ChristianChan

Intro

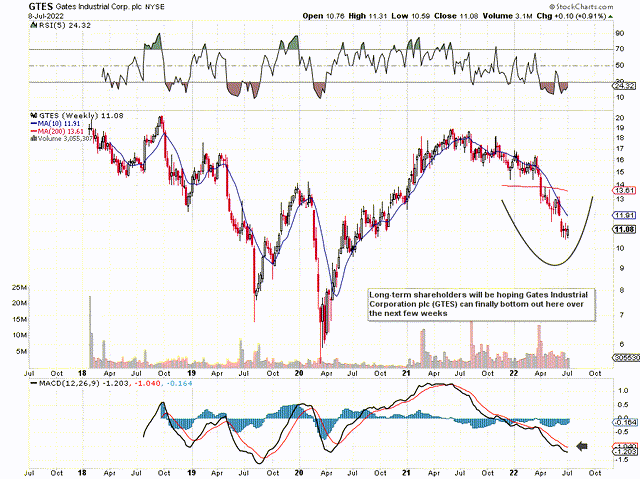

Gates Industrial Corporation plc (NYSE:GTES) (Specialised Industrial Machinery Outfit) came across our desk from a value screen we ran where profitability, low debt, and attractive valuations were the main themes in the search. As we can see from the technical chart below, Gates Industrial Corporation has been making lower lows for over 12 months now which obviously means the stock’s valuation is a whole lot more attractive now in mid-2022 than it was in mid-2021. Although we have seen some stability in GTES’s share price action over the past four weeks or so, we await a move above the $12 level which should coincide with a crossing over of the intermediate MACD technical indicator. This indicator (which is a solid play on the stock’s trend & momentum) has not been this oversold since early 2020 so a significant rally may be in the works here going forward if indeed a swing can be printed.

GTES Technical Chart (Stockcharts.com)

Earnings Revisions Improving

Followers of our work will be aware of the fact that we favor cash-flow generating companies, especially where growth has come to a standstill which usually depresses the stock’s valuation. The reasoning behind this premise is that if a company can continue to generate cash in difficult times, this increases the odds significantly that growth will eventually return due to the company being able to invest consistently through the downcycle. Gates is expected to report roughly 10% negative growth ($1.23 per share) in fiscal 2022 before bouncing back to double-digit growth in the following year. The $1.23 bottom-line expectation has been revised down by roughly 10% over the past six months but downward revisions have slowed considerably over the past 30 days which explains the consolidation we have seen in the stock’s share price. Suffice it to say, although Gates remains healthily profitable, if earnings revisions continue their positive trend, then we believe it is only a matter of time before the stock’s share price follows suit.

Strong Demand Trends

From a long-term fundamental standpoint, demand trends remain strong as the backlog number expanded once more in the recent first quarter. Although Gates’ top-line number in Q1 came in ahead of expectations, sales numbers would have been higher for the Covid-19-related issues in multiple facilities earlier this year. By being proactive however through exploring different ideas on the supply side, management believes it will be able to minimize downtime in the company’s facilities in the latter part of the year. If indeed this is true and margins can continue to grow (as they did sequentially in Q1), then Gates will have three important pillars to place to drive the company forward which are demand, uninterrupted production to meet this demand, and profit by being smart with pricing in order to combat inflationary headwinds.

Attractive Risk/Reward Setup

Suffice it to say, investors need to look beyond the negative bottom-line growth which Gates will most likely report this year and instead look at the company’s fundamentals as a whole. For one, given how shares have performed over the past 12 months, the risk-reward profile from the long side stacks up for the following reasons.

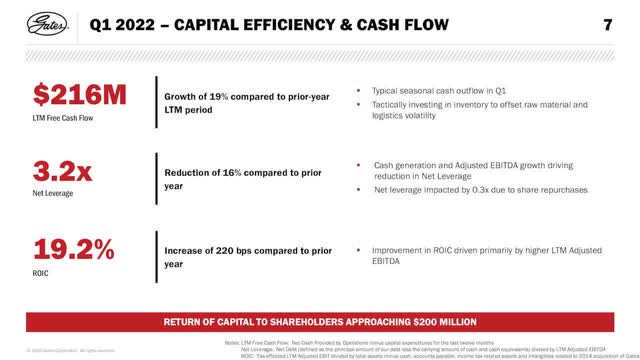

- Shares are trading with a non-forward GAAP earnings multiple of 9.02 which is the lowest multiple we have seen in many years in GTES. However, if we take the company’s earnings out of the equation, the company’s assets (P/B of 1.02), sales (P/S of 0.85), and cash flow (P/C of 10.37) all point to significant value here even if the face of the expected negative earnings growth this year. In fact, despite shares of GTES losing 40%+ of their value over the past 12 months or so, the company’s long-term debt situation, cash flow, and ROIC all improved compared to the first quarter in the prior year. These trends bode well for share-price gains in the long run.

GTES – Capital Efficiency & Cash-Flow (Company Website)

- Remember management should be graded on areas such as sustained investment, book-value growth, and also sustained share buybacks. In all of these areas, we see strength as management has been diligent in investing behind its various growth initiatives and has also grown book value and reduced the number of shares outstanding as a result. The very-same demand that GTES is experiencing now is a result of the continuous investment which the company has done up to now. Moreover, in the high-growth mobility and diversified Industrial segments, strategic investments (whose objective is to meet the ongoing demand here) are already underway. Although bottom-line earnings will obviously be impacted over the near term by this spending, investors need to look at how cheap the company’s assets are at present and the strong potential that this spending will in time push the company forward significantly.

Conclusion

Therefore, to sum up, Gates Industrial’s risk/reward profile stacks up in our opinion due to the company’s growing profitability and very low valuation. Let’s see if shares can keep rallying so a convincing swing low can be confirmed in the technicals. We look forward to continued coverage.

Be the first to comment