maybefalse

Brookfield Renewable Partners L.P. (NYSE:BEP) is one of the leading renewable energy providers in the United States; its generation mostly comes from hydro with 33.75% share, 24.6% – wind, 14.1% – solar, and 27.55% – “Distributed Energy & Sustainable Solutions.” The continuous period of rising electricity prices is leaving BEP to be one of the beneficiaries. Moreover, the story doesn’t end there, since the company has the potential for further development; it also pays stable dividends.

Nine-month 2022 Financial Highlights

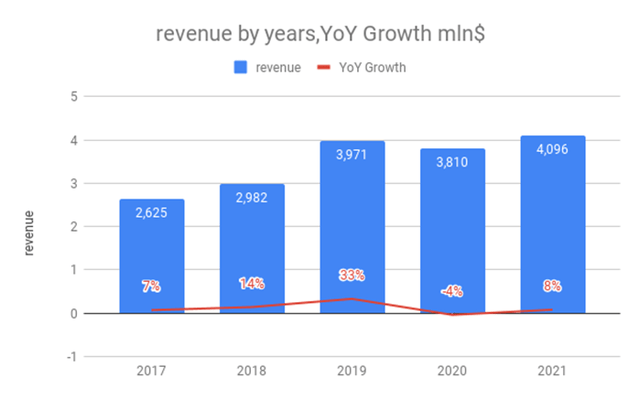

The last 12 months’ revenue, ending Sep 30, 2022, increased by 16.97% to $3.515 million owing to higher energy prices and business expansion. Installed capacity rose from 20.515 to 23.617 (MW); Average revenue grew from $84 to $88 MWh.

The weighted average term of a Power purchase agreement, or PPA, is 14 years. Not only does the business enjoy sectoral stability, since Utilities are the most sure-footed sector, but it also has strong cash flows. Cash flow from operations was up 42.1% YoY. The company’s interest expense grew by $147 million compared to the same period due to portfolio growth, accelerated financial activity in South America, and strategic financing of the Canadian hydroelectric power plant. The net income resulted in $78 million. Given the Fed’s rate increase, it is nice that Brookfield gets roughly 90% of its funding at a fixed rate. During the year, the company continues to build various projects with a projected capacity of over 19,000 MW.

In September, the company agreed to form a strategic partnership with Cameco Corporation (CCJ) to acquire Westinghouse Electric Corporation; the total equity investment will be $4.5 billion, and BEP’s part is $750 million, or approximately 17% stake in a newly formed entity. This partnership creates a platform for strategic entrance into nuclear power generation.

Figures show that Brookfield Renewable is a growth company. The company’s main asset is hydroelectric power plants; this source accounted for 50% of all generations in 2021. The most dynamic source is solar, which rose from 753 (GWh) in 2017 to 1,777 (GWh) in 2021. The company actively invests in new projects and sells old capacities.

The Company’s financial reports

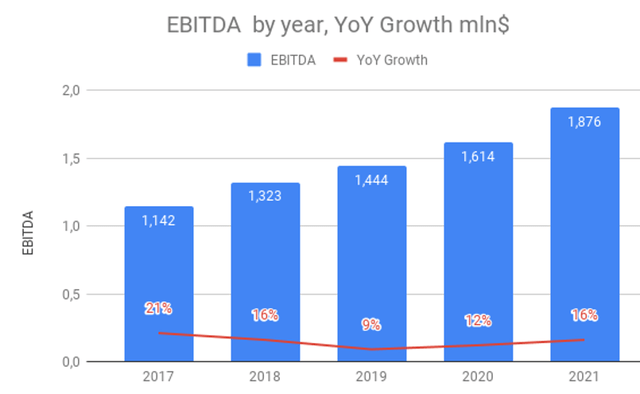

The bet on wind and solar allows the company to demonstrate confident EBITDA growth. In 2017, the share of wind and solar generation was 15% and 1%, respectively; in 2021, the percentage increased to 21% and 14+%, respectively. It also reduces the risk of the weather factor, which plays a significant role in the company’s performance.

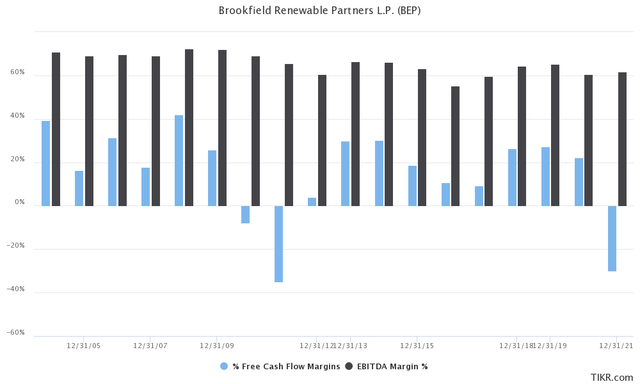

As for the historical data: the company maintains wide margins. EBITDA and FCF margins were selected to show the marginality. The exception was in 2021, when the company’s FCF decreased due to heavy CapEx. BEP is obviously a stable business, with the FCF margin averaging 15% for the last 10 years.

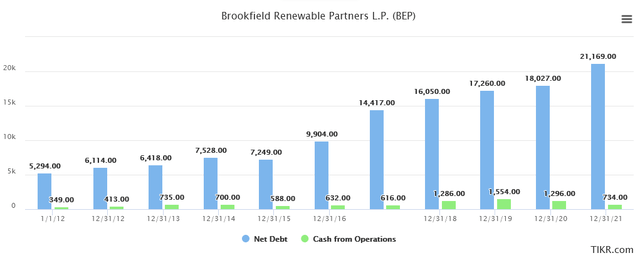

The net debt position of Brookfield Renewable Partners has been growing over the past five years; it doubled. Meanwhile, a corresponding growth of FFO suggests that the business has been effective.

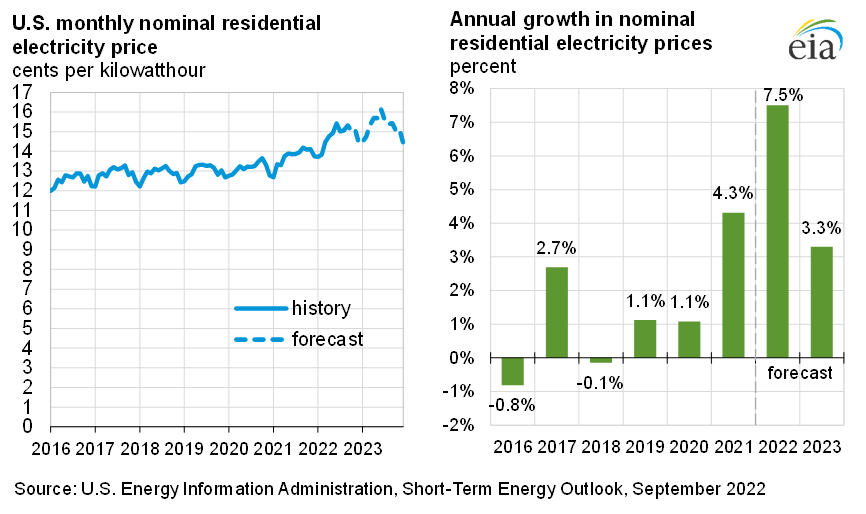

Energy Market

Renewable energy is rising; it is expected to grow at an 8.5% rate, increasing from $860 billion in 2021 to $1.68 trillion by 2029. That will drag Brookfield Renewable along at a solid pace. Rising energy costs have driven the surge in inflation. As a result, BEP will fix at higher rates when existing contracts expire. So, according to IEA’s forecasts, in 2022, the average price of electricity for the U.S. population will be 14.8 cents per KWh, which is a 7.5% lift YoY.

Energy information administration

The company teams up with others and invests in tech, including green hydrogen, carbon capture, and storage – CCS. The green hydrogen market is expected to grow at a CAGR of 39.5% toward $60.56 billion by 2030. BEP has worked with Enbridge (ENB) to develop green hydrogen resources in Quebec. It is also partnering with hydrogen company Plug Power (PLUG) to provide renewable energy to its first plant to produce sustainable hydrogen. The carbon capture and storage market is expected to grow at a 13.7% CAGR towards $7 billion by 2030. Brookfield recently formed a joint venture with oil producer California Resources (CRC).

The company’s growth drivers include scale savings and further capacity growth. Accordingly, Brookfield Renewable has long-term potential for revenue growth and FFO.

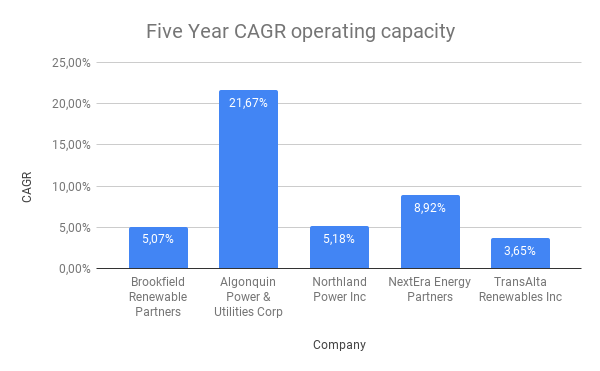

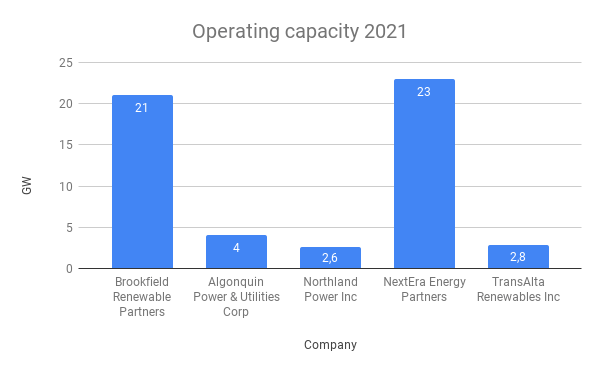

Competition

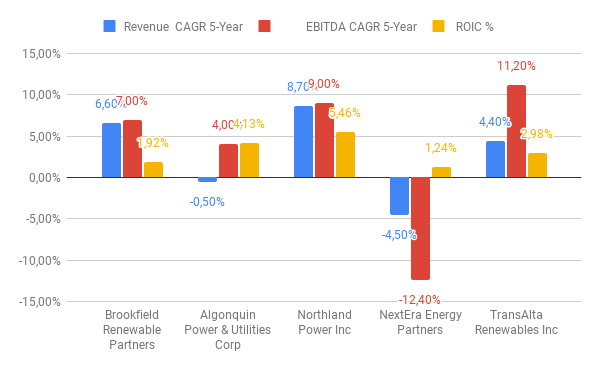

Let’s pick peers: Algonquin Power & Utilities Corp. (AQN), Northland Power Inc. (OTCPK:NPIFF), NextEra Energy Partners (NEE), and TransAlta Renewables Inc. (RNW:CA). NextEra is leading the pack by overall installed capacity, and Brookfield Renewable is slightly lower with 21 GW. The installed capacity growth rate is weak among peers; only Algonquin Power & Utilities Corp is actively growing.

Companies’ reporting

Companies’ reporting

In financial terms, most companies have a low ROIC. It indicates that if interest rates rise further, the borrowing costs would be higher; Companies would find it challenging to pursue M&A deals and expand the business. However, Brookfield noted that with the $15 billion closure of the Brookfield Global Transition Fund, the company has access to capital to invest.

Companies’ reporting

As for BEP’s multiples, facts point to a discount compared to the closest counterparts and industry.

|

Company Name |

PE (TTM) |

P/B (TTM) |

EV/EBITDA (TTM) |

P/S (TTM) |

|

Brookfield Renewable Partners |

-51,13 |

1,80 |

11,56 |

1,84 |

|

Algonquin Power & Utilities Corp. |

109,57 |

1,01 |

21,63 |

2,03 |

|

Northland Power Inc. |

13,05 |

2,44 |

7,20 |

3,59 |

|

NextEra Energy Partners |

15,57 |

2,02 |

15,52 |

5,72 |

|

TransAlta Renewables Inc. |

46,20 |

2,16 |

14,55 |

8,10 |

|

Average |

25,20 |

2,30 |

14,10 |

7,02 |

|

Potential Growth/Fall |

– |

27,78% |

21,97% |

281,52% |

|

Median Utilities – Independent Power Producers industry |

17,55 |

1,58 |

12,70 |

3,40 |

|

Potential Growth/Fall |

– |

-12,22% |

9,86% |

84,78% |

(Source: Gurufocus.com.)

Dividends

Under the current dividend policy, the company pays $0.32 per quarter. The dividend growth rate over five years was 4.06%, while the payout ratio rose from 53% to 84%. Despite the increased payout ratio, the company has no liquidity problems. The company reported about $4 billion in available liquidity, which still lags the headroom for business growth. The average dividend yield was 4.46%, slightly below the potential current 3.30%.

|

Year |

Funds From Operations per Unit$ |

Distribution per LP Unit$ |

Payout Ratio |

Dividend Yield Year End Yield |

|

2017 |

1,90 |

1,00 |

53% |

5,36% |

|

2018 |

2,16 |

1,05 |

49% |

7,57% |

|

2019 |

1,30 |

1,10 |

85% |

3,31% |

|

2020 |

1,32 |

1,16 |

88% |

2,68% |

|

2021 |

1,45 |

1,22 |

84% |

3,39% |

(Source: Companies’ reporting)

Major Risk

The focus of the energy policy may shift away from renewable energy due to the energy crisis. Because of this, the U.S. government allowed the increase of oil production, which could delay the energy transition. That could result in a reduction of interest in stocks like BEP.

Conclusion

Brookfield Renewable Partners L.P. is expected to deliver in coming years thanks to the commissioning of new capacities and rising electricity prices. Brookfield Renewable is one of the leaders in renewable energy and currently is trading with a discount; it also has a consistent dividend history. Multiples show a discount of 15-20+ %, and Brookfield Renewable Partners stock looks attractive for purchase.

Be the first to comment