BalkansCat/iStock Editorial via Getty Images

Elevator Pitch

My Hold investment rating for MINISO Group Holding Limited (NYSE:MNSO) remains unchanged from my earlier update for the company written on October 25, 2021. In that previous article, I touched on MNSO’s “new sub-brand, TOP TOY” and the company’s pace of “new store openings.”

In my current article, I focus my attention on MINISO Group’s proposed Hong Kong or HK listing and the new policy guidelines on blind boxes in Mainland China. The dual listing in Hong Kong will help to allay the market’s worries about MNSO being forced to delist from the US. On the flip side, new regulations and guidelines on the sale of blind boxes in Shanghai, China, are not good news for MNSO’s growing TOP TOY business. MNSO also appears to be fairly priced with a forward P/E multiple in the high-teens range, so a Hold rating for the stock is reasonable.

Hong Kong Listing Will Help MINISO To Address Chinese ADR Delisting Concerns

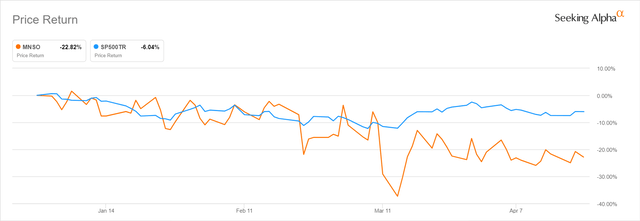

MNSO has underperformed the S&P 500 in 2022 thus far. Year-to-date, MINISO Group’s shares have dropped by -22.8% as compared with a much milder -6.0% decline for the S&P 500. As per the chart below, MNSO’s share price has actually tracked the S&P 500 quite closely between January 2022 and early-March 2022, but there was a divergence that started in the middle of March.

MINISO Group’s 2022 Year-to-date Stock Price Performance

Seeking Alpha

Notably, MINISO Group’s stock price fell by -33% from $9.71 as of March 9, 2022 to as low as $6.48 at the close of the March 14, 2022 trading day. MNSO’s share price weakness during this period came about as Seeking Alpha News reported that the SEC “named five companies from China that could be de-listed” by virtue of “not adhering to the Holding Foreign Companies Accountability Act.” This drove a broad sell-off in Chinese ADRs (American Depositary Receipts) which include MNSO, as it was uncertain if China would change its policy to allow US-listed Chinese companies to open their books for review by US regulatory agencies. But MNSO’s shares staged a decent rebound in the next month or so to close at $7.98 as of April 20, 2022, and this is closely linked to the company’s proposed Hong Kong listing.

MINISO Group announced on March 31, 2022 that it “has filed an application with the Stock Exchange of Hong Kong Limited in connection with a proposed dual primary listing.” There were already media reports published at the end of 2021 that speculated on MNSO’s planned listing in Hong Kong. In other words, MINISO Group is not merely doing a dual listing in Hong Kong to hedge against delisting risks in the US; the company might also have considered factors such as fund raising (i.e. additional financing channel) and valuations (i.e. a possibility of higher valuations in Hong Kong) in deciding on a Hong Kong listing.

In the worst case scenario that MNSO is compelled to delist its shares in the US, MINISO Group’s shareholders will at least have the option of converting their US-listed shares to shares traded in Hong Kong assuming that the proposed dual listing is successful.

Pop Toys And Blind Boxes

Moving away from the discussion on MINISO Group’s listing status, it is relevant to assess the regulatory risks associated with the company’s key growth driver, the new sub-brand TOP TOY.

MNSO’s most recent Q2 FY 2022 (YE June) financial results announced on March 3, 2022 provide an indication of how fast the company’s TOP TOY brand is growing as compared with its core legacy MINISO brand. MINISO Group’s sales generated from the TOP TOY business increased by +20% QoQ from RMB109 million in Q1 FY 2022 to RMB131 million in Q2 FY 2022. Over the same period, MNSO’s domestic revenue derived from its core legacy MINISO brand rose marginally from RMB1,874 million to RMB1,877 million on a QoQ basis.

The number of TOP TOY stores also jumped by +24% QoQ to 89 as of the end of December 2021, while the company’s store count for the MINISO brand in Mainland China expanded by a slower +4% QoQ to 3,168 as of end-Q2 FY 2022. It is clear that the new TOP TOY sub-brand is growing faster and has great long-term potential (if one compares the number of TOP TOY stores with MINISO stores).

However, increased regulatory scrutiny over the sale of blind boxes in China might be a negative for the future outlook of MNSO’s TOP TOY business. Reuters defines blind boxes as “unlabeled packages containing random novelty gifts from retailers.”

A January 13, 2022 news article published in one of China’s state-linked media publications, Global Times, highlighted that Shanghai has come up with new regulations “to strengthen ‘blind box’ supervision”, which came after The China Consumer Association “released a statement criticizing KFC”, the fast food chain operator, for “encouraging consumers’ irrational purchase behavior by launching a ‘blind box’ with toy collections.” A separate January 15, 2022 news article published by South China Morning Post on the same topic mentioned that children younger than eight years can’t purchase blind boxes, and there will be a RMB200 ceiling imposed on the per-unit sales price for blind boxes as part of the draft guidelines for the sale of blind boxes in Shanghai.

At the company’s Q1 FY 2022 earnings call on November 18, 2021, MNSO emphasized that “TOP TOY has been committed to multi-category strategy since day 1, because we firmly believe that our toys should not be limited to blind boxes and that there should be many other potential categories.” The company’s comments at this Q1 FY 2022 results briefing are essentially an implicit acknowledgement that blind boxes are still a very significant product category for TOP TOY as it stands now.

It is very likely that the new policies and guidelines pertaining to blind box sales in Shanghai will be extended to other parts of Mainland China in time to come. This might lead to lower-than-expected sales volume and weaker-than-expected profit margins for the TOP TOY business. With these new blind box sales guidelines being imposed going forward, retailers won’t be able to charge a very high selling price for such blind boxes, and speculative activity involving blind boxes (especially the trading and resale of such blind boxes on the second-hand market) might also ease.

Bottom Line

MINISO Group is at a fair valuation warranting a Hold rating. MNSO currently trades at 18.8 times consensus forward next twelve months’ normalized P/E as per S&P Capital IQ data, and this is reasonable taking into account its consensus FY 2022-2024 revenue CAGR of +24% and its forward FY 2023/2024 ROEs of 15%-17%.

While a Hong Kong listing is positive for MNSO, this seems to have been priced in to a considerable judging by the stock’s share price recovery in the past one month or so. On the other hand, MNSO’s Top Toy business is growing rapidly but new blind box regulations could be a key headwind. In summary, I have a mixed view of MINISO Group considering these two factors.

Be the first to comment