WillSelarep/E+ via Getty Images

Investment Thesis

Since I last recommended Molina Healthcare (NYSE:MOH) to Seeking Alpha readers as an investment opportunity in July 2020, the Long Beach, California based company’s share price has barely stopped growing – at the time of writing, current price of $355 means the stock is up >90% since my note.

With ~5.1m members, Molina has a ~2% share of the US healthcare market. The company is looking up at the likes of CVS Health Corp. (CVS), which has a ~5% share, Health Care Services Corporation, ~6%, Humana (HUM), ~7%, Centene Corp. (CNC), ~10%, Elevance (ELV), ~11%, and UnitedHealth (UNH), the largest of all, with a ~12% share of the market according to Statista.

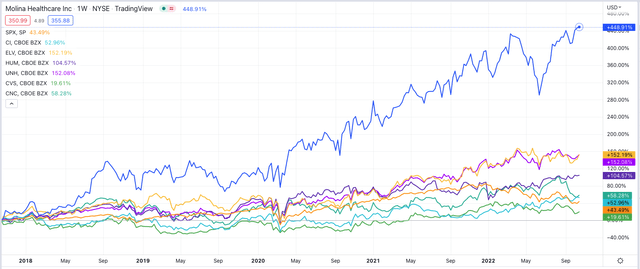

Share price performance of selected listed US health insurers – past 5 years. (TradingView)

Source: TradingView.

As we can see above, Molina’s stock price performance has been in a different class to the rest of the sector – not that the industry as a whole has been performing badly. Out of my selection above, only CVS stock has failed to outperform the S&P 500 – and that is likely more due to the performance of its pharmacy division than its managed healthcare division.

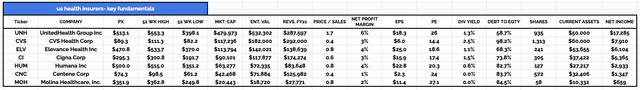

Investment fundamentals of selected health insurers. (Google Finance / TradingView)

Source: TradingView / Google Finance.

Above, we can see that Molina’s revenue generation, net income, and net profit margins are paltry compared to some of the major market incumbents, although this is reflected in a market cap valuation that is 2x less than Centene, 3x less than Humana, 4.5x less than Cigna (CI), and not in the same league as the giants Elevance, CVS and UnitedHealth.

To me, that suggests that despite its phenomenal recent valuation growth, there is plenty more ground for Molina to make up on the incumbents, implying that shares are still some way off reaching their peak.

One caveat is that Molina – unlike all of the others above bar Centene – does not pay a dividend, so there is less protection in place should the share price falter, as happened in June this year, for example, when it fell to $250, having traded >$350 in mid-April. Despite this dip, however, Molina shares have gained >20% across the past 12 months – only Cigna stock (+38%) has performed better.

Unlike the Big Pharma sector, however – where the average dividend yield is >3% per annum, making buying their stock not dissimilar to buying a fixed income security – health insurer’s dividend payouts are lower – the average yield is currently <1.5%.

Bearing all of this in mind, on the face of it Molina Healthcare stock looks to be a strong buy and hold opportunity. There will be bumps along the road – health insurance stocks can be highly sensitive to adverse news-flow or market conditions – but generally speaking, the sector has been buoyant while the S&P has been sinking by 18% over the past 12 months.

In the remainder of this post I will delve a little deeper into Molina, its members, business model, and plans for the long term.

Molina Healthcare’s Recent Performance

Molina plans to announce its Q322 earnings on 26th October. In H122, the company generated $15.8bn total revenues, net income of $554m on an adjusted basis, and EPS of $9.45. It is guiding for FY22 premium revenue of $30bn – a double digit percentage year-on-year uplift – and earnings per share (“EPS”) of $17.60. Both figures were raised when Q222 results were released in late July. If targets are met, the forward price to earnings (“PE”) ratio would be ~20x – about average for the sector.

The medical care ratio (“MCR”) – a key measure of performance for healthcare insurers, being medical costs as a percentage of premium revenues, was 88% overall. Across Molina’s three divisions – Medicaid, Medicare, and Marketplace, the ratios were 88%, 86.9%, and 91.2% respectively. Management has commented that the MCR in Medicaid and Medicare was below its long term target range.

Although Molina may not pay a dividend, the company says it spent $200m repurchasing 658k shares in Q2’22, as a result of harvesting “$165 million of subsidiary dividends in the quarter”, Chief Financial Officer Mark Keim told analysts on the Q2’22 earnings call.

Business Model

According to its 2021 10-K submission, “Molina was founded in 1980 as a provider organization serving low-income families in Southern California. The company was family run until 2017, when the Board of Directors replaced founder David Molina’s two sons, Mario and John, with former Aetna CFO Joseph Zubretsky. Zubretsky remains at the helm.

Molina has traditionally focused on lower income patients and its Medicaid division is by far its largest, accounting for 4.33m members as FY21, with Medicare accounting for 142k members, and marketplace 728k members.

Quoting from Molina’s 10K once again:

Medicaid is a state-operated and state-implemented program. Subject to federal laws and regulations, states have significant flexibility to structure their own programs in terms of eligibility, benefits, delivery of services, and provider payments. As a result, there are 56 separate Medicaid programs—one for each U.S. state, each U.S. territory, and the District of Columbia.

The federal government guarantees matching funds to states for qualifying Medicaid expenditures based on each state’s federal medical assistance percentage (“FMAP”). A state’s FMAP is calculated annually and varies inversely with average personal income in the state. The approximate average FMAP across all jurisdictions is currently 66%, and currently ranges from a federally established FMAP floor of 56% to as high as 85%.

In May this year, Molina stock began to slip as the company received a double downgrade from Bank of America as analysts suggested, “The industry is going to have to manage through rapidly declining Medicaid membership, as well as the expiration of the expanded Affordable Care Act subsidies”, which they predicted would squeeze Molina’s already tight margins beyond breaking point and put its core business under pressure.

Whilst its true however that Medicare Advantage (“MA”) is generally seen as the health insurance space to operate in, as more and more seniors opt for its greater flexibility, whilst insurers find it easier to drive higher margins, this sector has itself been rocked by increasing competition.

As I wrote in January this year, Humana – which has the second largest Medicare Advantage membership after UnitedHealth – saw its stock price collapse after slashing its new member forecast for 2022 from ~350k, to ~175k, based on increasing and unsustainable (in CEO Bruce Broussard’s opinion) competition on price.

With newly IPO’d companies such as Oscar Health (OSCR), Bright Health Group (BHG), and Alignment Healthcare (ALHC) all hoping to take MA members away from the incumbents, this space is becoming less attractive. These three companies shares prices have fallen respectively by 86%, 94%, and 33% since their big money IPOs.

Meanwhile, Molina’s Medicaid business appears to be thriving, not shrinking , with the company announcing new contract wins in Mississippi, Iowa, Nebraska, and apparently, California, for a 5-year period from 2024, administering Medi-Cal, a Medicaid solution for low-income individuals. Earlier this month, analysts at JP Morgan gave Molina an “Overweight” rating and a price target of $360, which the company has nearly met already, fuelled by these contract wins.

Looking Ahead

According to a 2021 investor day presentation, Molina is targeting total revenues of $42bn in FY25, which translates to a compound annual growth rate (“CAGR”) of 14% and will be driven by its current footprint contributing an additional ~$4bn per annum, strategic initiatives driving ~$5bn, and acquisitions driving ~$5bn. Molina is an acquisition hungry company, as CEO Zubretsky discussed on the Q222 earnings call:

We have now announced seven acquisitions since we embarked on our growth strategy. The five already closed are achieving or exceeding their earnings accretion target. Given our track record and a pipeline replete with actionable and strategically focused acquisition opportunities, we are confident in our ability to continue to execute on this important dimension of our growth strategy.

Molina is targeting long-term EPS growth of 15-18%, without straying too far from its core business, believing it can generate an 8-10% organic growth rate in Medicaid, and 11-13% in Medicare. The company was able to share some initial guidance for 2023 on its Q2’22 earnings call. Double digit percentage revenue growth is expected, for the second year running, partially enabled by the renewal of a deal with CVS Caremark to act as its Pharmacy Benefits Manager – CEO Zubretsky commented:

The CVS Caremark relationship has been essential to our delivery of excellent pharmacy service to our customers and members and has enabled strong cost control. We are very pleased to have extended this relationship.

Molina has also taken the unusual, and hopefully progressive step of switching to a fully remote-working environment – resulting in the company reducing its real estate footprint by “approximately two thirds, yielding substantial and sustainable G&A savings” according to Zubretsky.

All of this has enabled Molina to forecast for EPS of ~$20 in 2023, shrinking the forward PE ratio to <18x.

Conclusion – Molina’s Growth Spurt Is Likely To Continue – MOH Shares Remain Attractive

Molina has made a success out of focusing on providing more traditional types of Medicaid to lower-income patients and their families. This approach has enabled Molina to grow rapidly – from driving premium revenues of $5.5bn in 2012, to an expected $30bn this year.

The good news is that Molina does not appear to have reached its ceiling – in fact, its greatest period of growth may still be ahead. Besides the core businesses, in which Molina apparently excels, five acquisitions since 2019 have resulted in ~$8bn of additional run-rate revenue, management claims, and investors should expect the M&A activity to continue – and perhaps even get a little more ambitious, given Molina has >$10bn cash at its disposal.

There is strong demand for all three of the services Molina provides – Medicaid, Medicare, and Marketplace – and recent wins suggest the company’s ability to compete for and win more contracts is strong, whilst other health insurers begin to struggle. Thanks to its entrenched position in the low income market, and decade of expertise, it will be difficult for new market entrants to take market share away from Molina.

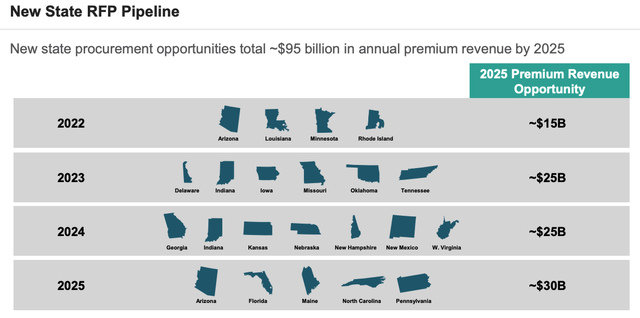

RFP Pipeline (investor day presentation)

A quick glance at the above slide from last year’s investor presentation provides a lot of encouragement that, provided its experienced management team continues to execute well, there are tens of billions of near-term revenue opportunities to realise, and we should also consider the fact that Medicaid enrolment typically rises during economic downturns – such as that we are currently in the midst of.

Of course there are some risks to consider. Molina’s tight margins, the lack of a dividend, the sensitivity of health insurers’s stock prices, and a step into the unknown with a move to fully remote working constitute weak points in the overall investment thesis, potentially.

On balance however, as I hope I have shown in this post, the opportunities outweigh the threats, and personally I am expecting Molina’s share price to keep rising.

Be the first to comment