Maddie Meyer

Moderna is a return on invested capital monster

In one of my previous articles regarding September‘s large-cap Magic Formula scores, I noted a couple of companies with ROIC scores outside normal upper limits. The two companies were Moderna (NASDAQ:MRNA) and Hewlett-Packard (HPQ). Being that ROIC is a non-GAAP item, I wanted to personally drill down further and investigate the actual return on invested capital for both companies. According to my brokerage, both were clocking ROICs of over 100%. As taught in Joel Greenblatt’s Little Book That Beats the Market, return on assets, or ROA can be used as a proxy. For both stocks I deferred to ROA which immediately lowered the total scores of the two stocks. To go a step further, I pulled out the handy excel sheet to attempt to calculate the actual mrq ROIC for both.

My findings were that HP’s ROIC number mrq was down to around 20%, a tad lower than ROA. However, Moderna remained high with 75% ROA. My thesis is Moderna is an outstandingly priced stock based on past earnings and ROIC, but a hold in this case until we see more product diversification. If they can maintain and even grow what they have in front of them, this could be one of the best deals in the market.

Magic formula deep dive

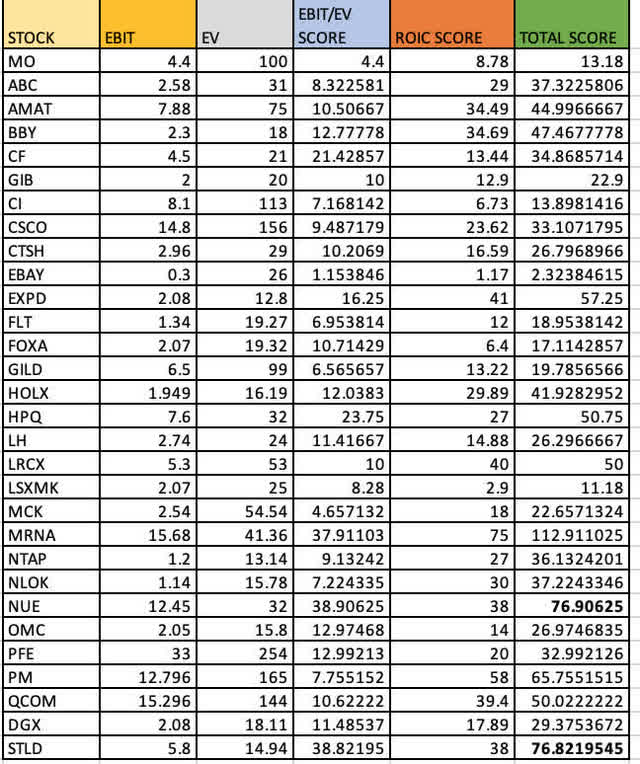

Below is an excel sheet I put together at the end of September covering the actual Magic Formula scores for large-cap stocks. Anyone not familiar with Magic Formula Investing can sign up for a free account to access Joel Greenblatt’s proprietary screener. The screener is based on Joel Greenblatt’s Little Book That Beats the Market, this is a value investing classic that gives insight into how he was able to consistently achieve 50% returns, albeit with a smaller fund. His original strategy was based on concentration. He later developed a method that would rank stocks according to both “cheap and good” metrics. His computer back-tested this diversified model across many periods and found that this more diversified method could achieve similar results to the concentrated one.

One part of the equation is a score for ROIC. An ROIC of 30% for example would be a score of 30. The other was earnings yield, an earnings yield of 10% would be a score of 10. In the excel sheet, we use EBIT/EV to score the earnings yield of the constituents. The Magic Formula site does not provide scores, just a list of stocks above a set market cap. Scoring the stocks on your own is a worthwhile endeavor:

Magic Formula Scores (Excel sheet, data from Merrill Lynch and Yahoo finance)

The conclusion was that Nucor (NUE) had the highest score amongst large caps at the current based on numbers not outside the norm. Moderna was the highest score overall and not in an industry with cyclicality. This was very interesting to me. My brokerage was picking up numbers for ROIC well above 100% and 75+% ROA. I imagine the Magic Formula screener was picking up similar data, so I felt I needed to investigate further before crowning them the winner.

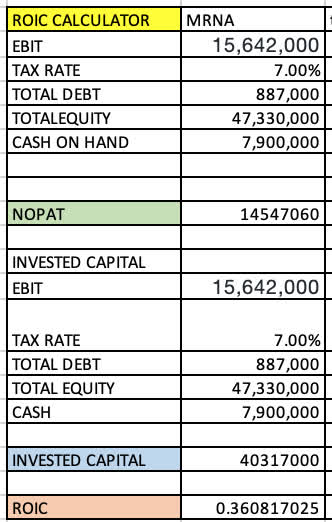

Moderna’s ROIC drill down with NOPAT

ROIC is a non-GAAP measure according to the securities and exchange commission. There will be some variations of the metric that pick up different items by different software. This leads to ROIC being one of the most variable statistics you will see on your brokerage or other financial software that provides data on this. For this exercise, we use EBIT X (1-tax rate) to get an idea of net operating profit after tax or NOPAT. After which we get the total invested capital of Debt + Equity – Cash. Finally divide NOPAT by invested capital.

Moderna ROIC (excel sheet, data from Seeking Alpha)

The data used from seeking alpha were TTM by quarter in an attempt to drill down the most recent situation. In this scenario, Moderna is achieving an amazing 36% ROIC with a 7% tax rate from 2021, the tax rate is very liberal. What the final tax rate in 2022 will be is hard to say. Nonetheless, 36% ROIC on non-cyclical, non-software/tech-related products is a feat.

ROIC outlook

The main components of the quick ROIC calculation have EBIT, tax rate, and capital employed as the main variables. Decreases in EBIT, increases in taxes, and or increases in debt without a high return on that capital reflected in EBIT will all affect the metric. Share count increases in equity raises that do not achieve a higher than the current return on capital would also have a negative effect. Here is the shares issued/bought back, and debt trends for Moderna:

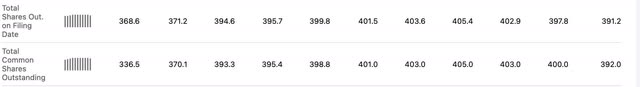

MRNA Share Count (seeking alpha)

Above is Moderna’s share count by quarter starting in Dec 2019 on the left.

We can observe the share count decreasing from a high of 405 million shares in September 2021, decreasing to 392 million shares as of June 2022. Positive management of share buybacks at lower prices by Moderna management. This is a capital-employed reduction trend which will help to increase ROIC if EBIT remains stable or increases.

MRNA total debt (seeking alpha)

Above is Moderna’s total debt by quarter starting in Dec 2019 on the left. Moderna’s total debt has been reduced from a high in 2021 of $1.08 Billion down to only $805 million at current. Again, a reduction of capital employed through debt paydown will have a positive effect on ROIC if EBIT and tax rates remain stable.

The product

Most everyone is familiar with Moderna’s chief product, the mRNA Covid-19 vaccine. The company specializes in products that utilize messenger RNA to help program ribosomes to produce a protein which in turn creates an immune response from the human body. The process described in their most recent 10-K is as follows:

When a cell needs to produce a protein, the instructions to make that protein are copied from the DNA to mRNA, which serves as the template for protein production. Each mRNA molecule contains the instructions to produce a specific protein with a distinct function in the body. mRNA transmits those instructions to cellular machinery, called ribosomes, that make copies of the required protein.

Furthermore:

Commercial sales of our COVID-19 vaccine accounted for $17.7 billion in revenues for the year ended December 31, 2021, based upon the delivery of approximately 807 million doses of the vaccine, accounting for all of our commercial revenues. We anticipate that sales of our COVID-19 vaccine in 2022 will similarly provide all of our commercial revenues for the coming year.

Some of their new proposed products fall under other vaccine products as well as gene therapy products:

Additionally, we have established Moderna Genomics (MGX) with the vision of becoming a leader in large, complex genomic editing. In November 2021, we announced a multi-year research collaboration with Metagenomi to leverage Metagenomi’s discovery platform and expertise to develop next-generation in vivo gene editing therapies. Our work in genomic editing is subject to all risks associated with gene therapies. Although there have been significant advances in recent years in fields of gene therapy and genome editing, in vivo CRISPR-based genome editing technologies are relatively new and their therapeutic utility is largely unproven.

As we can see from the 10-K, basically all of Moderna’s revenue is derived from their Covid-19 product. The company has promising technology that might allow for further product lines using the science and technology of messenger RNA, but at this time, it’s a big risk to the investor that will have to determine if they will bet on a company with a lack of product diversification. Other projects, like the proposed gene therapy products, may be long in the making as much of what this entails is new and will remain controversial. If the company ends up being a medicinal/pharmaceutical giant for years to come with a diverse range of products, then this is a bet that would pay off handsomely at these price levels.

The guidance

MRNA eps estimates (yahoo finance)

The average analyst estimate for EPS 2022 rings in at $26.41 a share, lower than 2021 EPS of $30.31. Even at that amount, the earnings yield for Moderna would be (EPS/SP) $26.41/$120= 21.6%. If estimates are right, this would decrease their Magic Formula score to (EY+ROIC) 21.6+36=57.6. Still an amazing number and well above a fair value of a stock at 20 or more. If we fast forward to FY 2023, estimates dip significantly to an average of $8.78 a share. That would be a significant reduction in earnings yield to today’s share price all the way down to 7.3%. Again, analysts are betting that Moderna will not have any new revenue-generating product lines by 2023 and that the Covid-19 pandemic will begin to be an afterthought.

Debt and dividend

The company employs very little debt at just over USD 800 million. With a debt-to-equity ratio of only 4.93%, the company could lever up significantly to pursue projects on the verge of approval to make sure they get to the finish line. The company pays no dividends as it retains all earnings to grow the business, pay down debt, and buy back shares. With Moderna being almost a biotech small-cap operation that hit it big and has now grown into a large-cap behemoth, it should take steps to diversify its product line even beyond its mRNA technology.

Pharmaceutical acquisitions would be smart in an attempt to create a diverse business similar to Pfizer (PFE) or Johnson & Johnson (JNJ). Moderna has a long way to go and a lot of decisions to make. Their name is now prominent at the forefront of medicine, so any acquisition of companies with currently sellable products outside of vaccines could immediately benefit from the Moderna label. If they wait too long and their name begins to fade along with their ability to leverage, the opportunity could be a foregone conclusion very quickly.

Valuation

Currently trading at 3.5 X earnings, having a 36% ROIC and very little debt, this stock is cheap. Even just using next year’s numbers for average EPS from analysts of $8.78, a normal stock market valuation of 15 X earnings would still put the fair value at $131 a share. At today’s prices, it does leave a margin of safety through 2023. However, I believe this stock will fall out of the Magic Formula top stocks list in 2023 as both the earnings yield and ROIC fall. The stock as it stands currently, screens as one of the top stocks in the entire market even down to companies with a $50 million market cap. That is impressive being that scale usually reduces returns on invested capital and earnings growth.

Summary

To me, Moderna is a bet. It is a bet that they will produce product diversification that will carry it beyond just the production of their Covid-19 vaccine. Many of their products are controversial and it may be wise to diversify into more traditional medicines to create a reliable revenue stream. They have the cash flow and low amounts of leverage that would allow them to pursue new products. How judicious they will be and how well they will execute is outside my realm of expertise. Therefore for me, this is a hold until I see revenue generated from additional products.

Be the first to comment