD 30,476 per day (Q3 2021: USD 19,007 per day). Full-year 2022 guidance was increased to revenues of around USD 600 million and EBITDA of USD 500 million.

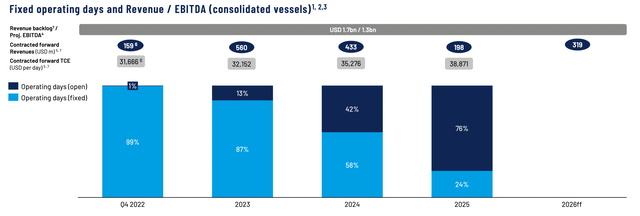

The interesting thing about MPCC is that there is high visibility into its near future earnings. Even if the container sector is softening, as spot rates normalize to levels well-below the peak (but still above pre-pandemic levels), the next few years are almost guaranteed to be strong thanks to its pre-contracted backlog. Based on the company’s disclosed numbers, as of Q3 2022, its revenue backlog amounted to USD 1.7 billion, corresponding to a projected EBITDA of USD 1.3 billion over the period Q4 2022 to 2026. This estimate takes into account only the revenues that have already been contracted forward. As a consequence, as shown below, MPCC is likely going to earn almost all of its market capitalization by the end of 2023. The crucial point here is that MPCC is a shipowner that provides the ships under lease contracts to operators; thus, it can negotiate longer-term arrangements, which are subject to less volatility.

Charter backlog and forward visibility (company presentation, Q3 2022)

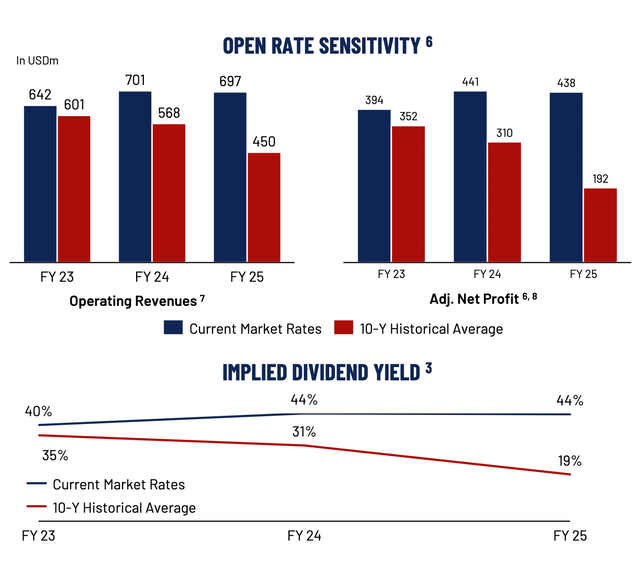

The other crucial point is that MPCC is committed to returning capital to shareholders. Its dividend policy requires it to pay out 75% of net income on a quarterly basis as recurring dividends, plus discretionary event-driven dividends related to e.g. the sale of old vessels. The board is also open to considering share buybacks, depending on share price developments. If current market rates continue, the forward dividend yield would be around 40%. Even if rates revert to their 10Y historical average, the mean yield over the next 3 years would be around 25%.

Implied dividend yield (based on closing price of NOK 16.67 as of 14 November 2022 ) (company presentation, Q3 2022)

With such a huge margin of safety, the company definitely looks undervalued. That’s why I would like to see insiders increase their participation. This is indeed the case, as insiders have been scooping up shares for months. Most recently, a member of the Board of Directors, Mr. Peter Frederiksen, bought 200 thousand shares at an average weighted price of NOK 17.54 per share. Over the last 6 months, the bulk of the insider buying has actually been at prices above the current share price of around NOK 18 per share.

Conclusion

Despite several headwinds for the container ship sector, MPCC offers a very attractive risk/reward ratio. The downside is limited by its pre-contracted backlog, so much so that MPCC could pay out its entire current market capitalization as dividends by 2025. In addition, the supply/demand dynamics are not as bearish in the small and mid-size segment as they are in the overall container sector. The company appears to be severely undervalued, as confirmed by insiders consistently accumulating shares over the last few months.

Be the first to comment