SteveLuker/E+ via Getty Images

The iShares MSCI Australia ETF (NYSEARCA:EWA) isn’t badly positioned at all with its sectoral exposures. But for all the financials it holds, it is a littler hamstrung by a more dovish Royal Bank of Australia. Materials exposures though are generally more well positioned than a typical portfolio, and give a lot of USD denominated market exposure where the AUD might be a bit of a weak spot. Overall, it’s a decent ETF, but we’d prefer to select out specific Australian exposures that have less AUD risk and have more pointed commodity exposures given the current environment.

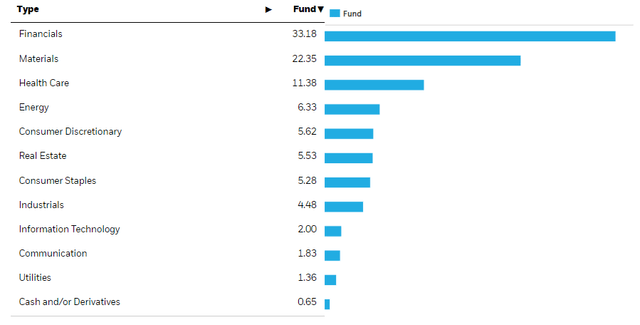

EWA Breakdown

Let’s start with the sectoral breakdown.

The thing to note is the large financials exposure. This includes elements like Macquarie (OTCPK:MCQEF) which is a full-service bank. It’ll have some countercyclical elements in the public markets divisions, with pro-cycle elements in the capital markets divisions. On balance there is resilience though. Otherwise, it is more traditional banking and financial exposures which are going to be levered to rate hikes. Most of this financial portfolio is positively levered to rate hikes, which is why it’s a little unfortunate that leverage in the Australian housing market is hamstringing the monetary authorities from more aggressive rate hikes to fight inflation – thus bucking the trend. Indeed, this isn’t great for net interest income evolutions for the companies. Where there are insurance exposures, the downside is limited growth on reserve portfolios. But it is essential, because the Australian housing market is one of the most overvalued in the world, and is therefore very leveraged with substantially variable rate bonds. The recent RBA hikes signals a relatively slow pace of rate hiking, if there would be anymore at all, relative to the vast majority of other western economies.

Overall, the financial exposures are not ideal relative to other economies, but the material exposures are looking pretty good, which is 22% of the allocations to the financials’ 33%. Woodside (WDS) is one of the major exposures, and gives upside to the gas prices, which are likely to go even higher. Natural gas futures are retreating even though this winter, almost upon us now, might see a total stop in supply from Russia. Otherwise, materials exposures are a little more mixed, an example being BHP (BHP) which has both metallurgical coal and iron ore exposures which have more downside, while copper will see more secular upside at least. Similarly, Rio Tinto (RIO) has a lot of pretty undesirable iron ore exposures, which are seeing hard turnaround from the fiscal and monetary boom of the last couple of years. There is some balance with other materials which puts it in an alright position relative to some other miners, but it’s not ideal.

Healthcare sits at 11% which should also be resilient.

Remarks

The portfolio yields about 7.4%, which is what you’d expect from all the financial exposures, which all pay very solid dividends, as well as the material companies which are still printing cash but whose forward earnings uncertainties have compressed their multiples and upped yields. The PE is at 11x, so about a 9% earnings yield. Relative to Australian risk-free instruments that seems good, and that the equity risk premium is being properly priced. However, on a global level, we may see pressure on the AUD. Slower rate hiking will mean some pain for the AUD. At least many of the Australian resources trade in the USD reserve currency, and this is a nice mitigating factor for investors to consider. Still relative to a global standard for risk-free rates, which could go above 5%, a 9% yield seems just about appropriate, with perhaps some room for downside. Overall, EWA is alright, but it’s not a no-brainer.

Thanks to our global coverage we’ve ramped up our global macro commentary on our marketplace service here on Seeking Alpha, The Value Lab. We focus on long-only value ideas, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 6 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, us at the Value Lab might be of inspiration. Give our no-strings-attached free trial a try to see if it’s for you.

Be the first to comment