metamorworks

A Quick Take On MiX Telematics

MiX Telematics (NYSE:MIXT) reported its FQ2 2023 financial results on Oct. 27, 2022, beating expected revenue and missing EPS estimates.

The company provides vehicle and other mobile asset tracking and management software and systems globally.

MIXT is seeking to essentially acquire its way to a bigger presence in North America while its financial resources and results have underwhelmed.

In the near term, I’m on Hold for MIXT.

MiX Telematics Overview

South Africa-based MiX was founded in 1996 to provide fleet and mobile asset management to companies worldwide

The firm is headed by founder and CEO Stefan Joselowitz.

The company’s primary offerings include:

-

Fleet Manager

-

Asset Manager

-

Matrix

-

Beam-e

The firm acquires customers via its direct sales and marketing efforts as well as through partner referrals.

MiX Telematics’ Market and Competition

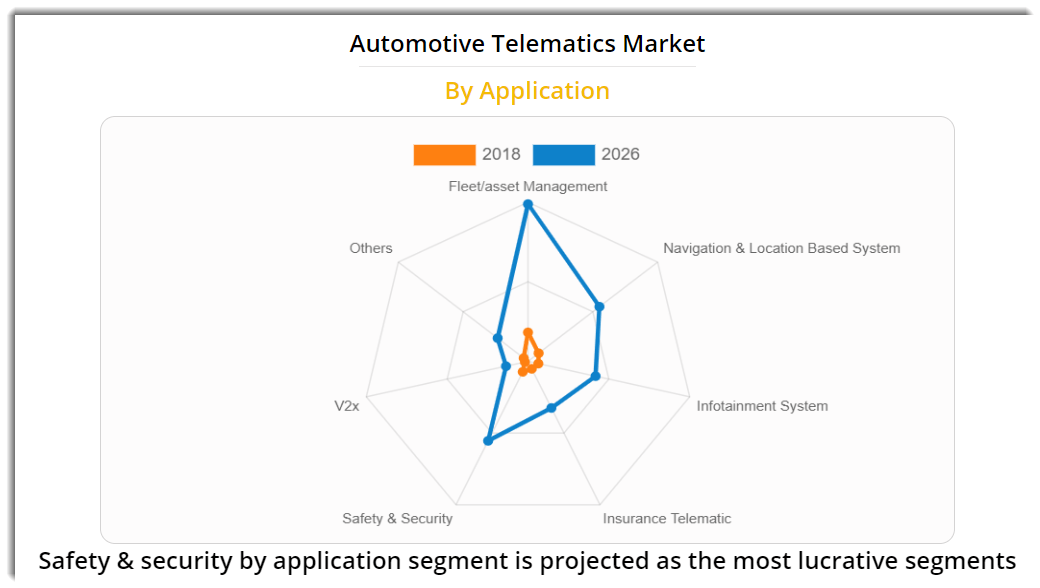

According to a 2019 market research report by Allied Market Research, the global market for automotive telematics was an estimated $50.4 billion in 2018 and is forecast to reach nearly $321 billion by 2026.

This represents a forecast CAGR of 26.8% from 2019 to 2026.

The main drivers for this expected growth are advances in solution options for organizations and a strong demand for increased transportation efficiencies.

Also, below is a chart showing the expected growth pattern by segment within the larger vehicle telematics market:

Automotive Telematics Market (Allied Market Research)

Major competitive or other industry participants include:

-

Verizon Connect

-

Karoooo

-

WebFleet

-

Masternaut

-

Fleet Complete

-

Tracker

-

Netstar

-

Ctrack Inseego

MiX Telematics’s Recent Financial Performance

-

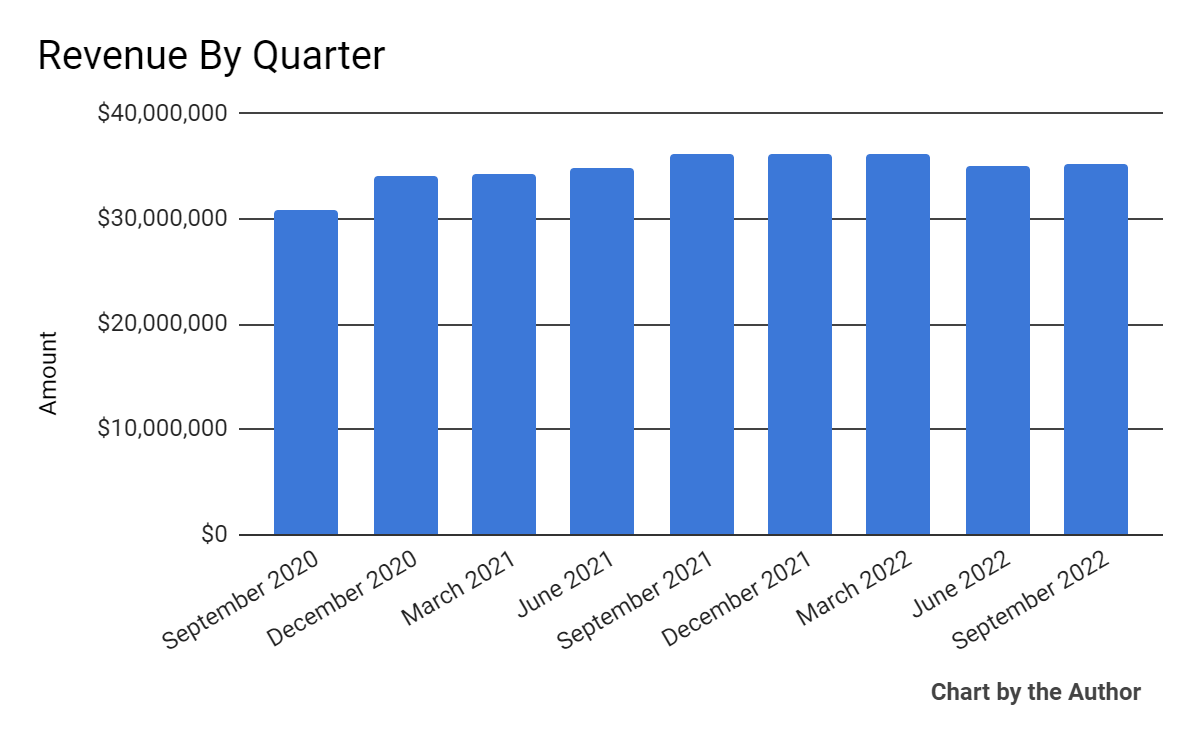

Total revenue by quarter has remained largely flat for many quarters:

9 Quarter Total Revenue (Seeking Alpha)

-

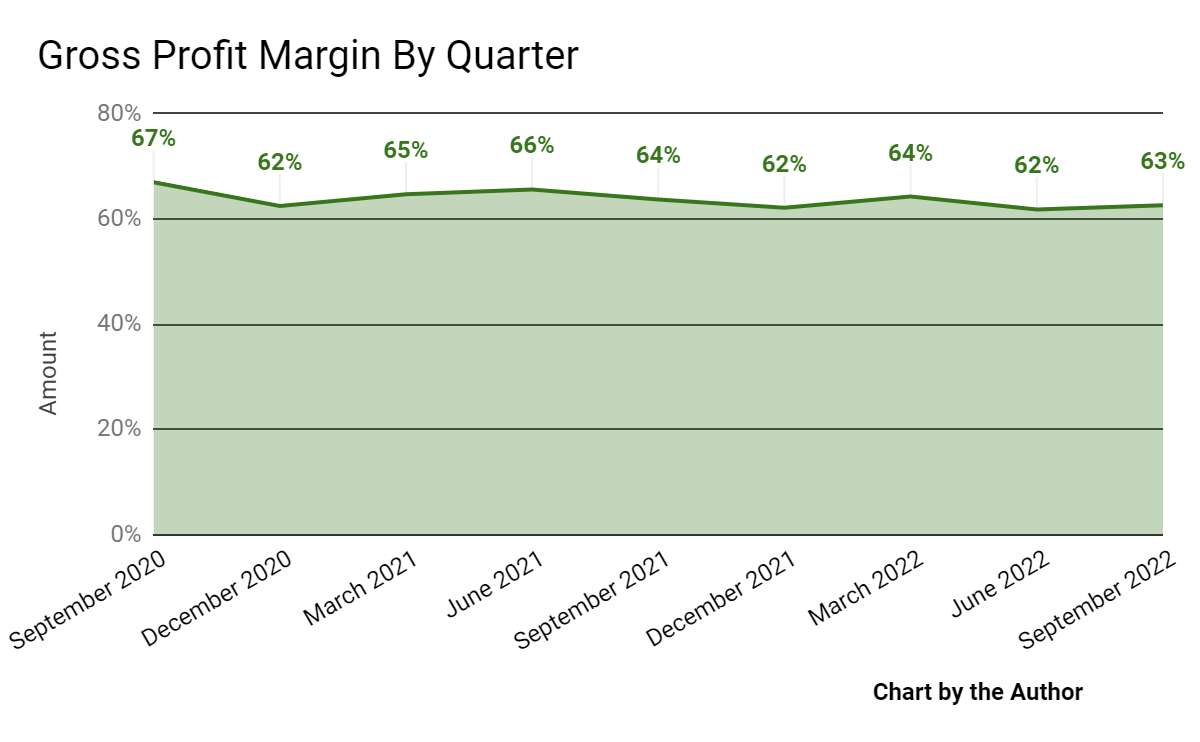

Gross profit margin by quarter has trended slightly lower over time:

9 Quarter Gross Profit Margin (Seeking Alpha)

-

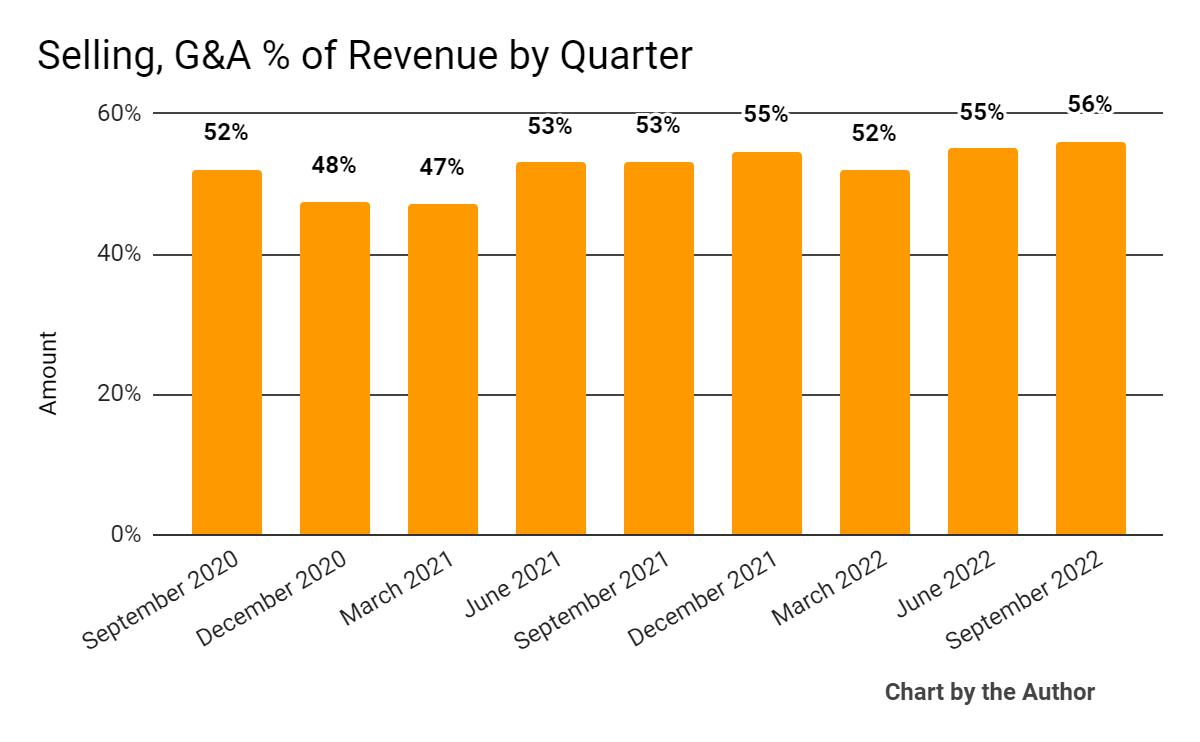

Selling, G&A expenses as a percentage of total revenue by quarter have trended slightly higher in recent quarters:

9 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

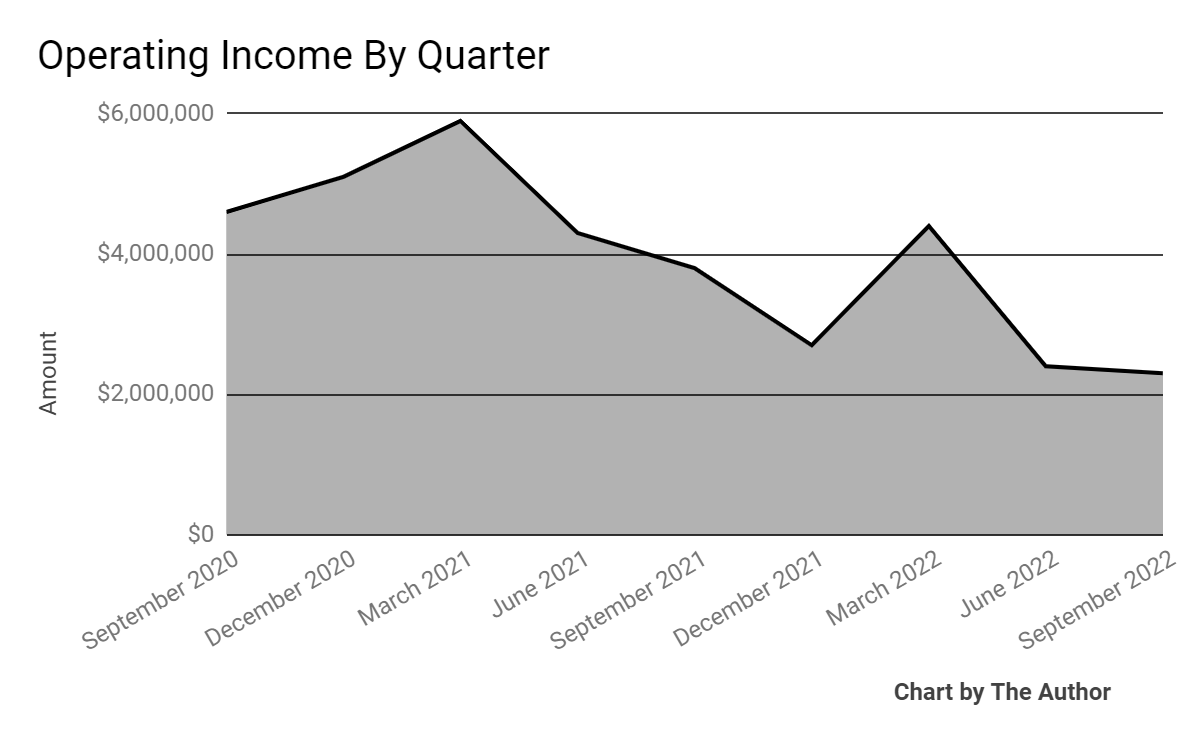

Operating income by quarter has dropped markedly in recent quarters:

9 Quarter Operating Income (Seeking Alpha)

(All data in above charts is GAAP)

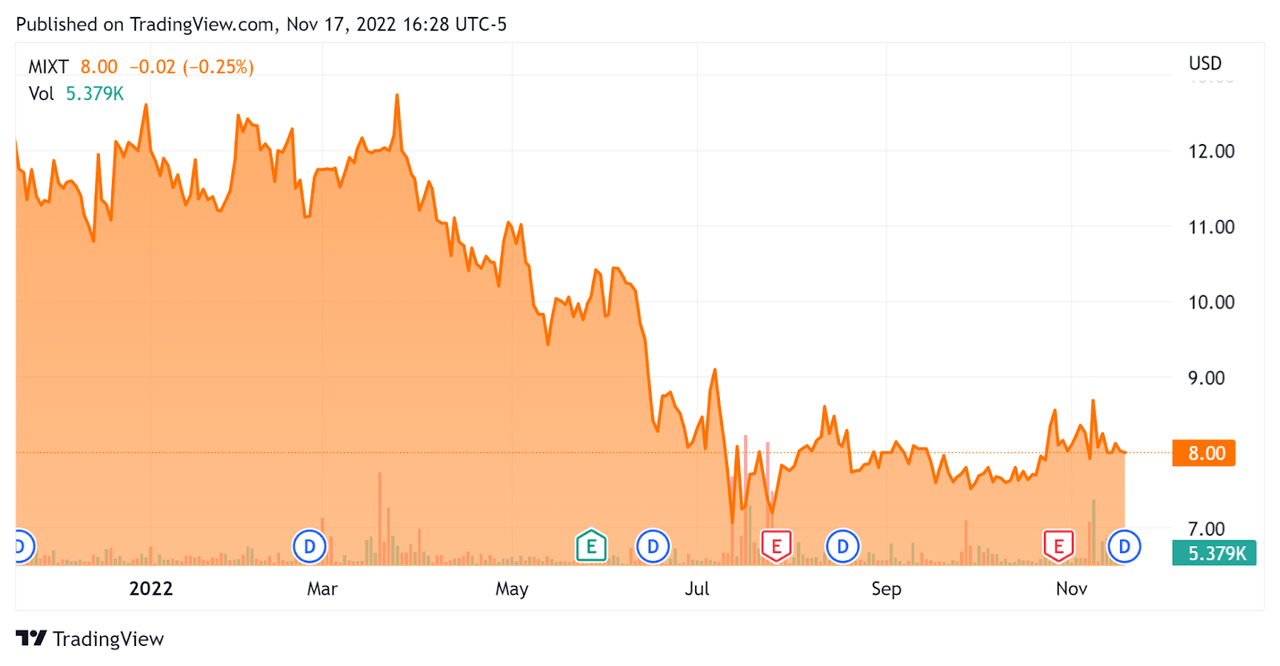

In the past 12 months, MIXT’s stock price has fallen 34.6% vs. the U.S. S&P 500 index’ drop of around 16%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For MiX Telematics

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

1.13 |

|

Revenue Growth Rate |

2.3% |

|

Net Income Margin |

2.5% |

|

GAAP EBITDA % |

18.7% |

|

Market Capitalization |

$165,520,000 |

|

Enterprise Value |

$160,960,000 |

|

Operating Cash Flow |

$10,320,000 |

|

Earnings Per Share (Fully Diluted) |

$0.01 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Karooooo (KARO). Shown below is a comparison of their primary valuation metrics:

|

Metric [TTM] |

Karooooo |

MiX Telematics |

Variance |

|

Enterprise Value / Sales |

3.80 |

1.13 |

-70.3% |

|

Revenue Growth Rate |

25.4% |

2.3% |

-90.9% |

|

Net Income Margin |

17.6% |

2.5% |

-85.7% |

|

Operating Cash Flow |

$61,250,000 |

$10,320,000 |

-83.2% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

MIXT’s most recent GAAP Rule of 40 calculation was 21% as of FQ2 2023, so the firm needs significant improvement in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

2.3% |

|

GAAP EBITDA % |

18.7% |

|

Total |

21.0% |

(Source – Seeking Alpha)

Commentary On MiX Telematics

In its last earnings call (Source – Seeking Alpha), covering FQ2 2023’s results, management highlighted the organic growth of its customer base by 38,300 net new subscribers.

The company has seen strong growth in demand due to companies experiencing higher energy and transportation costs, new vehicle supply chain shortages and increasing compliance requirements.

MIXT also acquired Trimble’s Field Service Management segment, adding 38,000 new subscribers, doubling its U.S. connections.

Management intends to continue its selective approach to M&A to expand its presence throughout North America.

As to its financial results, total revenue fell 2.2% year-over-year, although the subscription revenue component rose on a constant currency basis by 10.1%.

The firm’s revenue results were negatively impacted by the strong US dollar, reducing the value of its non-USD revenue collections.

Management did not disclose any retention rate metrics, but did say it expects its Trimble FSM segment to retain 75% of its customers.

MIXT’s Rule of 40 results have been mediocre and in need of improvement.

SG&A as a percentage of revenue has risen sequentially and year-over-year, while operating income has dropped significantly.

For the balance sheet, the firm ended the quarter with cash and equivalents of $19.7 million, sharply lower than its March 31, 2022 balance of $33.7 million. Short-term borrowings balance was $12.0 million.

Over the trailing twelve months, free cash used was $10.9 million and the firm had $20.9 million in capital expenditures.

Looking ahead, management targets revenue growth of 15% – 20% on a constant currency basis and 30% adjusted EBITDA margins.

Regarding valuation, the market is valuing MIXT at an EV/Revenue multiple of one-third that of KARO.

The primary risks to the company’s outlook are improving supply chain conditions at the same time as worsening economic activity due to a widely-expected slowdown or recession as we enter 2023.

MIXT is seeking to essentially acquire its way to a bigger presence in North America while its financial resources and results have underwhelmed.

In the near term, I’m on Hold for MIXT.

Be the first to comment