Michael Smith/Getty Images News

Carrols Restaurant Group, Inc. (NASDAQ:TAST) is one of the largest “Burger King” franchisees in the U.S. operating more than 1,000 restaurants along with 65 “Popeyes” locations. It’s been a rough stretch for the company attempting to emerge from pandemic disruptions while facing a tight labor market and inflationary cost pressures. The stock is down more than 50% this year with the latest headwinds being concerns over the strength of the U.S. economy.

That being said, we’re taking a more positive outlook based on some encouraging signs from its last quarterly report. Notably, comparable restaurant sales trends have been solid and the potential that margins improve into 2023 can support an earnings rebound. Overall, we see value in the fast-food industry with Carrols Restaurant Group as a potential winner going forward.

TAST Key Metrics

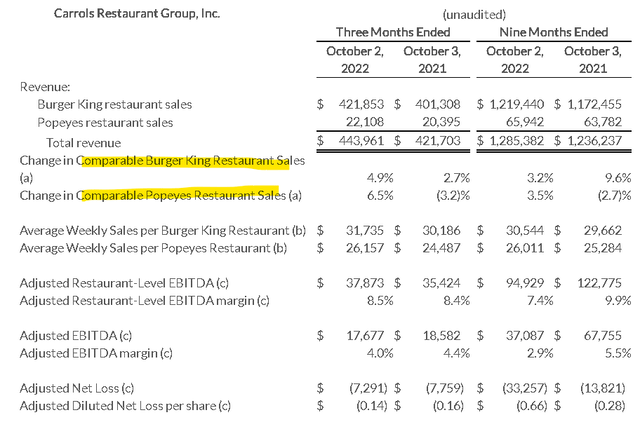

The company last reported its Q3 earnings on November 9th with an adjusted EPS loss of -$0.14, representing negative income of -$7.3 million compared to -$7.8 million in the period last year. Revenue this quarter reached $444 million, up 5.3% from $422 million in Q3 2021. Within that figure, comparable restaurant sales at Burger King climbed by 4.9%, while the momentum at Popeyes was stronger at 6.5%.

One of the themes this year has been an effort to gradually raise prices in response to higher costs. The trend is evident with the average check at Burger King restaurants up 11.0% y/y between menu changes along with a reduction in promotions. On the other hand, traffic is down by 5.5% y/y which follows broader macro trends considering the stronger environment for consumer spending last year.

Popeyes is a smaller part of the overall firm, contributing just 5% of total sales, but has seen more positive traffic trends, up 3.6% y/y, Management notes the strength of the brand that has captured some market share within the quick service restaurants industry.

The result is that the adjusted restaurant-level EBITDA for the company at $37.9 million in Q3 increased 7% y/y. Beyond the pricing efforts, labor and food costs, along with critical items such as packaging have at least stabilized compared to trends in the first half of the year.

Nevertheless, management notes that commodity supply chain pressures and the labor market remain elevated compared to what would be seen as optimal conditions. The firm-wide adjusted EBITDA which captures corporate expenses declined by 4.9% y/y to $17.7 million. On this point, an outlook for further cost reduction going forward can be connected to the bullish thesis for the stock as margins climb into 2023.

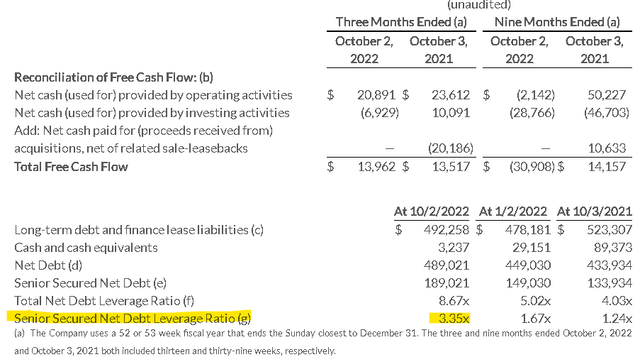

As it relates to the balance sheet, Carrols ended the quarter with $3.2 million in cash against $492 million in total debt, or $189 million excluding property finance leases. By this measure, the net debt leverage ratio at 3.4x is objectively high but otherwise stable considering positive cash flows and also below the loan covenant subject to a 5.8x limit. Liquidity is further supported by $195 million in availability under its existing revolving credit facility. Leverage should improve going forward.

What’s Next for TAST?

There’s no need to sugarcoat the data recognizing that TAST has some fundamental weaknesses between recurring losses and the debt position that keeps shares in a speculative category. The company’s market value of just $80 million makes it a “nano-cap” which translates into unique risks for the stock that should keep share volatile for the foreseeable future.

Still, the attraction here is the exposure to globally recognized brands between Burger King and Popeyes as a major regional restaurant operator in the United States with a particular presence in the Northeast region of the country.

The argument we make in favor of the stock is that considering all the headline-making macro headwinds, fast food can represent a relatively defensive side of consumer discretionary as an affordable dining option compared to casual dining or even other types of leisure and entertainment. In other words, as bad as the economy can get, people will always need to eat with Burger King and Popeyes locations maintaining an underlying level of demand.

Getting into 2023, the scenario of a slowing economy could have the effect of easing tight labor market conditions allowing Carrols to adequately staff its restaurants with reduced wage pressures. Aspects of inflation such as energy costs and even on the logistics side trending lower are positive for margins setting up a strong year ahead for financials.

Despite the depressed stock price, we don’t see any solvency risk or liquidity crunch for that company that would signal a looming bankruptcy. With a string of more positive operating and financial results over the next few quarters, the stock should respond with a rally, with room for its valuation multiples to expand.

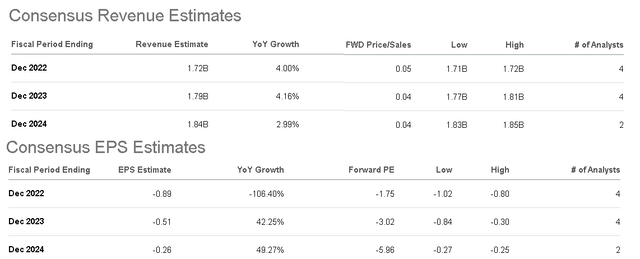

According to consensus estimates, the outlook is for annual revenue growth to average around 3.5% over the next two years while the net loss at least narrows from a forecasted EPS of -$0.89 this year towards -$0.26 in 2024. The bullish case for the stock is that there is upside to these estimates.

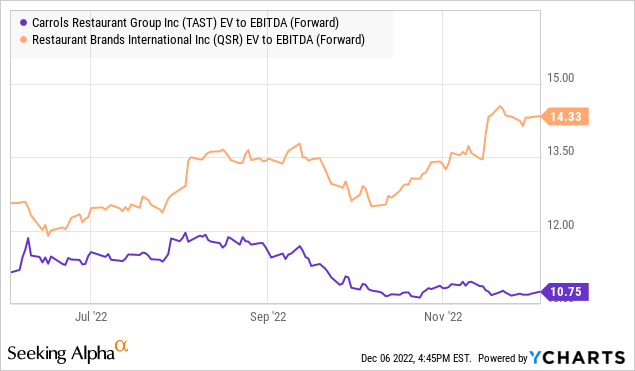

The metrics we’re looking at include an EV to forward EBITDA metric of 10.8x which is below the 14.3x in Restaurant Brands International Inc. (QSR), the holding company and franchiser of Burger King and Popeyes. In other words, investors have the opportunity to invest in those concepts at a discount through the Carrols Group while QSR has the advantage of stronger fundamentals. We believe TAST can outperform to the upside.

TAST Stock Price Forecast

We rate TAST as a buy with an initial price target of $2.20 representing a 12.5x EV to EBITDA multiple based on a consensus EBITDA estimate of $56 million for the full year 2022. Notably, the stock traded at this level as recently as September and the setup of a stronger 2023 with improving earnings could be the catalyst for shares to rally higher. Again, the story here comes down to operating margins that can benefit as inflation trends lower and interest rates stabilize.

The main risk to watch would be a deterioration of the economic outlook defined by a deeper recession. Weaker-than-expected operating trends could open the door for a leg lower in the stock. Monitoring points in the year ahead include comparable sales and traffic trends at Burger King and Popeyes locations.

Be the first to comment