Hispanolistic

A Quick Take On monday.com

monday.com Ltd. (NASDAQ:MNDY) went public in June 2021, raising approximately $574 million in gross proceeds from an IPO that was priced at $155.00 per share.

The firm provides low/no-code software as a service (“SaaS”) software solutions to organizations worldwide.

MNDY faces uncertainties, as it appears the U.S. economy is nearing or already in a recession, which may have the effect of slowing its sales cycles.

Given macroeconomic risks and a stock that appears more richly valued than its peers despite increasing operating losses, I’m on Hold for MNDY for the near term.

monday.com Overview

Tel Aviv-Yafo, Israel-based monday.com was founded to develop what it calls its Work OS platform to enable organizations to more easily create software solutions from the firm’s low/no-code software building blocks.

Management is headed by co-founder and co-CEO Roy Mann, who was previously senior technology leader at Wix.com.

Co-founder and Co-CEO Eran Zinman was previously the R&D Manager at the founding team of Conduit Mobile.

The company’s primary offerings include:

-

Boards

-

Integrations

-

Forms

-

Workspaces

-

Automations

-

Views

-

Dashboards

- Projects, Dev, Marketer, Sales CRM

The firm acquires most new customers via its self-serve online portal and through direct sale efforts.

For larger firms, it uses customer support service personnel as needed to provide additional customer service capabilities.

MNDY’s Market & Competition

According to a market research report by MarketsandMarkets, the global market for low-code software was an estimated $13.2 billion in 2020 and is expected to reach $45.5 billion in 2025.

This represents a forecasted very strong CAGR of 28.1% from 2021 to 2025.

The main drivers for this expected growth are a growing demand by companies of all sizes for digitizing operations and a continued maturation of agile DevOps practices.

Also, the North American region is expected to account for the largest market share through 2025 and will likely continue to retain the largest companies serving the industry.

Major competitive or other industry participants include:

-

Asana

-

Wrike

-

SmartSheet

-

Notion

-

Citrix Systems

-

Zendesk

-

Freshworks

-

SugarCRM

-

Pipedrive

-

Zoho

-

Atlassian

-

Procore Technologies

-

Workday

-

BambooHR

-

Hootsuite Media

-

Adobe Experience Cloud

MNDY’s Recent Financial Performance

-

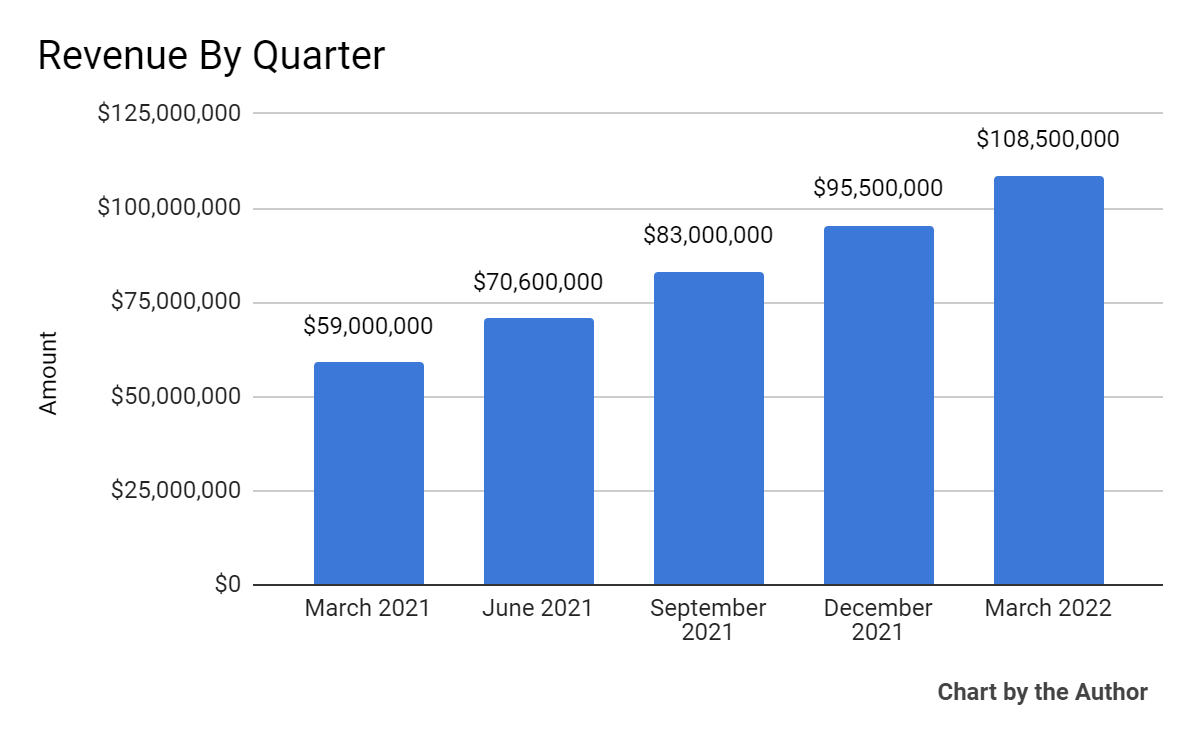

Total revenue by quarter has steadily over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

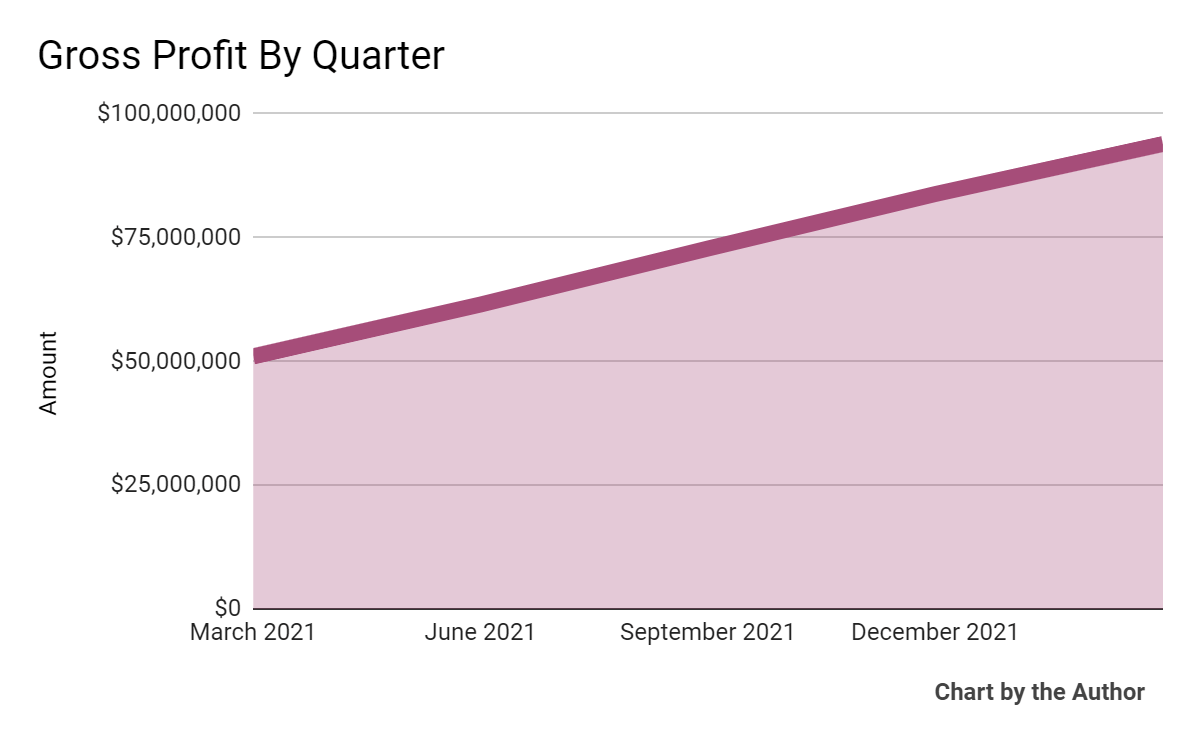

Gross profit by quarter has followed a similar trajectory as that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

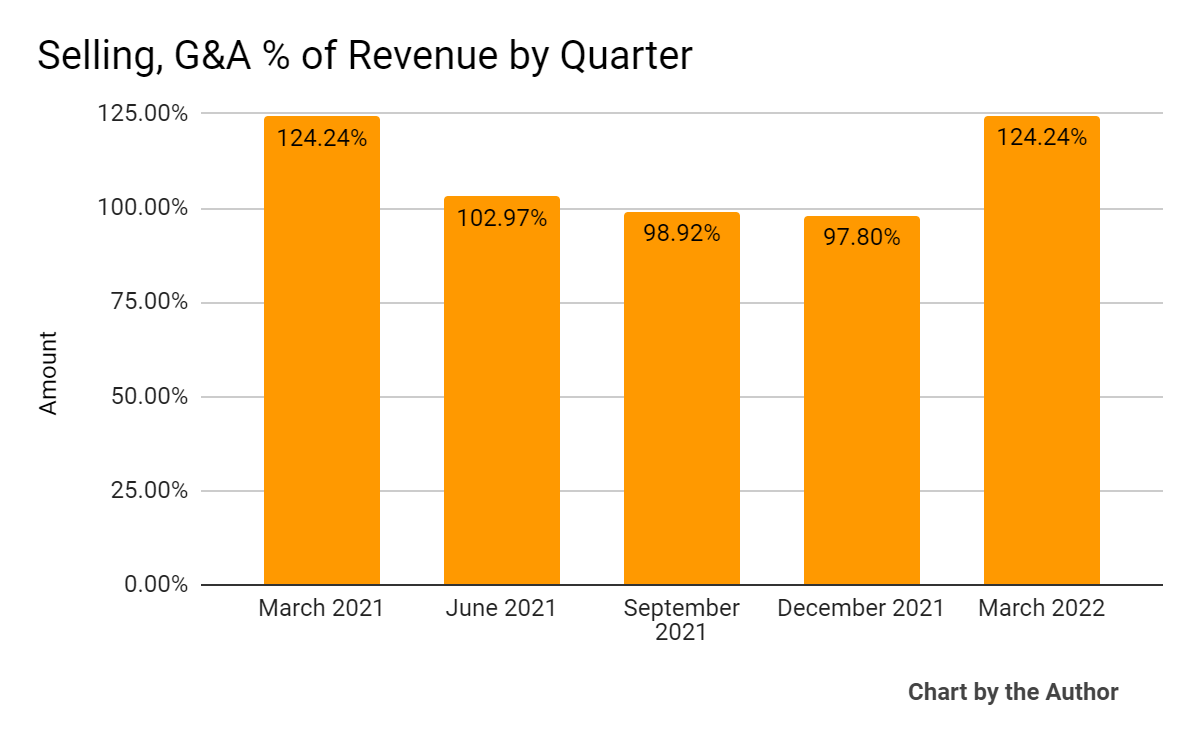

Selling, G&A expenses as a percentage of total revenue by quarter have risen markedly in Q1 2022:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

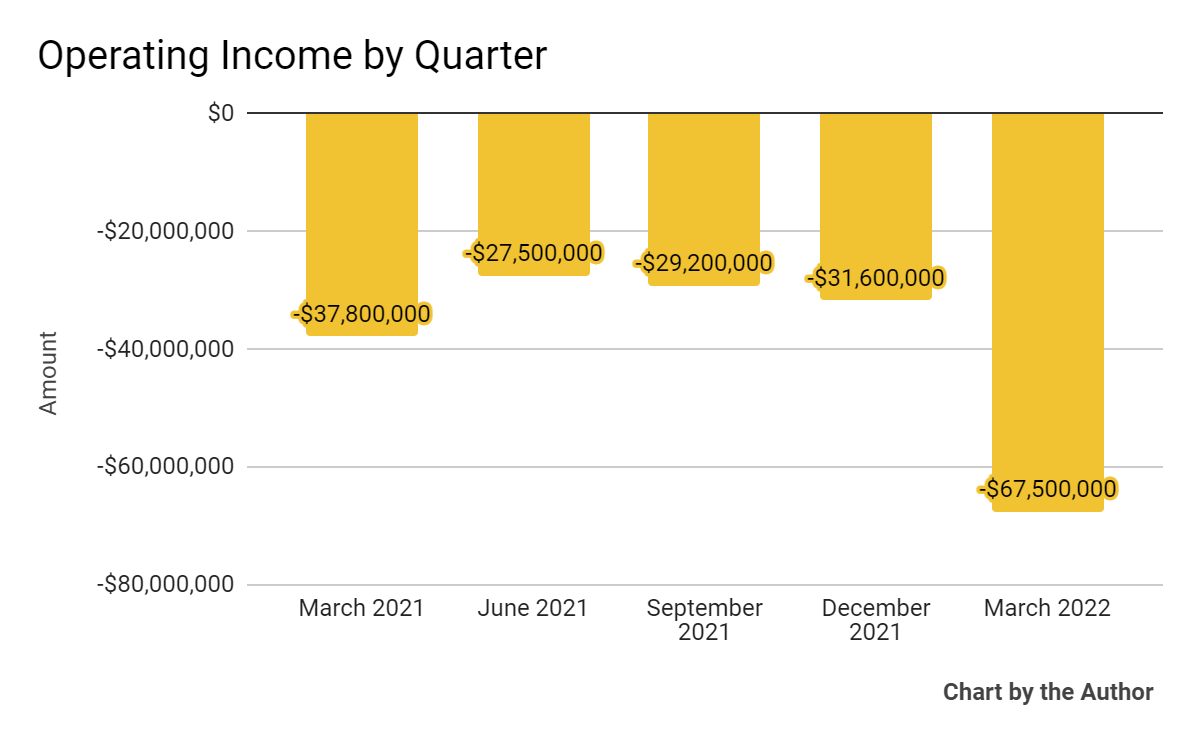

Operating losses by quarter have remained material and worsened in Q1 2022:

5 Quarter Operating Income (Seeking Alpha)

-

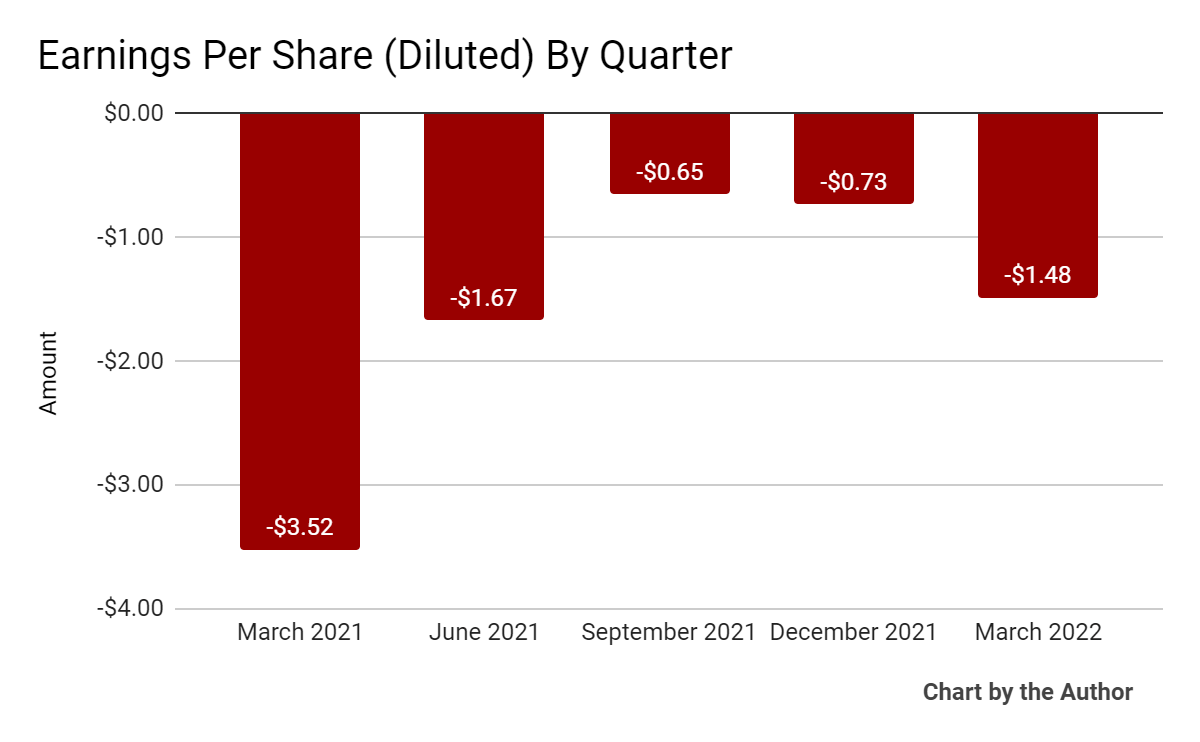

Earnings per share (Diluted) have followed roughly the same trajectory as operating losses:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

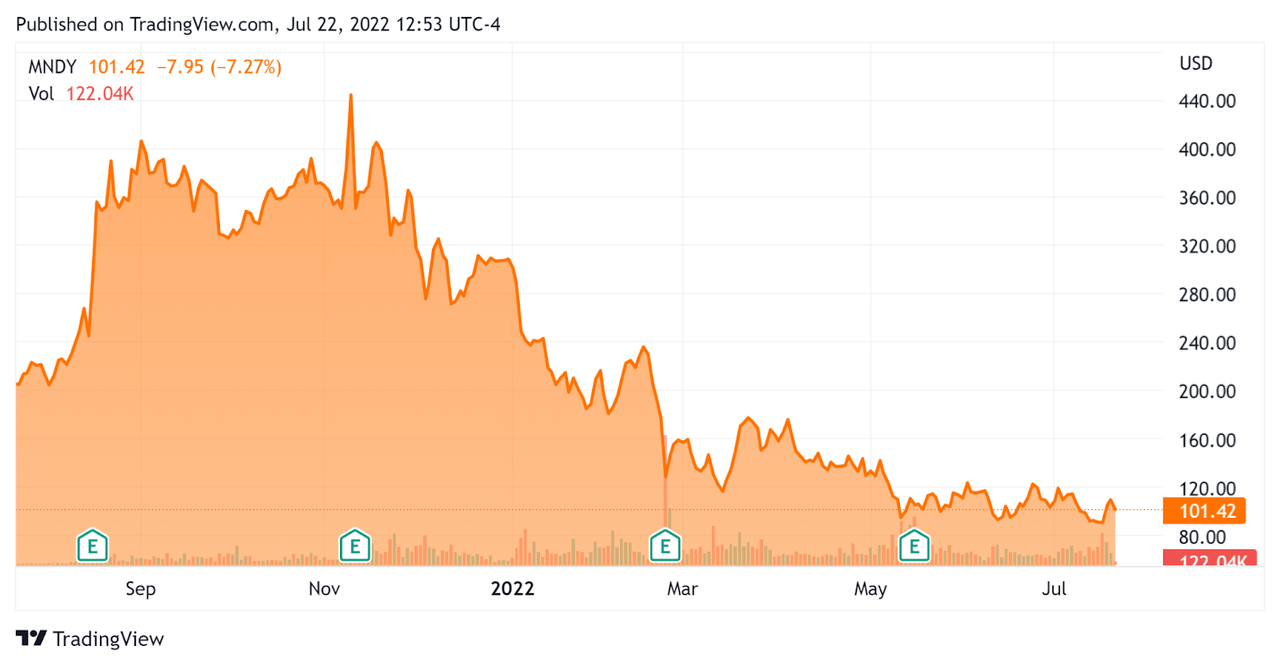

In the past 12 months, MNDY’s stock price has dropped 51.1 percent vs. the U.S. S&P 500 index’s fall of around 9.1 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For MNDY

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Enterprise Value |

$4,140,000,000 |

|

Market Capitalization |

$4,930,000,000 |

|

Enterprise Value/Sales (TTM) |

11.58 |

|

Price/Sales (TTM) |

11.77 |

|

Revenue Growth Rate (TTM) |

90.08% |

|

Operating Cash Flow (TTM) |

$4,040,000 |

|

CapEx Ratio (Op C.F./CapEx) |

-0.41 |

|

Earnings Per Share (Fully Diluted) |

-$4.53 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Atlassian (TEAM); shown below is a comparison of their primary valuation metrics:

|

Metric |

Atlassian |

monday.com |

Variance |

|

Enterprise Value/Sales (TTM) |

20.98 |

11.58 |

-44.8% |

|

Price/Sales (TTM) |

20.78 |

11.77 |

-43.4% |

|

Operating Cash Flow (TTM) |

$837,470,000 |

$4,040,000 |

-99.5% |

|

Revenue Growth Rate |

32.8% |

90.1% |

174.8% |

(Source – Seeking Alpha)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

MNDY’s most recent GAAP Rule of 40 calculation was 47% as of Q1 2022, so the firm has performed well in this regard, per the table below:

|

GAAP Rule of 40 |

Calculation |

|

Recent Rev. Growth % |

90% |

|

GAAP EBITDA % |

-43% |

|

Total |

47% |

(Source – Seeking Alpha)

Commentary On monday.com

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted its investments in security, governance and compliance offerings to enterprises.

In its desire to “move up market,” the firm is also focusing greater effort on enterprise customers with greater than $50,000 ARR (Annual Recurring Revenue), with these customers now accounting for 22% of its total ARR.

Notably, in Q1, the net dollar retention rate of these high ARR customers was over 150%, an impressive achievement indicating strong product market fit and an efficient upselling/cross-selling process.

Overall, its net dollar retention rate was ‘over 125%,’ a strong result for all customer types.

The company also launched its new Work OS product suite: monday projects, monday dev, monday marketer, and monday sales CRM.

As to its financial results, MNDY hit a milestone with revenue exceeding $100 million for the first time.

On the expense side, sales and marketing expenses rose to 100% of revenue as the company increased the pace of sales rep hiring and spent $11 million on Super Bowl advertising. G&A expenses were more or less flat.

For the balance sheet, the company ended Q1 with around $850 million in cash and equivalents while it used $16.2 million in adjusted free cash use.

Looking ahead to the full fiscal year 2022, management expects revenue to be $490 million at the midpoint of the range, or a 59% growth rate. non-GAAP operating losses are expected to be $137 million as management says it will “continue to invest in growth with a strong focus on driving business efficiency.”

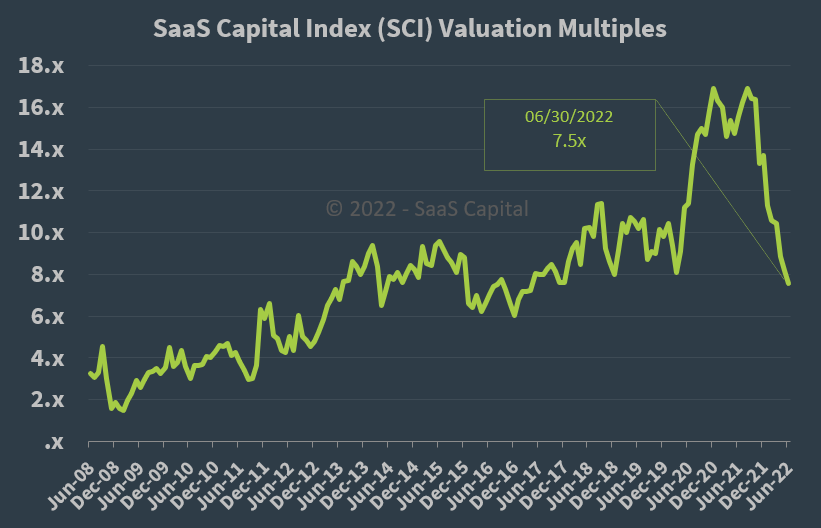

Regarding valuation, the market is valuing MNDY at an EV/Sales multiple of around 11.6x.

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.5x at June 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, MNDY is currently valued by the market at a premium to the SaaS Capital Index, at least as of June 30, 2022.

The primary risk to the company’s outlook would be a U.S. recession which would reduce customer demand for or slow its sales cycles for its offerings.

A potential upside catalyst to the stock could include a reduction in interest rate expectations, which may have the effect of increasing its valuation multiple.

However, the firm faces uncertainties as it appears the U.S. economy is flirting with or already in a recession.

Given these macroeconomic risks and a stock that appears more richly valued than its peers despite increasing operating losses, I’m on Hold for MNDY for the near term.

Be the first to comment