Matveev_Aleksandr/iStock via Getty Images

Aquaculture is one of our favorite investment themes for a medium-to-long-term investment horizon. Besides population growth, higher living standards, and healthier diets supporting greater consumption of fish proteins, several countries around the world are also investing in aquaculture as a solution to food security as well as to support climate change initiatives.

Past outbreaks of food-borne viruses and episodes of food contamination have disproportionately afflicted sources of land-based animal proteins. Thus, investors may consider adding aquaculture to their portfolios to diversify risks associated with investing in the food industry.

In this article, we assess the long-term return drivers for the aquaculture theme, as well as the potential impact of the newly proposed “resource rent tax” in Norway.

Population Growth & Demand For Healthy Fish Protein To Sustain Long-term Growth

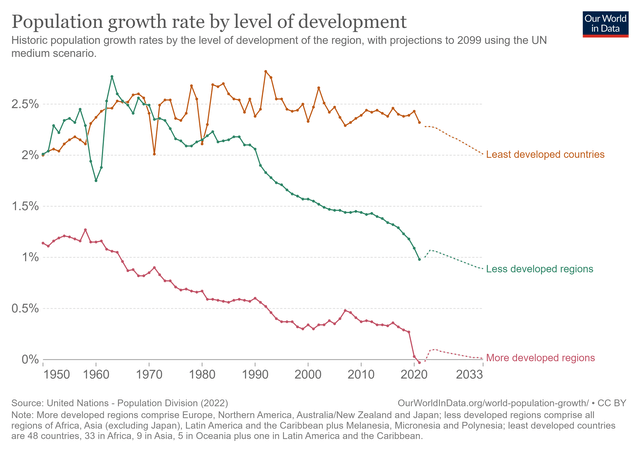

Investors are often unimpressed by analysts pointing to population growth as a long-term return driver of an investment theme. This is understandable given that world population growth rates have been declining steadily and are expected to continue to drop from the current 0.84% to just 0.64% annually by 2040 based on the latest forecasts published by the United Nations. Most of world population growth will also come from developing countries as several developed countries are already experiencing population declines.

United Nations – Population Division (2022), OurWorldInData.org

For aquaculture, however, the positive effects of population growth on demand for fish proteins are further amplified by other factors such as rising affluence in emerging markets and healthier eating habits. Simply put, not only does population growth lead to higher base demand, but the consumption of fish in proportion to other sources of proteins for a balanced diet is also increasing, thus amplifying aggregate demand growth.

Furthermore, declining fish stocks in oceans also means that the world will have to rely increasingly on aquaculture production in order to meet the growing demand for fish proteins.

Mowi Is Leading Salmon Aquaculture With Its Vertically Integrated Model

For investors looking to add portfolio exposure to this theme, we pick Mowi ASA (OTCPK:MHGVY) as the best-in-class company to execute our bullish view on the aquaculture theme.

Mowi is currently the largest producer of farmed salmon in the world by volume. The company’s products are sold across more than 70 countries, with representative operations in 25 countries. Mowi operates in three main business areas including Feed, Farming and Sales & Marketing, of which salmon dominates an overwhelming share of its business.

Besides enjoying significant advantages in economies of scale, we particularly like how Mowi has successfully integrated its operations vertically across the value chain over the years. Mowi is the only salmon producer in the world with a full vertically integrated business model that underscores many of the company’s competitive advantages over its peers. Due to the unique challenges associated with salmon production, Mowi’s ability to control the entire value chain is absolutely crucial.

Mowi has the unique capability to coordinate and apply its research & development efforts with full control over its entire value chain from genetics, feed, farming operations, harvesting, processing, logistics, sales and marketing. In comparison, other salmon producers (even with scale) either rely on off-the-shelf solutions for genetics and feed and have limited control over the quality and development of their suppliers.

Aquaculture Is Constantly In A Technological Race

Interestingly, aquaculture is among one of the most technologically sophisticated industries today. And Mowi has been pioneering and leading aquaculture technology for many years, creating a substantial technological gap between the company and its peers.

Mowi has also been developing the same strain of salmon since the company’s early beginnings in 1964. Having full control over breeding, genetics, and feed means that Mowi is able to produce a superior product compared to its competitors. By producing their own eggs and brood stock, Mowi is able to secure and select the best genetic properties for future generations of salmon. The company continues to invest aggressively in improving disease resistance and other biological qualities of its salmon.

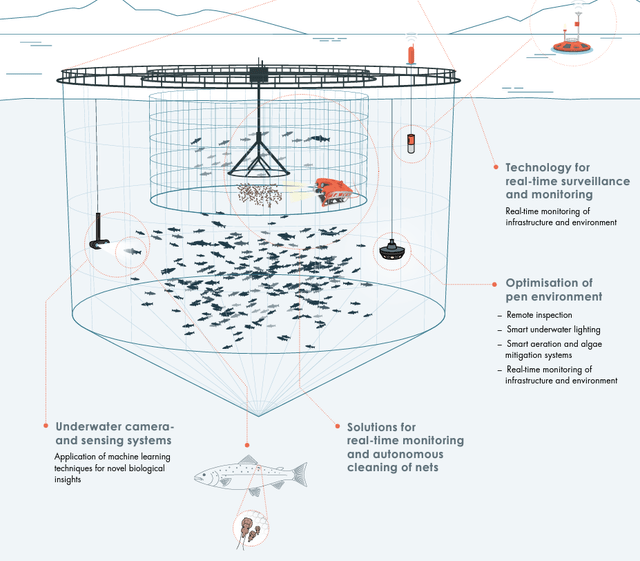

Other areas of R&D that we think will further enhance Mowi’s competitive advantage include Smart Farming technologies. These projects have been in development at Mowi for several years and some are already being applied in real-world salmon farming environments. Below is a diagram extracted from Mowi’s 2021 Annual Report showcasing some of these innovative R&D projects in application.

Salmon Aquaculture Is Environmentally Friendly, Crucial In An Increasingly Carbon Conscious World

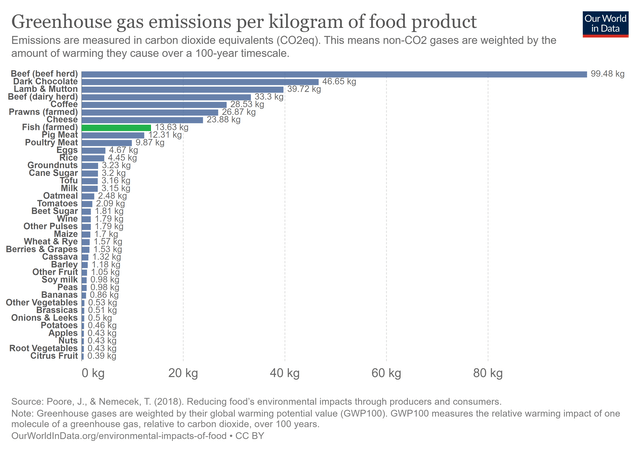

The chart below shows quantities of greenhouse gas emissions across different food products. As we can see, the production of animal-based proteins is responsible for some of the highest levels of greenhouse gas emissions. Within the animal-based protein group, farmed fish is actually one of the more environmentally sustainable food sources (highlighted in green).

Hannah Ritchie and Max Roser (2020) – “Environmental Impacts of Food Production”. Published online at OurWorldInData.org. Retrieved from: ‘https://ourworldindata.org/environmental-impacts-of-food’ [Online Resource]

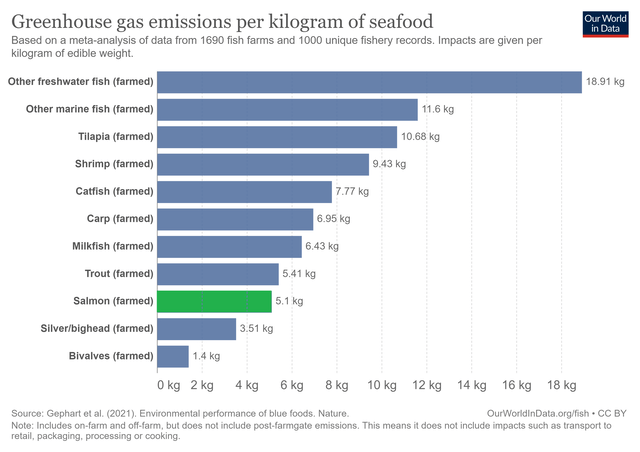

However, due to the variety of different species of fish being farmed, this still presents a highly aggregated picture. If we look further into the specific fish species farmed, we highlight that farmed salmon (highlighted in green) is among the lowest in greenhouse gas emissions at just 5.1 kilograms per kilogram of seafood. This makes farmed salmon one of the most environmentally sustainable and scalable sources of animal protein in the world today.

Hannah Ritchie and Max Roser (2021) – “Biodiversity”. Published online at OurWorldInData.org. Retrieved from: ‘https://ourworldindata.org/biodiversity’ [Online Resource]

Qualitative factors aside, Mowi has also performed well financially over the years, providing investors with a TTM ROE of 22.4% and a 5-year average ROE of 15.8%. The company also enjoys stable gross margins averaging 46% and EBITDA margins of 20%, with a dividend yield of 4.2% over the last 5 years.

In terms of valuation, we note that Mowi almost never trades at deep discounts due to the relatively stable nature of its profitability and earnings. Currently, the stock is trading at just 11.3x TTM GAAP P/E, but we note that this is due to the recent 22% drop in Mowi’s share price following the announcement of a newly proposed 40% “resource rent tax” in Norway. Including corporate tax, this would amount to a 62% tax on profits from salmon producers. Thus, current P/E ratios do not account for the potential decline in EPS that most analysts expect will be shaved by as much as a third, if the newly proposed tax is implemented.

Awaiting Outcome Of Resource Rent Tax

The Norwegian government’s announced proposal to increase taxes on salmon production is likely to present significant downside risks to the aquaculture industry in Norway. Major salmon producers including Mowi have already shelved investments in Norwegian production in anticipation of reduced cashflows in 2023. More concerning, we caution that reduced investments would mean production volumes may potentially stall, presenting downside risks to 2023 earnings and beyond.

The proposal is still in a public consultation process until 4 January 2023 but most analysts believe it will be implemented as planned.

In Conclusion

Despite a positive long-term outlook, Mowi ASA could nonetheless be negatively impacted by the newly proposed “resource rent tax” that could potentially shave earnings by as much as a third. Plans to invest in new production capacity have also been shelved, presenting significant downside risks to 2023 earnings growth and beyond.

We initiate our coverage of Mowi with a “Hold” rating for now, with the view to upgrade our rating once we have more clarity on future earnings.

Be the first to comment