Cindy Ord

Thesis

When a company is trading at x10 EV/EBIT, I like to define it as a deep value opportunity. Because on an unlevered basis, the business would return a yield of 10% (inverse the EV/EBIT multiple).

After a sharp selloff, down about 39% YTD, Comcast Corporation (NASDAQ:CMCSA) now trades at a one-year forward EV/EBIT of x9.7.

Comcast’s valuation is very cheap, I argue, and not justified reflecting on the business’ fundamentals and potential. In my opinion, the company should be worth at least $38.75/share, which is in line with an 8% yield.

Not The Time To Worry

If a company trades at an EV/EBIT multiple close to x10, then investors would expect that the respective stock might be a value trap – meaning that the business shrinks and/or loses profitability. But this is not the case for Comcast.

During the past five years, Comcast managed to expand its topline at a CAGR of about 7.5%, growing from $85 billion in 2017 to $121.7 billion in 2022 (TTM reference). Over the same period, operating income grew at a 5.5% CAGR reaching $22.2 billion in 2022 (TTM reference).

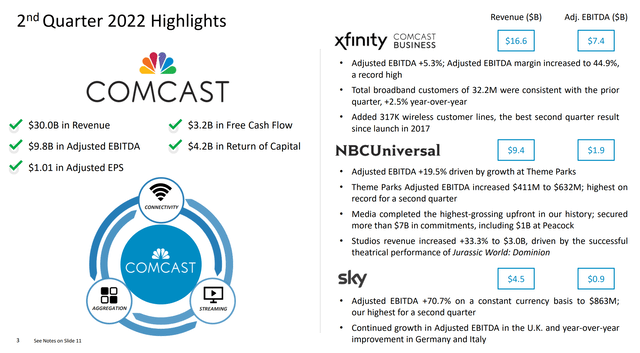

Comcast even managed to perform in Q2, a quarter which was clearly pressured by multiple macroeconomic headwinds. Notably, the company managed to increase adjusted EBITDA by 10.1% year-over-year, to $9.8 billion. Respectively, adjusted EPS increased by 20.2% year-over-year, to $1.01/share.

Comcast Q2 Results Presentation

Brian L. Roberts, Comcast’s Chairman and Chief Executive Officer, commented (emphasis added):

Our financial results in the second quarter were very strong across the board, with Cable, NBCUniversal, and Sky each delivering solid growth in adjusted EBITDA, resulting in a double-digit increase in adjusted earnings per share and healthy free cash flow generation.

In Cable, we achieved our highest adjusted EBITDA margin on record even amid a unique and evolving macroeconomic environment that is temporarily putting pressure on the volume of our new customer connects.

NBCUniversal, terrific results at theme parks fueled our growth in the quarter, and we expect our recent premieres and planned slate of content and live events from our media and studios businesses, including Jurassic World: Dominion, Minions: The Rise of Gru, Nope, Sunday Night Football and The World Cup, to make significant contributions later this year, including to our subscriber growth at Peacock.

And, at Sky, we grew adjusted EBITDA by double-digits, with year-over-year improvement in each of our markets in Europe.

Looking ahead, our company is in an enviable strategic and financial position, with substantial cash flow generation and a strong foundation for innovation.

Shareholders Being Rewarded

Investors might want to appreciate that the lion’s share of Comcast’s financial success, as presented, is distributed to shareholders.

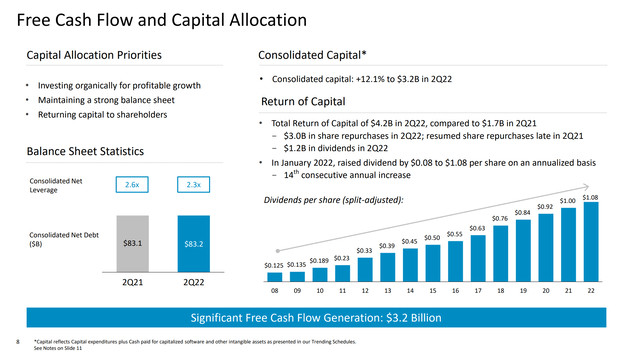

In Q2 2022, Comcast returned a combined $4.2 billion to equity investors, $3.08 billion share repurchases and $1.2 billion of dividends. Annualized, this would imply a 12.2% yield, which is even more than the 10% yield that I hinted on in the article introduction. (Long term, however, CMCSA will not be able to distribute more than the inverse of the EV/EBITDA multiple.)

Notably, from 2008 to 2022, Comcast increased dividends to shareholders at a compounded annual growth rate equal to almost 17%, jumping from $0.12/share in 2008 to $1.08/share in 2022. Comcast’s dividend yield is now greater than 3%.

CMCSA Q2 Investor presentation

Cheap Valuation

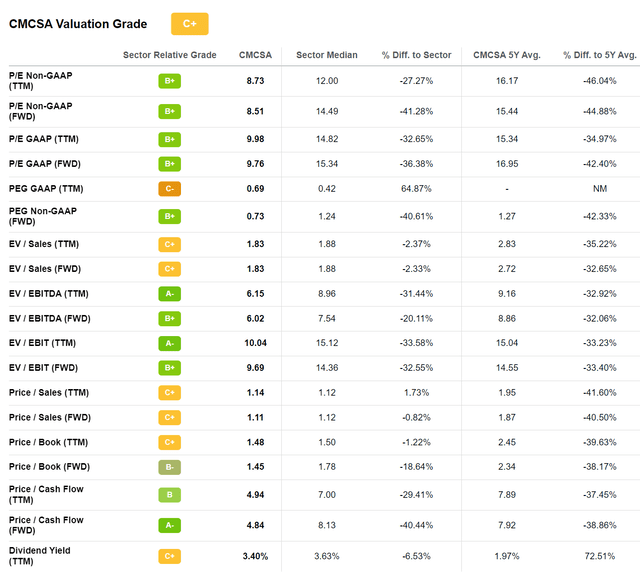

CMCSA stock is also trading cheap, consistently trading at a discount versus the communication sector with regard to all multiples. For reference, CMCSA stock is valued at a one year forward P/E of x9.7, versus x15.3 for the sector median, implying a 36% discount. The stock’s P/B is x1.45 versus x1.78 for the sector, an 18.6% discount respectively.

Personally, I would require an 8% yield for investing in CMCSA stock, which would equal a x12.5 EV/EBIT ratio and a valuation of $38.75/share respectively.

Why Could Investors Be Selling?

If CMCSA financials are strong and the valuation is cheap, why are investors still selling the stock? While there could be numerous independent and subjective reasons why single investors might be selling the stock, I argue there are two major themes.

First, in a rising interest rate environment, investors are worried about Comcast’s debt position. As of Q2 2022, Comcast recorded total debt of $98.7 billion, against cash and short-term investments of only $6.8 billion. Accordingly, Comcast’s $91.9 billion of net debt could be exposed to higher interest payment costs. If rates were to stay elevated for a longer period of time, Comcast would need to roll debt at much less favorable interest rate conditions. But investors should consider that even if Comcast’s cost of debt were to jump to 10% (about $9 billion of interest payments, versus $4.13 billion TTM), the company would not at all be in difficulty.

Secondly, Comcast suffered from the broad sector selloff in the media space – as The Walt Disney Company (DIS) lost about 35% YTD, Netflix, Inc. (NFLX) 59%, Warner Bros. Discovery, Inc. (WBD) 51% and Paramount Global (PARA) 38%. Investors became increasingly worried that competition in entertainment will eventually erode profitability, as content investments surged and global subscriber potential for streaming services suddenly hit a limit, with Netflix posting disappointing subscriber growth.

But investors should consider that Comcast is a diversified media company with strong exposure to multiple verticals, including streaming, news, cable television, film studios, theme parks, and sports. Fretting that Comcast’s portfolio has a dim future is, in my opinion, as unreasonable as believing that streaming attracts unlimited potential. Markets simply have a tendency to overreact. And now they are clearly reacting too much on the downside for the media industry.

Conclusion

In my opinion, Comcast stock is a strong buying opportunity. Looking at the share price bloodbath in the media space, I am confident in speculating that investors have overreacted – and dip buyers will be rewarded handsomely. In fact, CMCSA shareholders are already being rewarded, as the company returned a combined $4.2 billion to equity investors in Q2, $3.08 billion share repurchases and $1.2 billion of dividends (12.2% yield annualized). Buy.

Be the first to comment