LittleCityLifestylePhotography/iStock via Getty Images

Recently, I wrote an article on Calavo Growers Inc. (CVGW) arguing that it is in the midst of a turnaround and appears cheap on a valuation basis. In this article, I will analyze one of its biggest competitors, Mission Produce, Inc. (NASDAQ:AVO).

From my analysis below, while Mission Produce has key differentiating attributes such as vertical integration and a global distribution network, operating results since its IPO have been lackluster. Using fair assumptions, Mission Produce appears to be overvalued on a DCF basis. I would recommend investors stay on the sidelines until the company demonstrates it has a superior business model through consistently delivering stronger profit margins.

Introducing The Mission

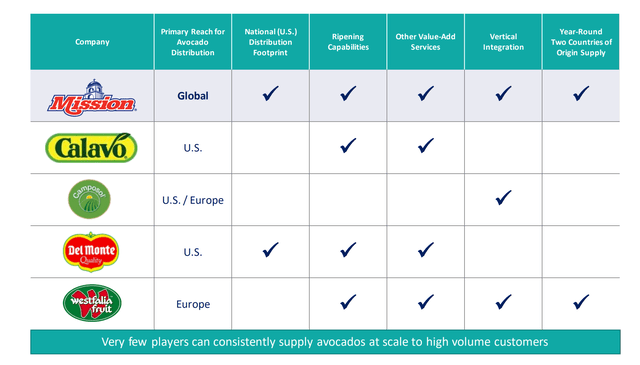

Although Mission Produce’s roots don’t stretch as far back as Calavo (Mission was founded in 1983 instead of 1924 like Calavo), it claims to have surpassed Calavo in terms of scale and global reach. Today, Mission claims to be the largest avocado distributor by volume, and is the only distributor with an international distributing footprint, bringing avocados to Asia and Europe. Mission has also vertically integrated into farming with farms in Peru. Figure 1 highlights the key capabilities of the main avocado players.

Figure 1 – Key competitors in the avocado space (Mission Produce investor presentation)

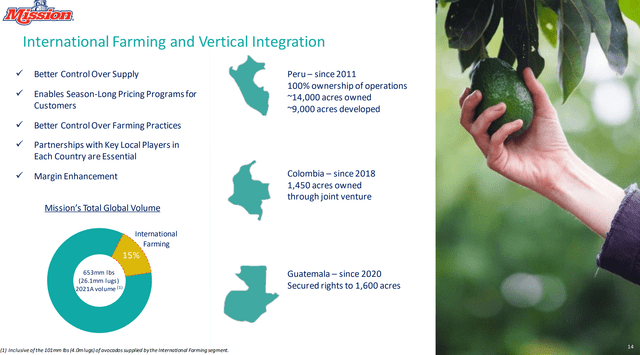

Mission chose to vertically integrate to better control its fruit supply and provide year-round product sourcing. It also enhances the gross margin beyond just the marketing and distribution fee. Approximately 15% of Mission’s global volume comes from its own farms.

Figure 2 – Rationale for vertical integration (Mission Produce investor presentation)

International Is A Key Market

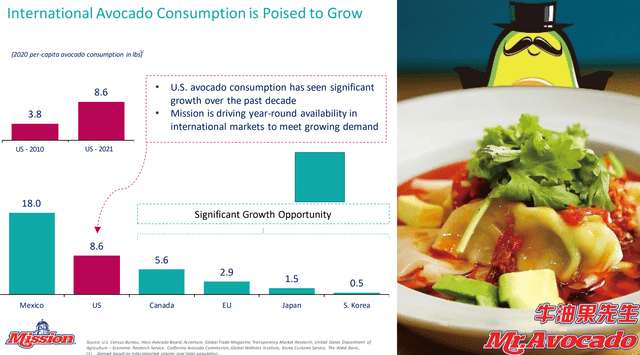

Mission recognized early on that internationally, avocado consumption was underpenetrated and poised to grow. While US per capita consumption of avocados have more than doubled in the past decade (from 3.8 lbs to 8.6 lbs), other countries are barely scratching the surface of their consumption (Figure 3).

Figure 3 – International has room to grow (Mission Produce investor presentation)

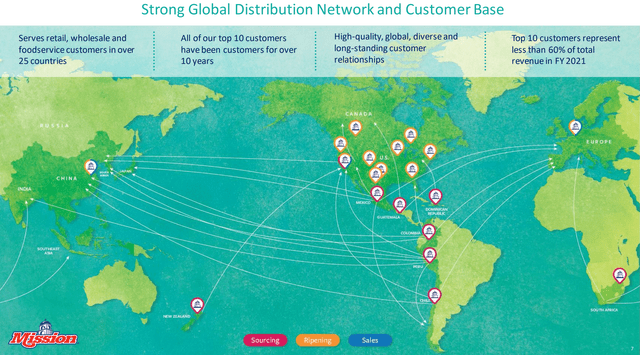

To support this international ambition, Mission has built its distribution network and forged high quality customer relationships. For example, Mission distributes to Loblaw Companies Limited (OTCPK:LBLCF), the largest grocer in Canada.

Figure 4 – Mission international footprint (Mission Produce investor presentation)

Public Mission

Mission is a relatively young company, having only come to the market in October of 2020 through an IPO. The IPO was well received, with Mission raising $89 million through selling 7.5 million shares at $12.00 apiece, while insiders, including the CEO and directors, sold an additional 1.75 million shares.

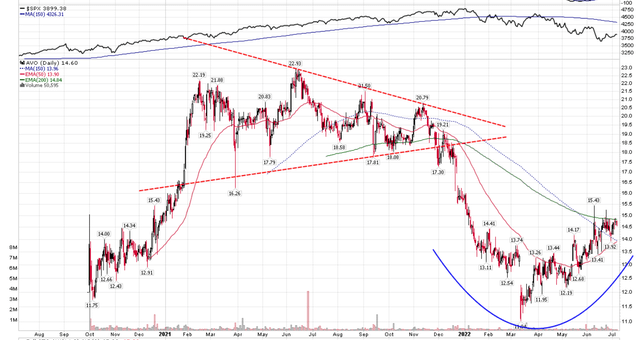

Mission’s stock started off with a bang, almost doubling to $22 per share within months and topping at $23 a share in mid-2021 (Figure 5). However, since the hot start, the stock price has deflated, at one point trading below the IPO price in March after a poor Q1/2022 earnings release.

Figure 5 – Mission stock price has deflated from hot start (Author created with pricing data from stockcharts.com)

Were Strong Pre-IPO Financials A Fluke?

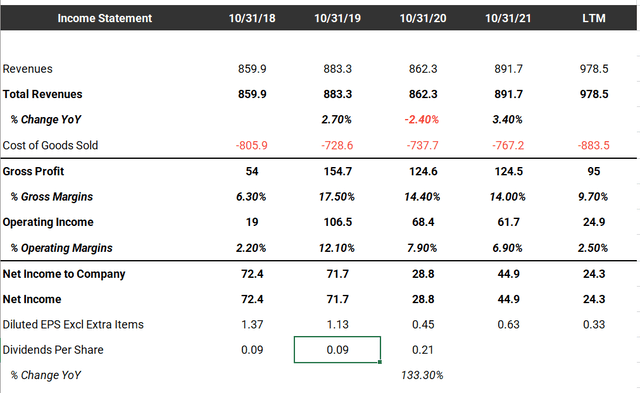

Mission Produce IPO’ed on the back of extremely strong financial results, as shown in Figure 6. In fiscal year 2019, the company achieved gross margin (GM) of 17.5% and operating margin (OM) of 12.1%. For comparison, in my Calavo Growers article, I showed Calavo achieved 10.7% and 5.8% in the same year. In addition, over the long run, Calavo has averaged a 10% GM and 4% OM.

Is it possible that Mission Produce is 2-3x as good (as measured by operating margin) as Calavo in the commodity avocado marketing and distribution business?

Figure 6 – Mission Produce summary financials (tikr.com)

The result, for early Mission investors, was unfortunately a no. Mission’s business quickly came back to earth. As we saw in Calavo’s results, 2020 and 2021 were tough years for the avocado industry due to cheap imported fruit. In fiscal year 2020, Mission’s GM compressed 310 bps to 14.4% and OM fell 420 bps to 7.9%. In fiscal year 2021, Mission’s GM and OM fell further to 14.0% and 6.9% respectively.

There is an important lesson here for early IPO investors. Always assume insiders know more than you and be wary of financial results that look too good to be true.

Poor Momentum Continued To 2022

Mission’s poor operating momentum since IPO has continued to 2022, with the poor Q1/2022 earnings results culminating in a steep 1 day decline of 11% on March 11th. Mission reported a net loss of $13.4 million, despite revenues rising 25% YoY. Gross margin came in at 0% for Q1/2022 and the CEO blamed the disastrous quarterly result on an ERP system conversion:

“We are disappointed in our fiscal first-quarter performance where we experienced greater than anticipated operational challenges associated with our ERP system conversion on November 1, 2021. The ERP implementation caused certain operational issues that temporarily limited our ability to manage our business and operations efficiently and eroded our ability to drive the per-unit margins that we have historically generated. We believe the most acute challenges we faced in the first quarter have been largely addressed,”

– Quote from Steve Bernard, CEO, Q1/2022 press release

However, as of the recently released Q2/2022 earnings, there appears to be lingering issues. The CEO commented that:

“Our per-box margins have recovered and returned to the high-end of normal historical ranges”

– Quote from Steve Bernard, CEO, Q2/2022 press release

My question is, why is company gross margin only 7.1% in Q2 versus 14%+ in 2020 and 2021 if per-box margins have returned to historical ranges? We will likely need to observe a few more quarters to see what the ‘normalized’ gross margin is for Mission Produce.

Valuation Is Rich

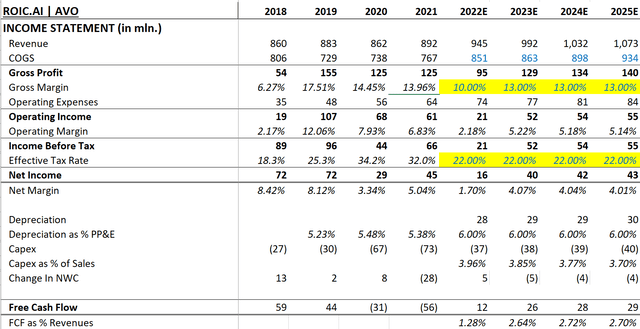

With the recent operating hiccups, what are Mission Produce shares worth? In Figure 7, I have built a simple model to think about how the business can develop over the next few years. I assume the company can overcome the ERP issues and gross margins recover to 10% this year (H1/22 gross margins were only 4.1%), and 13% long run, which is the average of 2018 to 2021 gross margins. This drives operating margins of 2% for 2022, and 5% long term. What is interesting is that cash operating expenses as a percent of revenues have steadily increased, from 3% in 2018, to 3.6% in 2019, 4.4% in 2020, and 4.9% in 2021. Absent new information, I have kept the cash operating expenses at 4.9% to 5% for the forecast period, but I suspect this could be underestimating expenses as they have grown to 5.5% of revenues in H1/22.

Figure 7 – Simple financial model for Mission Produce (Author created with data from roic.ai)

Another figure that stood out from the model worth mentioning is that capital expenditures were abnormally high in 2020 and 2021 post IPO. While in 2018 and 2019, capex was 3.2% and 3.4% of sales, this figure jumped to 7.8% and 8.2% in 2020 and 2021. Management cited the construction of a new Laredo facility for elevated capex, hence for modeling purposes, I have returned future capex to less elevated levels around 3.8% of sales. But this assumption could have large implications for free cash flows, as the company could have under-invested prior to the IPO to ‘buff up’ the financials. For reference, in the first half of 2022, capex as a percentage of sales was 5.9%.

Also, the company’s effective tax rate has been highly variable due to changing tax rates in Peru. For modeling purposes, I have chosen to use 22%, the statutory rate.

The end result is long-term net margins of 4%, roughly half of the bonanza 2019 net margins that Mission IPO’d on. I believe this figure is fair, given Calavo earns a long term average net margin slightly less than 4% and there is not much competitive moat in the commodity avocado marketing and distribution business to warrant a significant premium.

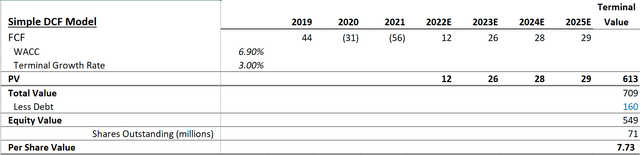

From this financial model, I am able to generate a simple DCF model as per Figure 8. Using WACC of 6.9% and 3% terminal growth rate gives a per share value of $7.70.

Figure 8 – Simple DCF model (Author created)

To me, the purpose of a DCF model is not to generate precise valuation forecasts. Instead, it is to test the reasonable-ness of my assumptions versus what the market is valuing shares at. Based upon the fair assumptions I have used in my financial model, it appears Mission Produce is overvalued as the current stock price is $14.60 while my model only generates $7.70 in value.

Of course, I could be wrong in my assumptions, particularly as the operating margins are lower than the 7.2% Mission has averaged from 2018 to 2021. If I were to model 7.2% operating margins, then my DCF valuation would be $13.40, approximately fair value. But at the moment, I cannot see a path to 7% operating margins using reasonable assumptions.

Risks To The Mission Produce Story

The biggest risk to the Mission Produce story is execution. Specifically, the financial performance post-IPO has been very volatile, highlighted by the company reporting a 0% gross margin for Q1/2022. Until the company can stabilize the business and deliver consistent margin and earnings over the coming quarters, questions will hang over the story.

Also, with rising inflation globally, Mission’s vertical integration strategy could hurt it as the company is more exposed to labor and input cost inflation than a pure marketing and distribution business.

Finally, Mission Produce has significant debt outstanding of $160 million. Although the interest rate on the debt is currently low (ranging from 1.8% to 2.4%), there is a significant amount, $90 million, that is due in full in October 2023. Another bank loan of $72 million is due in October 2025. If credit markets were to seize up, Mission may find it hard to refinance the loans, or it may not be able to finance at attractive interest rates.

On the upside, as Mission Produce is vertically integrated on 15% of their avocado volume, a strong avocado pricing market like in 2019 can deliver outsized financial gains.

Conclusion

In conclusion, Mission Produce is another interesting consumer staple name capitalizing on the robust international growth profile of avocado consumption. What differentiates Mission Produce from Calavo is primarily Mission Produce’s vertical integration and increased international distribution. Mission Produce is a younger company in terms of publicly available financial information, and my best attempt at a fair financial model suggests the company is overvalued.

I would recommend investors stay on the sidelines to see if the business can normalize to higher operating margins.

Be the first to comment