RHJ/iStock via Getty Images Source: Own Processing

Precious metals royalty and streaming companies represent a very interesting sub-industry of the precious metals mining industry. They provide some leverage to the growing metals prices, similar to the typical mining companies; however, they are less risky in comparison to them. Their incomes are derived from royalty and streaming agreements. Under a metal streaming agreement, the streaming company provides an upfront payment to acquire the right to future deliveries of a predefined percentage of metal production of a mining operation.

The streaming company also pays some ongoing payments that are usually well below the market price of the metal. They can be set as a fixed sum (e.g., $300/toz gold) or as a percentage (e.g., 20% of the prevailing gold price), or a combination of both (e.g., the lower of a) $300/toz gold and b) 20% of the prevailing gold price). The royalties usually apply to a small fraction of the mining project production (usually 1-3%), and they are not connected with ongoing payments. They can have various forms, but the most common is a small percentage of the net smelter return (“NSR”). The NSR is calculated as revenues from the sale of the mined products minus transportation and refining costs.

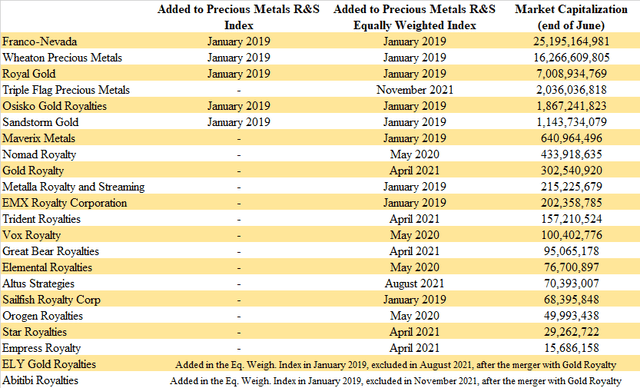

To better track the overall performance of the whole sub-industry, I created a capitalization-weighted index (the Precious Metals Royalty and Streaming Index) consisting of 11 companies (in June 2020, expanded to 15). Later, based on the inquiries of readers, I also introduced an equal-weighted version of the index. Until March 2021, both indices included the same companies and were calculated back to January 2019.

However, some major changes occurred in April 2021. Due to the boom of the royalty and streaming industry and the emergence of many new companies, the indices experienced two major changes. First of all, the market capitalization-weighted index was modified to include only the 5 biggest companies: Franco-Nevada (FNV), Wheaton Precious Metals (WPM), Royal Gold (RGLD), Osisko Gold Royalties (OR), and Sandstorm Gold (SAND). The combined weight of these 5 companies on the old index was around 95%, therefore, the small companies had only a negligible impact on their performance. The values of the index were re-calculated back to January 2019, and between January 2019 and March 2021, the difference in the overall performance of the old and the new index was only 2.29 percentage points. The second change is related to the equally weighted index that was expanded to 20 companies.

The previous editions of the monthly report can be found here: May 2019, June 2019, July 2019, August 2019, September 2019, October 2019, November 2019, December 2019, January 2020, February 2020, March 2020, April 2020, May 2020, June 2020, July 2020, August 2020, September 2020, October 2020, November 2020, December 2020, January 2021, February 2021, March 2021, April 2021, May 2021, June 2021, July 2021, August 2021, September 2021, September 2021 (extended), October 2021, October 2021 (extended), November 2021, November 2021 (extended), December 2021, December 2021 (extended), January 2022 (extended), February 2022, February 2022 (extended), March 2022, March 2022 (extended), April 2022, April 2022 (extended), May 2022, May 2022 (extended), June 2022 (extended).

The market capitalizations of the precious metals R&S companies kept on falling in June. However, the big three (Franco-Nevada, Wheaton Precious Metals, Royal Gold) maintained more than 94% share in the total market capitalization of the industry. There are not many things worth mentioning in the table above. Only Triple Flag Precious Metals outgrew Osisko Gold Royalties and became the fourth biggest precious metals R&S company by market capitalization. The smallest of the companies is still Empress Royalty (OTCQB:EMPYF), but as I wrote here, its cash flows are poised for rapid growth during the remainder of this year, which should start to be reflected also by the share price and market capitalization.

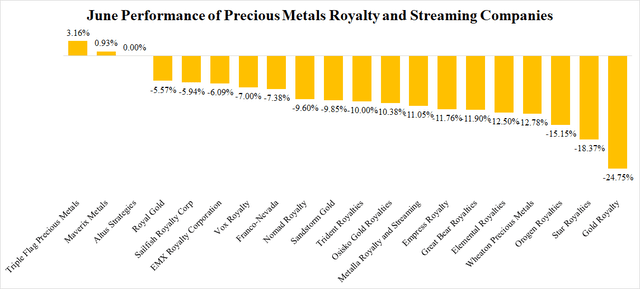

Only one company ended the month of May in green numbers. From this standpoint, June was slightly more successful, with two companies that ended the month in green numbers. Triple Flag recorded a 3.16% growth and Maverix Metals (MMX) 0.93% growth. Altus Strategies (OTCQX:ALTUF) ended the month where it began. All the remaining companies recorded losses. The smallest one was experienced by Royal Gold (-5.57%) and the biggest one by Gold Royalty (GROY) (-24.75%). Gold Royalty’s share price peaked at $7.08 on June 25, 2021. Since then, it declined by 66.95%.

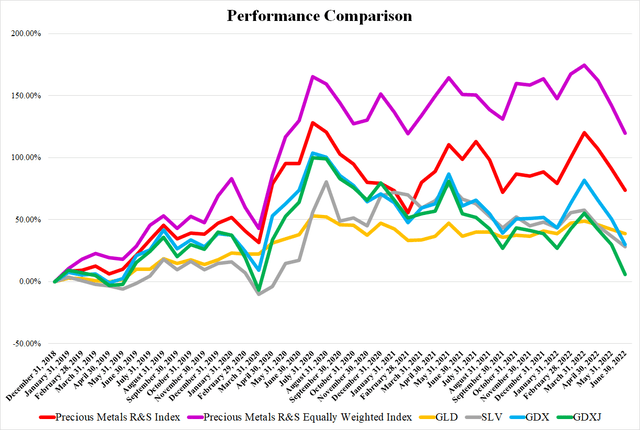

In June, the share price of the SPDR Gold Trust ETF (GLD) declined by 2.15%, and the share price of the iShares Silver Trust ETF (SLV) declined by 6.05%. This, along with the broader stock market weakness, weighed also on the mining industry. Shares of the VanEck Vectors Gold Miners ETF (GDX) and the VanEck Vectors Junior Gold Miners ETF (GDXJ) declined by 13.71% and 18.39% respectively. Compared to the precious metals miners, the precious metals R&S companies did relatively well. The Precious Metals R&S Index declined by 9.09% and the Precious Metals R&S Equally Weighted Index declined by 9.3%. Also the chart above shows that since December 2018, the R&S companies have outperformed the miners, and also both the precious metals significantly. However, the gap between the R&S companies and precious metals has tightened notably over recent months.

The June News

The month of June was pretty poor in news. Several smaller deals took place and several companies provided portfolio updates. Probably the most important June news is the merger of Elemental Royalties and Altus Strategies.

Sandstorm Gold (SAND) declared a quarterly dividend of C$0.02 ($0.016). It will be paid on July 29, to shareholders of record as of July 19.

EMX Royalty (EMX) announced that its 0.7335% NSR royalty on the Caserones mine generated $2.7 million in Q1. The company also announced the acquisition of 7,924,106 shares of Norra Metals (OTC:NRRMF). This purchase elevated its interest in the company to 12.53%.

On June 21, EMX reported drill results achieved by South32 (OTCPK:SOUHY) on the Hardshell property. The best intersections include 1.52% copper over 76.5 meters and 1.06% copper over 73.8 meters. Very good is also intersection of 0.69% copper, 12.2% zinc, 8.2% lead, and 77 g/t silver over 9.8 meters. EMX owns a 2% NSR royalty on Hardshell.

Vox Royalty (OTCQX:VOXCF) announced the acquisition of 3 Canadian royalties. A 1% NSR royalty over a part of Treasury Metals’ (OTCQX:TSRMF) Goldlund project, an effective 0.6% NSR royalty over Goldseek Resources’ (OTC:GSKKF) Beschefer project, and 1.5% NSR royalty over Torogold’s Gold River deposit. Vox agreed to pay up to C$1.8 million for this royalty package.

According to the portfolio update, the forecast ore tonnages at the Binduli North gold expansion project increased by 1/3. Another good news is that at the Sulphur Spring project great drill intersections including 3.5% of copper equivalent over 65.1 meters or 6.7% of copper equivalent over 27.8 meters were made.

Elemental Royalties (OTCQX:ELEMF) and Altus Strategies have announced a merger of equals. You can find an analysis of this deal here. The Altus shareholders will receive 0.594 Elemental shares for each Altus share. Upon completion of the deal, the Elemental shareholders should hold 52.9% and Altus shareholders 47.1% of the new company that will be named Elemental Altus Royalties.

Altus Strategies (OTCQX:ALTUF), besides the abovementioned merger, also reported that its 0.418% Caserones NSR royalty generated a pre-tax income of $1.54 million in Q1. Moreover, based on the latest reserves update, the mine life was expanded from 17 to 28 years.

At its Egyptian projects, Altus Strategies made multiple high-grade gold discoveries. The discoveries were made through reconnaissance sampling on all 4 Altus’ Egyptian projects that cover an area of 1,914 km2.

Sailfish Royalty (OTCQX:SROYF) announced that Mako Mining made a high-grade gold discovery on the Las Conchitas North property, 750 meters to the north of the San Albino mine. The best intersection included 51.8 g/t gold and 29.8 g/t silver over 0.9 meters. Sailfish owns a 3% NSR royalty on San Albino and 2% NSR royalty on Las Conchitas. Later in the month, Sailfish Royalty announced that Mako Mining significantly expanded the SW Pit zone at the San Albino mine.

Orogen Royalties (OTCQX:OGNRF) announced the acquisition of 3% NSR royalties on three projects located in western Kenya. In an exchange for the royalties, Orogen will pay Advance Lithium Corp. $120,000 and it will transfer its interest in the Sarape Gold. Orogen will retain only a 1.5% NSR royalty on Sarape.

Empress Royalty (OTCQB:EMPYF) announced that the Manica mine reached the pre-production stage, This is the second of Empress Royalty’s assets that reached pre-production over the last month. Empress owns a 3.375% royalty on Manica. A detailed article about Empress Royalty’s near-term growth prospects can be found here.

The July Outlook

The first trading day of July was positive. However, also June began positively, only to turn into another bloodbath. The gold market and broader stock market sentiment remain the key driving forces for the precious metals R&S companies in the near term. However, sooner or later, the investors will realize that the R&S companies should benefit from the inflationary pressures, as their costs are more or less fixed, while they are free to enjoy increased metals prices.

Be the first to comment