FerreiraSilva

During the past year, the widespread opinion on Petrobras (NYSE:PBR) was that the political risk of a Lula da Silva win makes the company ‘un-investable’ and the stock should be avoided. Meanwhile, shareholders were showered with dividends and the annual yield, taking into account the last four dividend payments, stands at above 50% at current prices. Following the narrow win of Lula over Jair Bolsonaro, some investors in Petrobras are holding their breaths until there’s more clarity about the future of the company, while some have abandoned the ship as soon the results were announced, as memories of Operation Car Wash are still fresh.

In this article, I’ll argue that a repeat of the Car Wash scandal is unlikely and although dividends will very likely be reduced, this is not a reason to avoid Petrobras, given its significant discount to other oil majors. Furthermore, Lula has already been president and during his term, the company has traded at significantly higher than current multiples.

Company overview

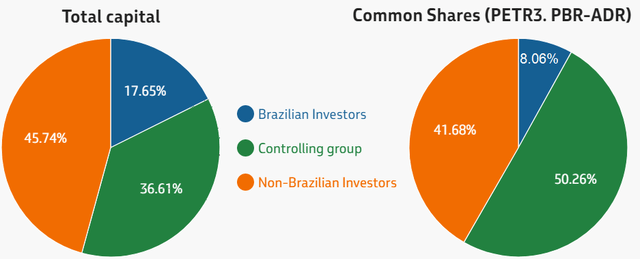

Petrobras is a Brazilian major oil and gas company with daily production rate of around 2.6Mboe. The biggest shareholder in the entity is the Brazilian government, which combined with its subsidiary – the Brazilian Development Bank has 36.61% stake in total capital. However, when it comes to common shares, which have voting rights, the state controls 50.26%, giving it the ability to have a final say about the direction of the company.

Perobras’ ownership structure (Petrobras)

As one of the major oil producers, Petrobras is well covered, so I’m not going to go into lengthy details about the business itself. Instead, I’m going to focus on the elephant in the room – political risk.

A repeat of the car wash scandal is unlikely

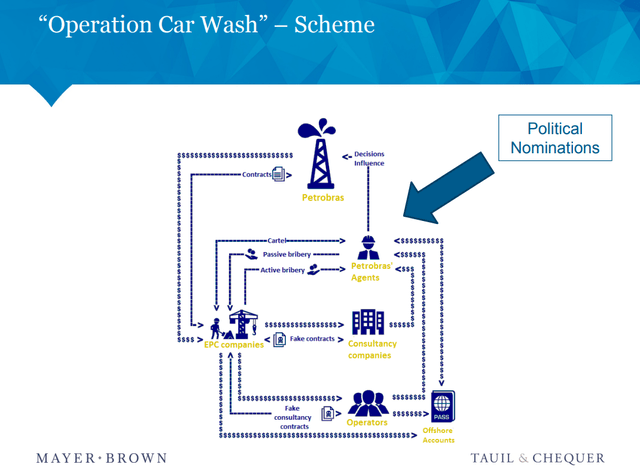

In short, Operation Car Wash revealed a massive corruption scheme, which extracted billions of dollars from Petrobras, through inflated construction contracts with third parties. The scheme included top executives from the company and the third-party operators as well as politicians. It’s alleged that the participants in the scheme have redistributed between themselves billions of dollars. In relation of the scandal, Lula da Silva – then former president of Brazil and now newly elected again – was convicted.

Operation Car Wash scheme (Mayer Brown)

In light of that, the statements of Lula and his political aides – that the company should invest more instead of giving enormous dividends – are alarming. After all, it was exactly through supposed investments that Petrobras was previously drained. However, from the emergence of the scandal to today quite a few changes took place in order to minimize the chance of such embezzlement to take place again.

For example, the corporate Bylaws of Petrobras were changed in a way to limit political interference. According to art. 3, §6 of the bylaws, the company must be compensated for the difference between a result under normal market conditions and a result under obligations, forced upon the company by the government for supposedly contributing to the public interest. In addition, under art. 21, §2 the scope of people who could take administrative role excludes anyone who has been involved in conducting political campaigns or had decision making role in a political party or held office in a union organization or was a representative of regulatory body which oversaw the company, in the last 36 months. This in turn limits the path of political figures to end up in decision making spots at the company.

Of course, Bylaws could be changed, given that the government has voting majority. However, such a move will inevitably give reason to Lula’s political rivals to ring the alarm and bring back the Car Wash story to the public. In my opinion, the last thing an elected official should do, especially after a very narrow win, is to begin his term with a scandal and give his opponents a reason to stir the public opinion against him.

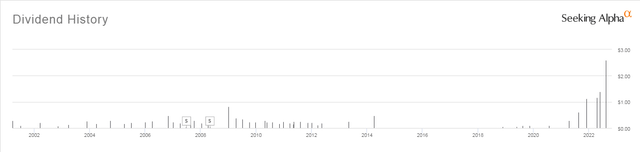

The dividend will likely be reduced

That being said, for one to expect that absolutely nothing will change and the current dividend policy will remain in place, I think is a bit too optimistic. According to the Bylaws of Petrobras, at least 25% of adjusted net income should be paid as dividends. In a scenario, where the company is trading at P/E in the 3-4 range, that would imply dividend yield of around 7%, which would still be higher than the energy sector average.

Petrobras’ dividend distributions (Seeking Alpha)

A complete halt of the dividend is very unlikely, especially given that besides current Bylaws having a certain dividend policy embedded in them, during the last term of Lula, the company was making distributions to shareholders. Not to mention, that as the biggest shareholder in PBR, the government also gets serious revenue from the dividends.

So reducing the dividend to a yield of the low-teens at current share price seems like the most likely path to me. Such a move will allow Lula to claim that he stopped the supposed enrichment of foreign investors before the public, but at the same time such a move won’t be interpreted as hostile by most foreign investors, who seems are currently pricing a much worse outcome.

Whether the remaining part of the cash flow will be used in the wisest manner is a different story, but as I stated above, a repeat of the car wash scandal type of use for the funds is highly unlikely. If the money is used primarily for exploration, this could end up being long-term positive for Petrobras, as production capacity should be maintained or, even better, expanded.

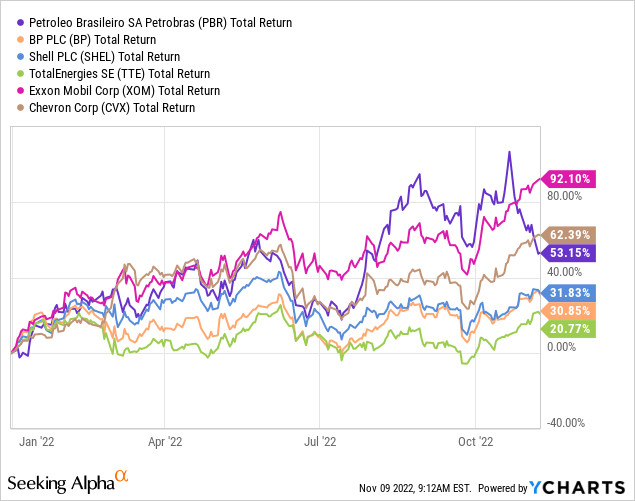

Share price and valuation

Looking at the YtD total return of Petrobras in comparison with other western oil majors, gives a very interesting perspective. The Brazilian company has underperformed only the two peers of US origin – Exxon Mobil (XOM) and Chevron (CVX), while those incorporated in Europe – BP (BP), Shell (SHEL) and TotalEnergies (TTE) have lagged behind. This is not surprising as politicians in the EU and the UK have imposed windfall taxes on oil and gas companies. At the same time, I couldn’t find any mention of a windfall tax for Petrobras by Lula or his political aides. In light of that, it seems that Brazil is far better jurisdiction for energy companies, than European countries.

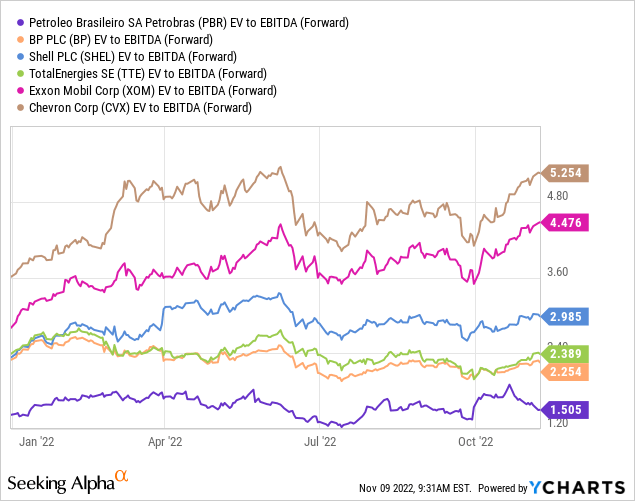

However, looking at the Forward EV/EBITDA multiples of the same peer group, all of companies, including the ones from Europe have considerably higher coefficients. While a case for the discount of Petrobras to the US peers seems legitimate, I don’t think that the European oil and gas producers should be trading at a premium to a Brazilian company. Given the market cap and net debt of Petrobras, the share price of the company should appreciate more than 70% in order for the forward EV/EBITDA ratio of BP, which is the lowest in the peer group, to be reached.

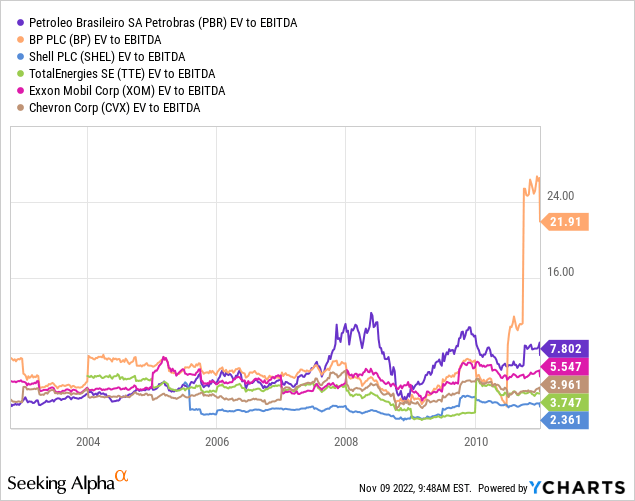

Looking back at history, to the previous term of Lula from his election in the end of October 2002 to the end of his term in the end of 2010, it can be observed that Petrobras was not trading at a discount to peers. There was a discount in the very beginning of Lula’s presidency, but the valuation gap was later closed. And although history doesn’t repeat itself, it often rhymes. So I wouldn’t be surprised if similar development of events unfolds in the next few years.

Conclusion

The political risk priced in Petrobras seems to be overblown. There’s no reason for the Brazilian company to be trading at significantly lower multiples than other oil and gas majors, who are getting slapped by windfall taxes by their governments. While the dividend will most likely be reduced, its elimination is highly unlikely. PBR may have to increase investments, but a Car Wash type of embezzlement is also highly unlikely. I think that when the transition of power in Brazil ends, markets will be calmed down, and price appreciation could be expected.

Be the first to comment