HAKINMHAN/iStock via Getty Images

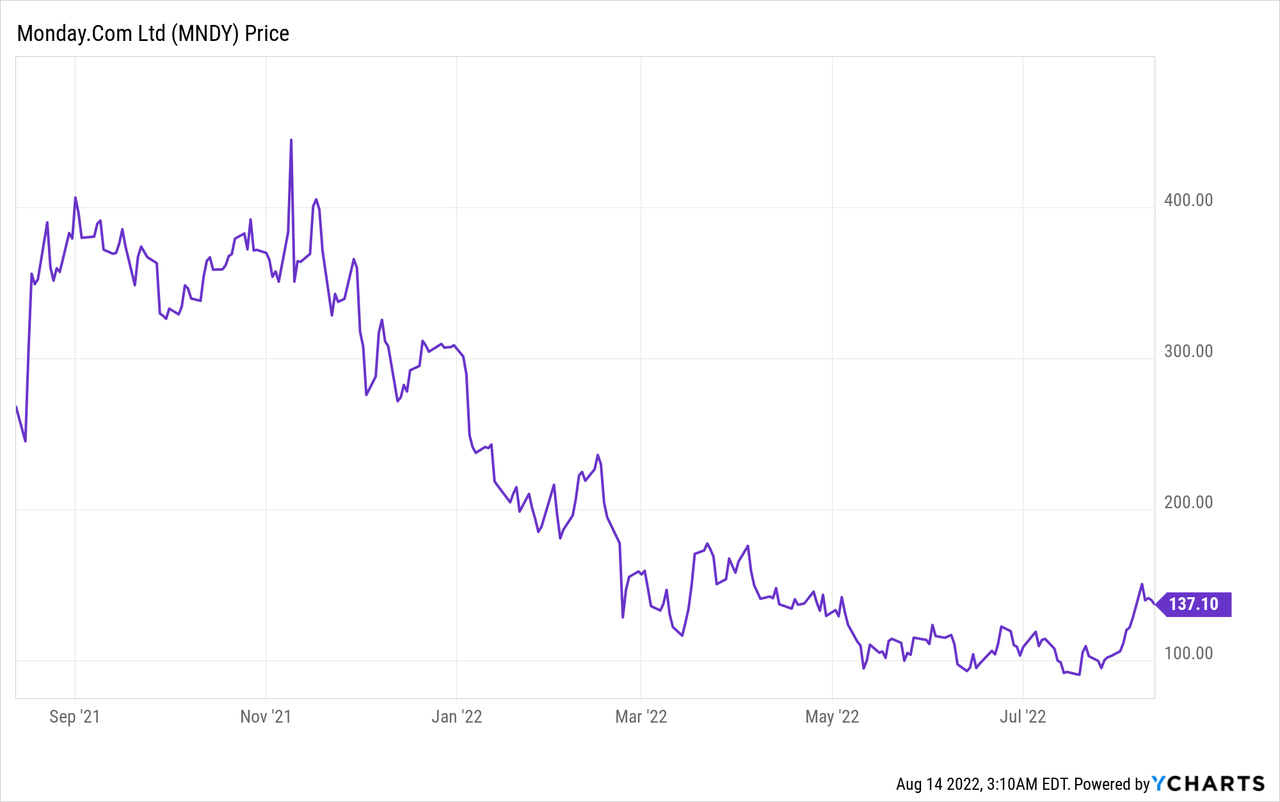

monday.com (NASDAQ:MNDY) is Software as a Service (SaaS) company which focuses on improving the efficiency of team collaboration. Founded in Israel in 2012, the platform has expanded its product range through a process of “continued innovation”. The company went public in June 2021 and saw its share price double in the first few months. However, then the market realized inflation wasn’t “transitory” and interest rates would be hiked in 2022. This caused growth stocks to have their multiples compressed and monday.com saw its share price get butchered 75%. However, the company has continued to grow its revenue, customers, and margins. It surpassed revenue and profit expectation for the second quarter of 2022 and the stock is undervalued intrinsically at the time of writing. Let’s dive into the business model, financials, and valuation for the juicy details.

SaaS Business Model

monday.com is a Project Management platform which allows teams to customize workflows, add automations and get a unified view of projects.

The heart of the platform is its new Work OS (Operating System) which acts as a backbone management tool for teams. Traditionally fixed software architectures forced users to adapt to the software, rather than the other way around. However, monday.com has created a flexible and modular platform which can easily be adapted with “no code” building blocks, thus no advanced development skills are required. The platforms “modules” include Work Management, Marketer, Sales CRM, Dev, and Projects.

Monday.com (Investor Presentation)

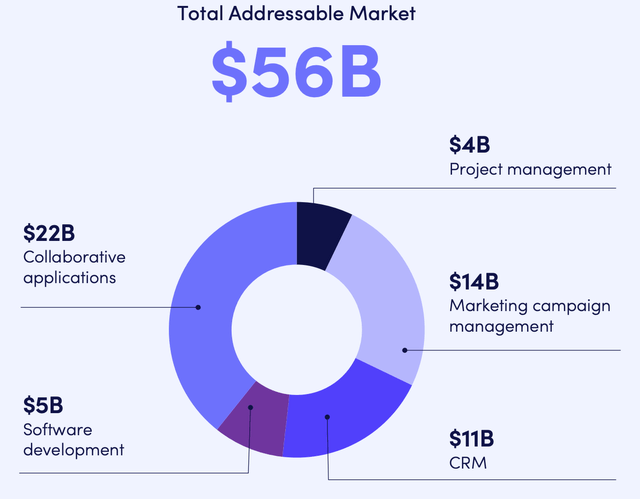

As a cloud native software package, it is perfect for those businesses digitally transforming from rigid on-premises applications to the cloud. The Total Addressable Market (TAM) is estimated to be a staggering $56 billion across Collaborative Applications, Marketing management, Project Management, Software Development and CRM.

Total Addressable Market (Investor presentation)

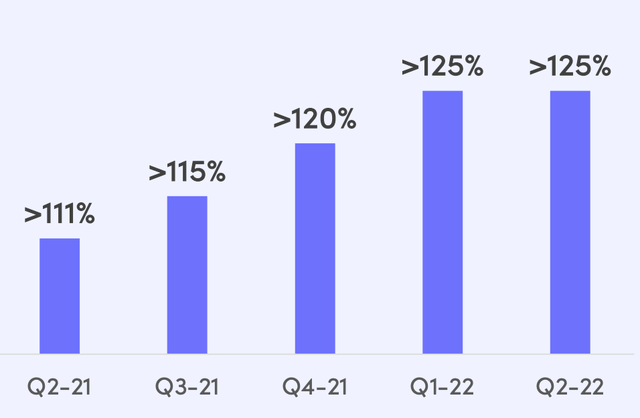

monday.com offers a pure Subscription based SaaS model in which there is a Price per user, according to the specific plan. At the time of writing the company has over 152,000 customers which include many leading names such as BBC, Peloton (PTON), Canva, Universal Studios, Coca-Cola (KO), HubSpot (HUBS) and many more. I was surprised to see HubSpot on this customer list, as they have a similar SaaS platform although more focused on Marketing and Sales. Its range of customers reinforce the company’s tagline which is “Every team, every industry, Every use case”. As of the second quarter of 2022, the product had a high net dollar retention rate of over 125%. This means customers of the platform are finding it “sticky” and spending more through module upsells.

Customer Retention (Q2 earnings report)

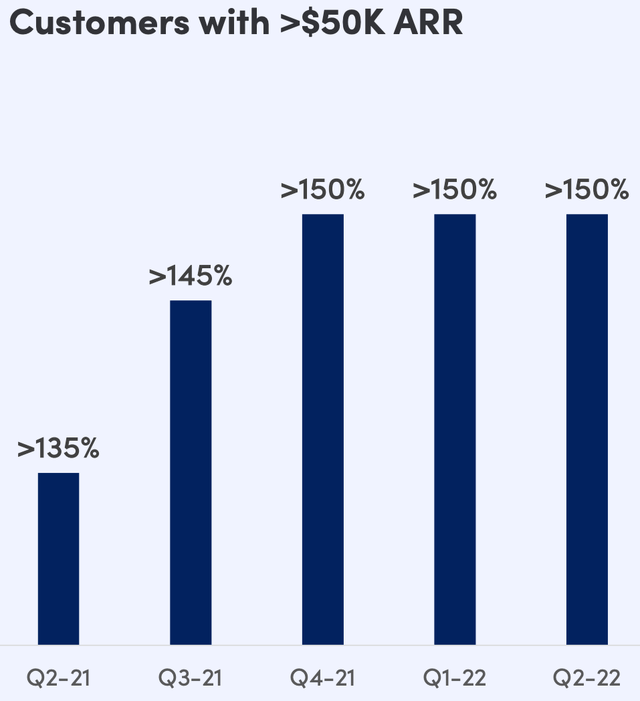

The company’s growth strategy includes “rapid product innovation”, “one platform, many products” and “moving up market”. The “many products” can be thought of the company’s various modules but also its “Monday Apps Marketplace” where external developers can create new tools for businesses, which further extends the use cases of the product. “Growing up market” refers to the approach of targeting more enterprise customers. This is a solid strategy as customers with over $50k in Annual Recurring Revenue (ARR) have generated higher retention rates of over 150%, which is fantastic.

High ticket customer retention (Q2 Earnings Report)

Insider Holding

Investing into founder led companies is a key tenet of my investment strategy, in this case Founder and CEO Roy Mann still owns 13.03% of the company and thus has “Skin in the Game”. Although I would like to see some insider buying as a signal of confidence.

monday.com’s Growing Financials

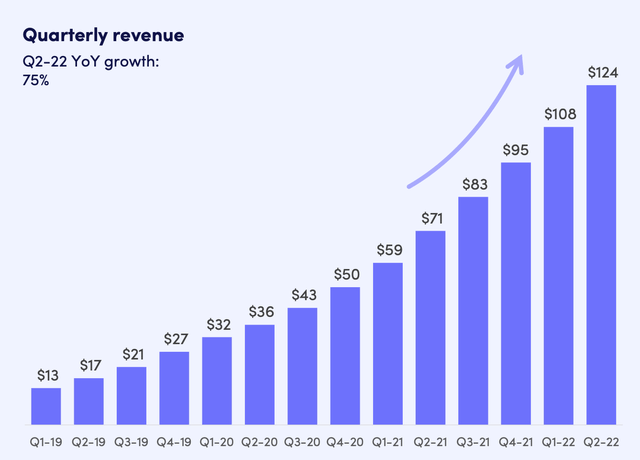

monday.com generated strong financials for the second quarter of 2022. Revenue popped to $124 million, beating analyst estimates by $5M and up by a blistering 75% year over year. This was driven by the number of paying accounts for the new Monday Work OS platform, which surpassed 1,000 in the first two months of release.

Monday.com Revenue (Q2 Earnings report)

Its “Moving Upmarket” strategy is working so far for the company as the number of paying customers with over $50,000 in annual recurring revenue (ARR) has jumped to 1,160, up 147% year over year. This was driven by notable wins which included Renault, Savills, BKP and more.

As a Software company, monday.com has an incredibly high Gross Margin of 87%, which was been pretty consistent over the past year.

The company generated a GAAP operating loss of $46.2 million, which was greater than the $27.5 million produced in Q2 21. However, the good news is its GAAP operating margin did improve by 2 percentage points to -37%. Keep in mind this is driven by operating expenses such as $30.8 million in stock-based compensation. In addition to huge Sales and Marketing investments of ~$87 million as the company invests aggressively for growth.

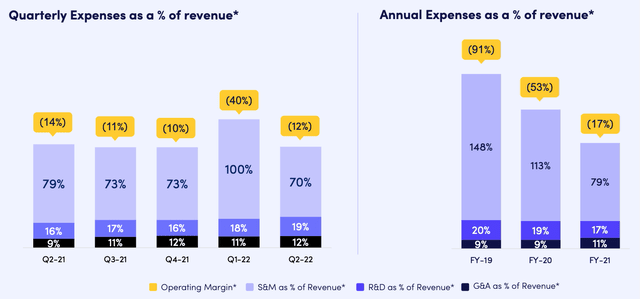

Therefore, its Non-GAAP net loss per share was -$0.33 which beat analyst estimates by $0.42. The key metric to watch is expenses as a percentage of revenue. Ideally, we want to see this declining over time which indicates high operating leverage for the business. In this case we can see this has gradually being improving on an Annual and Quarterly basis after a large negative bump in Q1 22.

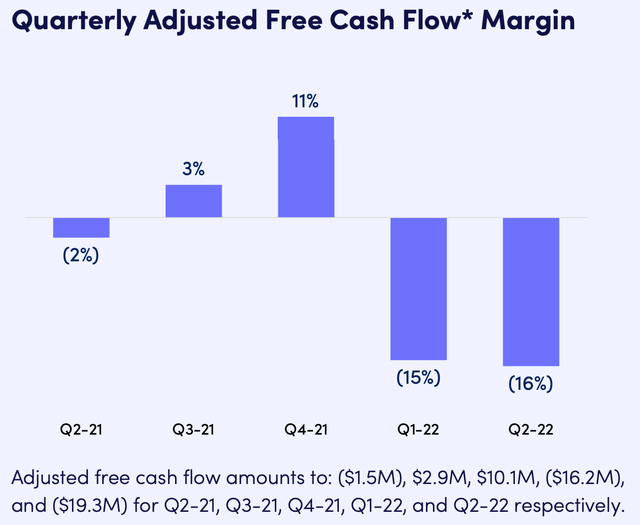

Net Cash from operating activities was $14.1 million, with -$19.3 million in adjusted free cash flow. Its Adjusted Free Cash Flow margin has been fairly volatile going from +11% in Q4 21 to -16% in Q2 22.

Moving forward, management has issued strong guidance with $130 million to $131 million revenue expected for the third quarter of 2022. In addition, they raised their full year guidance for 2022 to between $498 million and $502 million, which would represent growth of 62% to 63% year over year. This is in stark contrast to many other software companies which has reduced guidance due to the uncertainty.

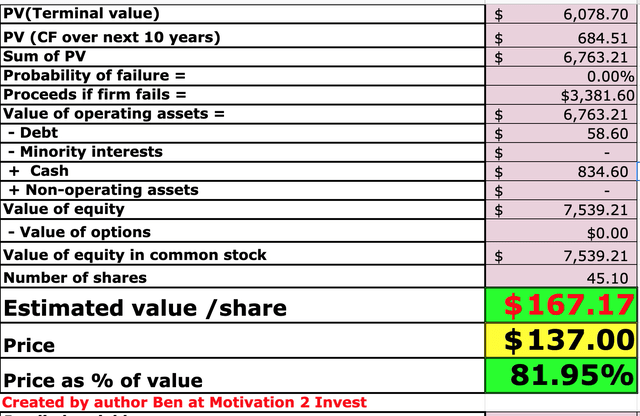

monday.com has a robust balance sheet with $834 million in cash and short-term investments, in addition to $58.6 million in total debt.

MNDY Stock – Advanced Valuation

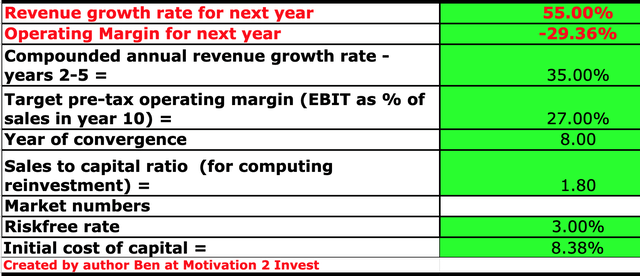

In order to value monday.com, I have plugged the latest financials into my advanced valuation model, which uses the discounted cash flow method of valuation. I have forecasted 55% revenue growth for next year and 35% over the next 2 to 5 years. These are very conservative estimates given managements strong guidance for the full year 2022.

Monday.com (created by author Ben at Motivation 2 Invest)

I have also forecasted the company’s operating margin to increase to 27% over the next 8 years. This will be driven by increased operating leverage and the company’s “moving upmarket” strategy which is working well so far. Keep in mind the base operating margin includes an adjustment from R&D expenses which I have capitalized.

Monday.com stock valuation (created by author Ben at Motivation 2 Invest)

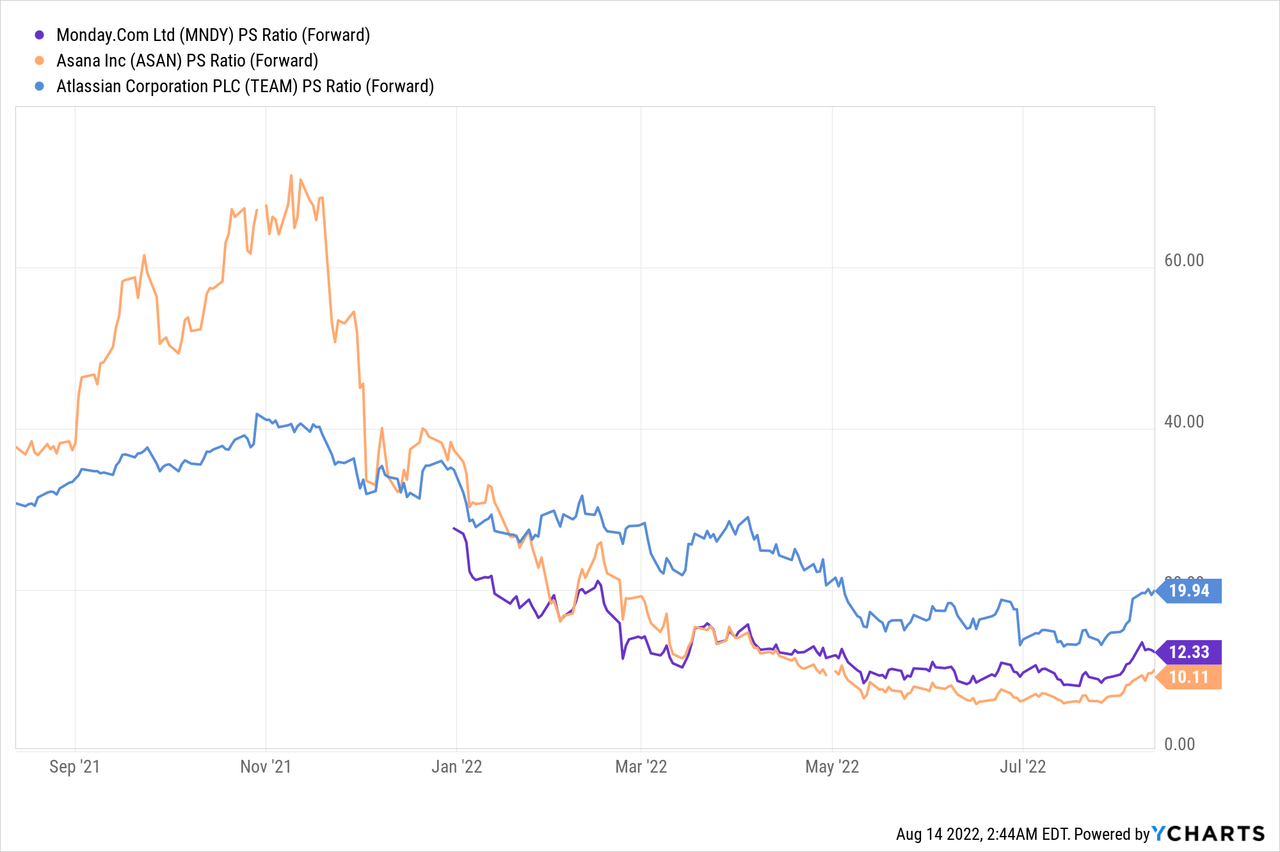

Given these factors I get a fair value of $167/share, the stock is trading at $137/share and thus is ~18% undervalued at the time of writing. As an extra data point Monday.com is trading at a Price to Sales Ratio = 12.33, which cheaper than levels in 2021. However, it trades at slightly higher valuation than team collaboration software rival Asana (ASAN), which trades at a PS Ratio = 10.1. I have previously written an in-depth post on Asana and the insider buying by the founder, you can read the full post here.

Risks

Competition

Team collaboration software has many competitions which include Adobe Workfront (ADBE), Zoho, Trello by Atlassian (TEAM) and more. According to Gartner Reviews, Monday.com comes in at number two on its review list due to number of 4.5 star reviews it has had. However, Asana has 4.6 stars but less reviews. These SaaS platforms tend to be very “sticky” with customers which is a good sign, but it also means an aggressive “land grab” must occur to capture these customers in the first place. This is why we are seeing companies in the industry investing profits aggressively for growth.

Recession/Spending Slowdown

monday.com’s management seems confident on its full guidance for 2022, but this boldness is unique given many other companies are slashing headcount and reducing expenses. I do not believe monday.com’s customers will end their subscription but I do believe the high inflation, rising interest rate environment may be a headwind to future growth rates.

Final Thoughts

monday.com is an innovative company which is truly offering a user friendly and useful product to users which improves team collaboration. Its customisable features make the possibilities endless for customers which is one reason we see high retention and growth. The stock is undervalued intrinsically and they have a large total addressable market. The only issue is management seems strangely confident given the forecasted recession.

Be the first to comment