Torsten Asmus/iStock via Getty Images

Introduction

Inflation is a widespread fear throughout the market. So, what asset can hedge inflation, or even benefit from it? My answer is Teck Resources Limited (NYSE:TECK).

Commodities are often the go-to to hedge inflation as they are positively correlated with it. Unlike many other commodity companies, TECK has a more diversified portfolio of products. TECK benefits from rising copper, zinc, and steelmaking (otherwise known as metallurgical or coking) coal prices while having an operational hedge against increasing energy prices.

Note: Prices are in USD unless otherwise stated.

Commodity Inflation and Macro-Situations

First, let’s look at relevant price changes.

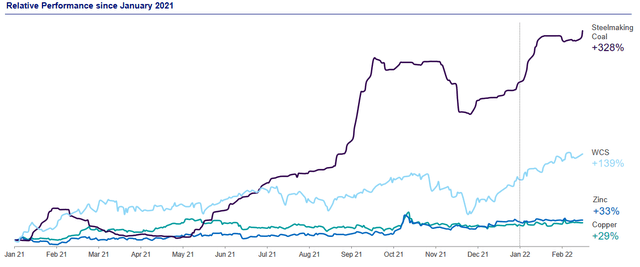

Commodity Prices (Teck Resources Q4 Investor Presentation)

Relevant commodities have all materially increased over the past year. Steelmaking coal, copper, zinc, and crude oil account for 52%, 21%, 22%, and 5% of revenue respectively for Q4 2021.

The substantial rise in the price of TECK’s primary products has led to a massive 50.6% increase in revenue year-over-year for 2021.

Steelmaking Coal

Steelmaking coal prices have been pushed up dramatically as the world’s biggest importer China informally restricted the majority of its imports from Australia, the world’s largest exporter of steelmaking coal. China has let through coal that has been stuck at customs for months, but imports are still a small fraction of what they were, so heightened prices remain.

Looking forward, another geopolitical situation is playing out as Europe looks to phase out Russian coal products. Russian coal accounts for 45% of European imports, so importers will need to pay a premium to make up the deficit. TECK’s coal may be particularly attractive as it has lower carbon emissions, meaning it may be more enticing to the increasingly green-conscious continent.

However, temporary headwinds should be expected. Steel demand has dampened for 2022. Steel demand is critical as it is the core usage of steelmaking coal. Widespread COVID-19 lockdowns and a weakened real estate market in China are causing a drop in expected demand. China being the world’s largest producer and consumer of steel is critical to the demand for metallurgical coal.

TECK has benefited from the large price increase even as its production is lower than guidance for Q1 2022 due to Canadian Pacific Railway (CP) strikes. Only 6.0m tonnes of coal were sold in Q1 under the guidance range of 6.1-6.5m tonnes. But, due to the macro-price effects, TECK still came out on top increasing sales by $88m for the segment.

It should be noted that TECK is committed to reducing its exposure to coal, so don’t expect non-price-driven growth in this segment.

Copper

Copper is needed for products of the future, meaning demand will continue to grow long-term. For example, conventional gas-powered vehicles only use 18-49lbs of copper whereas battery electrical vehicles can use 183lbs.

Copper is facing additional short-term inflationary pressure due to the war in Ukraine. Russia produces roughly 4% of the world’s copper supply, much of it ending in China.

Although the west has not enacted copper at this time, it may be in the near future. Europe’s largest smelter Aurubis is trying to “get out” of existing contracts with Russian suppliers, so it may be a sign of things to come.

China would likely be able to absorb the increased volume by rerouting trade routes, but would ultimately push up copper prices.

Although copper supply has seen its usual Chinese New Year reprieve, copper is still expected to run a deficit in 2022. As demand outpaces supply and inventories fall, expect higher prices and potentially more short-term squeezes like the one in October 2021.

Peru is the second-largest copper producer, accounting for ~11% of the world’s copper production, and the third-largest zinc producer, accounting for 9.9% of the world’s zinc production. Production in the country has been at risk as large-scale protests against inflation slow down production. This benefits TECK as supply has become more constrained, pushing up prices of the minerals.

TECK is rebalancing its portfolio towards copper and moving away from carbon producers in the long term.

TECK is going to capitalize on the long-term prospects of copper with its Chilean QB2 project which will roughly double its current production to 515-615 thousand tonnes a year from 2023 to 2025. Further, the QB mill expansion will aid TECK’s long-term goal of increasing copper production.

There is ongoing geopolitical risk in Chile, which may hurt TECK. Chile is undergoing a rewrite of its constitution, which may alter how the country treats its national resources. TECK’s strong ESG commitment may draw them favor over other multinationals if Chile restricts access to its natural resources. As of now, it is unclear where the constitution will land, even being pushed back to July 5th from the previous April meeting.

Zinc

Zinc’s primary usage is galvanization but is also used in metal alloys, batteries, and various oxides for chemical use.

Zinc is facing similar inventory shortages to copper. Zinc’s supply has been facing pressure due to high energy prices largely caused by the war in Ukraine. Smelters have temporarily curtailed production, leading to a short-term gap in the market. Zinc prices are expected to fall from the recently set all-time high in the medium term as production ramps up.

Energy

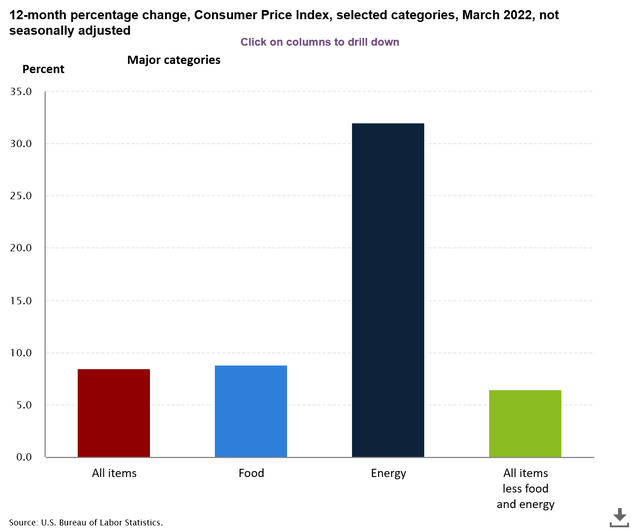

Energy inflation has been one of, if not the most, consumer visible signs of inflation (just look at all the coverage at gas stations).

Energy has been the main inflationary force in recent months.

U.S. CPI (U.S. Bureau of Labor Statistics)

TECK’s Fort Hills operation is in Alberta, so its crude tracks the Western Canadian Select or WCS. WCS generally trades at a discount of $10-$15/bbl compared to WTI as it is a heavy sour blend, making it more expensive to refine. Due to the generally higher operating costs and being a discounted blend, energy prices need to be higher for WCS to be profitable.

A $1 increase in WCS increases the recoverable amount of the Fort Hills project by $100m. The recoverable amount is the present value of the expected return over the life of the project. In the unlikely case of WCS staying at $90/bbl, the project would have a realized value increase of $4.2B in the long-term compared to TECK’s initial projection of $48/bbl. Even though this case is unlikely, it shows the degree of the recent price spikes aiding TECK.

Fort Hills’ operating cost is expected to be between $26 and $30 for 2022, as the production is now fully ramped, leaving plenty of room for profit at current prices.

As TECK’s other operations require energy products its Fort Hills operation can be considered an operational hedge. As TECK’s input costs related to energy go up, the Fort Hills operation should become more profitable offsetting the increased price of operations.

As said above, TECK is rebalancing away from carbon producers, to hit its 2050 goal of carbon-zero. So, it may divest from Fort Hill or spin off the assets, but this largely depends on shareholders’ perspectives once the results of the full production are released for Q1 2022.

Teck’s Financials

TECK’s financials are stellar, growth is amazing, and cash flow is great, while the biggest downside is the debt holding, but it is well within reason.

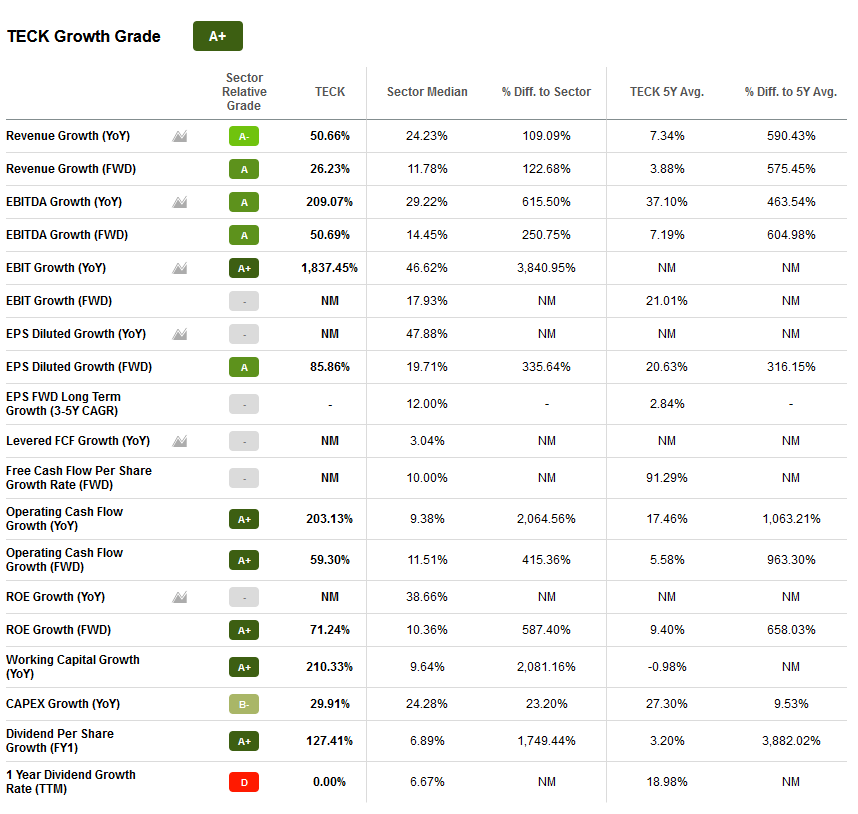

Growth Metrics (Seeking Alpha)

TECK’s growth in the last year has been largely due to the macro-driven price increases. Production has more-or-less been the same year-over-year. Obviously, growth will stay nowhere near the previous year, but it highlights the extremely beneficial macro-situation.

Dividends and Cash Flow

Dividends and total return to equity are increasing for 2022. The base dividend is increasing to $CAD 0.50 as well as additional buybacks have been approved for a total of $CAD 635m in return to shareholders.

When inflation occurs, cash management is key. Central banks raising interest rates to counteract inflation will hinder any company that does not have a strong cash buffer and reliable cash flows as raising capital is more expensive.

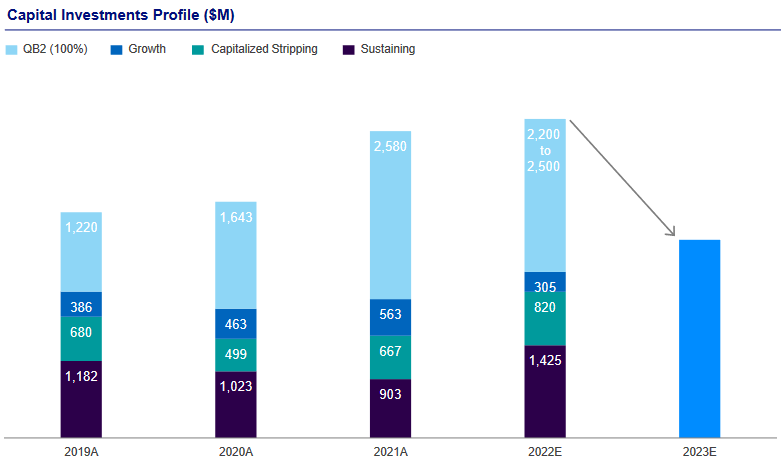

TECK has a great operational cash flow of 3.75B, while the main drawdown on cash is due to its long-term investments. Because QB2 financing will wind down, overall cash flow will increase, and 30% of the excess will be returned to investors as a special dividend.

TECK Capital Investment Forecast (TECK Q4 Presentation)

Assuming no additional large capital investments, overall cash flow should increase by $CAD ~2B, which would result in a special dividend increase of ~CAD 600m or ~CAD ~1.10/share.

TECK does carry $7.4B debt, so higher interest rates would hinder them if they need to roll the debt. But TECK’s next major debt obligation does not mature until 2030, leaving plenty of time for interest rates to normalize. Most investors are finding the 2Y rates more concerning than longer maturities, hence the recent slight inversion of the 10Y-2Y spread. Because TECK is cutting back on CAPEX, new debt issuance is unlikely, meaning they will not be severely affected by high short to medium term rates.

If interest rates were to push bond prices down to an appealing price, TECK may take the opportunity to repurchase some of its debt instead of issuing its usual special dividend.

Valuation & Profitability Metrics

TECK’s valuation has not caught up with the recent explosion in commodity prices.

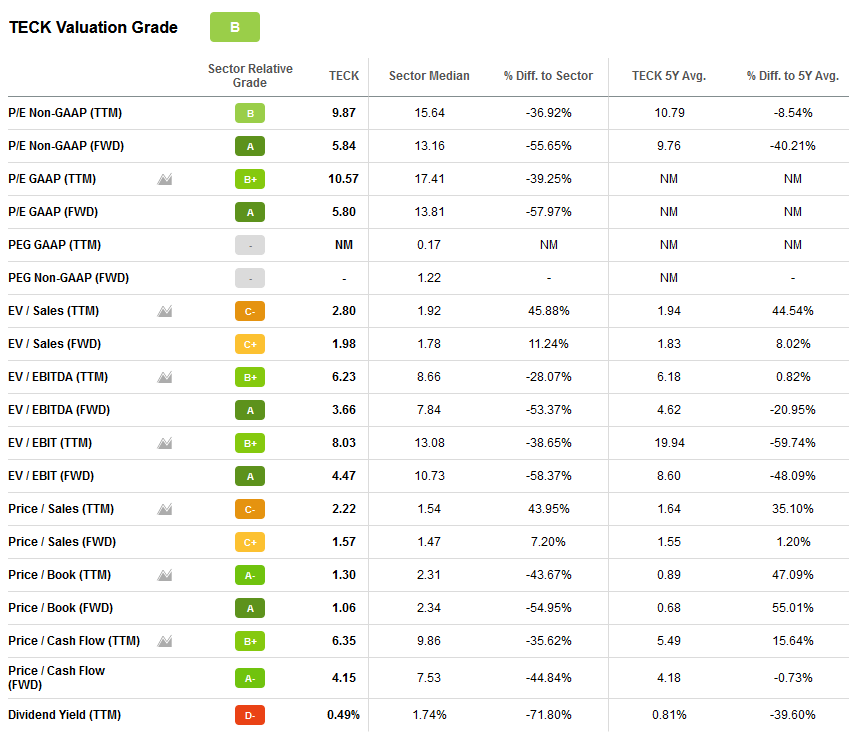

Valuation Metrics (Seeking Alpha)

TECK is trading at a discount on price-driven metrics. P/E, P/B, and Price/ Cash Flow all imply a discount, whereas TECK trades at a premium for P/S and more or less parity for forward P/S. Sales also drag down its EV/Sales metric.

In the coming years, TECK will experience above-average production growth, so past lower sales growth doesn’t represent the future. TECK’s strong growth also explains why its forward metrics are in line with the industry.

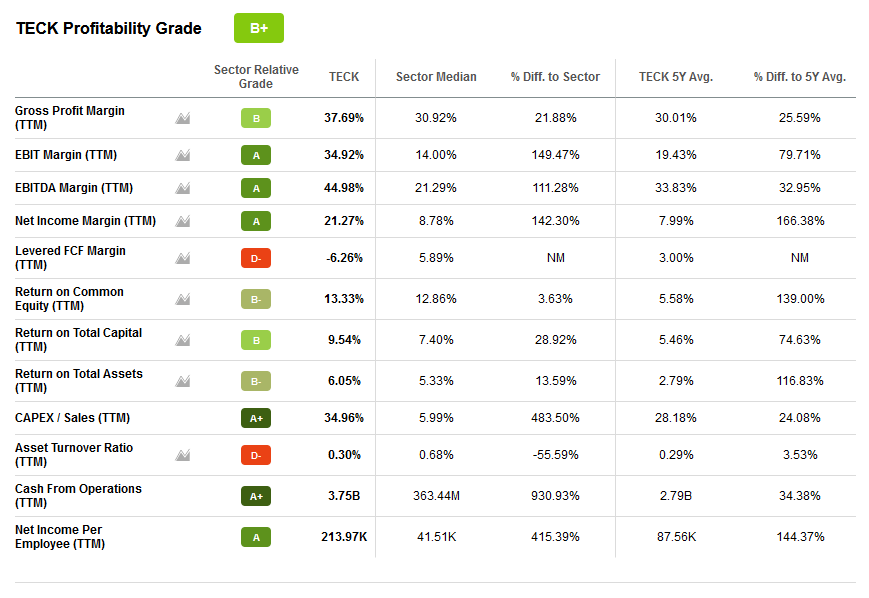

Profitability Metrics (Seeking Alpha)

Once incorporating the massive difference in CAPEX to the industry, it is easy to see why TECK will see great production growth over the coming years.

The lower-rated metrics will rise as CAPEX falls and production comes online which results in higher sales.

TECK has strong profitability margins, which is why, even though its sales metrics are lower, metrics based on earnings or EBITDA still shine.

Risks

The largest risk comes in the aforementioned rework of the Chilean constitution, but other risks do exist.

The west reopening to Russian exports would negatively impact the prices of relevant commodities, and therefore TECK. At this time, this is unlikely as more sanctions are being constantly being considered, but as the situation develops the likelihood could potentially change.

Natural disasters like the BC floods, which lowered 2021 production, can always occur.

If China continues its COVID-19 lockdowns, it will reduce how much the country imports.

Conclusion

TECK has an extremely beneficial macro-outlook as commodity prices rise. The long-term adoption of copper-needy products like electric vehicles or solar panels will increase demand for the mineral, allowing for TECK’s operational focus on the mineral to bear fruit. Although commodity prices may level off, the short-term boost has allowed for accelerated growth of TECK’s long-term plans. Ultimately, the longer inflation and therefore commodity prices stay high, the more TECK benefits.

Be the first to comment