Justin Sullivan/Getty Images News

It has already been more than two years since I first covered Mondelez (NASDAQ:MDLZ) and showed why investing in high quality businesses with strong competitive advantages pays off, even if you have to pay premium valuation.

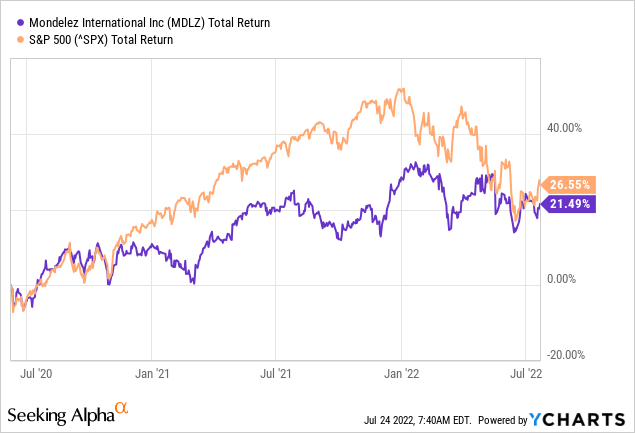

Since then Mondelez has delivered a total return of nearly 22%, compared to the broader market return of almost 27%.

Although this might not sound impressive at first, Mondelez market risk exposure, i.e. the beta coefficient, is considerably lower than 1.0, which means that on a risk-adjusted basis the company has significantly outperformed the market.

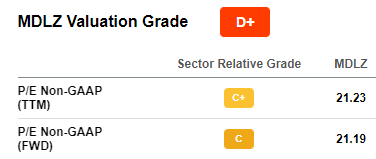

Over this two year period, there has been plenty of noise out there. Certain analysts and market commentators have been worried that the company’s premium valuation is not supported by its sluggish topline growth.

Seeking Alpha Seeking Alpha

Others have outlined the risk of rising cost pressures due to supply chain issues.

Seeking Alpha

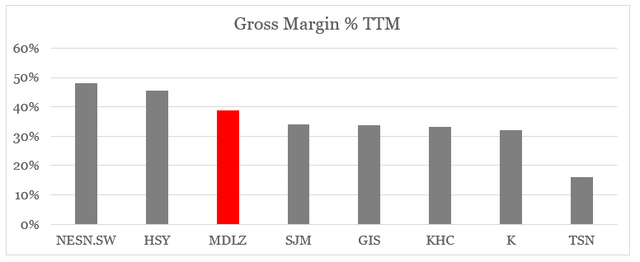

And most recently, the narrative of high cost-push inflation has also been haunting high quality names, such as Mondelez.

Seeking Alpha

People often try to predict when the next recession will strike, or what the next quarterly earnings numbers will look like or they look in the rearview mirror of inflation numbers to inform themselves about future risks for their stocks. Needless to say that all that is just noise and as we saw above, long-term holders of Mondelez have done very well throughout this period.

Don’t Miss The Forest For The Trees

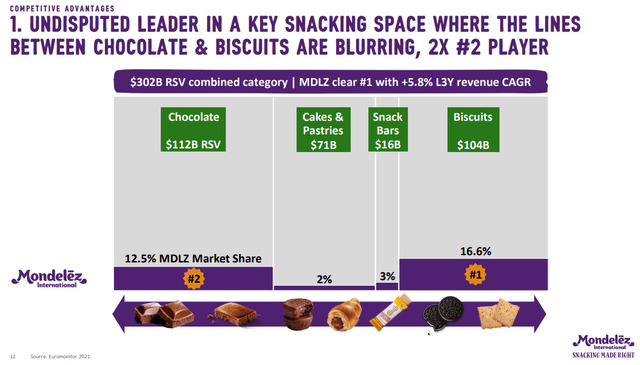

As I have previously shown, Mondelez strategy and almost impossible to replicate competitive advantages are the main reasons for considering the company as a long-term investment.

For example, many of the MDLZ iconic brands are both truly global and also associated with high price premiums and customer loyalty.

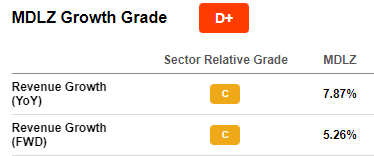

The price premium associated with the brands give the company one of the highest gross margins within the Packaged Food industry.

prepared by the author, using data from Seeking Alpha

As a result, even as inflationary pressures are likely to intensify going forward, MDLZ is one of the best-positioned companies in the sector to weather the storm.

We now expect input cost inflation in the low double-digit range for 2022 versus our prior view of approximately 8% (…)

Source: Mondelez Q1 2022 Earnings Transcript

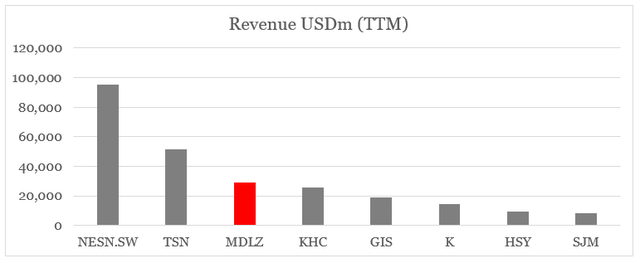

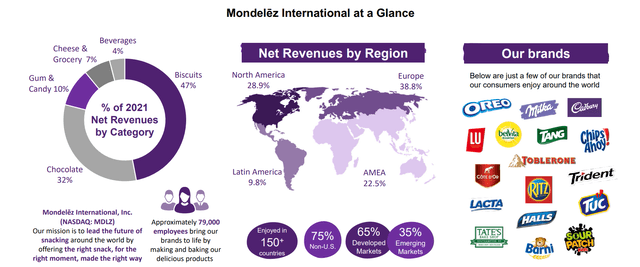

In addition to its iconic brands in high margin product segments, Mondelez also achieves significant economies of scale through its size and as we saw above it also has significant exposure to markets outside of North America and Europe.

prepared by the author, using data from Seeking Alpha

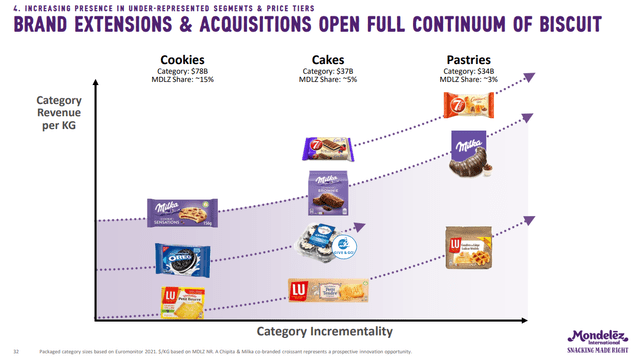

Nevertheless, Latin America, Africa, Middle East and Asia, made about a third of MDLZ revenues as of the end of fiscal year 2022 which leaves plenty of opportunities for future growth. Moreover, the current strategy to expand some of the strong global brands into adjacent categories represents yet another major opportunity for MDLZ.

Mondelez Investor Presentation

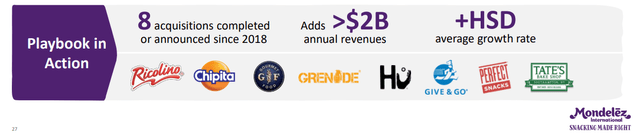

Having said all that, it’s not hard to make a compelling long-term investment thesis around MDLZ. However, there is one major risk with the company’s current strategy that is heavily focused on inorganic growth.

A Major Risk To Keep An Eye On

As I have outlined time and time before, once a company engages in a large number of M&A deals or pursues a very large deal, the risks for shareholder value destruction grow exponentially. The most obvious is the risk that the company is significantly overpaying for its targets, but also there are risks associated with blurring the current strategy, avoiding reckless spending on fixed costs and refraining management from empire building behavior.

That is why the recent acquisition spree of Mondelez should be on the radar of any long-term shareholder.

Mondelez Investor Presentation

As I previously noted, some of these deals were a very good fit from a strategy point of view. For example, Chipita and Give & Go gave Mondelez access to a number of adjacent markets, where the company could easily bring in its iconic brands and expertise.

Mondelez Investor Presentation

On the contrary, the latest deal for Ricolino seems to be aiming at achieving scale in certain geographies where MDLZ currently has relatively low market share.

We are excited to provide some additional details on our recently announced acquisition of Ricolino, the number one sugar confectionery and number four chocolate player in our priority markets of Mexico. This strategic acquisition will enable us to double our size in Mexico, a key priority market for us and Latin America’s second largest market after Brazil.

Source: Mondelez Q1 2022 Earnings Transcript

Such a strategy would make sense for highly commoditized products, but is far less appealing for a company that relies heavily on brand differentiation. Therefore, I am slowly growing skeptical of Mondelez’s current approach, especially if the company continues down this path of larger and less attractive deals from a strategy point of view.

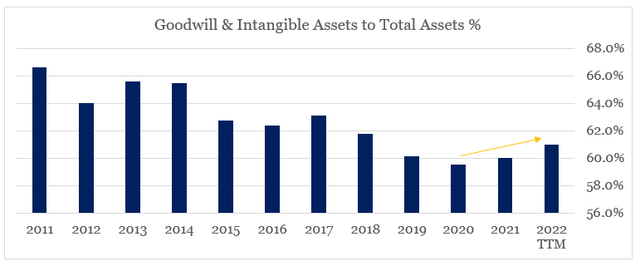

Although MDLZ has made a large acquisitions recently, the overall size of those deals have not materially moved the needle on the company’s goodwill & intangible assets to total assets ratio.

prepared by the author, using data from SEC Filings

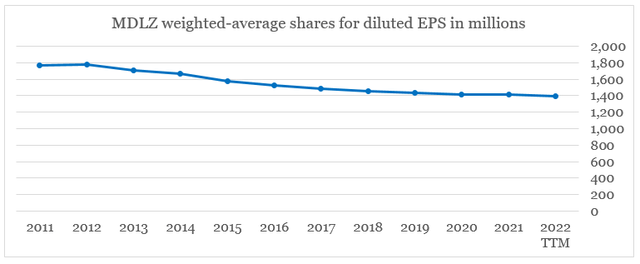

Moreover, MDLZ shareholders did not experience significant dilution and the total number of shares outstanding continues to decline.

prepared by the author, using data from SEC Filings

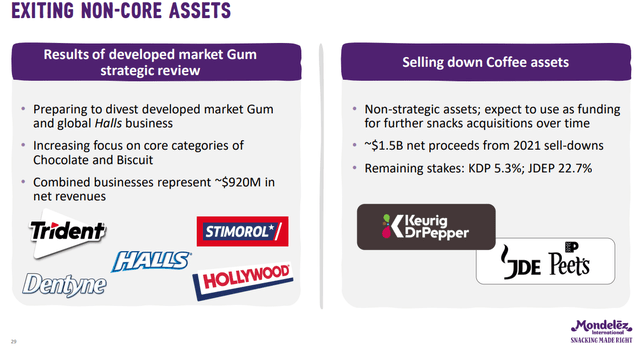

The reason why this is possible is that MDLZ has been divesting a number of non-core assets in gum and coffee segments, which are both now less important from a strategy point of view.

Mondelez Investor Presentation

Conclusion

In spite of all the noise brought by macroeconomic factors and quarterly earnings numbers, Mondelez remains a solid long-term investment. The company is among the best positioned large cap businesses in the Packaged Food sector to weather the current storm and continues to deliver long-term shareholder value. Although the current strategy is solid, investors should be on their guard for all the risks associated with inorganic growth.

Be the first to comment