Dzmitry Dzemidovich

Introduction

In early August, I wrote an article on SA about Mexican household products direct-to-consumer company Betterware de Mexico (NASDAQ:BWMX) in which I said that its decision to increase the prices of its products at the start of the year seemed to be backfiring as the decline in revenues and EBITDA accelerated in Q2 2022.

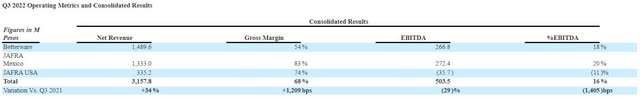

Well, this trend continued in Q3 2022 as revenues declined by 2.6% quarter on quarter despite the purchase of sector player Jafra being completed on April 7. EBITDA, in turn, slumped by 15.4%. However, the silver lining is that the guidance for the full year was almost unchanged and Betterware de Mexico expects to achieve annual costs savings of almost $40 million in 2023. Let’s review.

Overview of the recent developments

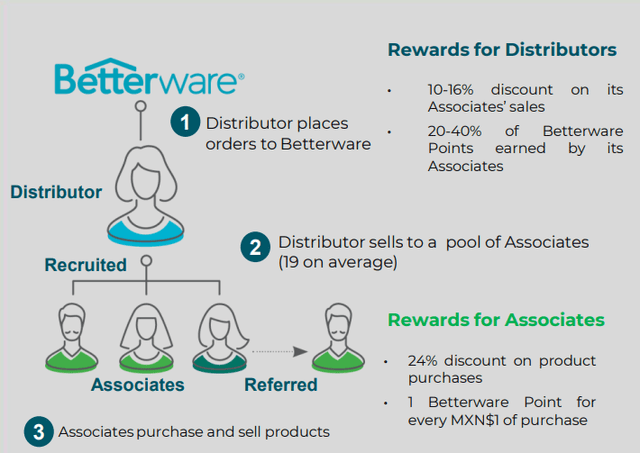

In case you haven’t read any of my previous articles about Betterware de Mexico, here is a short description of the business. The company was created in 1995 as a subsidiary of the British multi-level marketing (MLM) group named Betterware and was sold to a businessman named Luis Campos in 2001. Betterware de Mexico mainly sells kitchen and home products, and its distribution network has just two tiers, namely distributors and associates. The former place the orders to the company and then deliver them to the associates, with both of them getting discounts on products. About 90% of the products are made in China, and I think that relying on the MLM model instead of traditional ecommerce allows Betterware de Mexico to be more cost-effective in the advertising department compared to many of its competitors thanks to word-of-mouth marketing.

In December 2020, Betterware de Mexico released a B2C web app platform which enables users to order products from the company directly. The products are shipped to the closest available distributor, and I think this sounds like a good system as it allows the company to avoid last-mile delivery costs.

In April 2022, Betterware de Mexico completed the $255 million purchase of Mexican and U.S. operations of international cosmetics company Jafra at 5.5x 2022E EBITDA. In addition, Betterware de Mexico said it identified cost synergies of $5 million to $10 million. In my view, it sounded like a good deal as the company had a small debt load and this transaction was expected to add around $0.34 to the 2022 EPS. Unfortunately for investors, it seems the lifting of COVID-19 restrictions in Mexico in early 2022 created headwinds for the business as people returned to the office. In my view, the situation was made worse by the company itself as it decided to increase product prices by 12% to fight pressure on its margins due to inflation and supply chain disruptions. Looking at the Q3 2022 financial results, net revenues of the Betterware business slumped by 36.9% year on year and 7.1% quarter on quarter. However, there were also positive developments. For example, the Jafra business contributed EBITDA of 236.7 million pesos ($12 million) in Q3 despite unprofitable operations in the USA. This puts it on track to meet the 2022 EBITDA expectations that Betterware de Mexico had when the purchase agreement was signed in January. In addition, Jafra Mexico’s revenues grew 11% compared to Q3 2021 and this is the first time since 2017 that the business is growing.

In addition, Betterware de Mexico said in its Q3 2022 financial report that Jafra Mexico’s net revenues are expected to grow by 10% in Q4 as it continues to benefit from the recovery of the local beauty and personal care market to pre-pandemic levels (page 2 here).

Turning our attention to the sales network of Betterware de Mexico, it averaged about 870,000 associates and 43,000 distributors from mid-May to date. This represents a modest decline compared to the 908,000 associates and 44,400 distributors the company had at the end of June and I’m encouraged that the outflow has slowed down. In Q1, the company had 48,100 distributors and 997,000 associates, which means the sales network shrank by over 100,000 people in just three months. Another positive development is that the Jafra business added 51,000 consultants in September alone thanks to targeted recruiting promotions.

Looking at the future, Betterware de Mexico expects its consolidated net revenues and EBITDA for 2022 to be in the range of 13 billion pesos ($656.5 million) to 13.3 billion pesos ($671.6 million) and 2.1 billion pesos ($106 million) and 2.3 billion pesos ($116.1 million), respectively. I consider this to be another positive development as these expectations are somewhat similar to the ones the company had three months ago. Back then, Betterware de Mexico was forecasting full year consolidated net revenues and EBITDA of 12.8 billion pesos ($646.4 million) and 14.2 billion pesos ($717.1 million) and 2.4 billion pesos ($121.2 million) and 2.7 billion pesos ($136.3 million), respectively.

Turning our attention to 2023, this should be a year of improved profitability in which Betterware de Mexico strengthens its balance sheet through the sale of non-core assets. The company forecasts that the completion of its organizational and expense restructuring process will result in about 300 million pesos ($15.1 million) in savings next year and that synergies from the Jafra deal will save around 200 million pesos ($10.1 million) to 300 million pesos ($15.1 million). Improved manufacturing efficiency is forecast to deliver another 170 million pesos ($8.6 million) in cost savings. Overall, you are looking at combined annual cost savings of up to 770 million pesos ($38.9 million).

In addition, Betterware de Mexico is selling Jafra’s headquarters in Mexico City, which is expected to generate proceeds of between 500 million pesos ($25.2 million) and 700 million pesos ($35.3 million). The company plans to use the fresh funds to repay debts. As of September 2022, net debt stood at 6.1 billion pesos ($307.1 million).

Overall, I think that the financial performance of Betterware de Mexico is stabilizing and the expected cost savings for 2023 look compelling. As a result, I’m changing my stance on the stock to speculative buy.

Turning our attention to the risks for the bull case, I think that the major one is a strong global recession as the businesses of consumer discretionary companies like Betterware de Mexico usually don’t perform well during them. According to a KPMG survey of 1,325 CEOs between July 12 and August 24, about 91% of U.S. CEOs said that they thought we are heading toward a recession in the next 12 months (slide 4 here). Just 34% of them revealed that they believed it would be mild and short.

Investor takeaway

Betterware de Mexico was among the companies that benefitted from COVID-19 lockdowns but their revenue growth rate nosedived after they ended. It seems that the company’s revenues could start rising once again in a quarter or two and I think that the amount of cost cuts the company has identified for 2023 looks impressive. In addition, the Jafra business is performing well as its EBITDA in Q3 2022 was close to the levels Betterware de Mexico was expecting when it bought it. The company is trading at about 5.2x EV/EBITDA based on the midpoint of the 2022 guidance and I’m considering opening a small position here.

Be the first to comment