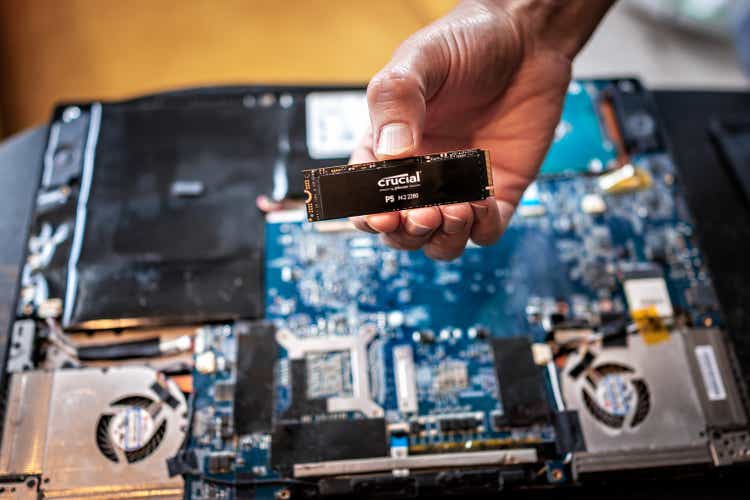

krblokhin/iStock Editorial via Getty Images

I wrote a few weeks ago here about the horrible and extended valuation setup working against NVIDIA (NVDA) investors. In late May here, I mentioned the “value trap” situation for Intel (INTC). Basically, what most analysts and turnaround investors considered a bargain valuation was destined to fall even lower in price as actual operating business results were weakening dramatically. So, which stock is a bargain in the Big Tech semiconductor space, if any?

My answer is Micron Technology (NASDAQ:MU), one of the largest memory chip makers in the world, which may in fact be worthwhile to own going into September 2022. When you dig deeper and compare valuation numbers (with analysts projecting a weak DRAM and NAND memory selling market until the summer of 2023) to both its 10-year past and the expensive setups of other large chip makers today, MU is close to tipping into true bargain territory. If you are a value or growth at a reasonable price [GARP] investor, purchasing this well-managed, strongly positioned blue-chip in the technology sector could help out portfolio returns in the years ahead. An added catalyst for investors is the U.S. government is offering tax breaks and other incentives in the CHIPS and Science Act passed this summer. Micron has committed to spend $40 billion on new American-based manufacturing capacity, creating up to 40,000 jobs.

Micron Website, August 27th, 2022

Valuation Story

While NVIDIA is clearly the most expensive major semiconductor name in U.S. trading (especially if chip sales are turning lower in a recession), Micron may be the cheapest in the group, at least from my vantage point. On a variety of calculations, Intel and Micron appear to have similar valuation setups. However, unlike INTC, MU’s low valuation is NOT matched against an imploding revenue and income future. My research conclusion is Micron should be owned before most other semiconductor companies are added to your portfolio, if risk-adjusted analysis is important to you.

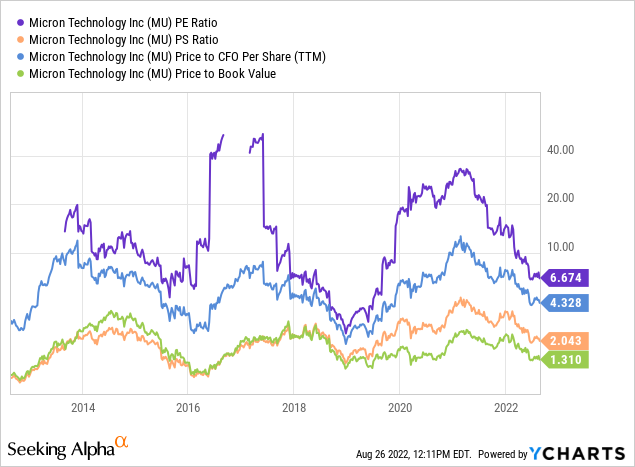

Looking back over 10 years of data, price to trailing earnings, sales, cash flow, and book value highlight a valuation already lower than usual. While price to sales is around long-term averages, most semiconductor companies are selling at massive premiums to the recent past, even after the 2022 bear market in Big Tech. Price is approaching accounting book value, nearing its lowest number since 2016. And, valuations on income and cash flow are well-below normal today.

YCharts, Micron – Fundamental Ratios, 10 Years

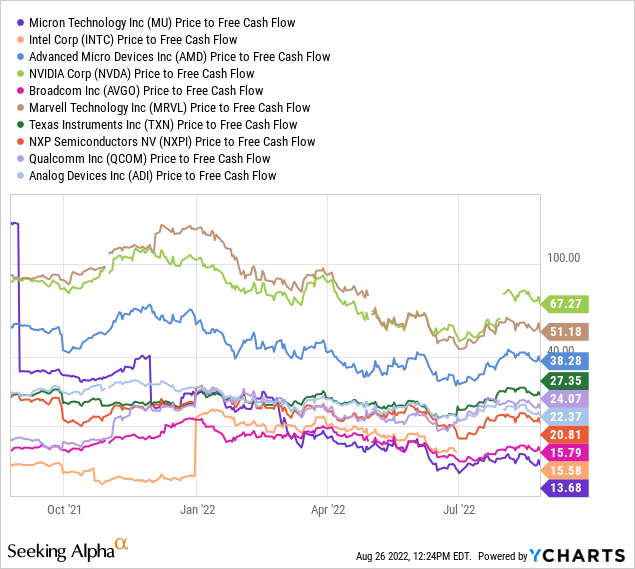

Price to trailing free cash flow of 13.7x is “the” bargain choice vs. its largest semiconductor peers and sometimes competitors. Below is a graph of this idea vs. Intel, Advanced Micro Devices (AMD), NVIDIA, Broadcom (AVGO), Marvell Technology (MRVL), Texas Instruments (TXN), NXP Semiconductors (NXPI), Qualcomm (QCOM), and Analog Devices (ADI).

YCharts, Micron Peers – Trailing Price to Free Cash Flow, 1 Year

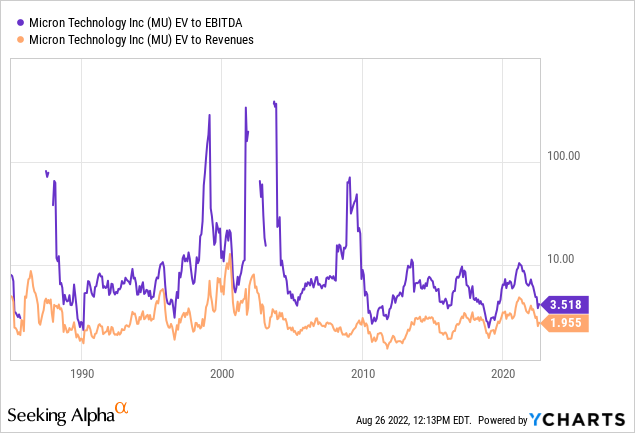

But the valuation news gets even better, when you incorporate balance sheet debt and cash holdings. Micron owned $10 billion in cash and $22.7 billion in total current assets at the end of June against $6 billion in debt and $16 billion in total liabilities. The positive effect on enterprise value calculations is today’s $64 billion in equity market value, which can be reduced based on the large net cash stash. So, EV to EBITDA (total cash flow generation using earnings before interest, taxes, depreciation and amortization) and EV to Revenue numbers are even less expensive than simple stock price comparisons. Reviewing 35 years of information, Micron’s EV to trailing EBITDA ratio of 3.5x is HALF of its long-term average (including recessions, wars, booms and busts). In addition, EV to trailing Revenues is a solid 30% discount to decades of history.

YCharts, Micron – EV Ratios, 35 Years

Enterprise value multiples are also a great financial exercise to more accurately compare companies with different management styles and leverage uses on an equal playing field, apples-to-apples for metrics. And, since Wall Street is more concerned about future results, we can take a look at “forward” estimates by analysts as part of our EV research (which include a slowdown in Micron’s businesses).

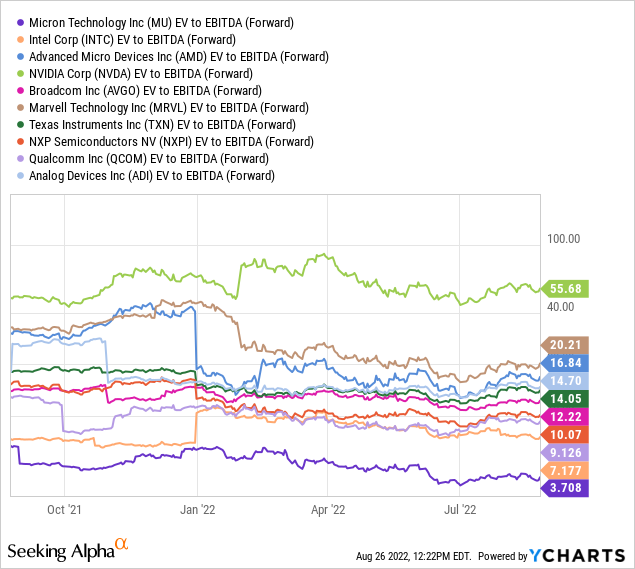

Perhaps the real eye-opening stat on Micron’s present valuation is found in EV to forward EBITDA data, graphed below. A projected 3.7x ratio is wickedly lower than a median peer group average of 12x, and mean average of 16.3x. Sure, you can argue memory chips sales and margins are more cyclical in nature than other semi-names, with operating losses occurring once every 5-7 years for the company. But, the typical semiconductor firm is selling for a large premium EV to EBITDA reading on the COVID-19 pandemic-related shortages of product. To honestly believe MU’s outlier number is appropriate, you have to also believe memory chips are on the way out for a technology, replaced with something better for all of our gadgets and machines.

YCharts, Micron Peers – EV To Forward EBITDA

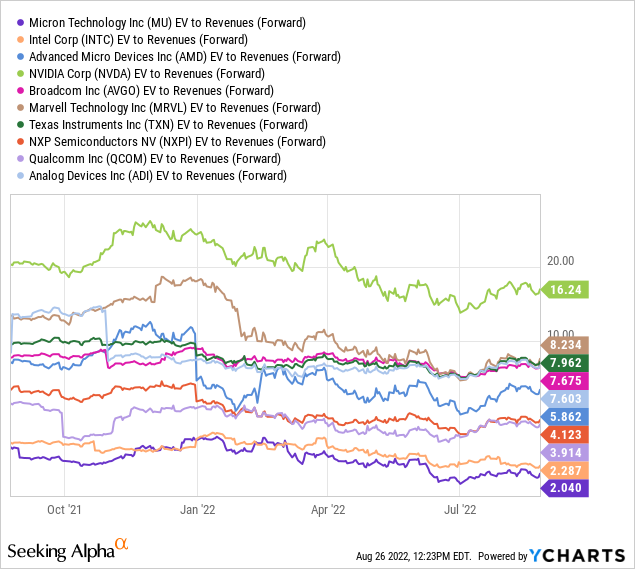

Again, the EV to forward Revenue projection of 2x is nowhere near industry norms. It’s even lower than Intel’s 2.3x. Measured at a median average discount of 60% vs. the peer group and 70% discount to the mean average, investors hunting for bargains have found a target worthy of purchase.

YCharts, Micron Peers – EV To Forward Revenues

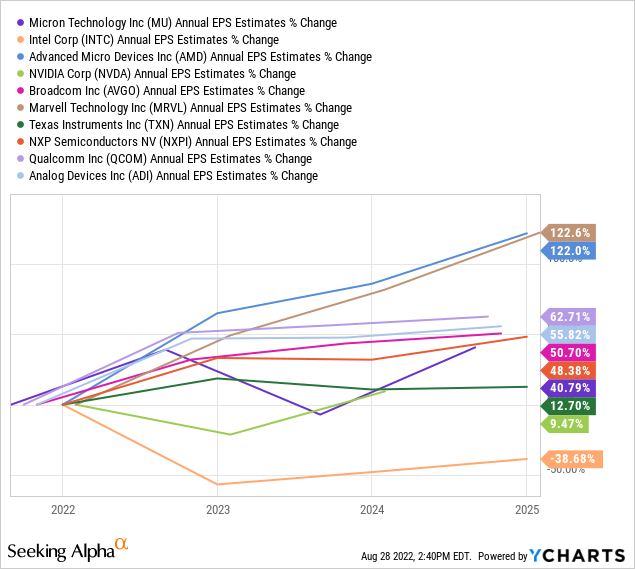

Taken together, the low valuation stats, alongside an approximate industry-normal EPS growth forecast between late 2021 and the middle of 2024 (pictured below), create a hard to ignore buy proposition.

YCharts, Micron Peers – EPS Estimates to Late 2024

Technical Trading Picture

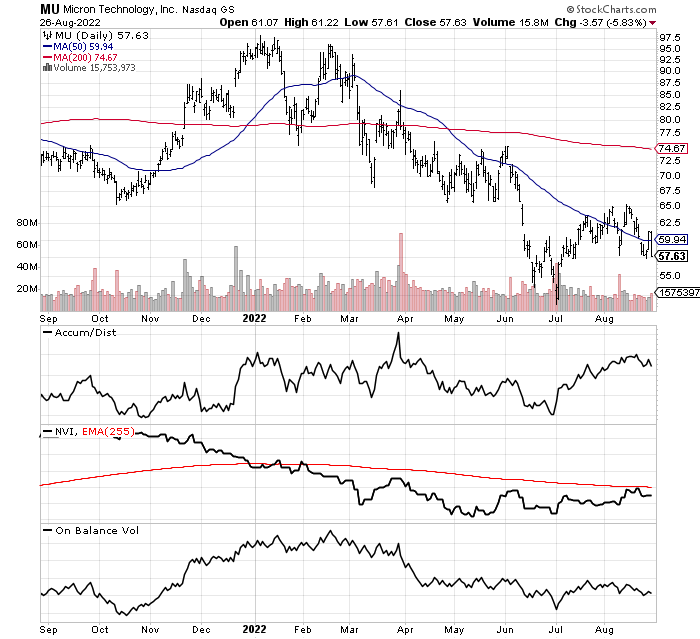

I know investing during bear markets is tough. It’s definitely a different animal than bull markets when it comes to buy decisions, as upside momentum is usually absent in blue chips. I would categorize the -40% Micron decline in price since January as lacking any real sell intensity. If appears to be one centered around the general Big Tech plunge, as industry sales growth slows and interest rates rise (a double whammy knocking price from extended overvaluations).

For MU specifically, the Accumulation/Distribution Line, Negative Volume Index, and On Balance Volume may have all reached bottoms already. All three have not declined materially over the past year, while they have perked up since late June. If these indicators remain steady while price dips below $50 in coming months, a technically-derived strong buy situation could materialize (on positive momentum divergences vs. a new price low).

StockCharts.com – Micron, 1-Year Chart of Daily Values

Final Thoughts

If valuations matter as an investor (which they should if you own stocks for years or decades), buying Micron at a forward EV to EBITDA number of 3.7x is a completely different position than NVIDIA at 55x. As an owner, I would much rather receive huge upfront cash flow and income in a company riding a long-term demographic uptrend in memory chips, than gamble on a projected high-growth gaming/crypto-mining/AI future that appears to be faltering.

Does buying a true bargain in Big Tech guarantee positive investment gains right away? No, but it increases the odds of a large advance after the economy recovers from its recent slowdown (recession). Honestly, Micron could easily dip below $50 a share if hit by another bearish selling wave on Wall Street during the autumn. It may even fall below $40 in a stock market crash scenario. Yet, the odds favoring real “outperformance” of Big Tech names are approaching, either through smaller than average losses or stronger gains over time.

With interest rates still rising, and America’s inflation future still cloudy and hard to predict, a recession in the economy and memory chip demand overall (including weaker PC sales) may mean patience will be key when investing in Micron. A significant investment payoff may not occur until next summer, for example. If you want to reduce capital risk entering MU shares, a cost-average plan over the next 3-6 months may be the best accumulation approach.

You can purchase a small starter position at $57 now, then double your stake in two months, and double it again in four months near the beginning of 2023. This plan gives you upside potential right away, with a serious stake (perhaps at lower than current pricing for net cost) ready for a rebound in the second half of next year. Remember, stock price changes tend to look forward by 3-6 months. My best guess is price will bottom between September and December preparing for a stronger operating environment at Micron by the summertime.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Be the first to comment