narvikk/E+ via Getty Images

This is a Z4 Energy Research Quick Look ~ ProFrac (NASDAQ:PFHC) Acquires US Well Services (NASDAQ:USWS)

ProFrac is acquiring small cap clean frac company U.S. Well Services in a stock for equity deal with debt assumption.

We covered the ProFrac IPO on our website but in a nutshell, prior to this deal, they were a high margin 31 fleet operator employing a two pronged strategy of Acquire, Retire, Replace and scaled vertical integration with eyes on producing sustainable free cash flow and eventually returning cash to shareholders (probably in 2023). The IPO priced in May at $18, below the low end of the expected range, in soft energy market conditions but recovered nicely before the recent oil swoon and deal announcement on Tuesday night. We don’t own the name but we note that the deal dip was typical and less than noteworthy given the action in the group on Wednesday.

If you missed our recent piece on micro cap clean frac fleet operator USWS please click here. Though they are a tiny name in Total Enterprise Value (TEV) terms they are set to be running the most electric frac fleets (efleets) in the industry by year end.

For some macro frac segment thoughts this piece from last March on NexTier (NEX) may be of interest as the key points all still apply.

The Deal Mechanics

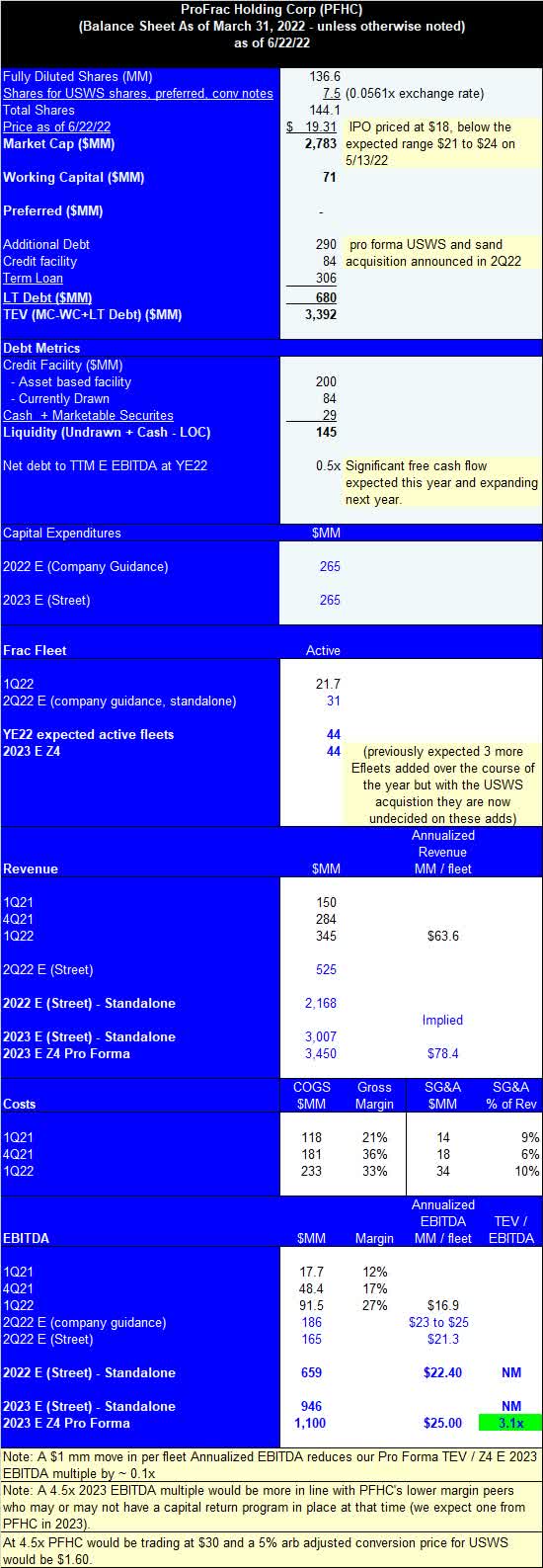

- PFHC to issue roughly 7.5 mm shares for USWS common, convertible senior notes, and convertible preferred, at an exchange ratio of 0.0561x to 1. At last night’s PFHC close of $19.31 that equates to $1.08 for USWS vs their close of $0.98 (about a 9% arb gap which we would expect to tighten over time as the deal is good for both companies and approved by both boards).

- ProFrac will assume about $200 mm of net debt at the time of the close in 4Q22.

- The TEV is pro forma, both this acquisition and that of a sand operation acquisition announced earlier this week for $90 mm (to be paid in cash).

The Assets

At year end 2022 the combined company will have 44 active frac fleets, up from an expected 31 active fleets of the standalone PFHC during 2Q22 and 21.7 in the first quarter (they were absorbing the FTSI fleets with that acquisition closing late in the first quarter). The new total will include 10 efleets from USWS (6 to 7 running in 2Q with 3 more on the way by year end) and 2 of their own eFleets to enter service over the remainder of the year. The USWS efleets will be low maintenance adds on the go forward capex side while garnering leading edge pricing (our recent but admittedly small sample size channel checks suggest a roughly 15% premium for efleets relative to Tier IV DGB fleets and a similar gap lower to get down to Tier II diesel pricing).

In the end, the acquisition will result in ProFrac becoming the 2nd largest frac fleet operator in the U.S. and easily the largest efleet operator with 64% of the fleet total next generation low emission assets. These fleets as noted above garnering significantly higher prices relative to older Tier II diesel fleets. Lastly, ProFrac obtains US Well Service’s portfolio of over 110 patents and while they are not looking at present to license the technology they are looking to broaden its applications. By the way, we’d not be surprised to see some sort of power generation deal/venture soon as management noted grid sourced power for efleets is often less than ideal while saying “stay tuned” on the call.

Not only do they get bigger, spreading more assets over their fixed cost base, but the deal aligns perfectly with their Acquire, Retire, Replace strategy as they don’t plan to grow horsepower from an industry standpoint. Instead, they look to acquire high quality assets that are better suited under their control while maintaining a strong hand on their supply chain allowing for the same assets to see higher utilization and margins. USWS efleets will be low maintenance adds on the go forward capex side while garnering leading edge pricing. The company also has three sand operations and their own repair and build facilities as part of their vertical integration strategy, helping to reduce costs, increasing reliability, and achieve higher frac fleet utilization.

The Balance Sheet

On the conference call some analysts voiced modest concerns about the leverage being taken on. By the end of the call this was well addressed by management. As noted the deal is expected to close in the fourth quarter. To be conservative, let’s just assume it closes at year end providing no material contribution this calendar year. In this case the company will be a significant free cash flow generator this year and still result in pro forma net debt at YE22 to Street standalone EBITDA of just 0.5x. This would not be considered a threatening level in our view even for a space where investors are quick to raise an eyebrow to leverage.

The Margins

Last week during their 1Q22 conference call, PFHC guided second quarter 2022 Annualized EBITDA per fleet to a group high range of $23 to $25 mm. These are levels their peers would like to achieve late this or early next.

In our prior discussions with USWS management we arrived at an expectation of a $18 to $20 mm type range for USWS by early 2023 as the increased number of fleets would then be better leveraged across the company’s fixed costs. PHFC sees a path to synergy savings of $35 mm and we note that PFHC has a track record of rapidly improving fleet margins and we would expect better numbers now for the USWS fleets than we (our Street consensus) were otherwise expecting for 2023.

We note also that USWS’s fleets are under “non leading edge” long term contracts but these are set to largely roll off in late 2022 and early 2023. On the call, PFHC management indicated they are looking forward to: 1) increasing the utilization of USWS’s fleets and 2) negotiating for higher revenue per fleet as the contracts come due with PFHC looking to internalize some of the savings upstream players are now achieving relative to diesel fleets. This is a conversation we have seen as overdue by all names in the frac space.

Valuation

We’re going to forget about any stub financial add late in 2022 that USWS would bring and focus on 2023.

- Our 2023 model assumes the 44 active spreads at year end 2022 are all PFHC runs during 2023. We view a previously spoken to but not yet committed additional 3 efleets they may build next year as potential upside to our estimates.

- We are also assuming their 2Q22 range top annualized EBITDA per fleet of $25 mm is a fair if overly conservative average figure for all of 2023. This figure assumes continued progress on raising profitability of the existing 31 “legacy” fleets while moving the USWS assets up into the lower $20 mm’s. Again, we think this will prove conservative given strong demand tailwinds that we do not expect to abate soon. We’ve included $1 mm sensitivity notes at the bottom of the cheat sheet so if you don’t like our number it’s fairly easy to get to your own.

- On this basis, PFHC has a TEV to Z4 2023 E Pro Forma EBITDA of 3.1x. This is towards lower end of the group and well below NEX at 4.3x and LBRT at 3.8x.

- At what we would expect to be a more normal 4.5x multiple PFHC would trade to $30 which in turn would suggest USWS near $1.60.

Our USWS and PFHC Thoughts & Plan:

- PFHC announced the acquisition on the eve of a turbulent day in the energy space with oil down between $5 and $7 hours after their news hit the tape.

- PFHC initially fell as much as 15.5% on the day before recovering to close down a much more small-deal-bolt-on-like 10%. For its part, even with the deal dip in ProFrac USWS rallied 37% on the session.

- We previously noted USWS’s assets as a natural target for PFHC’s and as recently as last Friday in our pre call note for the PFHC 1Q22 results on our site wrote: “We have to wonder if USWS isn’t a natural target for PFHC as they speak to their trademarked Acquire, Retire, Replace strategy where they see more opportunities. Our sense is they want to grow and a fleet of efrac spreads, soon to number 10, and new in vintage, garnering premium pricing with good clients would make a lot of sense as a bolt on for them, especially with USWS’s stock on its heels.”

- Given the somewhat unfortunate timing of the deal announcement relative to the oil price bobble we want to let the Street digest this accretive deal over the next several weeks.

- We currently do not plan to hold USWS through the 4Q22 deal close but will let PFHC approach a more fulsome valuation, likely in the lower to mid 4x’s and then sell and re-evaluate our wedge of frac company holdings in the Z4 portfolio as we own several names in the space.

- We do know that PFHC is running well high to others on a per frac fleet margin basis due to their supply chain control efforts including the vertical integration strategy. We also like how they are speaking to “shared gain” relative to good times in E&P and the cost savings they provide.

Z4 Energy Research PFHC Pro forma Cheat Sheet (Z4 Energy Research)

Be the first to comment