Travel Faery/iStock Editorial via Getty Images

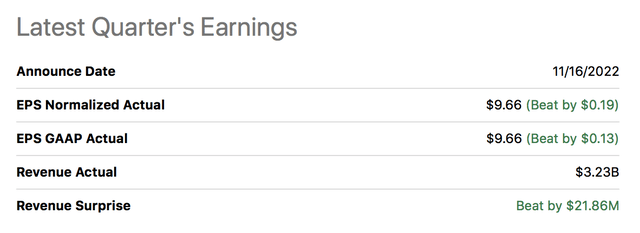

ZIM Integrated Shipping (NYSE:ZIM) reported its third-quarter financial results earlier this week, unveiling a welcome surprise to investors by beating estimates. There’s a debacle about whether ZIM will falter amid rising systemic risk. In addition, many investors are wary of the stock’s illustrious dividend profile and question its sustainability. In today’s article, we uncover key talking points about ZIM Integrated Shipping and discuss investors’ horizons as a key decision-making variable.

Earnings Review

Operating Results

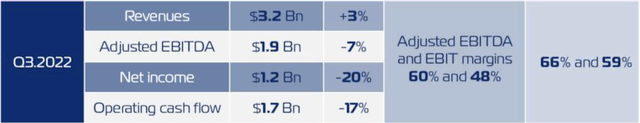

Unlike Golden Ocean (GOGL), ZIM Integrated Shipping experienced year-over-year growth with a 3.2% increase in top-line revenue. The company’s embedded growth remains on track, with its average TEU rate increasing 4% year-over-year, with cumulative rate increases since the turn of the year reaching 43%. Despite ex-post rate increases, ZIM’s carrier volume dipped by 5% compared to Q3 2021 due to port congestion and receding consumer demand.

ZIM’s fleet size has stayed the same since its last report, with its vessel count currently at 149. The company’s average remaining duration of current capacity is at 27.4 months, and 37 of its vessels are up for renewal in 2024.

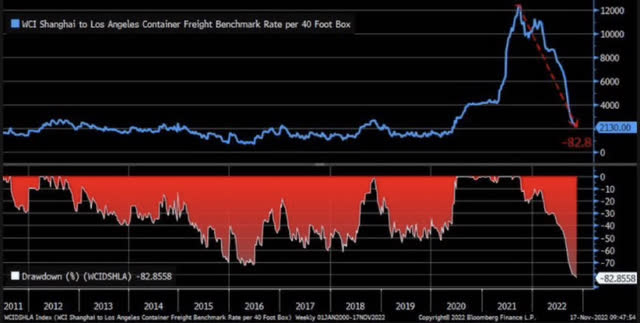

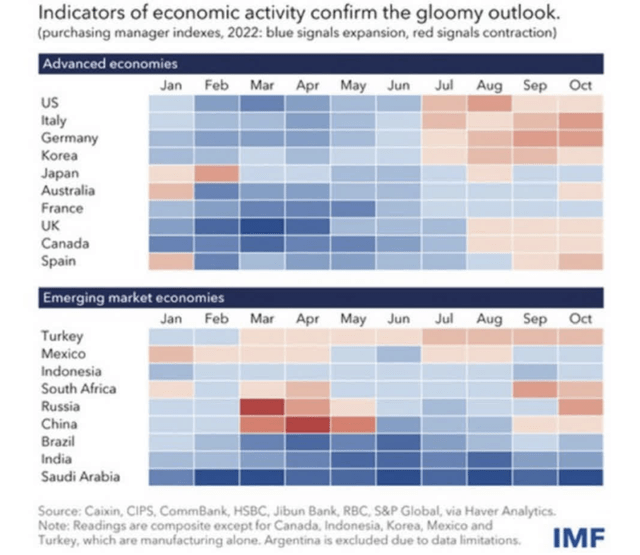

Broadly speaking, shipping rates are declining. We believe rates are declining due to demand destruction caused by the unsure economy. For example, the port of Los Angeles has experienced a 25% drop in container activity since October last year. In addition, the International Monetary Fund recently reported slowing economic growth, which could be a key reason behind tapered shipping rates.

Despite producing year-over-year growth, we believe it’s only a matter of time before ZIM starts feeling systemic heat.

Bloomberg Terminal; Market Radar

The diagram below reiterates the state of today’s economy. Slowing purchasing power will likely influence global trade, damaging demand for ship operators. The economy is a cyclical vehicle, and it won’t surprise us if the shipping industry experiences a sharp drop in the coming quarters.

Global Economic Activity Heatmap (IMF)

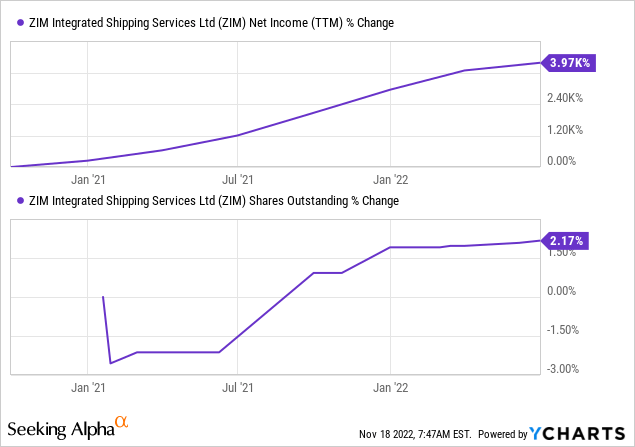

Accounting Metrics

Before delving into ZIM’s accounting metrics, let’s consider a few line items. The company’s adjusted EBITDA fell 7% year-over-year, and its net income was compressed by 20%. We believe inflation will remain resilient, leaving ZIM’s income statement under pressure.

Furthermore, the company’s operating cash flow slumped by 17% year-over-year, reflecting an apparent slowdown in the company’s core operations. Many believe revenue represents a firm’s growth; however, cash flow presents a better viewpoint as it isn’t recorded on an accrual basis. In addition, observing operating cash flow is the most critical as it phases out any non-organic cash inflows.

Based on our observation, ZIM’s core cash inflows are in decline.

Seeking Alpha; ZIM Integrated Shipping

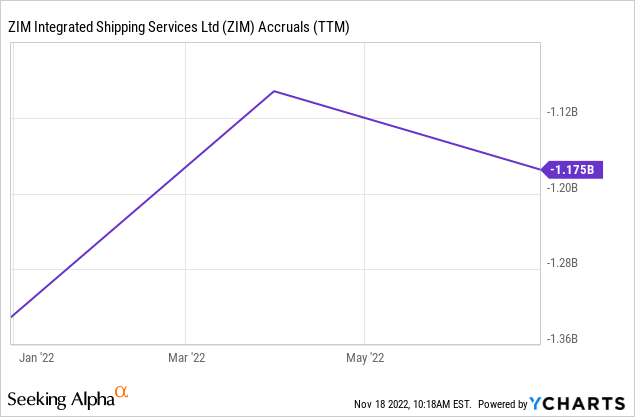

A point of concern for us is ZIM’s Beneish M-score, which sits at -0.93. As a rule of thumb, the Beneish M-score should be below -1.78 to conclude that a company is an unlikely earnings manipulator. ZIM’s elevated M-score implies that it could be recognizing certain income statement items prematurely, leaving investors in danger of facing a backdrop in following earnings reports.

Despite its unfavorable M-score, ZIM doesn’t have positive accruals, meaning its cash from operations and investing remains above its net income, indicating that its organic cash movements are higher than its accrual-based earnings (which is a good thing).

Investment Horizon

Assessing ZIM’s prospects requires an investor to determine his/her investment horizon. Some investors prefer buying and holding, some shift portfolio weights, and some execute short-term trades. Thus, a cyclical stock such as ZIM will yield different results for various categories of investors.

Let’s discuss the elephant in the room: ZIM’s illustrious dividend yield. The firm’s humongous dividend yield displayed at 105.98% is a policy-driven payout. The company re-distributed 10% in special dividends after its second quarter due to superior performance. However, ZIM’s general policy is to distribute 30% of its net income to investors.

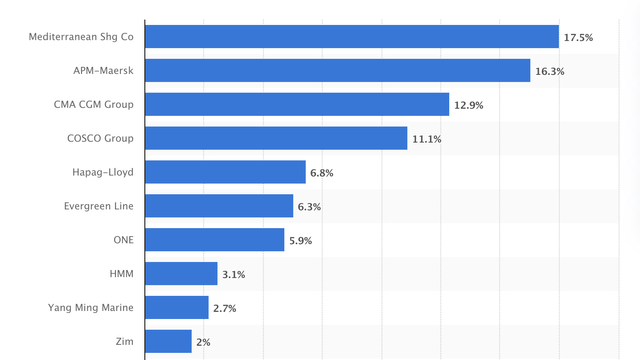

Although ZIM is a mature company, its stock hasn’t been publicly listed for a long time; thus, it’s difficult to understand the company’s dividend pattern. However, reverting to our previously discussed top-down approach, it’s evident that this firm and other shipping companies are severely exposed to economic cycles. In addition, it’s worth mentioning that shipping rates were likely unrealistic during the pandemic, and ZIM’s presence in a “high barriers to entry” industry allowed it to take full advantage. Thus, basic economics 101 tells us that ZIM’s current level of net income is likely unsustainable, and income statement compression could force the firm to tap into investor resources to sustain the company.

Ship Operator Market Share October 2022 (Statista)

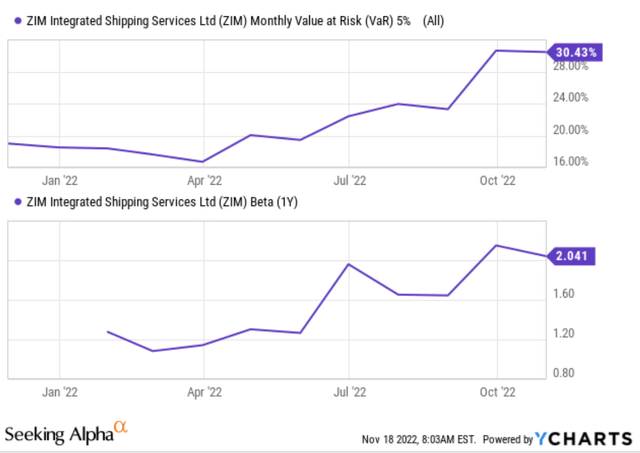

Now, back to the central argument, which is your investment horizon. ZIM is set to pay a quarterly dividend worth $2.95 per share on December 7, with a shareholder of record date set at November 29. If you’re investing now, assuming the stock price remains static, you could lock in an income return of above 11% (from dividends). Considering the stock’s 5% Monthly VAR of 30.43% and its beta sensitivity (sensitivity to the broader stock market) of 2.041, I’d say it’s a plausible tactical play.

Assuming a longer-term vantage point, you’d likely be more exposed to dividend destruction and price risk than short-term investors. Again, this draws back to the macroeconomic argument I tabled earlier on.

To ZIM’s defense, the stock possesses impressive price multiples with its price-to-earnings and price-to-book ratios at 0.52x and 0.59x, respectively. Investors could see the asset as a bargain buy; however, we argue that cyclicality will upend the stock’s valuation metrics, causing a possible value trap.

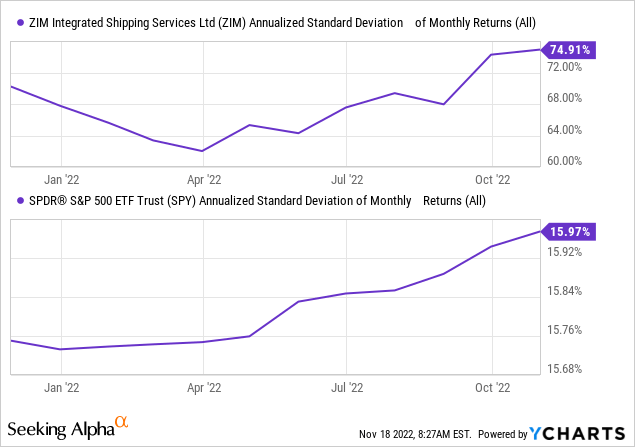

Furthermore, ZIM’s annualized standard deviation is exceptionally high. Therefore, investors must ask themselves whether the stock’s dividend benefits are adequate to phase out price risk.

ZIM’s prospects depend on an investor’s horizon. The stock’s dividend yield makes up for short-term price risk. However, longer-term price risks and dividend cyclicality could be unfavorable.

Concluding Thoughts

Despite experiencing solid year-over-year revenue growth, ZIM integrated resources could be faced with demand destruction, in turn causing its recent progress to stagnate. Moreover, the company’s top-line income and cash flow statements are polarized, presenting concerns.

From an investment vantage point, holding a position in ZIM depends on your horizon. Long-term prospects seem doubtful, but short-term allocation could yield significant benefits. The stock is undervalued; however, keep cyclicality in mind.

Considering a quarterly horizon, we assign a hold rating to ZIM and will revisit our stance thereafter.

Be the first to comment