PeterPhoto

Dear Readers/Followers,

Safe companies are a focus for me – especially during times such as this with significant volatility. There is something to be said to take shelter under quality when the world is in upheaval – and Moody’s (NYSE:MCO) is certainly quality. It’s a firm that, while not viewed as significant as Standard & Poor’s (SPGI), is still one of the “big three”, the big three being Moody’s, S&P, and Fitch.

There are other rating companies, more local ones that are more suitable for many of the European investments I make. These ones though, they’re the big dogs that follow international companies.

And in this article, I’ll introduce you to Moody’s.

What is Moody’s?

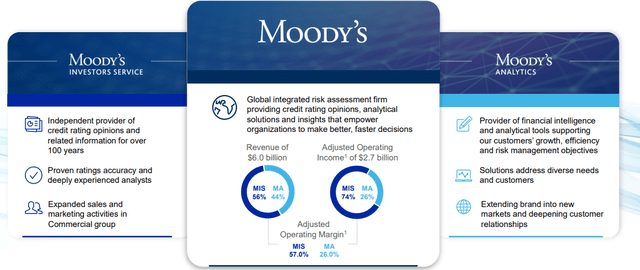

Moody’s is a financial services business. It’s the holding company of the Investors Services Arm, which is the credit agency that we most hear about, and Moody’s Analytics, which provides analytics software and services for companies and individuals.

The formation of Moody’s goes back to 1909 when John Moody produced manuals of statistics and bond ratings for companies and stocks. The company was M&A’ed by Dun & Bradstreet in -62, only to be spun off as its own company in 2000. That means that Moody’s has a 22-year stock market history. It was split into the two aforementioned divisions back in -07, and it’s a part of the Fortune 500.

The two main components, and relevant components, is the Investors service and the analytics. The investors service works with the bond credit rating business, and it rates debt securities in the public and commercial securities market and bond markets. This is not limited to the private sector – Moody’s does government, municipal and corporate bonds, managed investments such as money market funds, fixed income funds, hedge funds, and similar “plays”.

The purpose of the ratings that Moody’s give is simple. Provide investors with the information to estimate future and current creditworthiness, and this in a scale/gradation. This is not unique to Moody’s, but Moody’s uses a range from Aaa down to Caa, with appended numerical modifiers with lower numbers indicating higher ratings, with the exception for Aaa, Ca and C.

I personally believe S&P global and Fitch to be a bit easier to read. It’s easier to estimate what BBB+ or BBB- means, than Baa1 or Baa3.

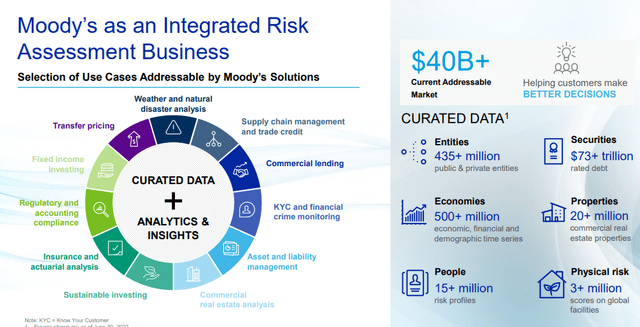

Aside from Investor services, you have the analytics segment which works on non-rating activities since -07. Moody’s does straight analytics here, with focus on credit, performance management, modeling, structured analysis and risk management. It also creates software and consulting, such as proprietary financial models and software tools.

It also offers learning and professional training for risk management and ancillary areas.

The fundamentals of this business are extremely good. As I said, BBB+ and with a market that’s unlikely to go away for as long as there is a market. Moody’s is in a position where the company is among market-leading players, and unlikely to decline or go away. If it did drop to a level for some reason, the company would without a doubt in my mind become a takeover target.

Moody’s works with a multi-year investment approach where customer access, excellent KYC, CRE, Banking, and digital/product development. The company invested $150M in growth initiatives during the last years, with another $150M invested in 2022 to accelerate the company’s medium-term growth.

From a financial perspective, the company’s revenues come from two segments -recurring or transactional in nature, as well as a geographical split. We want a high degree of recurring transactions – which in this case is 61% – and 55% US-based revenues. Moody’s is a business with annual revenues over $20B, and the company has 2022 guidance, guiding for a 35%+ operating margin with an EPS closing in on $10/share.

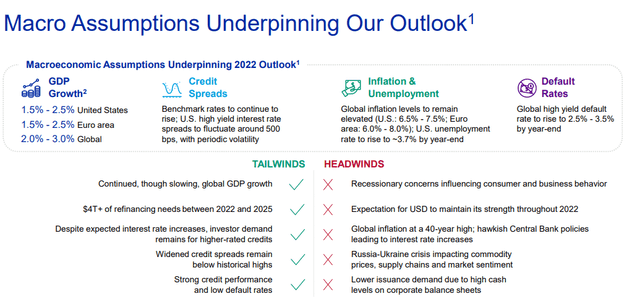

The company works with this guidance based on not exactly-high estimates for GDP growth going forward, and with elevated inflation numbers.

The company’s financial performance is, unsurprisingly solid. For the 2017-2021 period, the revenue CAGR has been 10%, and the adjusted EPS CAGR has been 19%. The company has been able to maintain adjusted operating margins of close to 44-49% for the same time.

Moody’s dividends is meager. At this time, despite a decline in share price, we have only about 1% in dividend yield. The company won’t be a big payor, but it will keep you safe over time. The company is also an active M&A’er and grower, with a solid focus on where the company’s capital goes. Earlier this month, it announced the acquisition of SCRiesgo, a credit rating agency.

For the future, we have the following business impact for Moody’s. We’re expecting an increase in default rates and troubles for the company. Despite the current yield spreads, their volatility is around the historical average at the time, even if we’re likely to see that grow a few more percent before it is over. Overall debt and leverage levels in US and EU for the company-covered speculative-grade companies (which are in the closest danger) is up for the past few years. In 2006, the average debt/EBITDA was around 4.6x. Today, it’s 5.2x in the USA. EU is better – 5x in 2006, and down to 4.8x today.

EU companies have been dialing down leverage more than US companies have – which makes sense given the current economic realities of the two areas. EU companies also have significantly better interest expense coverage on the basis of EBITDA than do companies in the US.

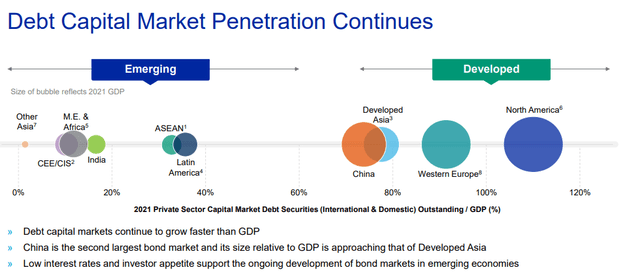

20 years ago, non-established markets in Asia and Africa were very small – emerging markets overall were very small when it came to businesses like Moody’s. That’s different today. Emerging markets are becoming of real interest here.

The recent results of the company confirm the overall company upside here. 3Q22 is what we have here. The company now handles over 35,000+ organizations and structured deals, which also includes 145 sovereigns and 49 supranatural institutions, like the EU, the IMF, and others.

The company’s 3Q22 revenue growth is impressive, and earnings are growing as well, though the last quarterlies have mostly come in below par in terms of analyst targets.

The company is also a play on interest rates over time – in that the company’s revenues have risen generally with interest rate declines – and when there has been a bump up, there has been a slowdown or a dropdown in revenues – though not to any worrying degree.

The problem with Moody’s and similar plays is that investors for some years have been used to these companies trading at significant premiums for a long time. We’ve now seen normalization down to better levels – but still not to any significant degree. Moody’s has seen strong share price appreciation trends and a lot of it due to the low-interest rate environment.

Current forecasts are for a similar dip in earnings as when we saw a big bump in rates. The low interest rates we saw enabled the company to grow due to massive activity levels across the board – now that we see the opposite, it’s likely, logically, that the opposite will happen with Moody’s as well.

That is the risk – and the bearish view here. The problem is, there is not really a stability argument against Moody’s – not as I see it at least. If the company needs to, it’ll change its pricing to maintain growth – and they have the market position to do so, just as the other major rating agencies do.

So, Moody’s is a solid company – and there’s no foundational reason why the company would be considered “bad”.

But there’s still valuation, and this is how I view it.

Valuation

As I said, Moody’s is at a massive premium – and that premium is around 22-25x P/E normalized. And despite declines, the company is still trading at close to 33x normalized here. And that is despite the pressures from interest rates, and an expected 32% adjusted EPS decline for the year.

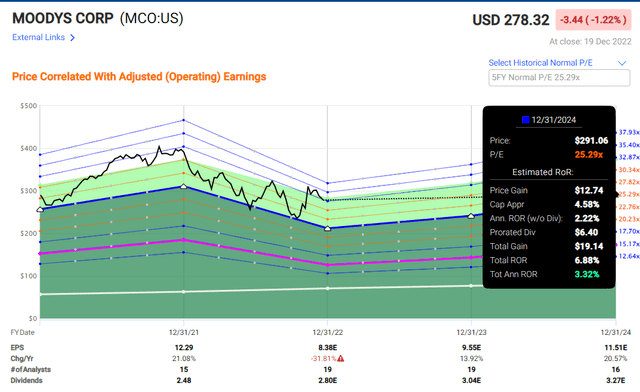

Assuming no more than a 25.29x P/E premium, even after the declines we’ve seen, the company’s upside is no higher than 3.32% per year, which is well below par for any investment we may want to be making here. My own personal minimum is 8% per year.

Moody’s Upside (F.A.S.T. Graphs)

And this company does not fulfill that – not even at 25x. We’re far from any sort of investable valuation here still. We had a decline some months back where we could have justified investing, but that isn’t now – and besides, there were better opportunities available at the time than this one.

So, what should we do with Moody’s?

Well, I believe that this company should be in a prime place in your watchlist. Because if this company ever becomes cheap, you’re virtually guaranteed (as I see it) to generate double-digit rates of return when it recovers.

So when is that?

Well, here I would accept a 24-25x P/E premium, which we’ve seen on a normalized basis for the past couple of years or so. That would imply, for a 2022E-heavy P/E basis, a target between $210-$220, depending on how high you want to go. If reversing to a 25x P/E for 2024E, the company could go as high as $290, but the current crunch in rates and softening in the number of defaults and issues suggests that the company’s earnings pressures and lack of growth might persist longer than the market expects, offsetting the 14 and 20% rates of EPS recovery.

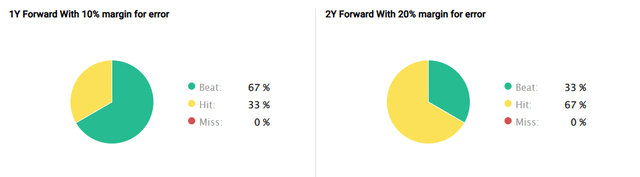

The historical analyst accuracy the company works with in terms success rates would imply that the company will indeed achieve those rates – or even greater.

F.A.S.T. Graphs Moody’s forecasts (F.A.S.T. Graphs Moody’s forecasts)

However, my stance is that the crunch we’re experiencing might be more serious than in the past 10 years – so for that reason, I’m sticking to that target here, and I don’t consider the company to massively outperform here. Recovery will be a long climb.

Analysts disagreed here. 17 analysts following the business, 11 of which are at a “BUY” or equivalent, with a target range starting at $260 and going all the way to $330/share. Still, in context, that’s down from $425 around a year ago, so the PT’s have already declined a bit. They just haven’t declined enough for my taste here, or for the fundamental requirements, I put in when I invest.

For that reason, here is my thesis for Moody’s – and my stance is to wait.

Thesis

- Moody’s is a class-leading financial services company that should be invested in, if cheap. The company has fundamental safety and a solid upside at the right sort of valuation. However, a bottom-tranche yield and a massive premium dictate that we should be careful investing here, lest we secure poor returns.

- The company is expected to see severe declines in EPS for this year, and a slow climb back up after that, given the crunch in interest rates and defaults we’re likely to see as a result of this.

- For that reason, I’m calling the company a “HOLD” here. My PT is $230/share at most as things stand.

Remember, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside that is high enough, based on earnings growth or multiple expansion/reversion.’

The problem is that Moody’s doesn’t fulfill my valuation-specific requirements or pricing concerns. That makes this investment a no-go here.

It’s a “HOLD”.

Be the first to comment