ijeab

We are back with another dividend income summary. This article is going to discuss our July dividend income totals. Get ready. Buckle Up. Let’s see whether we crushed it….or not…..last month!

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard-earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further downhill. While we are waiting to invest our money in the market, it is earning a high-interest rate in accounts. The two primary savings accounts I use are:

- Yotta (1%-2% APY, on average, with their weekly cash prices)

- SoFi (1.8% APY on all checking and savings accounts. Yes, you read that right!).

If you are looking to earn more on your cash, it is definitely worth checking those products out!

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find undervalued dividend stocks to buy. This simple, 3-step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful exercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s July Dividend Income Summary

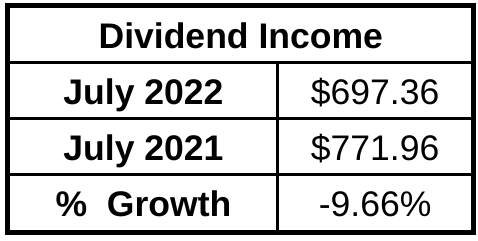

We received $697.36 in July dividend income! This was a 9.66% year-over-year decrease. That’s right, our total dividend income decreased from $771.96 received in July 2021.

Author

But…….there is much, much more to our July dividend income story. In July 2021, we received a huge special dividend from T. Rowe Price (TROW). The special dividend accounted for $220.50 of the $771.96 in dividend income received. Naturally, our income will decrease compared to last year when compared to an insanely large special dividend.

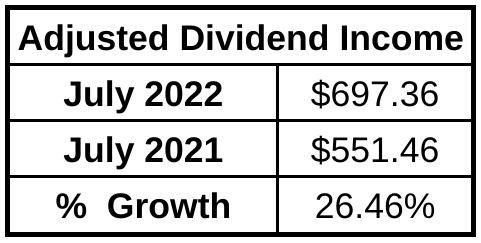

For the sake of a true apples-to-apples comparison, let’s remove the special dividend from last year’s July dividend income total. Once it was removed, our dividend income summary paints a much different picture. Our Adjusted Dividend Income growth rate is actually 26.46% compared to last year.

Author

July 2022 Individual Dividend Stock Payments

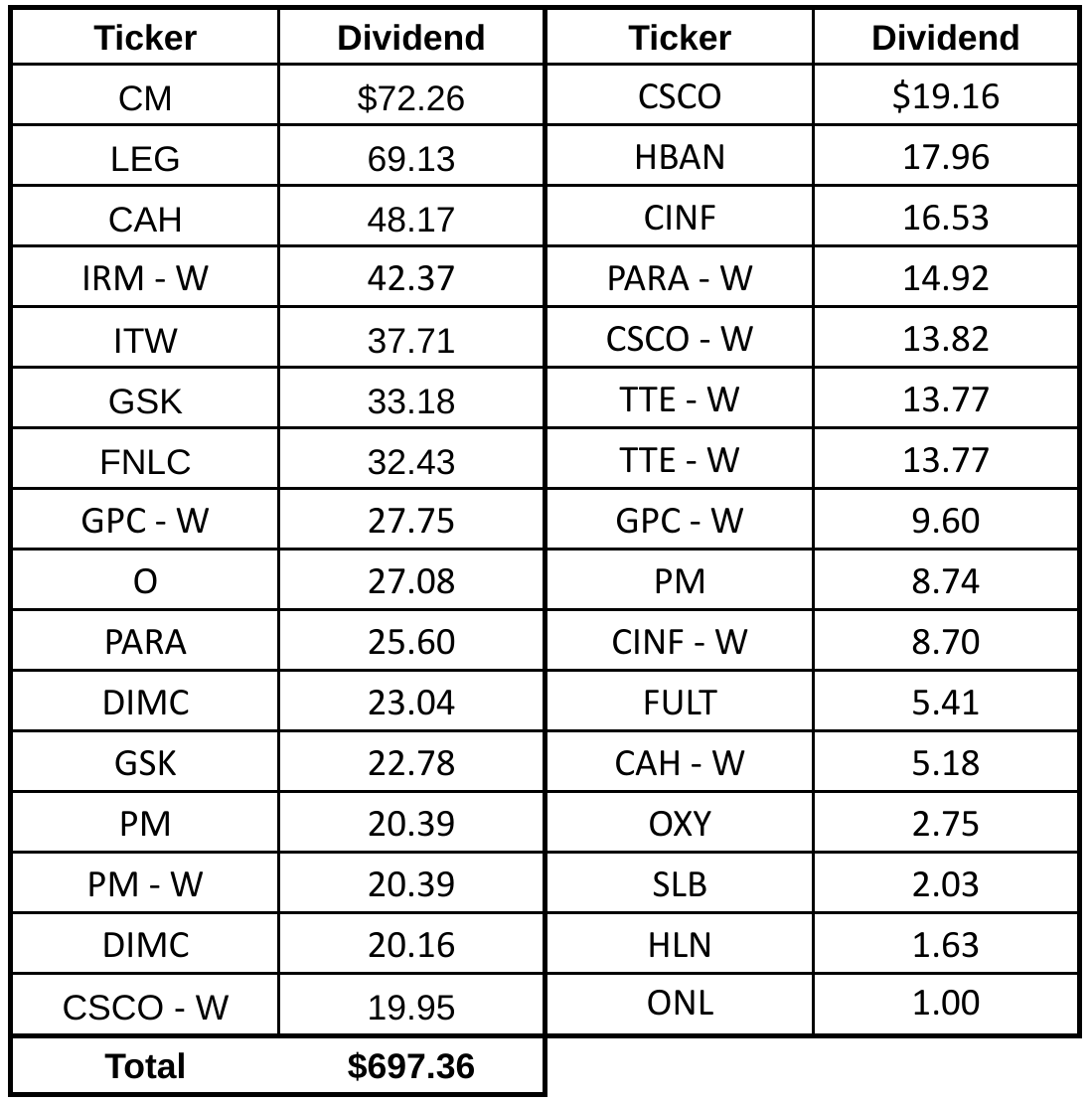

The devil is in the details, as always. This section will show the individual dividend payments my wife and I received during the month. What was the catalyst for the 26% adjusted dividend growth rate? Let’s find out. The following table details the dividend income payments received.

Author

The largest dividend payments were from positions that were established a long time ago. 9 out of our Top 10 largest dividend payments were purchased several years ago. Canadian Imperial (CM) takes the crown for the largest dividend payment of the month. The Canadian Banks are just the best….right?!

The true dividend growth compared to last year can be found in new positions and additions to current positions that occurred over the last 12 months. In particular, banks really flexed their muscles. The First Bancorp (FNLC) and Huntington Bank (HBAN) added $50 in new dividend income compared to last year. Fulton Bank (FULT) added another $5 of new dividend income. That’s over $55 from the three banks alone!

This month continues to show me the power of pushing hard and investing every dollar we can. When a sector shows signs of undervaluation, such as banking, don’t be afraid to deploy capital when you find investments that meet your criteria.

One other thing to note. My wife has Total (TTE) in two separate accounts. Both produce the exact same dividend payment. That’s why you see it twice on the chart. That wasn’t an oversight!

Summary

We are cruising through 2022 and another solid month in the books. July’s dividend income total was another step in the right direction. I’m happy that we have continued to invest in stocks that pay a dividend in an “off month.” We need to make sure that we are building a solid dividend income stream in all 12 months, not just the final month of the quarter. We still have some work to do, of course; however, earning $700 this month is one heck of a start.

Now, the fun really begins. How do we build on our successes in the second half of the year?! How do we post an even strong growth rate next month? It’s up to us to find quality dividend stocks that will continue to grow our dividend income.

How did you perform in July? Did you have a solid month? What was your largest dividend-paying stock? Have you been purchasing bank stocks lately?

Bert

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment