choness/iStock via Getty Images

ASM International NV (OTCQX:ASMIY) announced in a recent earnings call that the company expects to outperform in the WFE market. If we also add significant revenue growth expected in the ALD business and the Epi market, the company appears quite undervalued. Management expects sales growth close to 21% CAGR until 2025. In my opinion, if ASMIY finds niche markets in vertical furnaces and PECVD, the free cash flow margin could grow even beyond expectations. There are obviously risks from potential failure from suppliers, however, the current price mark appears too low considering the future potential for free cash flow.

ASM International

ASM International is a supplier of semiconductor wafer processing equipment and process solutions.

With the pandemic triggering structural changes in the semiconductor industry, new investments in capacity from 2021 and 2022 are reshaping the importance of ASM. Keeping this in mind, I believe that it is a great time for revising the expectations of management.

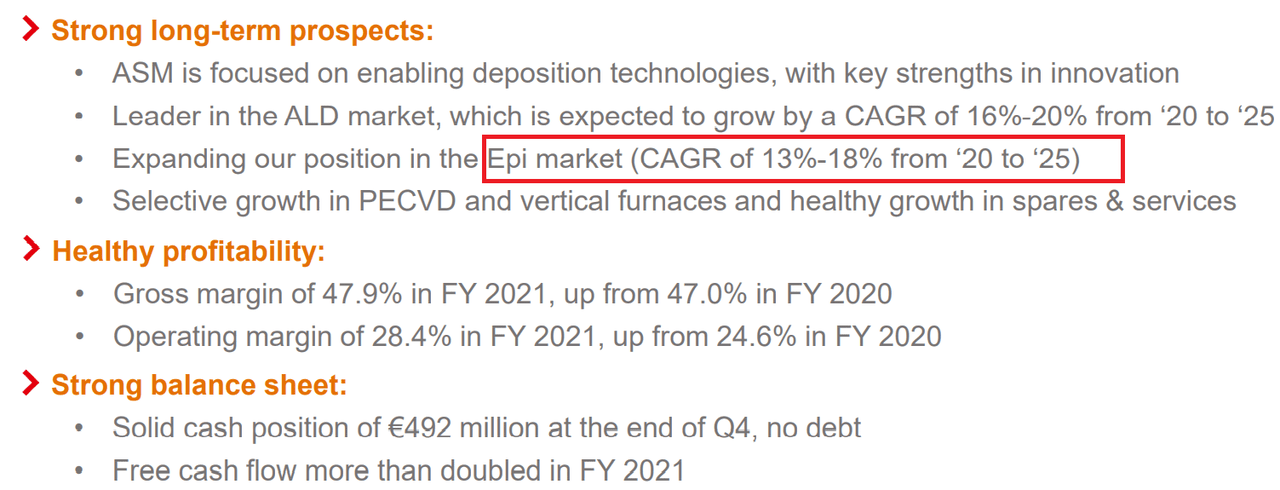

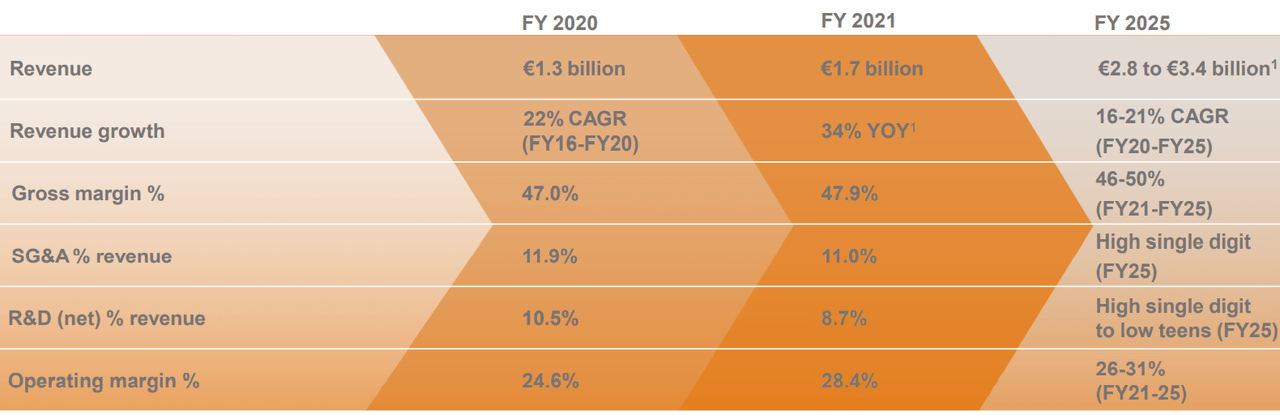

In the last presentation to investors, management highlighted the fact that it expects a significant increase in its position in the Epi market. The company also continues to expect to lead the ALD market. As a result, investors will likely be expecting increases in the gross margin and sales growth because the Epi market and the ALD market are expected to grow at a CAGR of more than 13%:

2021 Q4 Investor Presentation 2021 Q4 Investor Presentation

After noting the expectations of ASM and the Epi and ALD markets, I believe that the guidance given for 2022 is worth mentioning. ASM expects double-digit sales growth, around €530 million, in 2022. Management also noted that in the second half of 2022, revenue could accelerate even beyond the company’s expectations thanks to the WFE market:

Supported by a record high order backlog at the end of Q4, ASM has started the year on a strong footing. Looking at the first half of the year of 2022, supply chain conditions are expected to remain tight. For Q1, on a currency comparable level, we expect revenue of €500-530 million, with a further steady increase in Q2 revenue compared to Q1. Based on the current visibility, we expect revenue in the second half of 2022 to be higher than the level in the first half. The wafer fab equipment (WFE) market is forecasted to increase by a mid to high teens percentage in 2022. We expect to outperform the WFE market in 2022. Source: 2021_Q4_Investor_presentation

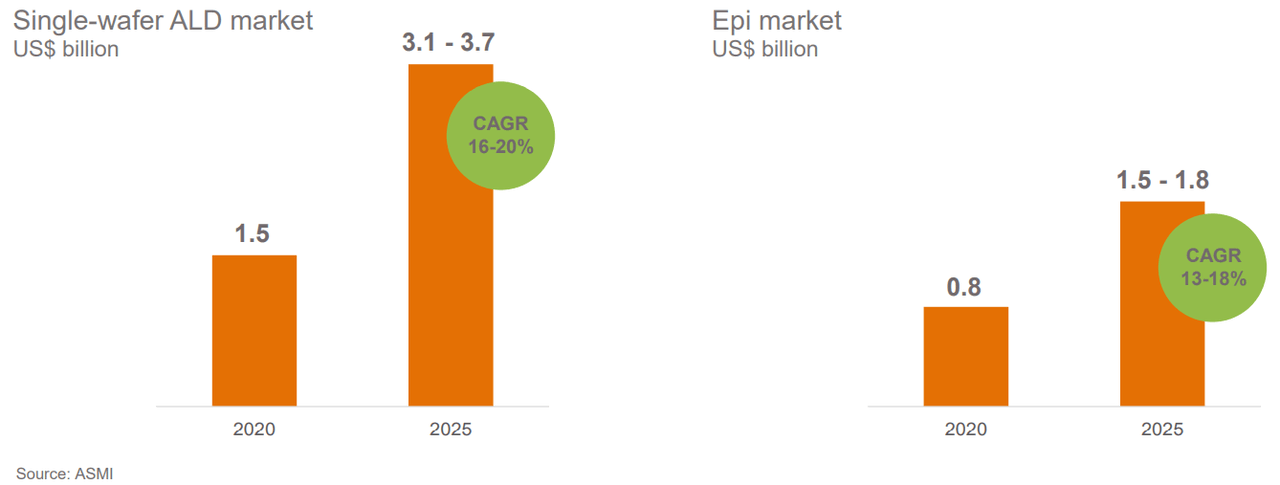

According To Analysts, The EV/EBITDA Would Get Cheaper From 2022

I became quite interested in ASM after reviewing the expectations of other analysts. Estimates include a significant increase in sales and EBITDA, which should lead to diminishing EV/Sales and EV/EBITDA. 2022 EV/EBITDA is expected to be 19x, and 2024 EV/EBITDA would be 13x. In my view, if a sufficient number of market participants learn that the EBITDA may be about to increase significantly, there will likely be demand for the stock. As a result, the EV/EBITDA ratio may not decline because the market capitalization could increase:

marketscreener.com

With The Assumptions Of Management And Other Conservative Figures, The Company Is Worth €647 Per Share

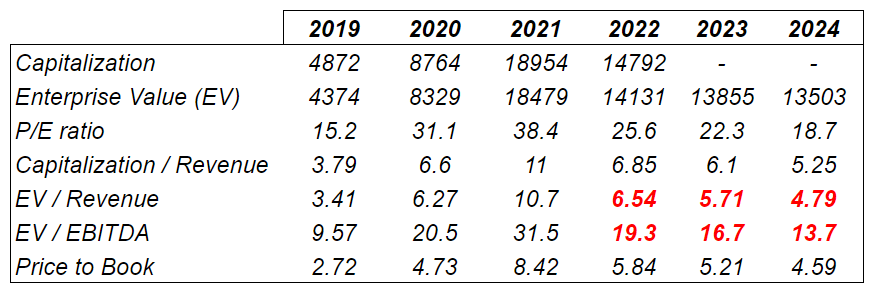

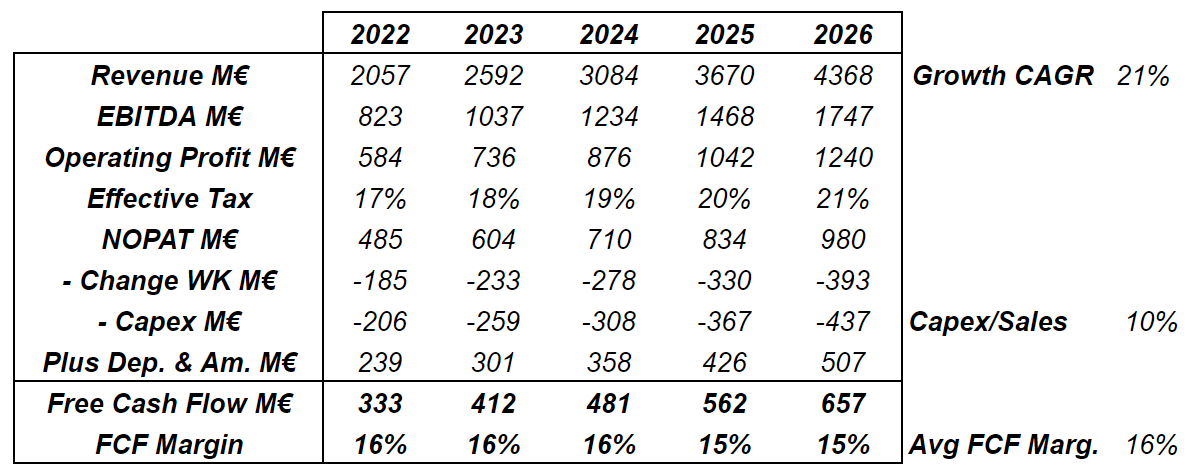

In the last presentation, I saw that management is expecting close to 21% sales growth from 2020 to 2025, and an operating margin close to 31%. I used some of the figures reported by management, so please have a look at the company’s guidance.

2021 Q4 Investor Presentation

In my view, if ASM continues to grow its ALD business, maintains leadership in logic/foundry, and keeps expanding in memory, revenue will trend north. Besides, if management successfully invests in new niches, and finds growth opportunities in vertical furnaces and PECVD, we could be expecting further EBITDA margin increases:

In vertical furnaces and PECVD, we want to further develop our current niche positions by addressing targeted growth opportunities. Vertical furnace applications for the analog/power market is an example of a niche position we have selectively been investing in. Source: Annual Report

Finally, under this case scenario, I would also expect growth in the company’s spares & service business. As a result, I believe that ASM will be able to report lower costs, and reduce the resources required to keep ASM’s systems running:

We aim to accelerate the growth of our spares & service business through continued expansion of our installed base, and growing our offerings to include differentiated outcome-based services. These are in addition to our existing offering of spare parts, maintenance and support services. Source: Annual Report

Under my own assumptions, with a sales growth close to 21% from 2022 to 2026, I obtained €4.3 billion in sales and 2026 EBITDA of €1.7 billion. Also, with a capex/sales ratio close to 10% and changes in working capital close to €184- €393 million, the average free cash flow margin would be equal to 16%.

YC

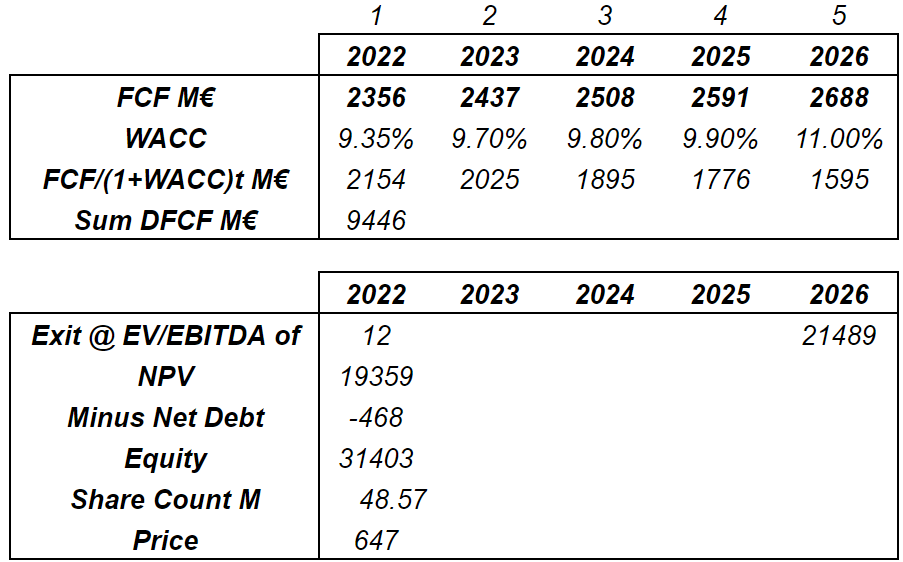

With a DCF model lasting five years and a free cash flow that grows from €2.35 billion to €2.68 billion, the discounted free cash flow should be €9.4 billion. If we use an EV/EBITDA of 12x, which is the median multiple for ASM’s industry, the net present value of the terminal value should stand at €19 billion. Finally, the implied stock price should be €647.

YC

Under Very Detrimental Assumptions, The Implied Fair Price Is €280

Under the list of risks, in my opinion, the most serious for ASM would be lack of innovation. If the market goes in a certain direction, and management cannot really offer products to fulfill new demands, sales growth will likely be negative. In line with the same risk, if ASM suffers unsuccessful or slow execution of research and development, and misses key inflections or opportunities, investors could lose their interest in the company.

Inability to respond to changes in product demand and technology change could result in decreased orders and financial loss and/or reputation damage. Source: Annual Report

Under this case scenario, I also envision a certain decline in demand after the sweet period that followed the pandemic. Notice that ASM did report the cyclical nature of the semiconductor market, and gave full commentary on potential risks related to insufficient production capacity:

Cyclical nature of the semiconductor market which leads to abrupt changes in demand resulting in fixed overheads during downturns or insufficient production capacity during upturns. Source: Annual Report

Given the warnings given by management about potential supply chain issues that ASM may suffer, under this case scenario, I assumed a failure from suppliers. In the worst case, I believe that the company could envision a drastic reduction in revenue:

Failure of suppliers to deliver resulting in financial loss due to penalties, rework and/or reduced future demand. Source: Annual Report

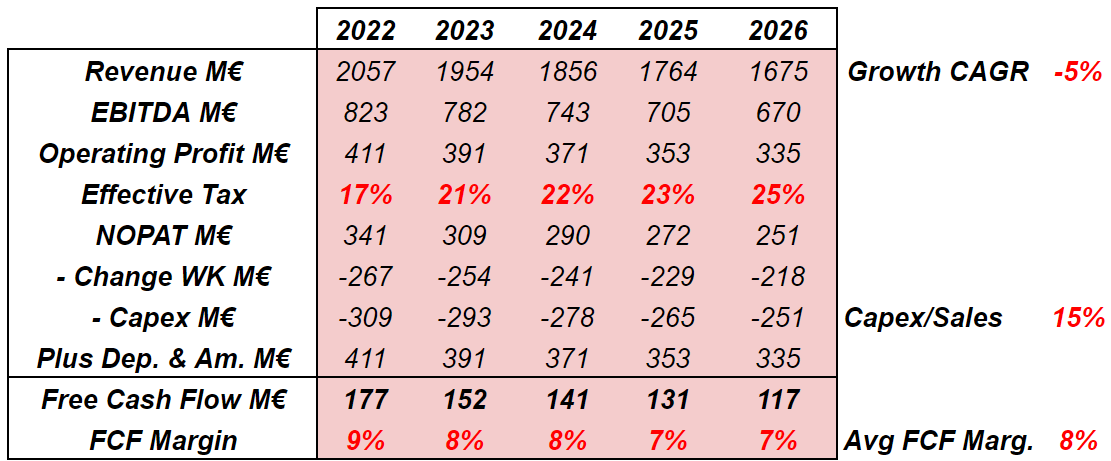

Under dramatic assumptions, I believe that -5% sales growth from 2022 to 2026 could happen. I also assumed that the effective tax should increase from 17% to close to 25% in 2026, which is also likely. My results include a 2026 free cash flow close to €115 million and a free cash flow margin around 7.5%-8.5%:

YC

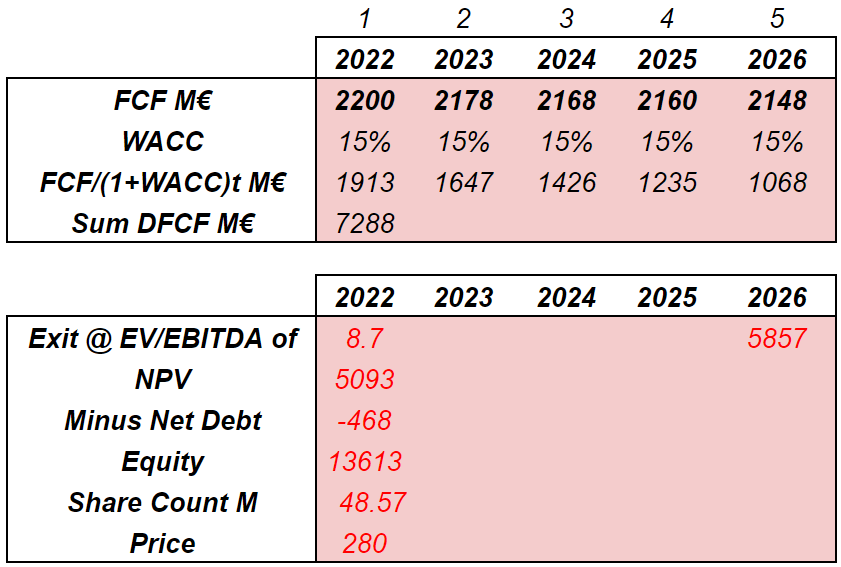

With an average weighted average cost of capital of 15%, the sum of the stream of cash flows from 2022 to 2026 implied almost €7.25 billion. I also assumed that ASM would trade at less than 8.7x because of the decline in the EBITDA margins, so that the implied price should be close to €280.

YC

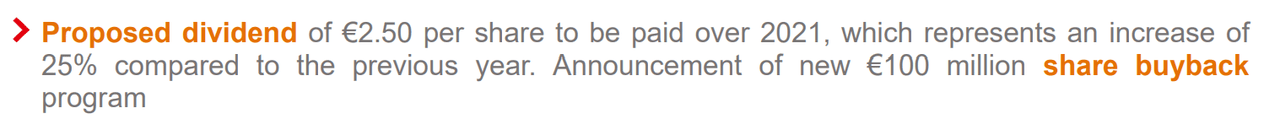

Management Announced A Share Buyback Program Because ASM, like I Do, Believes That The Company Is Currently Undervalued.

With most analysts claiming that ASM’s fair price is somewhere between €401 and €594, in my view, the share buyback program makes a lot of sense. I believe that the stock demand would increase as soon as more investors learn about the program. In sum, more stock demand will likely lead to an increase in the share price:

2021 Q4 Investor Presentation

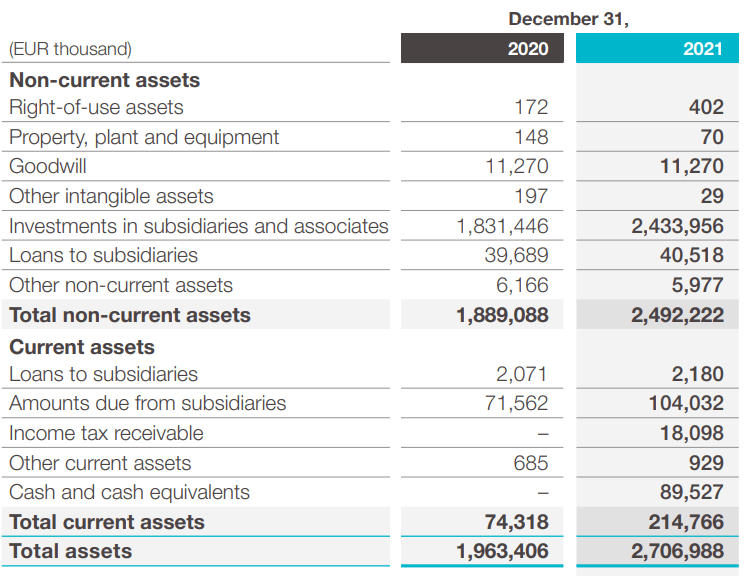

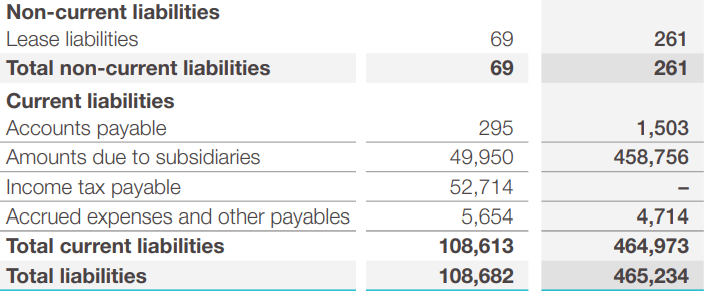

Quite Healthy Balance Sheet

ASM reports €1.9 billion in total assets and only €108 million in total liabilities. The asset/liability ratio seems quite healthy. With that, I don’t like the fact that 93% of the total amount of assets is represented by investments in subsidiaries and associates. From here, I don’t have a lot of information to assess the balance sheet of the associates.

2021 Q4 Investor Presentation

ASM reports only €49 million due to subsidiaries, which does not seem a lot for a company with €1.9 billion in total assets. In sum, I don’t believe that investors out there will worry about ASM’s financial debts.

2021 Q4 Investor Presentation

Conclusion

ASM International announced recently that the company expects to outperform in the WFE market. Revenue growth is also expected from its ALD business and the Epi market. In my opinion, investors are not aware that revenue growth is expected to be equal to 21% CAGR until 2025. In my opinion, if management successfully finds growth opportunities in vertical furnaces and PECVD, and their assumptions are correct, the implied stock price should be close to €647. I see some risks, but the current market price undervalues significantly the potential future cash flow.

Be the first to comment