RiverNorthPhotography

Introduction

Canadian National Railway Company (NYSE:CNI) recently reported Q3 earnings. Investors were waiting to see the impact of the grain harvest in Canada as well as how well the company was managing wage and fuel inflationary pressure. Here we are to take a look at the report.

Before we start, I would like to remind that this article can be considered as a follow-up of a series I recently published on SA to share some research I have been carrying out about North-American class 1 railroads. The series was introduced by this article: “Learning From Buffett About Investing In Railroads: The BNSF Case Study.”

I recommend reading it because it explains thoroughly what I have found out about the way Warren Buffett thinks about the railroad Berkshire Hathaway (BRK.A, BRK.B) owns. The approach I am taking to assess the company comes directly from what I am learning from Buffett and can, therefore, be a little bit different from other ways to value a company.

Summary of previous coverage

When Mr. Buffett started investing in capital-intensive businesses, he realized that capital-intensive business shouldn’t be shunned as long as a there is a reasonable expectation of decent returns on the capital employed by the business. In order to assess this, Buffett has taught us to look at four aspects: earning power, efficiency, use of capital, and shareholder return.

Secondly, Mr. Buffett has kept true to his investing philosophy that looks for investments that have some sort of a moat and that can benefit from macrotrends at play. In particular, class 1 railroads have a moat provided by their own railway infrastructure, which is costly and difficult to replicate. As far as macrotrends go, Mr. Buffett has highlighted more than once that he sees railroads enjoying three main tailwinds against trucks:

- cost and environmental advantages over trucking

- fuel efficiency that lead to better operating costs

- increasing need for freight trains.

I used this frame to cover Canadian National, in an article where I pointed out some well-known facts alongside with shedding some light on the metrics Mr. Buffett looks at. Readers can find the article here.

Canadian National

All financial numbers are reported in CAD.

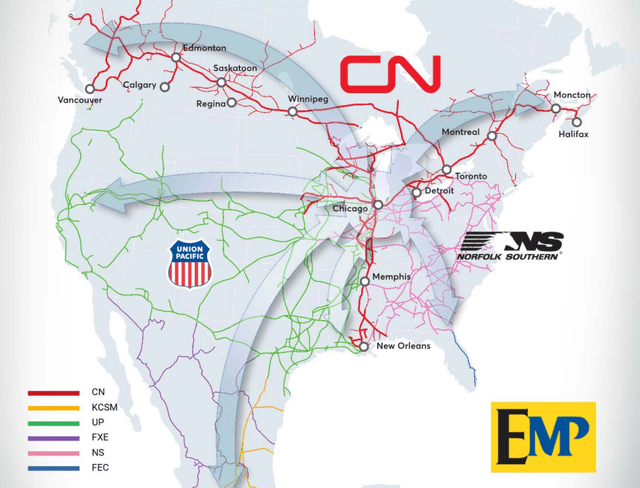

It is well-known that Canadian National own a one-of-a-kind network that connects both shores of Canada to the Gulf of Mexico. Until Canadian Pacific took over Kansas City Southern, Canadian National was the only one that had a three-coastal network. In any case, even if Canadian National isn’t a monopoly anymore, we are still before a duopoly that has very high barriers of entry for newcomers.

Secondly, Canadian National was amount the first railroad companies to address issues such as sustainability and this has made it very cost-conscious, especially about fuel costs. However, the most important development was that the company was a pioneer in Precision Scheduled Railroading (PSR), which has let to a more efficient way of using its network. However, this also led to some disputes with workers that asked for wage increases and better schedules. Now, the dispute seems to have been concluded with an arbitration process.

Past data

Let’s briefly recap what we saw in my previous article in order to know where we are starting from to look at the most recent quarterly report.

First of all, we saw that the company has seven main sources of freight revenues, with petroleum and chemicals holding the first place among commodities, followed by grain and fertilizers. We know that last year’s harvest wasn’t as good as this year’s, and this led many to expect that, starting from Q3, the company should see fast growth here. Not by chance, the company acquired 500 new grain hoppers in 2022.

Regarding the earning power, we found out that its pre-tax earnings/interest ratio was 10.37, which is the best ratio among class 1 railroads.

What we found out about the company’s efficiency was that the operating ratio of Canadian National was 62.9% in 2012, and after ten years it was down to 61.2%, meaning that the company has become a little more efficient. Actually, back in 2017 Canadian National achieved an operating ratio as low as 59.8%, that later spiked up to 65.4% during the pandemic. Now it is once again heading south, which is a trend we want to see going on. In the first six months of 2022, this ratio was once again below 60%, at 59.3%. We will see in the report where we are at.

As per fuel efficiency, Canadian National is once again the leader with 0.84 US gallons of fuel consumed per 1,000 GTMs. Most of its peers are between 0.96 and 1.11.

The company’s ROIC is also very good as it was at 14.1%, well above the current cost of capital that is around 8-9%. While investing to enhance safety and integrity of track infrastructure, as well as to develop its grain handling capacity and to open new facilities serving Canada’s hub for petrochemical production and refining in Alberta, the company has repeatedly stated and proven that it can keep its capex under control at 17% of total revenues.

Q3 Results

Before we look at the results, we have to consider an announcement that came out a month ago, a few days after I published my first article. Canadian National announced an exclusive partnership with Union Pacific (UNP) and Norfolk Southern (NSC) in Equipment Management Pool (EMP) program.

The EMP program is an interline service that enables shippers to use more networks, providing seamless access to most of the major cities across the whole North-American continent, from Canada to Mexico.

Canadian National Q3 Results Presentation

I think this move is an important strategic move that aims at making Canadian National strong against Canadian Pacific (CP). It really gives access not only to three different hubs on three coasts, but to all major hubs and cities across all the main commercial routes of the continent. This partnership also shows what I have been thinking for a while about Class 1 railroads: though we have seen big consolidation over the past decades, up to the point that we now have six main companies, there is still room for this trend to continue. I think we might end up down the road, if regulators allow it, with just two big competitors: one could be the result of this partnership, the other would see Canadian Pacific and CSX Corporation (CSX) that may either be bought by BNSF or may sign a similar partnership with the Buffett-owned railroad to compete west of the Mississippi.

Let’s get now to the quarterly report. There is no way around it: Canadian National performed really well. Let’s start from a few words Tracy Robinson, Canadian National new President and CEO, said at the beginning of the last earnings call:

Volumes turned positive this quarter, up 5% on in RTM basis. And when combined with solid pricing fuel surcharge revenues, and a lower Canadian dollar, we delivered record revenue. While we’re seeing some early signs of softness in certain markets, we will continue to be very busy through the fourth quarter, particularly on the western part of our network.

Many were forecasting that fuel surcharges would help railroad companies, but this was not the sole reason why Canadian National achieved record revenue. In fact, over the past quarters, the company has been laser focused on becoming once again a leader in efficiency. While other companies, in order to save on fuel costs, reduced their car velocity, Canadian National walked another path, as Rob Reilly, Canadian National’s COO, explained:

We are moving cars across the network with more speed and consistency. Our third quarter average car velocity was 212 miles per day, which is a 5% improvement over the third quarter of last year. This is the best performance since Q3 of 2016, and we achieved this despite handling 10% more GTMs over that same period.

A few numbers

Canadian National reported the following numbers

| in CAD million (except per share items) | Q3 2022 results | YoY difference |

| Revenues | 4,513 | 26% |

| Opex | 2,581 | 15% |

| Operating income | 1,932 | 44% |

| Operating ratio (opex /revenues) | 57.2% | +5.5 pts |

| Net income (adj.) | 1,455 | 35% |

| EPS (adj.) | 2.13 | 40% |

| Free cash flow | 1,356 | 80% |

| Share repurchases | 1,178 | 980% |

| Dividends per share | 0.7325 | 19% |

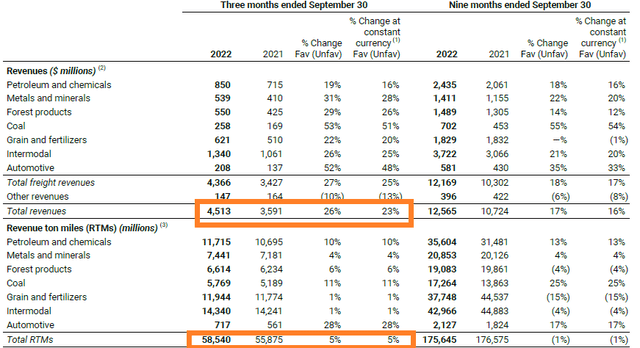

Now, a lot more money came into Canadian National’s pockets, as every single number reports. We have to understand what caused this. As we can see from the report below, while we have total revenues up 23%, total revenue ton miles (RTMs) was up just 5%. In other words, Canadian National did transport a little bit more YoY, with petroleum and coal seeing a rather strong increase, but what really drove the revenues was pricing.

Canadian National Q3 Earnings Report

Canadian National was able to charge more thanks to higher fuel surcharge revenue and freight rate increases. This added up to higher volumes, especially of coal an chemicals.

On the other hand, while the company was able to offset fuel costs thanks to its surcharges, operating expenses went up because of fuel prices, that increased 85% YoY. Overall, as we have seen, the company has however been able to manage well its costs increases, as it is proven by the operating ratio coming down YoY, once again below 60%.

We also have to explain why there was such a massive increase in free cash flow, which went up to $1,356 million vs $754 in Q3 2021. Canadian National explains this clearly: “the increase in the third quarter was mainly due to the $886 million refund of the advance paid to KCS, which was received in 2021.” Investors should, consequently, expect a decrease of free cash flow in the next quarter that should not concern.

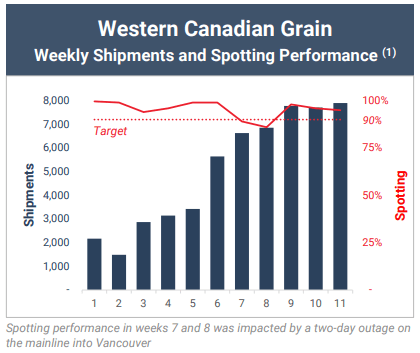

Now, we know that the 2021 grain harvest was dragging down Canadian National’s performance. However, we also know that the recent harvest has been the third-largest ever. At the end of the past quarter, Canadian National started seeing an uptick in weekly shipments, with spotting performance stable above 90%.

Candian National Q3 Results Presentation

I believe investors should expect a whole year of high grain shipments due to the very good harvest and the fact that, though Ukraine and Russia have reached an agreement to ship grain safely through the Black Sea, the Ukrainian grain output is well below – understandably – its usual levels, causing demand for North-American grain to go up.

One last note: automotive demand is becoming strong, and the company’s guidance sees a strong trend for the upcoming years as many manufacturers continue to shift into the backlog that is 9 months to 12 months.

Key Buffett Metrics

We have already seen that the operating ratio is going back to very good levels at 57%.

Let’s look at the earning power. It is important because it shows the ability of a company to earn enough money to cover its interest requirements in any economic conditions. It is calculated as pre-tax earnings over interest. In 2021 the ratio was 10.37. If we look at the TTM, the ratio is now at 13.38, which makes the company as solid as ever before its creditors.

Fuel efficiency improved again and it is now at 0.838 US gallons, an outstanding result even more important during times of high fuel prices.

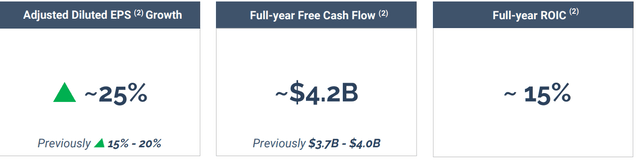

Regarding the important ROIC, Canadian National just revised upwards its guidance, bringing it to 15%, which was something I was inclined to think the company could achieve, as I wrote in my past article. As we see below, the company’s guidance for the full year looks indeed promising and, given the financial data reported so far, these results are clearly at hand.

Canadian National Q3 Results Presentation

One last comment: Mr. Buffett has told us that once a company has excess cash that can’t be reinvested at the same rate of return, it is then fine for it to return it to the shareholders. Canadian National has been the most conservative among railroad companies when speaking of shareholder return, keeping its payout ratio low and its share repurchases under control. However, in the past quarters, the company has bought nearly 23 million shares for $3.5 billion. That is equal to 4.3% of the current market cap. In addition, shareholders have received a 19% dividend increase this year. Given the amount of free cash flow the company will generate by the end of the fiscal year, we can expect both share repurchases to go on and the dividend to be bumped up as well.

Valuation

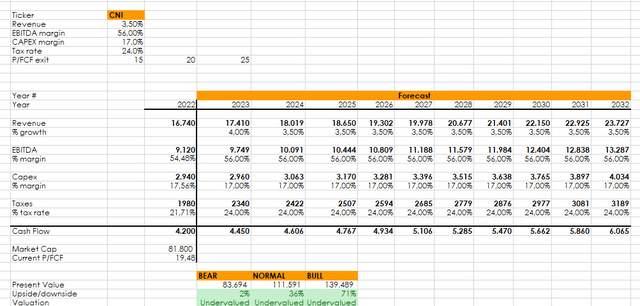

Before the new data the company provided us with, I revised my discounted cash flow (“DCF”) model a little. I think the company is now a better buy and I plan on initiating a position in the upcoming days.

Author, with data from SA and CNI’s guidance

I said that I want to buy Canadian National, since in the past months, while researching it, it seems the most undervalued among its peers. I will look for entry opportunities after the recent surge in price. Even though I plan on holding Canadian National Railway Company for a decade, I want to build a position over time, in order to dollar cost average and diminish price volatility risk.

Be the first to comment