cagkansayin

Investment Thesis

MongoDB (NASDAQ:MDB) is a great company with strong prospects. But the stock isn’t that cheap, so it may not be suitable for every portfolio. A lot of nuances are needed.

On the one hand, the stock has sold off significantly in the past month. One could argue that the stock today is oversold and due for a bid.

On the other hand, it’s difficult not to ask, are MongoDB’s growth days now in the rearview mirror?

On yet the other hand, when everyone is so bearish on the company, there’s clearly room for a near-term bounce.

As we go through the positives and negatives facing MongoDB, I believe that the risk-reward profile is positive.

At All Costs, Buy The Dip?

At the first ”sniff” that the Fed is likely to slow down rising rates, investors can’t wait to clamber back into the winning trade of the past decade. Investors are becoming increasingly hopeful that the bottom has to be in for risk assets.

After all, risk assets have come down more than 50% across the board, with high-growth tech being particularly hard hit. Indeed, MongoDB hasn’t been spared, with its own stock down more than 60% from its previous highs.

With this setup in mind, investors can’t wait to get to buy the dip in MongoDB. And even if I fundamentally believe that MongoDB’s Atlas platform is extremely well positioned for massive growth in data, which enterprises will need to for day-to-day productivity, is it worthwhile paying 9x forward sales? But I get ahead of myself. Let’s first take a step back.

Is MongoDB Still A Hypergrowth Secular Story?

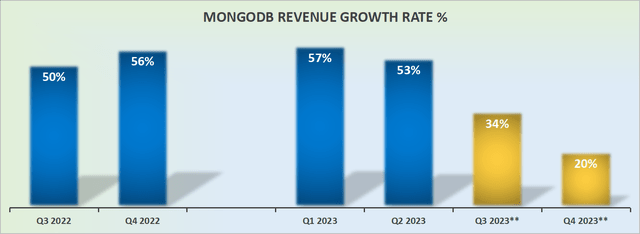

As you can see above, for the first half of fiscal 2023 MongoDB reported more than 50% y/y growth. That’s nothing short of impressive. Clearly, MongoDB came out of Q2 2023 as a hypergrowth company.

However, the problem right now is that looking beyond this, to the second half of fiscal 2023 its CAGR doesn’t look as attractive.

Even if we make room for MongoDB to be guiding downwards to allow for easy beats later on, the fact remains that MongoDB’s exit rate from fiscal Q4 2023 (ending January 2023) is clearly likely to come in below 30%.

So What’s Happening?

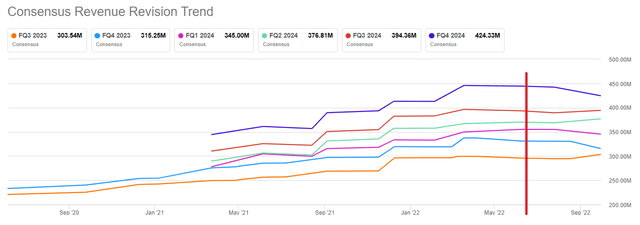

The red line in the graphic above is when the macro environment started to take a turn for the worst. And I fully recognize that growth investors seek out growth companies because they don’t want to deal with the macro story.

Investors purposely seek secular growth stories so that they don’t have to factor in the macro. The problem though is that foundation worked a charm in the past decade. We were in a benign macro environment, where investors were rewarded for ignoring the macro and buying every dip.

And analysts for their part, today appear to be behind the curve. What you see above is that analysts have not downwards revised to any great extent MongoBD’s revenue growth rates.

Even though we’ve seen broad evidence of weakness in all aspects of IT spending. For example, recently we saw Micron (MU) come out with comments to reassure investors that while things would improve over time, the near-term was showing weakness. Largely the same with C3.ai (AI).

One could counter by pointing out that these are small, cherry-picked sectors of the market. The problem though is that we haven’t fully got into earnings season! Until earnings come, investors have to try to piece together whatever insights are available.

Nevertheless, this is the core of my argument, analysts are behind the curve. Analysts haven’t fully updated MongoDB’s revenue growth rates to better reflect reality.

MDB Stock Valuation — 9x Forward Sales

Now, here’s the thing. In a period of 0% interest rates, paying 9x or 15x forward sales, it was all a bargain. After all, there was nowhere else to deploy capital.

But when investors can get 4% ”guaranteed” on a two-year government, the conversation rapidly changes.

All of a sudden, investors start to think, ”what have you done for me lately?”. And when investors are down more than 30% in the past few months on their holding, and we are about to enter tax loss season, investors start to reconsider, is it really worthwhile paying up for a ”growth story” that hasn’t quite got a solid, predictable, sustainable, hypergrowth path?

The Bottom Line

MongoDB was a hypergrowth company. But is it still a hypergrowth company? Recall, hypergrowth means companies that can sustainably grow above 30% CAGR for a prolonged period of years. Growth that investors can bank on.

Indeed, investors will always pay a premium for hypergrowth companies, irrespective of the macro environment. So once again I ask the question, is MongoDB still a hypergrowth company?

Investors need to build a lot of conviction to answer that in the affirmative. Because at 9x forward sales, that’s what’s required.

On the other hand, as discussed throughout the analysis, MongoDB is down more than 40% in 6 weeks. So that also should factor into the discussion, at least in the very near term.

All in all, I assert a bullish rating on this stock. But admit that it may not be suitable for every investor.

Be the first to comment