bin kontan/iStock via Getty Images

Investment Thesis

Mosaic (NYSE:MOS) has been a turbulent stock in the past 6 months. Soaring high only to fall back rapidly. Lately, Mosaic, together with other fertilizer companies, appears to be finally finding some support.

Essentially, investors are coming around and saying that at 5x free cash flow, perhaps Mosaic is cheap enough to make a speculative buy.

However, I push back that there’s very little “speculative” about Mosaic. Mosaic, too, believes that its shares offer investors compelling value.

Indeed, Mosaic is putting money where its mouth is, as it rapidly reloads its repurchase program and doubles its allocation to $2 billion.

Not only is Mosaic’s balance sheet now very strong, but Mosaic now declares that it will not look to return more capital back to debtholders. Now the time to get paid will be shareholders.

Altogether, it’s difficult not to be excited about Mosaic.

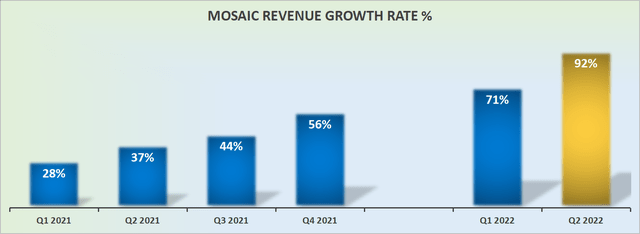

Revenue Growth Rates Jump, But So What?

Mosaic reported earlier this month that it had posted 92% y/y revenue growth rates. Talk about a hot fertilizer company. How has the market reacted?

Well, the stock is down 20% from its recent peak earlier this year, so even if lately the stock has found a bid, I believe that investors remain very much unexcited about Mosaic’s prospects.

Mosaic’s Near-Term Prospects

Previously I was inclined to argue that 2022 was a tough year for commodities, as the market had been so incredibly volatile. But it appears that as the year has rolled on, the other pockets of the market haven’t been all that fun either.

In fact, the argument used to be made that commodities companies are cheaply valued because they are cyclical. And that other sectors of the market, in particular tech, are expensive because they are “recession proof”. Well, it turns out that, that nicely told tale was nothing less than a tall tale.

Moving on, for their part, Mosaic makes the argument that its strong prospects are not in the rear-view mirror. Mosaic contends that its solid fundamentals will continue for the remainder of 2022 and into 2023.

Yet, once again, given that the stock is down from its highs, it shows that big institutions want nothing to do with this side of the market.

Even if a lot of focus was put on this sector at the start of the Ukraine war, that attention now has moved on. Investors got bored. Moved on.

After all, lest we forget, you should only buy commodity companies when they are priced high multiples, right? Because buying commodities on low multiples means that their best days are in the rearview mirror, right?

Well, typically yes. But I believe that this time it’s different. Why? Well, let’s look at the facts.

Capital Allocation Discussed

Mosaic has not squandered its capital. For the first half of 2022, Mosaic has returned 87% of its free cash flow.

Now Mosaic states that it expects to return 100% of 2022 free cash flow, after debt reduction commitments are met, to shareholders through a combination of share repurchases and dividends.

Think about it. Mosaic is basically saying, take our free cash flow. We are making more than we need.

There are many different macro cross winds to consider that make having clear visibility on the remainder of 2022 and how it will shape up challenging.

But just because there’s a range of potential outcomes, that should not prevent us from having some sort of discussion about Mosaic’s outlook.

This time last year, Mosaic’s biggest EBITDA contributor was phosphate. Today, the story is very much focused on potash. More than half its bottom line today is coming from potash.

And with the shortfall from Belarusian, there’s the overall expectation that potash continues to operate in a very favorable macro environment.

Consequently, I believe that it’s reasonable to expect that Mosaic’s $3.5 billion adjusted EBITDA could potentially repeat itself in the second half. If not considerably more, given that Q1 was still marked by lower potash and phosphate prices; “pre-war” prices.

Nevertheless, this implies that Mosaic could at least make $6 billion of adjusted EBITDA in 2022.

Of course, this immediately begs the question, is it likely that 2023 will be as strong as 2022?

For their part, Mosaic argues that even though there’s the expectation that a lot of the Russian potash will return to the market in 2023, despite the sanctions against Russia, that potash supply will find its way to the market. However, this will not be enough to offset the very high demand for potash.

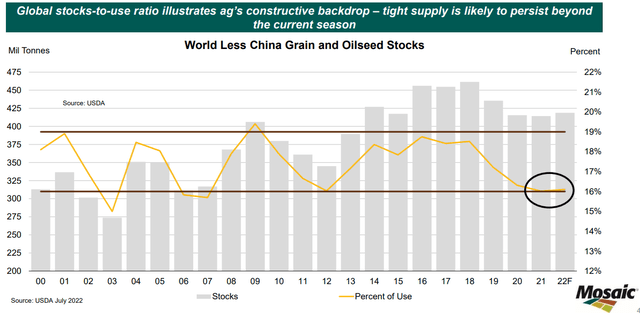

Simply put, Mosaic consistently notes that there’s a very low stocks-to-use ratio. This means that farmers are attempting to be as sparing as possible with their fertilizer, even as they come close to impairing their farming yield.

Indeed, as you can see above, there’s little ambiguity, there’s a very limited supply right now in the market, towards the lower end of the 20-year average.

It’s going to take more than 12 months to reverse this trend. Most fertilizer companies doing everything they can to increase production, but still unlikely to meaningfully reverse this balance.

This leads me to focus on Mosaic’s present valuation.

MOS Stock Valuation – 5x Free Cash Flow

As I’ve alluded to already, I believe that Mosaic’s H2 2022 will approximate the first half of 2022. While I recognize that for Mosaic, Q4 is typically the lowest season, this year we still have the late fall season ahead, in which farmers will seek out fertilizer after the late harvest.

On this note, Mosaic stated on the call,

[T]he late spring and late planting is going to lead to a late harvest. Now that means that the second half demand, while it should be in line with expectation, could come in the fourth quarter rather than the third quarter due to this delayed harvest. So while we expect a very normal second half, where exactly it plays out in terms of the timing is yet to be seen.

Consequently, altogether, I believe that somewhere around $6 billion of adjusted EBITDA sounds appropriate.

Note, that this would be 70% higher than the previous year, to be sure. However, keep in mind that Mosaic has very high fixed costs. This means that Mosaic has a large amount of inbuilt operating leverage.

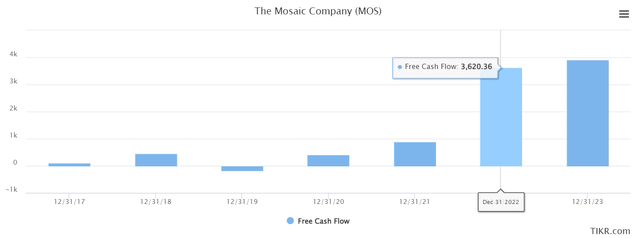

Hence, once again, this is my assertion, that $6 billion of EBITDA appears reasonable. Then, we have to keep in mind that Mosaic’s capex in 2022 is guided to reach about $1.3 billion. Altogether, I estimate that Mosaic’s free cash flow could reach $4.7 billion.

This is not comparable to 2021 when Mosaic made less than $1 billion of free cash flow.

Nevertheless, there’s still a $1 billion discrepancy between my free cash flow assumptions for Mosaic and what analysts presently believe Mosaic will make in 2022, see above.

Consequently, I believe that perhaps $4 billion of free cash flow, or halfway between my assumption and that of analysts makes sense.

This puts the stock priced at 5x this year’s free cash flow.

The Bottom Line

During the earnings call, Mosaic’s management said that they believe that their shares are very “compelling”. Obviously, management would talk up their stock.

But the facts appear to support that sentiment. In fact, there’s little reason for one to believe that 5x free cash flow is reflective of the underlying value of this business.

What 5x free cash flow means in practical terms is that investors only believe that Mosaic has 5 years left of these elevated free cash flow levels. Once 2022 and 2023 are behind the company, that its terminal value is only the equivalent of 3 years left. This seems to me to be absurdly cheap.

Yes, there are a lot of different moving parts. But it’s not like potash and phosphate are not incredibly necessary in food production. The only question that we have left outstanding is what will supply be like in 2023?

Is there any reason to believe that there’s going to be an oversupply of potash and phosphate in 2023? Presently, I don’t see how. If anything, there are more likely to be food security issues, brought about by high fertilizer prices and a deglobalization of supply chains.

Be the first to comment