martin-dm

“Anyone who lives within their means suffers from a lack of imagination.“― Oscar Wilde

Today, we do a deep dive on a small fintech company that recently debuted on the markets via SPAC. Like so many that IPO’d in this matter in 2020 and 2021, the shares find themselves deep in ‘Busted IPO‘ territory. However, this equity appears unloved and oversold. An analysis follows below.

Company Overview:

MoneyLion Inc. (NYSE:ML) is a New York City based financial technology platform catering to middle-class Americans, offering banking, personal loans, credit enhancement, cash advances, managed investment, and cryptocurrency products. Through its recent acquisitions of Even Financial and MALKA, it has diversified into affiliated marketing, as well as media and content management. MoneyLion was founded in 2013 and went public through a reverse merger into special purpose acquisition company (SPAC) Fusion Acquisition Corp., raising net proceeds (mostly through PIPE financing) of $293.2 million at a valuation of $10 per share in September 2021. Its first trade as a public concern was transacted at $9.397 per share and its shares have dropped like a lead balloon since. The company’s stock trades at just under $1.50 a share, equating to an approximate market cap of $320 million.

May Company Presentation

Consumer Products

The company’s platform is operated through its app, which once downloaded, provides the consumer with the following product options:

RoarMoney. RoarMoney is a mobile bank account (powered by MetaBank (CASH)) offering early pay on direct deposit, bill pay, rewards on it debit card, and no account minimums.

Investment Account. MoneyLion provides custom portfolios contingent upon the goals and risk profile of the investor through its relationships with Global X Management and Wilshire Advisors.

Credit Builder Plus. In exchange for $19.99 a month, MoneyLion provides a suite of credit enhancement services, including a credit builder loan and financial literacy tools. More than half the subscribers to this offering raise their credit score by 42+ points in 60 days.

Instacash Advance. Instacash advance provides a short-term 0% APR advance against expected income.

MoneyLion Crypto. This service provides the ability to buy and sell popular cryptocurrencies (Bitcoin, Ether, Litecoin, Bitcoin Cash) through its association with Zero Hash. MoneyLion shares in the fees collected by Zero Hash for facilitating cryptocurrency transactions.

Instant transfer fees generated from Credit Builder Plus and Instacash loans accounted for the bulk of MoneyLion’s fee revenue, which reached $116.1 million in FY21, or 68% of total. Membership income from Credit Builder Plus provided FY21 revenue of $32.4 million, or 19% of total. Net interest income from loans accounted for $7 million, or 4% of MoneyLion’s total FY21 top line.

Enterprise Partner Revenue via Acquisitions

The balance of the company’s FY21 revenue was derived from affiliates, whereby MoneyLion conducts campaigns promoting various partners on its digital platform, as well as from media and content production, client services, and associated licensing fees. The former produced FY21 revenue of $10.9 million while the latter accounted for $4.7 million.

May Company Presentation

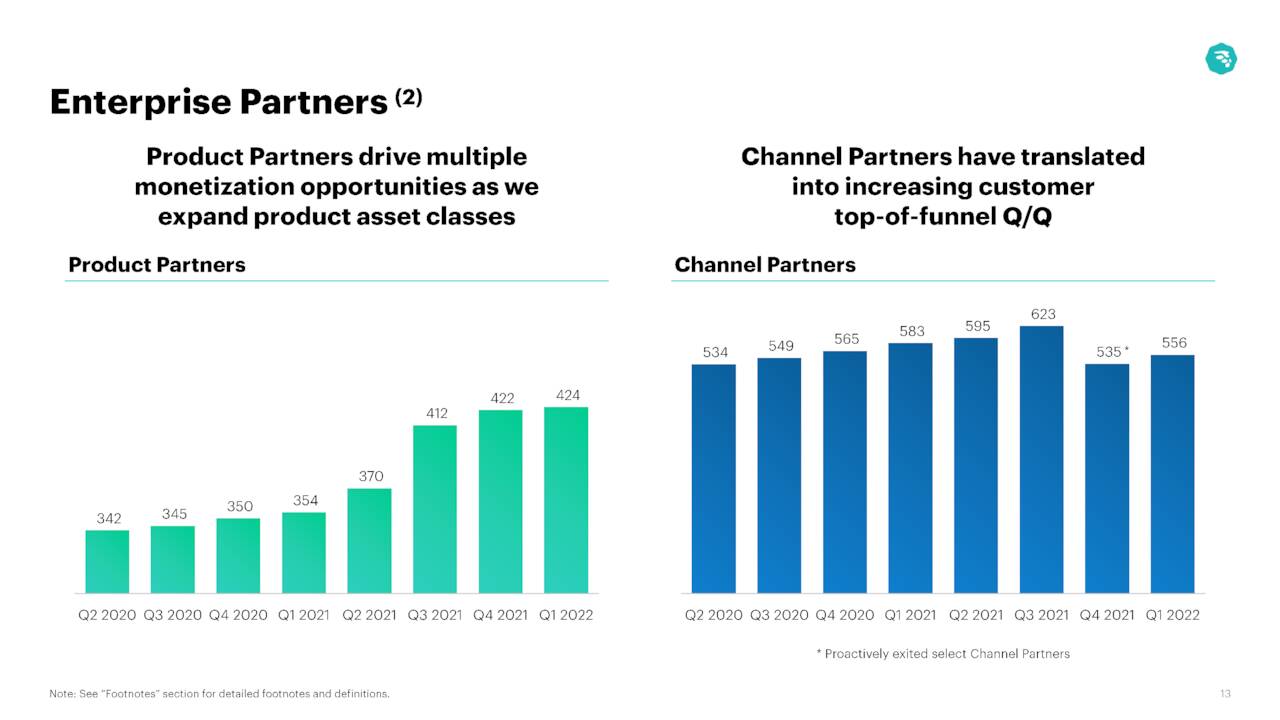

Both figures should climb significantly in FY22 thanks to two acquisitions the company effectuated since it went public. In November 2021, MoneyLion purchased MALKA Media, which provides digital media and content production services for its [NOW] parent company to enhance customer acquisition, as well as its own clients in entertainment, sports, gaming, live streaming, etc. Total consideration at the time of the closing, consisting of $10 million cash and 4.18 million shares of restricted stock, was $52.7 million.

Then in February 2022 MoneyLion acquired Even Financial, which matches consumers with the correct financial product (credit card, loans, mortgages, insurance, etc.) from a network of more than 400 financial partners and ~500 channel partners including news sites, content publishers, product comparison sites, etc. In return for extending the reach of MoneyLion’s products, as well as diversifying its revenue mix, Even Financial received a consideration of ~$440 million, consisting of cash, convertible preferred stock, and options.

These additions have already had a meaningful impact on the platform’s revenue composition, with affiliate fees, enterprise SaaS contracts, advertising fees, as well as media and content management contributing 31% to MoneyLion’s 1Q22 top line. Expectations are for this segment to comprise half of the company’s revenue by YE22.

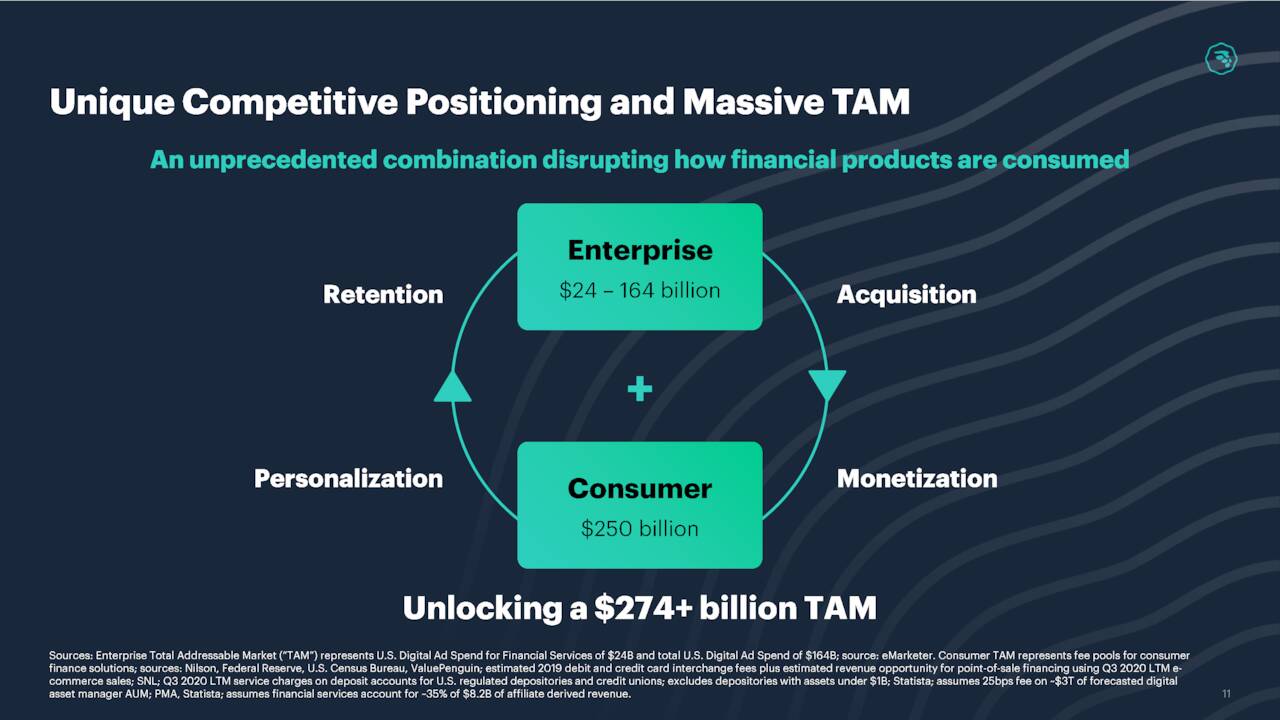

Fintech Marketplace

These acquisitions are part of management’s strategy to develop the premier financial super app, with its target market the 100 million middle-class Americans with annual incomes up to $150,000 and FICO scores up to 750. In the aggregate, management estimates this demographic has generated over $250 billion in annual fees for the financial services industry.

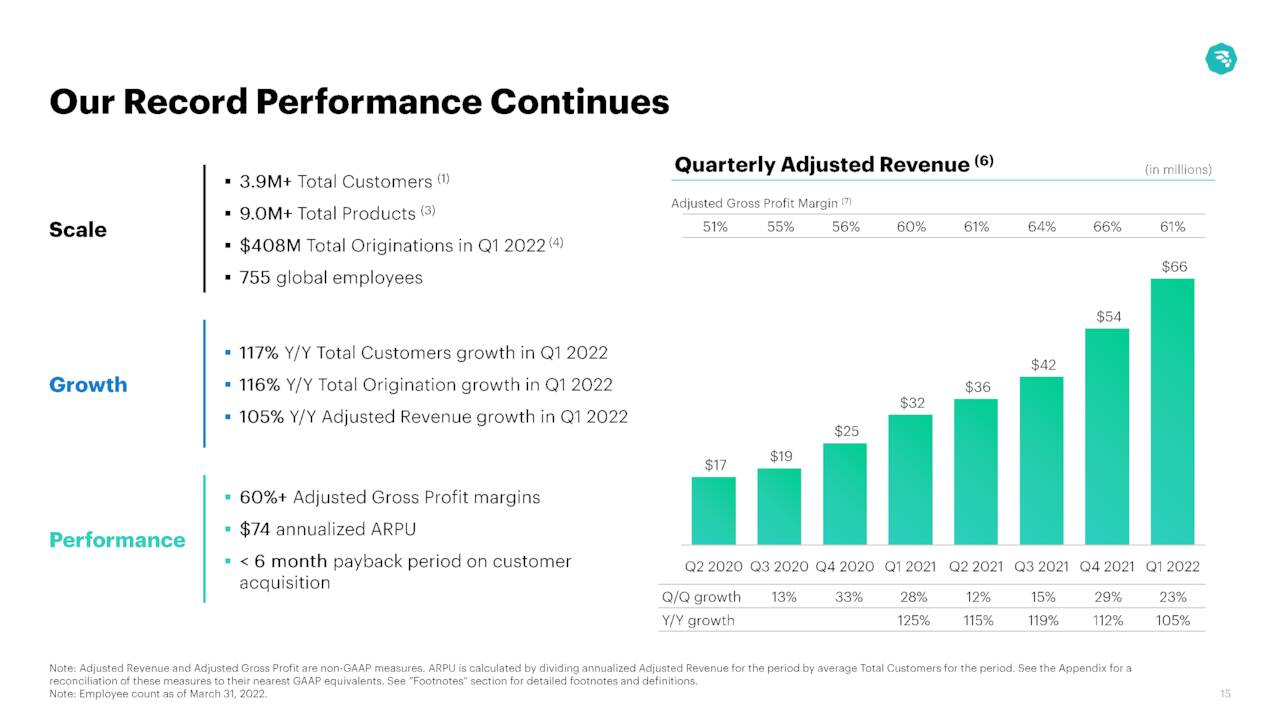

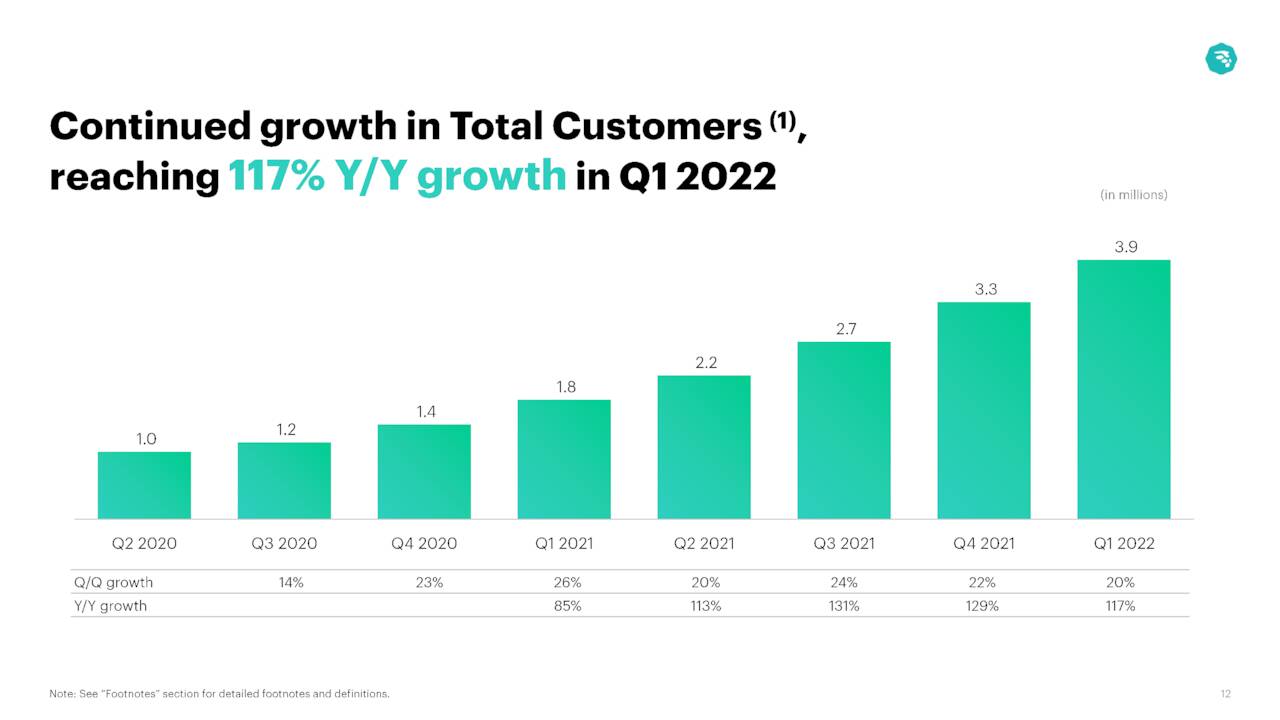

The fintech banking space is crowded with online-only banks such as Ally Bank (ALLY), deep-pocketed fintech players such as SoFi Technologies (SOFI), as well as traditional brick-and-mortar banks now providing customers with significant digital options. That said, MoneyLion, with its middle-class target market, grew its Adj. net revenue 117% from $76.1 million in FY20 to $164.9 million in FY21. That result was more or less in concert with total customers growth, which soared 129% to 3.3 million at YE21.

Share Price Performance

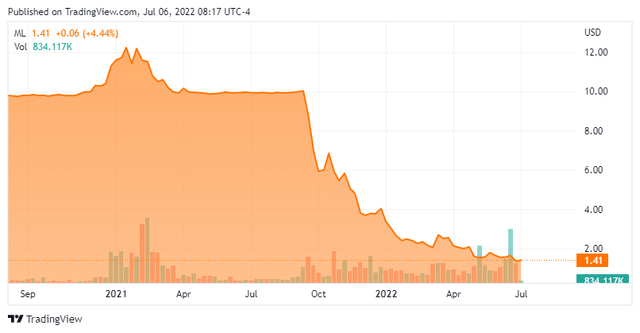

Despite its impressive progress, MoneyLion’s stock performance has been abysmal, initially due to the post-de-SPACing effect and subsequently to the risk-off trade. Fintech names, which carried values in the stratosphere, were even harder hit. When MoneyLion started trading on the NYSE in September 2021, it was valued at nearly 11.1x FY21 revenue net of cash, although it had no real profitability prospects until 2023. As such, its stock has been pummeled mercilessly in the risk-off environment, now down over 85% since its opening trade.

1Q22 Results & Outlook

May Company Presentation

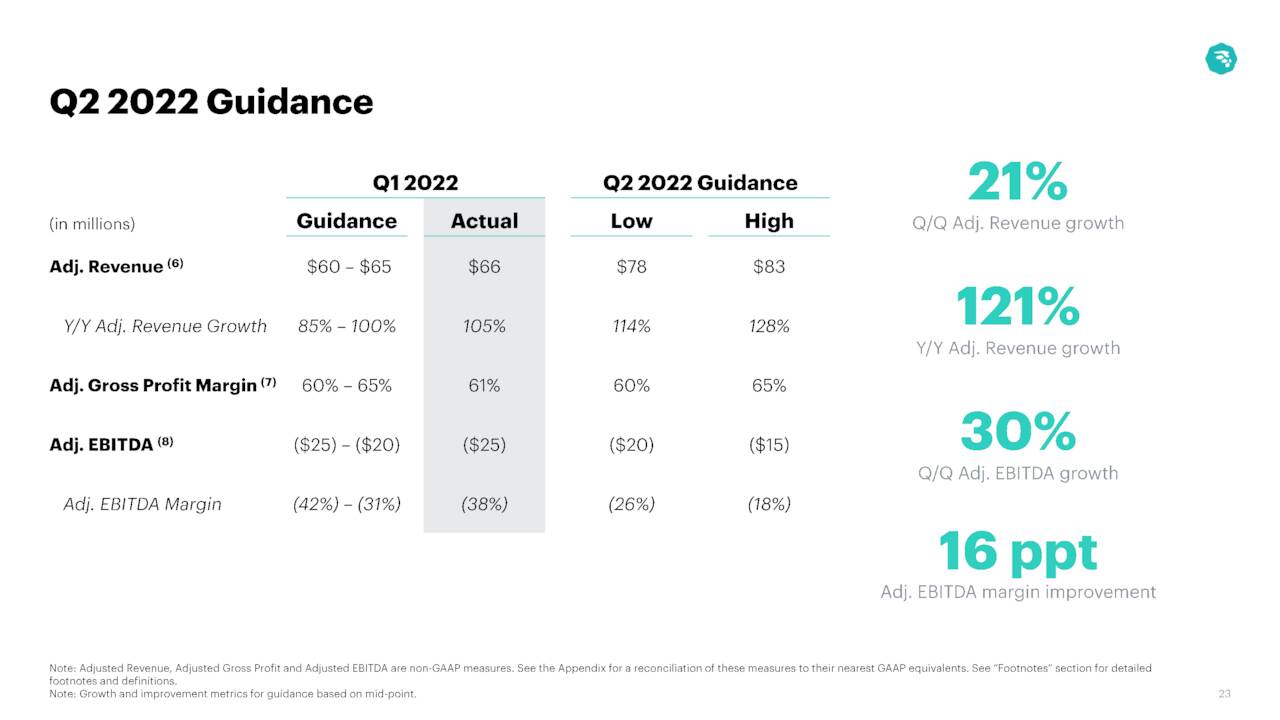

Despite the selloff, owing partially to the contribution from its acquisitions, the significant top line momentum continued for MoneyLion, posting impressive 1Q22 results on May 12, 2022. The company lost $6.0 million (GAAP) and Adj. EBITDA of negative $24.8 million on total net revenue of $69.7 million versus a loss of $73.4 million (GAAP) and Adj. EBITDA of negative $1.2 million on total net revenue of $33.1 million in 1Q21, representing 110% growth at its top line and a $5.3 million beat versus Street expectations.

May Company Presentation

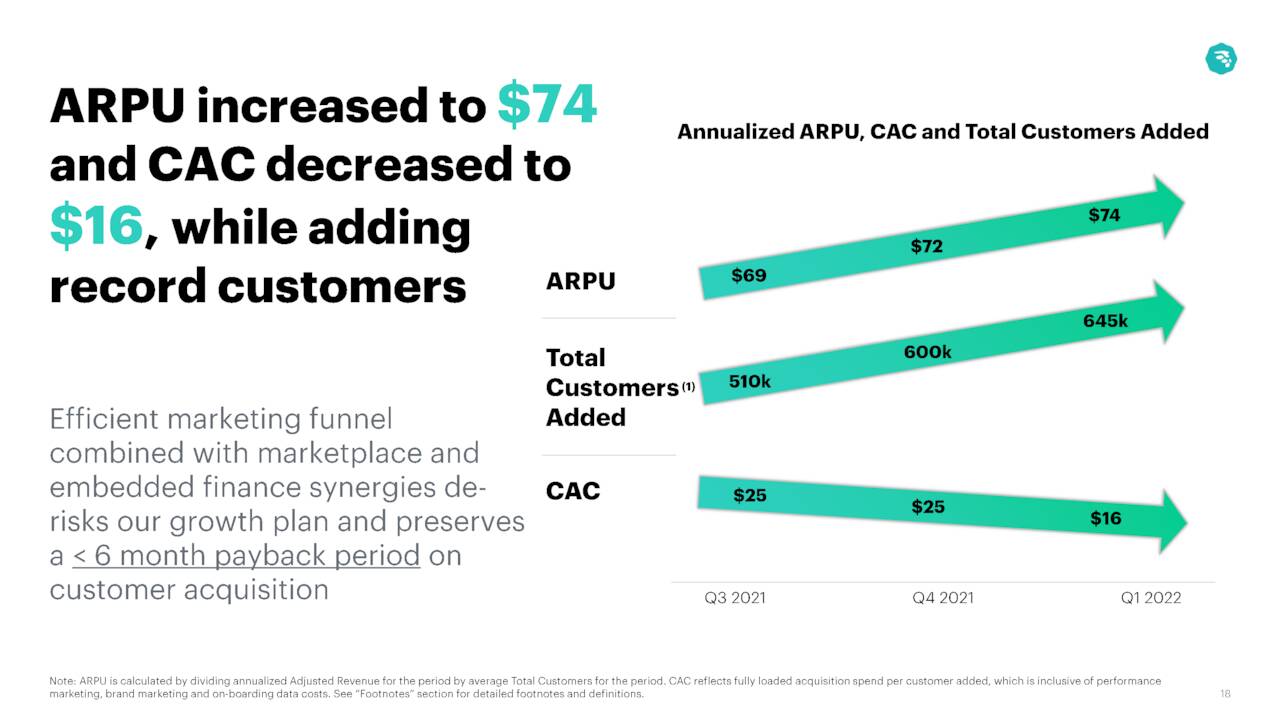

Total customers surged 117% year-over-year to 3.9 million as the company added 645,000 customers in the quarter while total originations increased 116% to $408 million. More impressive was the $2 sequential increase in average annual revenue per user to $74 while customer acquisition costs decreased $9 from 4Q21 to $16, thanks in large measure to synergies with its enterprise business.

May Company Presentation

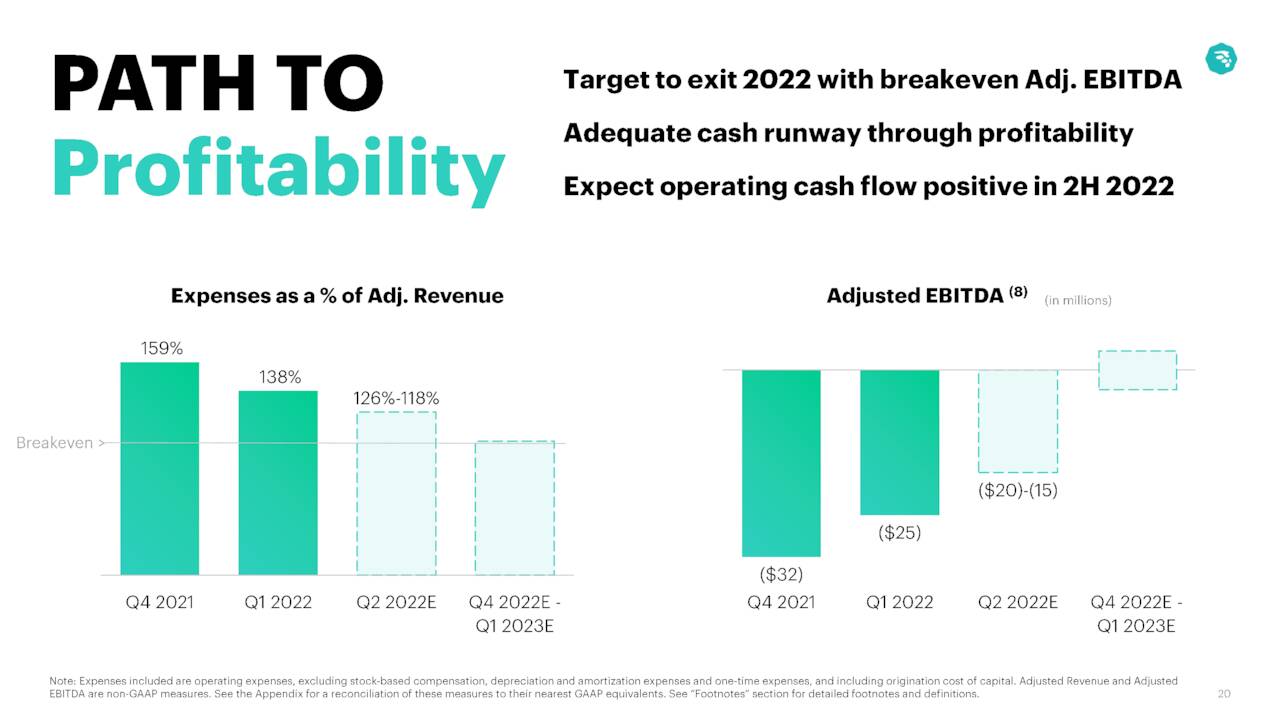

Furthermore, management reaffirmed its FY22 guidance that included Adj. EBITDA of a negative $47.5 million on revenue of $330 million (based on range midpoints), representing 100% growth at the top line. Gross margins should be similar to FY21 at 60-65%. MoneyLion also expects to be EBITDA breakeven exiting FY22 and operating cash flow positive in 2H22.

May Company Presentation

Balance Sheet & Analyst Commentary:

The company held cash of $185.0 million and debt of $90.0 million as of March 31, 2022. It also had $156.0 million outstanding to fund originated receivables. It lost $8.7 million from operating activities in 1Q22 and as such, should have sufficient cash to get it to profitability.

May Company Presentation

MoneyLion’s small Street following is positive with three analysts rating its stock a buy and the other an outperform. Cantor’s outperform rating is accompanied by a $5 price objective, the identical price target as Loop Capital which initiated the shares as a new Buy last week. Craig Hallum ($10 price target) and Rosenblatt ($12 price target) are more optimistic. On average, they expect the company to lose $0.29 a share (GAAP) on net revenue of $343 million in FY22, followed by a loss of $0.16 a share on net revenue of $567 million in FY23.

After purchasing 100,000 shares at $1.98 following the 4Q21 earnings report, CEO Diwakar Choubey repeated the same exercise subsequent to his company’s 1Q22 financial disclosures, buying 32,942 shares at $1.49 on May 20th, 2022. These purchases are a veritable drop in the ocean for Mr. Choubey, whose personal account and family trusts own over 22.6 million shares, or just shy of 10% of the company.

Verdict:

After trading at 11.1x FY21 revenue net of cash on its public debut, MoneyLion now trades at .65x FY22E revenue net of net cash, while expecting to become operating cash flow positive in 2H22 and achieving Adj. EBITDA breakeven by YE22. Given its revenue diversification, its triple-digit growth, and large target market, the valuation rubber band has been stretched too far. Therefore, we find MoneyLion’s stock is now attractively priced.

“Wealth consists not in having great possessions, but in having few wants.”― Epictetus

Be the first to comment