Artur Plawgo

On June 24, Morningside Venture Investments (MVIL) issued a non-binding proposal to acquire the remaining outstanding shares of a clinical-stage biopharmaceutical Stealth BioTherapeutics (NASDAQ:MITO). MVIL already has a 67% stake in the company. The offer is $0.313 per ADS or $0.263 after deducting ADS cancellation fees. At current prices, this offers a 10% upside (after ADS fees). Majority-of-minority shareholder approval will not be needed while the committee of independent directors is likely to accept the deal given MVIL’s influence over the company. I do not expect any regulatory scrutiny from CFIUS given MITO’s size.

In my view, the risks here boil down to whether MVIL can walk away from the acquisition. There are several reasons why offer withdrawal seems unlikely:

-

MITO’s key phase 3 drug for Barth Syndrome seems to have a good chance of being approved by the FDA despite its rejection in October 2021.

-

The buyer seems to be a reputable Chinese PE/VC firm and already has full control over MITO.

-

According to the acquisition proposal, MVIL is willing complete the transaction with a “superior degree of speed” and without broad due diligence which could point to a quick buyout timeline.

-

MITO’s stock price is currently below its most recently reported net cash levels ($0.27/ADS). However, the company is burning cash at a rapid pace – the latest estimate is that the company has enough cash to fund operating expenses into Q4’22.

Having said that, offer withdrawal from the Chinese company remains a risk, particularly given non-binding nature of the proposal. In my experience, non-binding takeover offers from Chinese companies generally have a noticeably lower closing rate than binding proposals. Investors should also be aware that there is a possibility that the Chinese government interrupts the payment of funds to foreign shareholders if the merger closes.

MITO

MITO is a ~$16m market cap clinical-stage biopharma that was founded in 2006 and IPO’ed in 2019. The company is involved in mitochondrial medicine discovery, development and commercialization. The share price has continued to decline since going public and now MITO trades close to an all-time low. This can be attributed to a couple of the company’s operational failures:

-

In 2019, MITO failed a phase 3 drug trial for a primary mitochondrial myopathy (PNM) drug. This was a key reason behind the 75%+ share price plunge in Dec’19.

-

In May 2022, the company failed a phase 2 trial for elamipretide treatment for blind people.

-

In July 2022 (already after the non-binding offer announcement) – shares sold off 15% on 5x heavier volume upon receipt of NASDAQ non-compliance warning – unlikely to be an issue while the current transaction is pending.

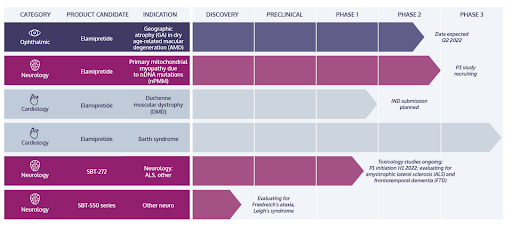

Since the 2019 failure, the company’s most advanced drug has been elamipretide for treatment of Barth Syndrome. It’s currently in its Phase 3 trial. MITO has sought FDA approval for the drug since 2021. However, last fall, the FDA declined to review MITO’s NDA (new drug application) as it lacked additional controlled data. The FDA recommended designing a new clinical trial instead of using historical medical records of patients as control group data.

Recently, however, the drug was granted a pre-NDA meeting. Reportedly, MITO will present new clinical data collected over 3.5 years, however, it will come from the same open-label extension of the ongoing phase 2/3 study and not a new trial. The FDA has previously said that an open-label extension study would not provide enough evidence to support an NDA. However, there are several reasons to expect the FDA to eventually approve the drug:

-

The original application showed that trial goals were met – the problem was that the data was compared to historical medical records. Nevertheless, this is encouraging and likely shows the drug’s efficacy. The company has also emphasized that the trial results have been “durable” across all patients.

-

Barth Syndrome is an ultra-rare disease – only around 130 individuals in the US have the condition. For this reason, a new clinical trial is inherently hard to design and carry out. MITO has also stated that the FDA itself did not identify a suitable trial design.

-

BridgeBio Pharma’s first FDA approval for a rare disease in early 2021 appears to be a similar case. The clinical trial relied on the same design as MITO’s – historical medical records were used as control data.

-

MITO has openly said that it did not expect the first NDA to be approved but was rather pushed by a community of Barth Syndrome advocates. The fact that now MITO has new data is encouraging.

-

The drug for Barth Syndrome has already received orphan drug, rare pediatric and fast track designations from the FDA, showing its uniqueness and essentiality for some part of the population. There are no FDA-approved drugs for the disease and other treatments are potentially years away.

The meeting is expected in Q3’22. Overall, FDA approval is far from guaranteed but it is clearly a high-potential phase 3 drug and probably explains why the controlling shareholder wants to cash out minority shareholders before the expected approval.

MITO’s pipeline also includes a phase 3 clinical trial for elamipretide in treatment for primary mitochondrial myopathy due to nDNA mutations (nPMM). Patient recruitment is ongoing and the trial is expected to take around one year.

Stealth BioTherapeutics

MVIL

MVIL is a Chinese PE/VC firm and part of the Morningside Group founded in 1986 by the Chan family, including now-billionaire brothers Gerald and Ronnie. MVIL seems reputable – the portfolio is large (57 biopharma investments) and the company has investments in numerous US-listed companies. The group’s AUM is reportedly at $1.8bn though I have not been able to verify this. For additional context, in 2008 Morningside Group launched another fund, MSVC, which currently manages over $5b in AUM. The fund was eventually spun-off but the group remains a significant investor which hints on the size of the buyer.

MVIL’s history with MITO is extensive – the firm has held a stake in MITO since 2006, participating in numerous equity raises (most recently in Apr’22 and May’21). MVIL seems to have full control here – MITO’s Chairman is one of Morningside Group co-founders while the CEO has worked with MVIL for over 20 years.

Based on my research, MVIL has not attempted any take-private transactions in the US before. Nevertheless, the company holds stakes in numerous US publicly-listed biopharmas:

-

LumiraDx (LMDX), 41% stake. FDA has granted emergency use authorization for its Covid-19 tests.

-

Kezar Life Sciences (KZR), 14% stake. The company is undergoing phase 2 trials.

-

Apellis Pharmaceuticals (APLS), 13% stake. APLS recently announced positive phase 3 trial results.

Conclusion

MITO setup indeed has the attributes of an attractive going private buyout. Independent committee and shareholder approvals are highly likely while regulatory risks are limited. Moreover, the buyer appears credible and does not seem likely to cancel the offer as the company’s key phase 3 drug may be nearing its FDA approval. Given this, I expect the deal to close and will open a position in MITO.

Be the first to comment