peterschreiber.media

Contrarian’s hypothesis

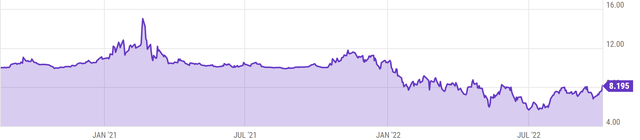

Mirion Technologies, Inc. (NYSE:MIR) has a long history of evolution. It initially formed through the merger of several businesses in 2005, slowly growing through acquisitions in the subsequent years. In 2021, it became public by merging with a special purpose acquisition company (SPAC). The stock is currently down 20% from its deSPAC price and 40% down from its all time highs, largely reflecting the overall market sentiment and the souring sentiment on SPACs. But what is the market missing in this particular stock that makes it such a great contrarian play?

Stock Price Performance (Y Charts)

With the ongoing clean energy revolution, if one were to completely replace fossil fuels, reliable baseload generation can be addressed only by nuclear energy. Perception of nuclear industry has flip-flopped over the decades, and this has an effect on the price of the metal and the performance of the miners, with an investment in the industry not achieving any positive real return in the last two decades.

“Pick-and-shovel play” is an investment strategy that allows one to be part of the underlying technology needed to produce a good or service instead of in the final output. Mirion’s products are needed to sustain the industry as a whole. They stand to benefit from any positive catalysts to the industry. The downside is very limited, as the products are well diversified across industrial and medical segments and will continued to be used regardless of short-term sentiments. In the latest earnings call, despite the setbacks suffered by its business from supply chain issues, customer project delays brought on by the Ukraine conflict, and cancellations related to Russia, company has stood by its positive future growth guidance. Investment in Mirion is not only a bet on clean energy, but also an investment in a business that aims to increase shareholders value return despite the volatile nature of the industry.

Short rundown of Mirion’s business

Mirion Technologies is a leading provider of detection, measurement, analysis and monitoring solutions geared towards multiple end markets (Medical, Industrial, Defense and Research), with a main focus on Medical and Industrial segments. With a large diverse addressable market, their products and services allow their customers to safely leverage the power of ionizing radiation. While medical is focused on enhancing the effectiveness and safety of life-saving procedures, industrial segment is focused on addressing critical radiation safety.

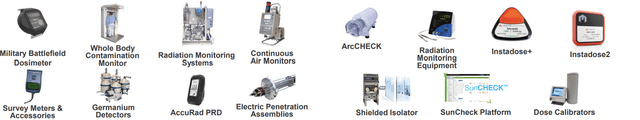

Product Portfolio (Company Website)

The above product portfolio covers hardware and software for radiation therapy quality assurance, Dosimetry solutions (measuring the amount of radiation medical staff members are exposed to over time), Radionuclide Therapy Solutions (nuclear medicine), monitoring, detection, identification, and quantifying instruments for industrial radiation.

Resilience of Mirion’s business

The nuclear and clean energy industries have been highly cyclical. This cyclical nature has had an effect on most businesses involved with the sector. But looking at revenue growth of Mirion from 2005 – 2021, we see that CAGR exceeds 10% and FY 2021 stands at $612 MM. This kind of growth is very difficult to see with industries directly involved in the nuclear/clean energy space (If we use Cameco Corp (CCJ) as a proxy for nuclear industry, revenues have been flat over the same period). With the turning economy that comes with declining topline growth, Mirion was still able to provide a positive adjusted growth guidance (4 – 6%) for 2022. It boasted an increase in year-to-date order growth of 25%.

How is Mirion able to maintain such resiliency, and would this resiliency hold for the future?

- Growing through acquisitions: Mirion has acquired 10 – 15 businesses in the last 15 years and although a majority of them were small, it expands the total addressable market and improves its growth profile. This well honed acquisition playbook will continue to provide more opportunities for Mirion to further expand its business.

-

Diversification of revenues: Since the industry is rife with changing sentiment, being overly exposed to one customer would put the business at serious risk. Information as late as 2020 revealed that top 5 customers represented only 21% of the total sales. Additionally, Mirion’s initial forte was the industrial segment, but over the years the revenue mix saw increased contributions from medical and other segments. There are multiple positives due to an increased exposure to the medical segment:

- Large, fragmented market and medical needs are not linked to specific geography (unlike the industrial segment where not every country uses nuclear energy)

- Medical device industry is a higher margin industry

- Aging population and increasing incidence of cancer needs to be met with better devices for radiation treatments, as radiation treatment is prescribed in more than 60% of the cases

- Medical needs are stable and immune to economic swings.

3. Recurring revenues: High barriers to entry and long customer relationships (Nuclear plants have long lifecycles and Mirion’s products are integrally involved throughout the entire Nuclear plant Life Cycle) have resulted in more than 70% of the revenues being recurring. Also, Mirion’s products are well geared towards safety and maintenance and would not see a cutback regardless of the economic conditions.

4. Energy needs and clean energy revolution: As more of the population aspires towards a higher standard of living it will be only met with increasing energy consumption and this effect is more pronounced in developing countries. Conventional means of increasing or replacing energy output will not fall in line with global decarbonization goals.

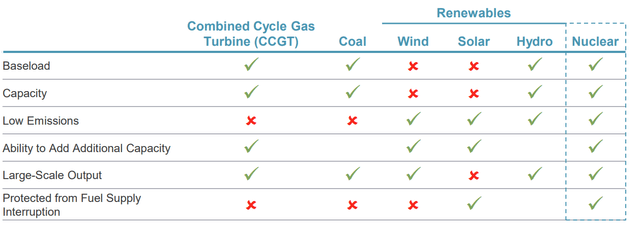

Although there are renewable sources of energy which most countries (developing or otherwise) can aspire to, this has several shortcomings. The below table gives a helpful comparison on how nuclear is a clear standout among the different energy sources.

Comparison of various fuel sources (Company website)

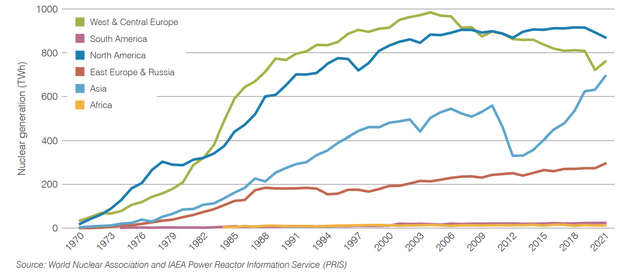

It is quite evident many countries across the world have realized this. Although, mainstream news shows Germany, Japan, and a few developed economies planning to phase out nuclear plants, a holistic view of the market suggests otherwise.

Nuclear power generation (World Nuclear Performance Report – 2022)

According to the WNA, in September 2022 there were 60 reactors in construction, 96 reactors planned, and 330 proposed. Clearly, the runway for growth in nuclear energy market far eclipses the phase out planned by certain countries. Additionally, ≈7% of Mirion’s revenues comes from the Decommissioning and Decontamination market, which is only expected to grow as more plants are retired.

Valuation

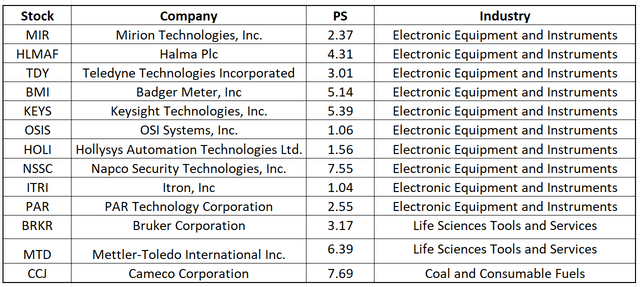

Since Mirion is currently not profitable, let us use the Price-to-Sales Ratio as a valuation metric and compare this against its peers in the same industry. When Mirion initially listed, calculating PS/ using FY 21 gave us a ratio 3.7. The subsequent souring market sentiment on SPACs and the ongoing bear market had pushed this all the way down to 1.8. It currently stands at 2.4 and it could very well get cheaper again from here. But what do we see when we compare the current P/S ratio with its peers in the industry?

Price-to-Sales Ratio (Author computed)

Within the “Electronic Equipment and Instruments” Industry, the average P/S ratio stands at 3.4, and if one were to slightly extend this exercise to include few other companies (From the Medical and Uranium Industries), the average would start shooting even higher.

In terms of Forward P/S multiples, assuming a 4% growth rate (lower end of management’s adjusted guidance), we see modest decreases in the ratio at 1.76, 1.69 and 1.62 for FY 2022, 2023 and 2024 respectively. Compared to its own valuation in the past and also within its peers, our P/S Ratio suggests to us that Mirion is undervalued at its current levels and a buy is warranted here.

Risks

The nature of the industries Mirion operates in makes it unlikely to face conventional risks to its business, and this was well demonstrated in the earlier section. Even when it comes to competitors, there are high barriers to entry, and currently Mirion is the market leader in most of the categories it operates in. So where do the biggest risks lie for Mirion?

Acquisitions

Relying on acquisitions for growth can be a double-edged sword. Currently, Mirion has about $1.6B recorded as goodwill in its balance sheet. If the company cannot successfully integrate or if the perceived value is not realized, it can result in significant write-downs, which will affect profitability. Also, since Mirion is currently not profitable and has only about $100M of cash on its balance sheet, any further acquisitions may have to be funded entirely by debt, which may deteriorate its financial health.

Russia-Ukraine conflict

Arguably, Russia’s expertise in nuclear power is quite unmatched. Russia has significant ambitions in scaling its nuclear energy output, and other countries also frequently defer to Russia for new builds. Mirion’s downside exposure to the effects of this conflict was further demonstrated from their Q1 and Q2 2022 earnings call:

Following the conclusion of our first quarter and analyzing the current global operating environment, we are updating our full year 2022 guidance,” continued Mr. Logan. “These updates reflect the removal of remaining Russian-related projects from our 2022 guidance, largely offset with new opportunities in the defense and nuclear power sectors. We don’t have the ability to project how the situation in Ukraine may affect our business in the future and felt it prudent to provide guidance that reflects current expectations..

The company recorded a goodwill impairment charge of $55 million in its Radiation Monitoring Systems (RMS) business due to the cancellation by one of RMS’s customers with a Russian state-owned entity to build a nuclear power plant in Finland (e.g., the Hanhikivi Project) as a result of the Russia-Ukraine conflict..

Supply Chain

As an Electronic Equipment manufacturer, Mirion relies on third-party manufactures for non-core components for certain products or services. Although the supply chain has begun to stabilize in recent months, if there are any further disruptions and Mirion’s suppliers experience supply shortages or component price shocks, it could very well have an effect on Mirion’s business.

Who should invest

At a base-case scenario, this investment would be well-positioned for an investor who wants to invest in the clean energy space or be part of the sustainable energy industry movement but wants their risks to be minimal. Many names in these industries are either operating under massive losses and have volatile earnings or are hiding behind sketchy financials. In addition to being part of the clean energy industry, Mirion is also diversifying its core revenues towards the medical industry, which plays a bigger role towards having stable revenues.

In an optimistic scenario, if one were to wholly lean on major adoption of clean energy (with nuclear industry taking the center stage) and mass adoption of its products in the medical industry, these would be the right catalysts to turbocharge its business and provide an investor with above-market returns.

“Editor’s Note: This article was submitted as part of Seeking Alpha’s best contrarian investment competition which runs through October 10. With cash prizes and a chance to chat with the CEO, this competition – open to all contributors – is not one you want to miss. Click here to find out more and submit your article today!”

Be the first to comment