Pro-syanov

Overview:

Caterpillar Inc. (NYSE:CAT) and Komatsu Ltd. (OTCPK:KMTUY) are two of the largest heavy equipment manufacturers in the world. Caterpillar is US-based and Komatsu is headquartered in Japan. Both sell and service large equipment worldwide.

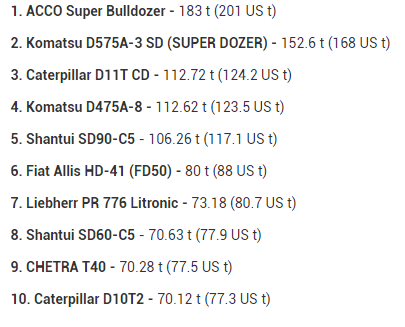

For example, here’s a list of the Top 10 largest bulldozers in the world. Note that four of the 10 are CAT and Komatsu.

Lectura Specs

Source: Lectura Specs

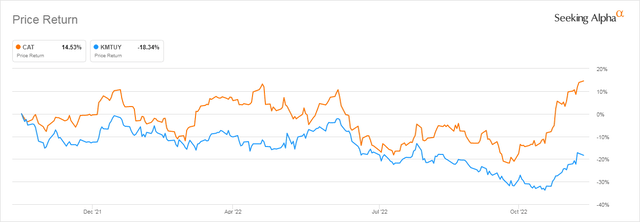

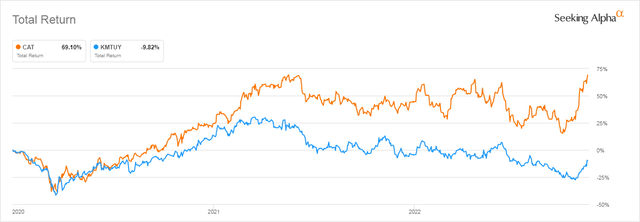

Over the last year and five years, CAT has outperformed Komatsu significantly as shown by the following two charts.

Seeking Alpha

Seeking Alpha

In this article, I will compare both companies to see which one, if either, looks like a reasonable investment at this time.

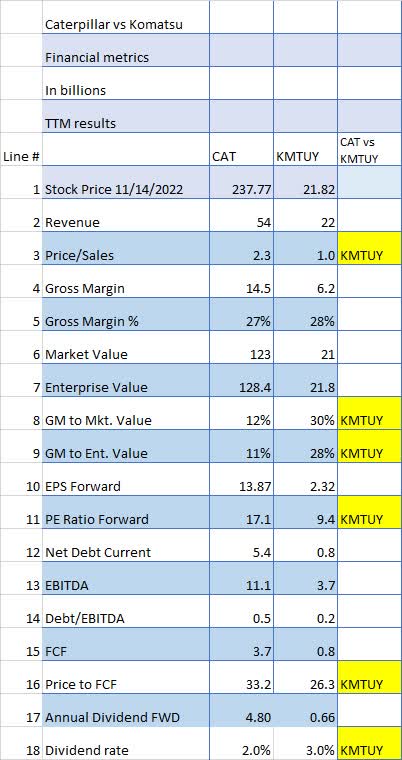

Financial metrics.

When we look at the financial metrics comparing the two companies on a TTM (Trailing Twelve Month) basis, several metrics jump out including the fact that Komatsu’s price/sales (Line 3) is less than half CAT’s. Typically when you see this kind of difference it implies the company with the lower ratio, in this case, KMTUY is perhaps undervalued at least relatively. However, as we will see later in this article, that may be the result of other factors.

That’s also shown by KMTUY’s slightly higher Gross Margin % (Line 5) of 28% vs. CAT’s 27%. But based on GM to Market Value Percentage (Line 8) Komatsu’s margin is much higher than CAT’s 30% to 12%. And it is true also for GM to Enterprise % (Line 9). Again, that might indicate that perhaps Komatsu is underpriced relative to CAT.

Seeking Alpha and author

Komatsu has a PE Ratio (Line 11) that’s 45% lower than CAT’s and a Price to Free Cash Flow (Line 16) with the KMTUY ratio being 20% less than CAT’s ratio.

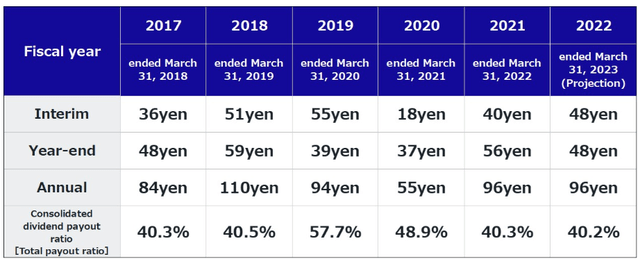

Both companies are extremely well funded with minuscule debt/EBITDA (Line 14). The dividend rate (line 18) is higher for KMUTY at 3% compared to CAT’s 2% but Komatsu’s dividend is more variable than Caterpillar’s.

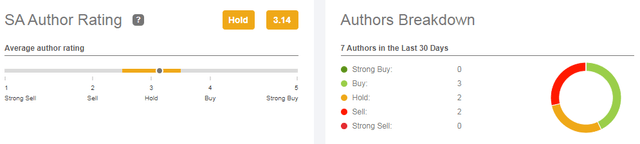

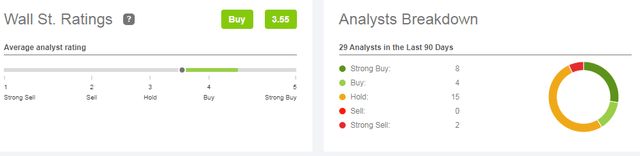

Wall Street Analysts’ ratings show Caterpillar is well-liked by the quant community.

Wall Street analysts appear to have mixed feelings for CAT, with Wall Street plus Seeking Alpha analysts combined showing 15 Buys, 17 Holds, and four Sells.

Seeking Alpha

Seeking Alpha

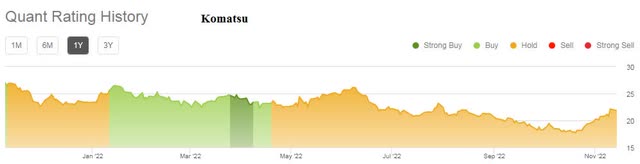

Komatsu does not have any analyst ratings but they do have Quant ratings. Interestingly enough, quants have had Komatsu a Buy for several months earlier in 2022 and a Strong Buy in the April time period.

Seeking Alpha

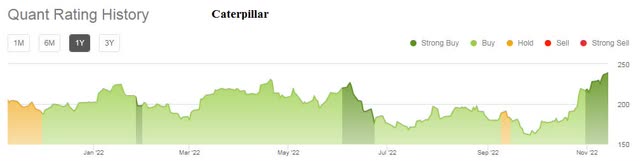

Caterpillar’s quant ratings are almost off the chart with Buy ratings for most of the year and Strong Buys for the last few weeks.

Seeking Alpha

Perhaps the quants know something that the other analysts don’t?

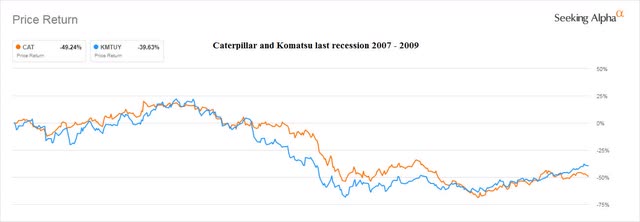

Neither Caterpillar nor Komatsu did well in the last recession.

If you are concerned, as I am, of a looming recession in the next year or 18 months, knowing how a company did in the last recession can provide some investment insight.

December 2007 through June 2009 is the last recognized recession period and neither Caterpillar nor Komatsu did well. Komatsu fell by 40% and CAT fell by 49% over that particular recessionary period.

Seeking Alpha

Dividends and share buybacks.

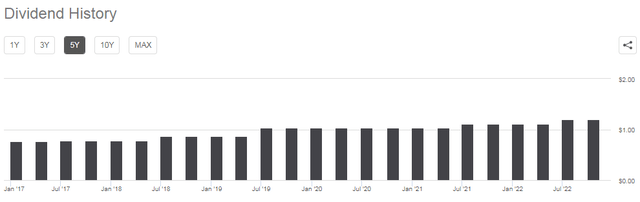

CAT has raised its dividend consistently over time and has raised it from $.77 to $1.20 since 2017 for an increase of 55%

Seeking Alpha

Komatsu’s dividend varies by year and is based on earnings. The following chart is in yen, not dollars.

Komatsu

So if you’re looking for a steady, consistent dividend, the choice is easily CAT.

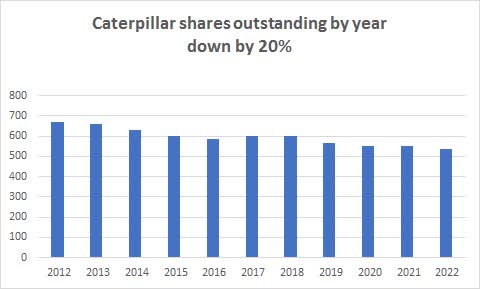

As for share buybacks, Caterpillar has lowered its share count for the last 10 years by 20%.

Author

On the other hand, I can find no record of Komatsu buybacks over recent time periods.

Share price since the Covid outbreak has increased for both companies.

If we look at the Total Return including dividends for both companies using the date of Jan. 1, 2020, as the beginning of COVID-19 we can see that CAT has done extremely well with an increase of 60% while Komatsu has actually fallen by 9%. This might imply that CAT is more resilient in difficult economic times than Komatsu is.

Seeking Alpha

Conclusion:

Comparing Caterpillar and Komatsu shows that although there are many similar comparisons both show the difficulty the entire industry has had over the last decade.

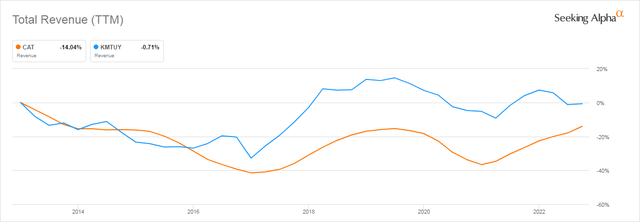

Looking at the following chart showing total revenue over the last 10 years, it’s easy to see that neither company has done well with Komatsu staying at virtually the same revenue level it had 10 years ago and CAT actually dropping by 14% over that same period.

Seeking Alpha

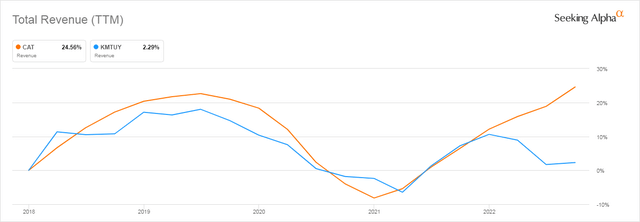

However, if we change the time frame to five years the situation is reversed with CAT actually growing revenues considerably faster than Komatsu.

Seeking Alpha

Looking at these two companies I see CAT as slightly better financially, especially considering its share buyback and dividend policy. And perhaps with all the money being thrown about by Washington for infrastructure, CAT has a head start on the next 10 years.

But after looking at all of this data, I cannot find a reason to buy either company.

Based upon the above analysis, CAT is a Hold, and Komatsu is a Sell.

Be the first to comment