Pictured: Distracted Montauk investor expecting a sale at a significant premium. ALLVISIONN/iStock via Getty Images

Distracted by wishful buyout speculation, investors in landfill gas producer Montauk Renewables (NASDAQ:MNTK) have bid up shares 66% YTD while a ~40% decline in RIN prices created >50% downside to consensus estimates. Montauk’s shares are now valued at >50x EBITDA despite risk of contract loss on 70% of projects as gas suppliers vertically integrate, anemic growth prospects due to increased competition in a saturated market, and precedent M&A transactions for best-in-class competitors at just 6x EBITDA. Investors should look out below because I believe Montauk’s rumored sale process is likely to fail, resulting in >50% downside as analysts revise their forecasts for lower RIN prices.

>50% Downside to Consensus Estimates

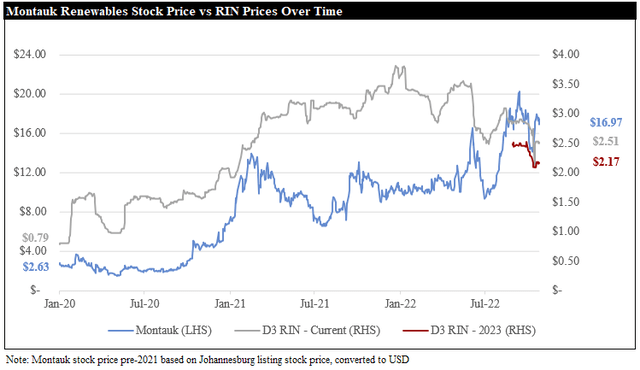

D3 RIN prices – responsible for nearly all of Montauk’s profitability – have declined ~40% this year and nearly 30% since Montauk reported Q2 earnings in August, creating >50% downside to 2023 consensus estimates. RIN prices rising from below $1.00 in early 2020 to above $3.50 earlier in 2022 have been a key driver of growth for Montauk’s EBITDA ($26 million in 2020 vs. $93 million 2022 consensus) and share price (< $3 in 2020 vs. ~$17 currently).

Source: Bloomberg; RIN Indices: RIN 3Y 22 Index; RIN 3Y 23 Index

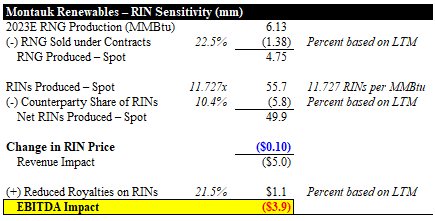

Unfortunately for Montauk, RIN prices have declined from $3.70 in early 2022 to $2.51 currently and $2.17 based on 2023 forward prices. Every $0.10 decline in RIN prices reduces Montauk’s EBITDA by ~$3.9mm, so the ~40% decline from $3.70 to $2.17 is expected to reduce Montauk’s EBITDA next year by ~$60 million.

Source: Montauk filings

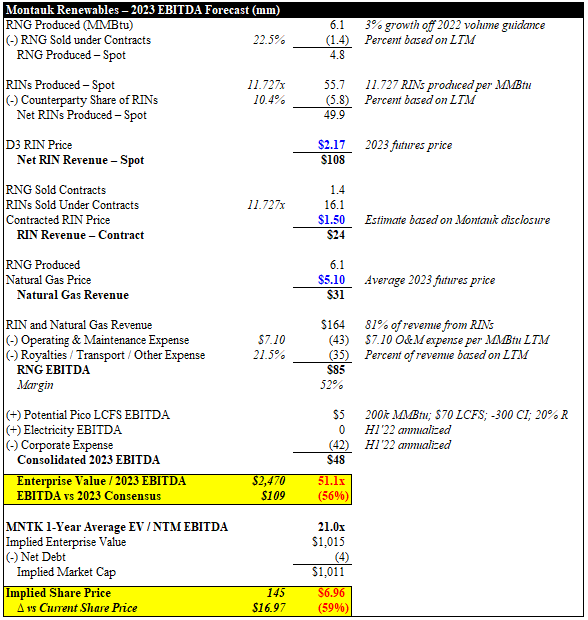

Based on RIN prices of $2.17, I estimate Montauk will earn ~$48 million EBITDA next year, a 56% discount to consensus of $109 million as analysts have yet to update their models for lower RIN prices. At Montauk’s historical 21x EV / EBITDA multiple the stock should be trading at ~$7.00, or ~60% below current levels.

Source: Montauk filings; Bloomberg; CME Group Natural Gas Futures; Alpha Magnet analysis

70% of RNG Production at Risk of Contract Non-Renewal

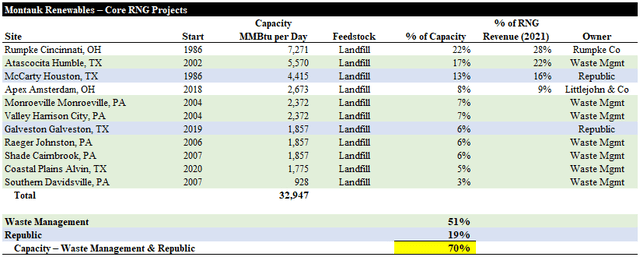

Montauk does not own any of their landfills and 70% of RNG production capacity sits on landfills owned by Waste Management (WM) (51%) and Republic Services (RSG) (19%).

Source: Montauk filings; Excludes dairy and electricity projects

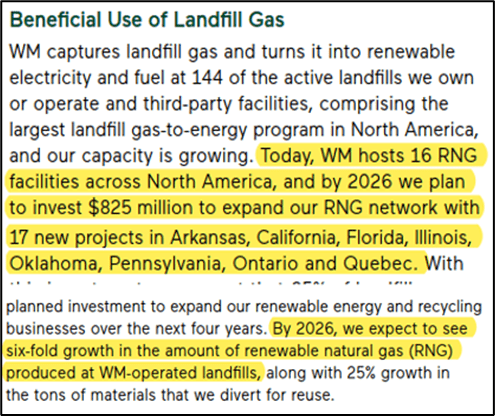

Both Waste Management and Republic are now vertically integrating into RNG production so I believe Montauk will almost certainly lose their important gas supply contracts upon expiration as Waste Management and Republic cut out the middleman (Montauk).

Source: Waste Management at Oppenheimer Conference (May 2022) Source: Waste Management 2022 Sustainability Report Source: Waste Management – Q3’22 Earnings Call (Oct 2022) Source: Republic / Archaea JV Announcement (May 2022)

No Significant Growth Prospects

Increasing competition from competitors including Archaea (LFG), Kinder Morgan (KMI), Ameresco (AMRC), Viridi, Waste Management, and NextEra (NEE) for a rapidly shrinking number of landfill gas opportunities has rendered Montauk unable to grow in its core landfill gas market. Montauk has announced zero new greenfield landfill gas projects since its IPO and has no meaningful backlog of growth projects, while industry leader Archaea has continued winning new projects and now operates 50 projects, with a development pipeline of over 80 projects.

Montauk’s 10-K reveals that of the 482 landfills the EPA identified as candidates for biogas projects, Montauk believes only 38 produce sufficient gas quantities to support a commercial-scale project, and 27 of the 38 sites are operated by Waste Management or Republic, leaving just 11 sites industry-wide that would be actionable for Montauk. Without new growth projects, Montauk is facing <1% organic growth over time according to the EPA‘s data on solid waste growth at landfills. Given the challenges in the landfill gas market, Montauk is attempting to pivot towards generating gas from dairy and swine manure, however these initiatives are generally sub-scale or speculative and have worse economics compared to landfill gas projects.

Buyout Is a Pipe Dream

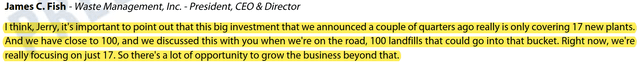

BP‘s recent acquisition of Archaea at a 54% premium and an August 3rd Bloomberg article noting Montauk was exploring a potential sale appear to have convinced investors that Montauk is the next alternative energy company about to be acquired at a big premium – I believe investors will be severely disappointed. Best-in-class competitor Archaea was acquired by BP for 5.8x EBITDA once their growth backlog is built out, and multiple other recent precedent transactions occurred at ~6x EBITDA. I believe no sensible acquirer would pay anything close to the current >50x EBITDA valuation for Montauk, particularly given Montauk’s significant contract risk and lack of meaningful growth prospects.

Source: Archaea, BP, Kinder Morgan, NextEra filings

Risks

The primary risks to my thesis are an acquisition by a large energy company and substantially higher RIN prices. I believe an acquisition is unlikely given Montauk is trading at ~50x EBITDA relative to precedent transactions at ~6x EBITDA. I believe a substantial increase in RIN prices is unlikely due to the significant expected growth in RIN supply over the next few years as more RNG projects are developed by competitors like Archaea, Waste Management, and Kinder Morgan. Additionally, even if RIN prices increase to $3.00, Montauk would be valued at 30x EBITDA – well above the ~6x paid in precedent transactions.

Regarding borrow rates, borrow on Montauk shares is available at low-single-digit rates.

Conclusion

I believe Montauk is facing >50% downside to 2023 consensus estimates due to declining RIN prices, risk of contract loss on 70% of its projects as landfill owners vertically integrate into RNG production, and anemic growth prospects. It is unlikely to be sold for anywhere near the current valuation – let alone a significant premium. I expect >50% downside (< $8) over the next three to six months as the rumored sale process fails and analysts revise estimates for lower RIN prices. At $8 Montauk would still be trading at a significant premium to M&A comps even after giving credit for synergies and higher RIN prices on both spot and contracted volumes.

Be the first to comment