Weerasaksaeku

Introduction

MPC Container Ships (OTCPK:MPZZF) is an Oslo-listed container vessel lessor. Due to the fact its only listing is in Norway, the company often gets overlooked, and that’s a pity as MPC was able to rake in the cash during the recent container shipping boom. And although that boom is clearly over, MPC is still trading at attractive levels as its contracted EBITDA represents in excess of 1.5 times the current market capitalization, and the company will generate its entire market cap in EBITDA within the next 25 months. That still makes MPC pretty attractive in my books.

Yahoo Finance

MPC has its primary listing in Norway where it is trading on the Oslo Stock Exchange with MPCC as its ticker symbol. The current share price of 18.30 NOK represents approximately US$1.83 based on the current USD/NOK exchange rate. There are currently just under 444 million shares outstanding.

As expected, the third quarter was strong, and shareholders were rewarded with a juicy dividend

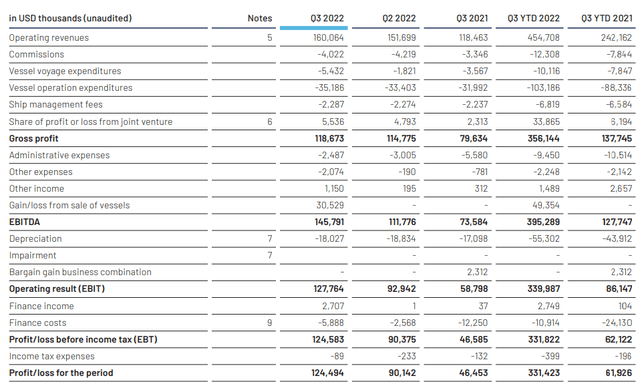

During the third quarter of this year, MPC reported a $160M revenue which resulted in a gross profit of $119M and an EBITDA of almost $146M as the company was also able to report a $30.5M gain on the sale of a vessel. The underlying EBITDA result – excluding the non-recurring contribution from the vessel sale) was approximately $115M.

MPC Investor Relations

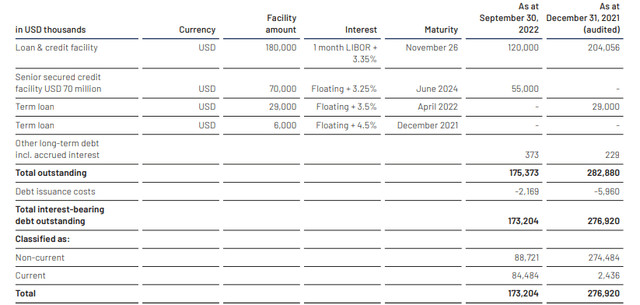

As the company has a very low net debt position, the net interest expenses are very low. That being said, we see the income statement contained almost $6M in finance costs but the footnote provides additional clarification: The entire gross debt position has a floating rate with a mark-up of 3.25-3.35% over the short-term market interest rates.

MPC Investor Relations

Given the recent increases of the USD yields, it would make sense for MPC to start repaying the gross debt and run a debt-free balance sheet. It’s fine to borrow cash when the cost of debt is low but once you are heading into a 7-8% cost of debt, it could make sense to further reduce the gross debt level as the $91M in unrestricted cash could easily be used to repay some of the debt.

Despite increasing interest expenses, MPC still reported an excellent net income of $124.5M for an EPS of $0.28. Keep in mind just under a quarter of this net income was attributable to the non-recurring gain on the sale of vessels, so the normalized net income was a bit lower.

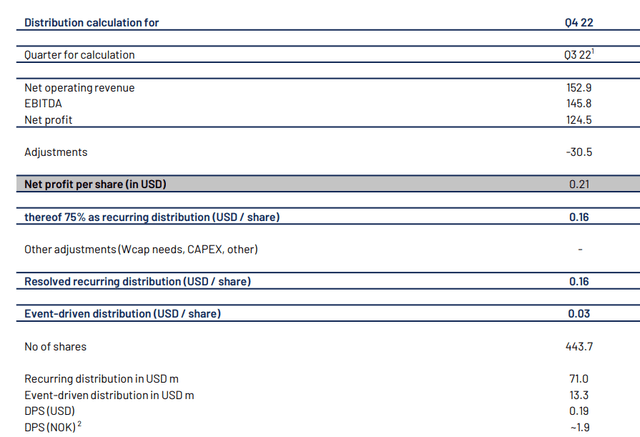

MPC is very transparent and provides a breakdown of the normalized profit as the dividend policy calls for a quarterly dividend of 75% of the recurring net income and an event-driven distribution.

As you can see below, the adjusted net income per share was $0.21 excluding the impact of the vessel sale and 75% of that adjusted EPS resulted in a normal dividend of $0.16 per share. The event-driven distribution represented US$13.3M or $0.03 per share for a total quarterly dividend of $0.19. The stock will trade ex-dividend on Dec. 20, and the dividend will be payable a few days later.

MPC Investor Relations

Given the strong backlog, one can expect the high dividend payments to continue in the near future. The dividends are currently paid as a (tax free) return of capital.

Although the container shipping market is in decline, MPC is in a good position

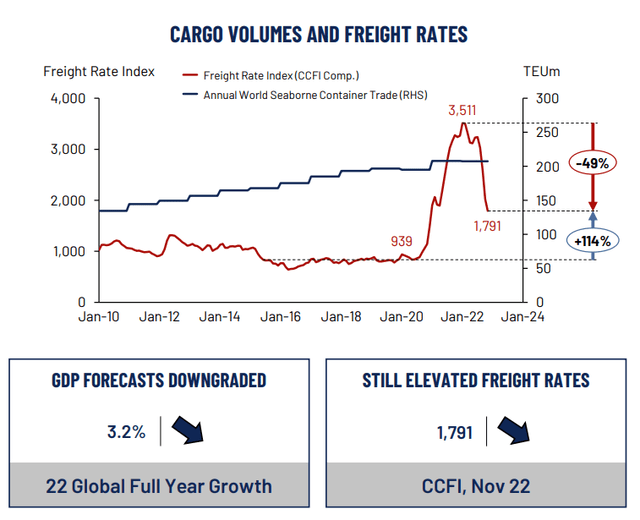

It goes without saying the container shipping sector is now way beyond its peak, and the image below, provided by MPC Container Ships, provides an excellent overview of the cargo volumes and the freight rate index.

MPC Investor Relations

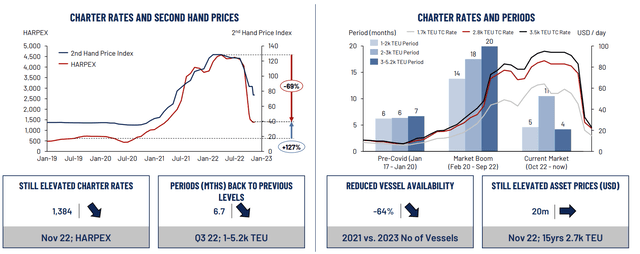

Needless to say lower freight rates also have an impact on the charter rates (which also decrease) and the value of vessels on the second hand market (if there’s less money to be made with operating a container vessel, then the by moments frantically purchase of new container vessels will die as well).

MPC Investor Relations

All these elements are a major reason why I have no position in the common equity of container vessel operators. The container market overheated and has now fallen off its peak, it’s as simple as that.

I still like the owners of the vessels – except for smaller or more aggressive operators which continued to pay top dollar for new or second hand vessels in the past 12-18 months – especially when those companies have leased the vessels to the operators based on long-term contracts. So unless the operators go bankrupt (which is now less likely considering most of them have been able to hoard cash during the past eighteen months, thereby strengthening their balance sheets), the lessors of container ships should be fine.

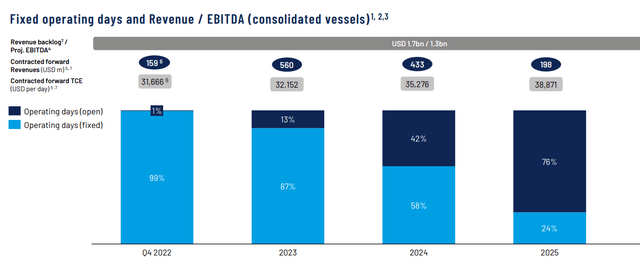

In MPC’s case, the company has strong coverage levels for the next few years at very strong average charter rates. 87% of the available days in 2023 have already been fixed at a very attractive charter rate of in excess of $32,000/day. And while the percentage of fixed days decreases to 58% in 2024, the average contracted charter rate increases by about 10%.

MPC Investor Relations

And this is where it gets interesting. In 2023 and 2024, MPC already locked in about $1B in revenue. The average EBITDA margin is approximately 75%, so I think it’s safe to say that between Q3 2022 and YE 2024, MPC Container will generate $750M in EBITDA. The current market capitalization of MPC Container Ships is approximately $810M so within the next 24 months, MPC will generate its entire market cap in EBITDA.

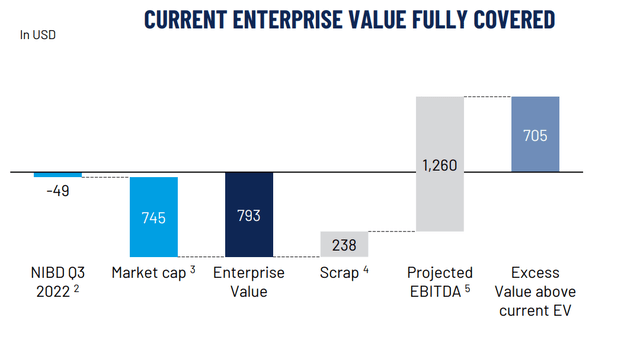

Of course EBITDA isn’t equal to free cash flow. But the image below also clearly indicates there’s value in MPC, even though the entire container shipping sector is in a downtrend. The total projected EBITDA based on the current fixed charters (and excluding the open days, which means not a single day of spot exposure is included) is $1.3B which, in combination with the anticipated scrap value of the vessels, greatly exceeds the current market capitalization and enterprise value.

MPC Investor Relations

Investment thesis

Since publishing my previous article on MPC, I have initiated a small long position. I fully understand the container shipping sector is now in a down cycle but I’m encouraged by the strong backlog of MPC Container Ships as the contracted revenue and EBITDA are very strong. While the dividend will fluctuate on a quarterly basis due to the company using a payout ratio of net income, the quarterly payments should remain at an elevated level and I wouldn’t be surprised if the company pays its entire market cap in dividends before the end of 2025.

An additional bonus is the discrepancy between the book value of the vessels (less than $800M) and the market value, which was estimated at $1.8B by the CEO in the recent conference call and at $1.2B in the recent corporate presentation. While the market value of second-hand vessels will come down, there appears to be at least $400M in “hidden value” on the balance sheet due to the difference between book value and market value.

Be the first to comment