Mindstyle

Investment thesis

Considering the results of recent years and especially those of the first half of 2022, Mondelez (NASDAQ:MDLZ) is a very solid company that manages to improve even when the economy is struggling. It is among the best companies in its industry, with profit margins that far exceed the average. However, despite this good premise I would not buy this company currently, as $60 per share is too much compared to the fair value of $42. So, my sell rating is not because of a problem with the company, but simply because of the current price per share. Mondelez is a great company and I would like to invest in it, but not at this price.

Growing profitability over the past 10 years

Mondelez is one of U.S. top companies in the sale of confectionery, food, snack and beverage products, thanks to its world-renowned brands. Major brands include Oreo, Tuc, Philadelphia, Ritz, and Milka.

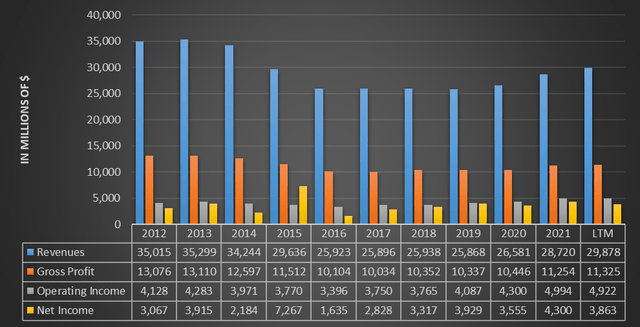

Over the past decade, the company’s revenues have declined but profit margins have increased, thus leading to improved profitability. This company’s internal efficiency is improving and its market power allows it to increase the price of its products without necessarily leading to a major reduction in revenues.

As can be seen from this graph, 2012 revenues were about $5 billion higher than LTM revenues; thus, at first glance it might be thought that there was a worsening. However, looking in more detail at the intermediate margins in the income statement we can see that operating income has actually never been higher. Profitability over the past 10 years has improved, and this has been mainly due to a reduction in operating costs.

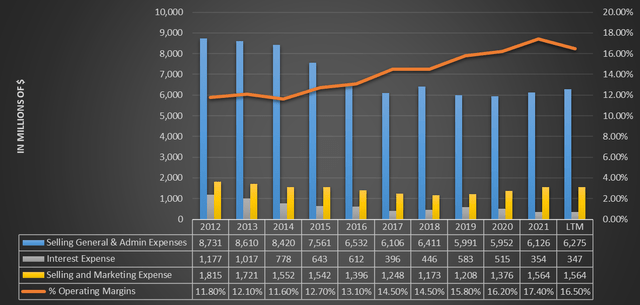

Selling general & admin expenses were about $2.50 billion higher in 2012. However, only a small part of the reduction in these costs was attributed to the reduction in selling and marketing costs; in fact, this segment suffered a reduction of only $251 million. This I consider to be positive, as the company reduced operating costs without necessarily affecting advertising costs too much. In addition, besides the reduction in operating costs, the reduction in interest expenses on debt should also be mentioned: in 2012 interest expenses were $830 million higher.

In 2012 the operating margin was 11.80%, currently it is 16.50%, a rather important improvement for a defensive company like Mondelez. Considering that the industry median is 8.57%, this gives even more of an idea of the market power of this company. It is hard to find a more profitable company than Mondelez in this sector.

A quite positive 2022 so far

The problems of the current macroeconomic scenario are affecting all companies; however, there are some that are experiencing these difficulties less. Mondelez, thanks to its efficiency and stability of its core business, is definitely among the companies that are suffering the least; in fact, its profitability has even improved compared to last year.

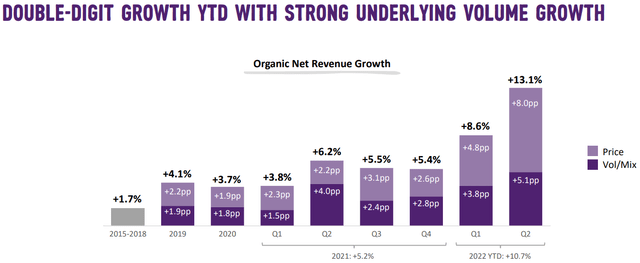

Mondelez’s organic revenue growth has been remarkable in the last two quarters, and in the second quarter it even touched double digits. This growth is directly influenced by two aspects:

- The growth in business volumes: consumers are buying more and more Mondelez products.

- The increase in prices for individual products: in Q1 it was 4.80% and in Q2 it was 8%. This increase was greater than in other years because the company wanted to burden consumers with increased operating costs due to inflation at 40-year highs.

In light of this data, it is interesting to note how Mondelez manages to achieve ever higher sales volumes despite rising prices, especially considering that its products are not essential to a balanced diet. I suppose the growing trend of obesity benefits Mondelez’s coffers, as daily consumption of extremely sugary products is becoming more common. Suffice it to say that since 1975 the obesity rate worldwide has almost tripled, especially among younger people. Although the negative consequences of obesity are now well known, the excessive consumption of sugar leads to a kind of addiction from which it is difficult to break free.

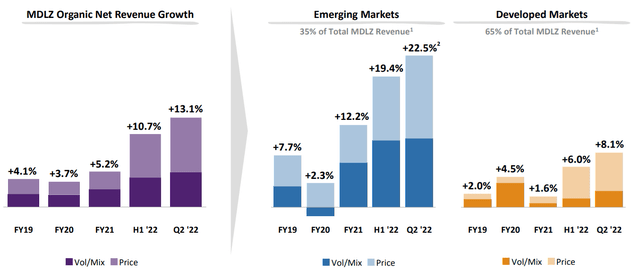

Looking at Mondelez sales by region, it would seem that this upward trend is affecting emerging markets the most, as developed markets already have a serious obesity problem, especially the U.S.

Organic revenue growth in emerging markets was 19.40% in the first half of 2022, while only 6% in developed markets. The increase in prices due to high inflation in emerging countries has certainly greatly influenced the bottom line (especially Argentina), however, the strong increase in volumes should also not be underestimated. From a future perspective, I expect emerging markets to provide the greatest benefit in terms of revenues for Mondelez.

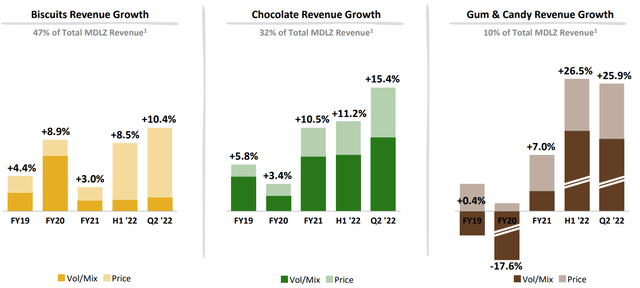

Finally, wanting to delve further into the topic of revenues, it is also good to clarify where they come from and how the various segments have reacted to the first half of 2022.

- The biscuits segment achieved revenue growth of 8.50% in the first half of 2022. This is a good growth, although it is driven almost entirely by rising price levels. Since this segment is responsible for 47% of total revenues, it would be great if more work was done on volume growth.

- The chocolate segment is the one that surprised me the most, as despite having a weight of 32% of total revenues it has had remarkable growth, especially in the last quarter. In particular, unlike the biscuits segment, this one was driven a lot by volume growth.

- The gum and candy segment weighs only 10% of revenues, but it has had sensational growth. Among the three segments, it is definitely the most volatile, in fact we can see that in 2020, for example, it had a sharp decrease of 17.6%. In any case, the figures for the first half of 2022 are excellent and may mean that the sales of this segment may have a greater impact on total revenues in the future.

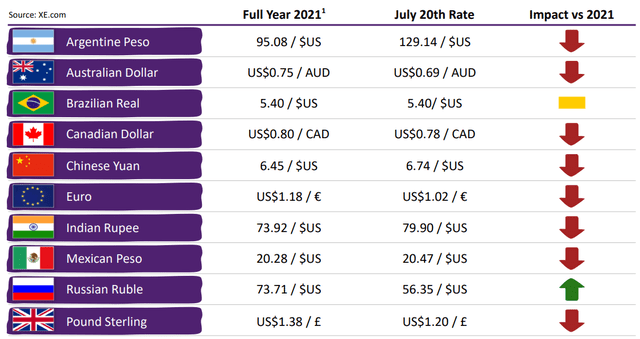

To conclude the discussion regarding Q2 2022, it should be noted that the company considered revenue growth on a constant currency basis. Also for Mondelez, the strengthening of the dollar against other major currencies negatively affected the revenue related to exported products.

With the exception of the ruble, the only currency that has not devalued against the U.S. dollar is the Brazilian real: in all other cases, the super dollar has negatively affected revenues from exported products.

How much is Mondelez worth?

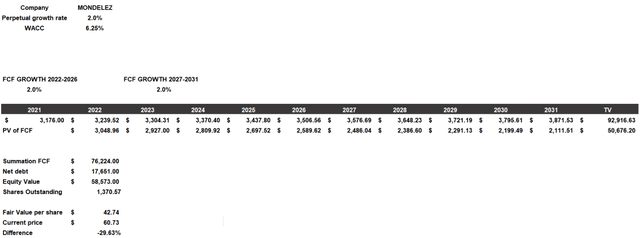

Overall, Mondelez’s first part of 2022 was not bad at all, however this is not enough to justify a buy. Personally, I always have to construct a discounted cash flow first in order to consider buying a company, since any investment is the present value of future cash flows. The model I built is composed of the following data:

- The cost of equity is 7%, and considers a beta of 0.61, a country market risk premium of 4.20 %, a risk-free rate of 3.50 % and additional risks of 1 %. The after-tax cost of debt is 3.74%.

- The capital structure is 75% equity and 25% debt, with a resulting WACC of 6.25%.

- The growth rate entered is 2%. I intentionally entered a low growth rate since Mondelez is a defensive company with fairly predictable free cash flow. As a value company in a slow-growth industry I think a 2% is appropriate.

- Net debt and shares outstanding were sourced from TIKR Terminal.

According to my assumptions, Mondelez is currently overvalued as it has a fair value of $42.74 while currently trading at $60.73. This is one of those situations where the company under consideration is great but at the same time overpriced. My sell rating has nothing to do with the company’s core business, but is simply related to a price that is too high. Certainly, it should be considered that when buying such an important company there may be an additional premium to be paid, but in any case I would wait for at least the $50 per share before opening a position. I do not completely disagree with those who open a position now since I value this company; however, I believe it can be bought at a lower price in the future.

Be the first to comment