coldsnowstorm/iStock via Getty Images

Minerva Neurosciences (NASDAQ:NERV) is a name I have not followed, nor even heard of, until its recent run. Its new price action makes for an interesting story. In this article I review its standing as an investment after its wild upswing.

Minerva’s shares traded with real urgency during the week of 08/22/2022

For Minerva the week preceding this 08/28/2022 writing was the week that was. After closing on Friday 08/19/2022 at $3.11, it hit a high of $5.19 on Monday 08/22/2022.

Before market open on 08/22/2022, Minerva filed its long delayed, as hereafter discussed, NDA for its for roluperidone for the treatment of negative symptoms in patients with schizophrenia. Also on Monday, Steve Cohen and Point72 filed a joint ownership 13G advising of acquisition of 470,000 shares, an 8.8% interest in Minerva.

After resting a bit on Tuesday, digesting the news, by Wednesday 08/24/2022, Minerva’s jets were firing again full steam, hitting a share price high of $8.58. Its volume Wednesday was exceptional leaping to >82 million shares.

Thursday 08/25/2022 was another consolidation day. On Friday 08/26/2022 it hit a peak for the week at $10.89, closing out the week at $10.33 on a volume of >61 million shares. Its price for the week from the previous Friday trough of $3.11 to its following Friday peak of $10.89 reflected an increase of >250%.

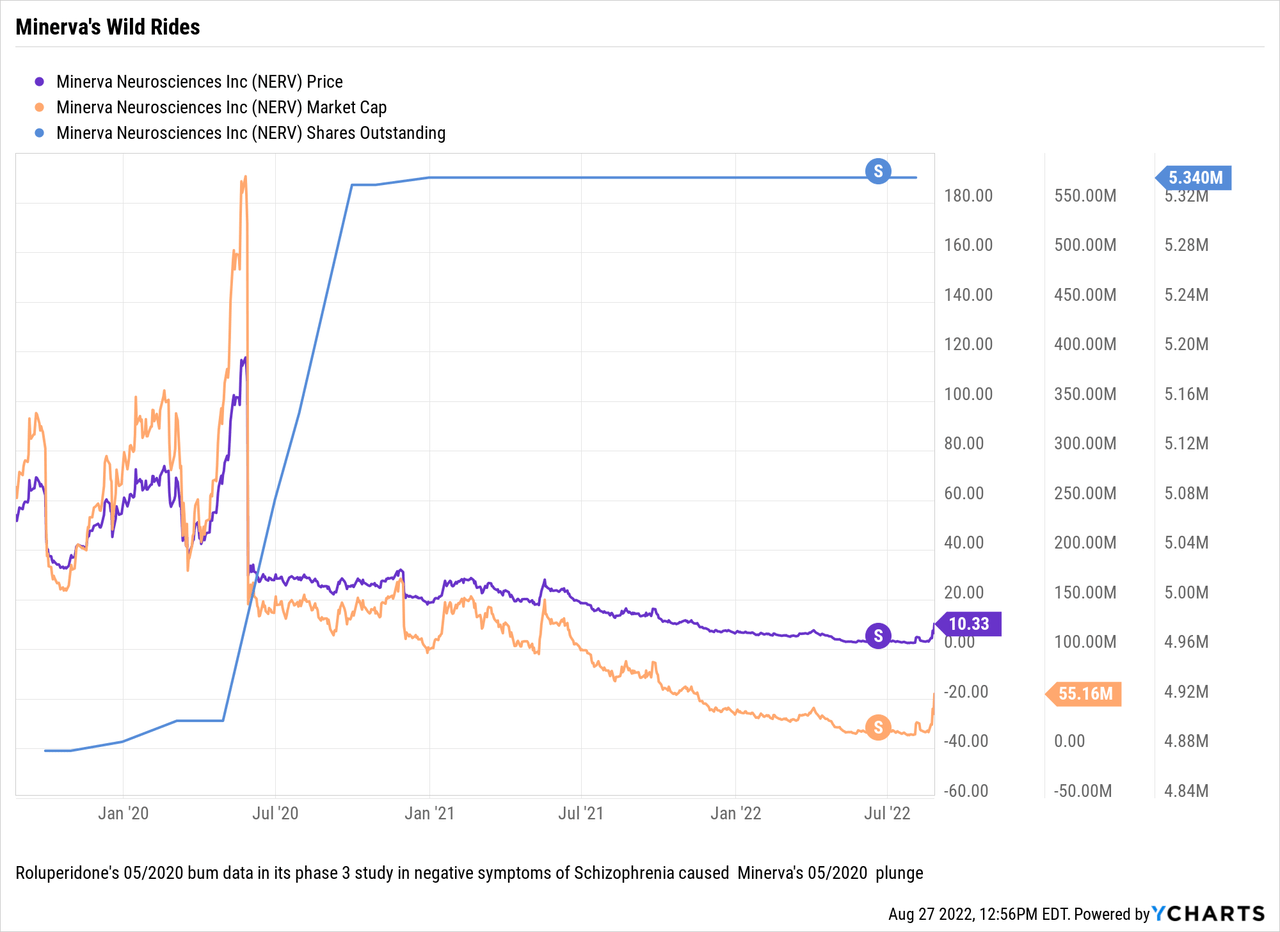

What has Minerva’s longer term share movement looked like? The chart below draws out Minerva’s share dynamics over recent years:

Minerva’s steep 05/2020 downdraft (>-81%) following its negative data release for its phase 3 trial for roluperidone in treatment of negative symptoms in schizophrenia dwarfs its recent upswing.

Minerva Neurosciences is a one trick pony with the one trick not yet fully mastered

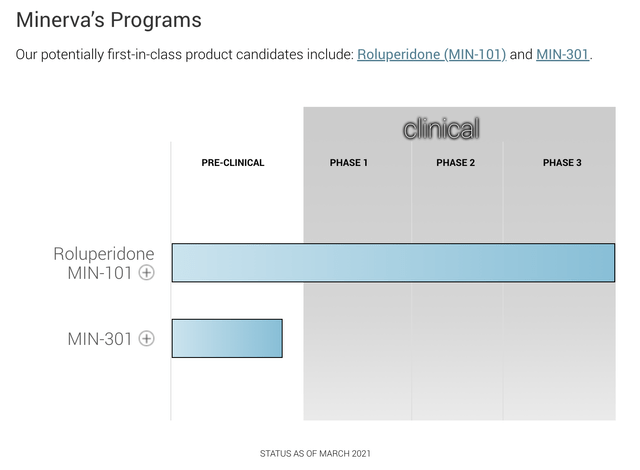

When trying to understand a new biotech name, I usually start by trying to run down its pipeline. For Minerva this endeavor was more difficult than typical. Its 2022 10-K atypically included zero help in this regard.

I moved on to check out its website. Again atypically, it includes no entry for its “pipeline” as such. However when I searched for the word “pipeline” it took me to its “programs”. There I found the following rather desolate entry which satisfied my need for a pipeline:

minervaneurosciences.com

As a preclinical program, one of many targeting Parkinson’s Disease, I give Minerva’s MIN-301 no real consideration. By my assessment MIN-301 is inconsequential in any current evaluation of Minerva.

So Minerva is all about roluperidone (MIN-101) in treatment of negative symptoms of schizophrenia. Despite its rough road back with its phase 3 data release in 05/2020, Minerva is motoring ahead with this as fast as it can.

Its progress has been halting at best as reflected by the following Seeking Alpha news items:

- 11/02/2020 Minerva schedules a Type C meeting with the FDA to advance its position of confidence in roluperidone and to discuss and define a forward path;

- 12/01/2020 Minerva and FDA at odds, with Minerva contending that the totality of the data demonstrates substantial evidence of effectiveness of the 64 mg dose, while FDA considers situation problematic for several reasons including inadequately powered phase 3 to show effectiveness;

- 05/11/2020 Minerva posts results from its Open-Label Extension [OLE] of its late stage roluperidone trial that it characterized as highly favorable in terms of longer term improvements in patients overall functioning “with few serious adverse events and no evidence of somnolence, extrapyramidal side effects or weight gain”;

- 09/30/2021 Minerva reported a positive bioequivalence study for roluperidone;

- 11/03/2021 FDA rebuffs Minerva request for a pre-NDA meeting for roluperidone, instead suggesting that a “Type C guidance meeting would be more appropriate to discuss the evidence for use of roluperidone as monotherapy”.

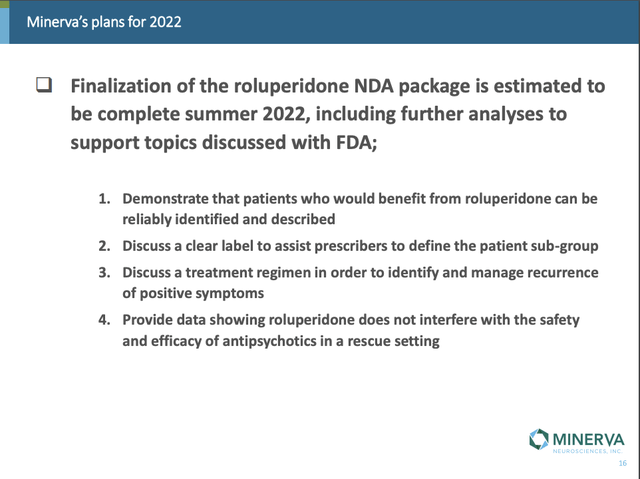

It seems that Minerva finally got the point and went ahead with a Type C meeting. On 04/07/2022 it reported minutes from an 03/02/2022 Type C roluperidone meeting, purposed so that Minerva could obtain:

…the FDA’s agreement on the use of roluperidone as monotherapy for the treatment of negative symptoms of schizophrenia in the subgroup of patients with moderate to severe negative symptoms and stable positive symptoms.

On 04/13/2022 it set up a slide deck with its “Roluperidone Update Presentation”. This was the material it used to illustrate its 04/03/2022 webcast with its Roluperidone Update; as I write on 08/28/2022 this webcast is still on Minerva’s website.

The summary slide at the close of this presentation addressed key issues raised by the FDA as follows:

seekingalpha.com

As I write on 08/28/2022, this is where the situation stands with Minerva’s 08/22/2022 filing of its roluperidone NDA. Next stop for roluperidone is FDA decision on whether to approve its filing; we should hear on this within 60 days, likely late October.

NERV will need to raise additional funds over its near to mid term

Minerva seems to have given up on earnings conference calls, having run its last earnings call for Q3, 2021. This is unfortunate because such calls provide a nice add of color to straight earnings press releases and 10-K/Q’s. But for whatever reason, current Minerva investors must make do with what’s available.

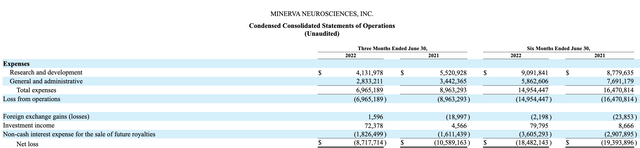

As for Minerva’s Q2, 2022 earnings press release, it lists the essentials. Most notably it listed Minerva’s bare bones liquidity position as of 06/30/2022 at ~$49.9 million. This compares to its cash, cash equivalents and restricted cash of ~$60.9 million as of 12/31/2021.

Minerva’s Q2, 2022 Statement of Operation below lists it most recent quarterly and semiannual operating expenses as follows:

Minerva Q2, 2022 statement of operations excerpt (sec.gov)

Based on this contained level of expenses Minerva’s modest liquidity should give it runway slightly in excess of a year. With Minerva’s recent share price run up, management is likely considering how it can take advantage with new ATM financing.

Conclusion

These are no doubt exciting times for Minerva’s shareholders. They have been following its efforts to get FDA approval for roluperidone in treatment of negative symptoms of schizophrenia with undoubted trepidation and likely relief now that its NDA is actually filed.

Further the entrant of a major new player on the scene has the bulletin boards buzzing. No doubt optimistic shareholders are figuring 250% last week, how about another nice run this week. Perhaps… a pullback seems more likely.

Unfortunately, the FDA filing is far from the end of roluperidone tests. First up, the application must be approved for filing. Hopefully all the prefiling rigamarole worked out the FDA’s concerns at this level, but not necessarily. Once the filing gets approved the next hurdle is for the FDA to actually approve roluperidone with a favorable label.

From there on, it’s the launch and the marketing. As of the latest word from the company, there are no other therapies approved for negative symptoms of schizophrenia. One of the companies I follow, Acadia Pharmaceuticals (ACAD), has long been pursuing an approval for its NUPLAZID in treatment of negative symptoms of schizophrenia. NUPLAZID has advanced to a phase 3 with top line results expected in 2023; so it is well behind roluperidone.

Investors who are inclined to favor Minerva’s value proposition as a pure focused play on an FDA approval of roluperidone have to hate its recent price runup. Just a short few ago it was available at a wicked sales price of just ~$3.20. What is a good price when the market opens tomorrow, 08/29/2022?

Typically after a big run like Minerva has had, it will see a pullback. I expect some type of pullback here. Regardless, Minerva will likely see lively trading for a while as investors parse out the significance of the 13-G. In checking out Point72 I ran across a pie chart showing its investment concentration by market cap. In its world Minerva, with its tiny market cap, seems an afterthought.

Little biotechs have had plenty of rough bouts with the FDA these past few years. I am smarting from recent putdowns of Omeros (OMER) and Acadia. For me at this stage it’s twice burned, thrice shy. Braver souls will never find a clearer binary choice than that presented by Minerva’s roluperidone as it seeks approval from the FDA, plus there is the added spice of Point72’s enigmatic stake.

Be the first to comment