Delmaine Donson/E+ via Getty Images

MIND C.T.I. (NASDAQ:MNDO) is an Israeli company that develops CRM software for small and medium size telecom carriers.

In a previous article from February 2022, I commented that MNDO was aware of the threats on the telcos markets, particularly arising from consolidation. The company is trying to transition into new business segments by acquisition.

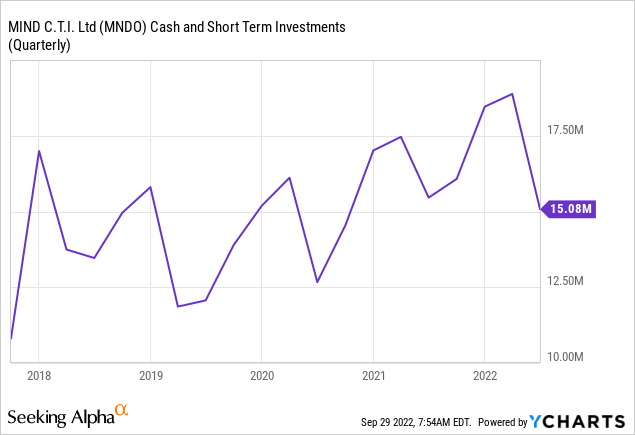

MNDO made two accretive acquisitions in 2019 and sits on $15 million in cash as of 2Q22. The company regularly declares its intention to acquire another business, but has taken time to do so. In my opinion, this signals conservativeness from the company’s management, a desirable characteristic. With significant insider shareholders, there is alignment to do the best for the company.

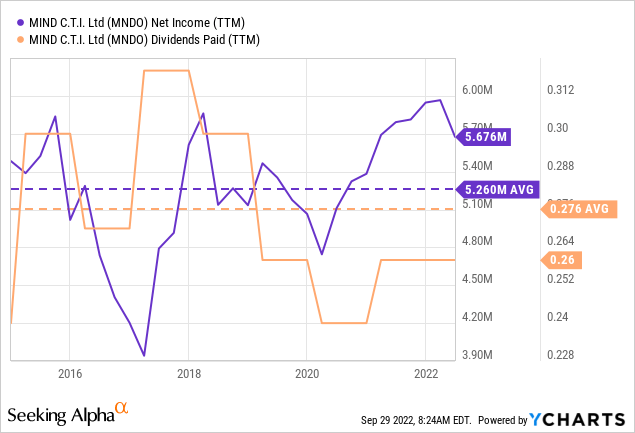

MNDO’s revenues have receded a little bit from records in 2021, but have not deviated from what is normal. For the past 10 years, the company has averaged $5.2 million in net income and paid most of that in the form of dividends. Trading at a market cap of $44 million, the company seems cheap. However, in my opinion, the risk of client loss is still there, and therefore the shareholder should ask for a higher return.

Note: Unless otherwise stated, all information has been obtained from MNDO’s filings with the SEC.

Competitive characteristics

MNDO sells different CRM solutions to small and medium size telecommunication carriers. These include billing, e-commerce platform, onboarding, customer service, etc.

For a small and medium sized carrier (called Tier III and II respectively), purchasing software from MNDO is cheaper and simpler than developing in-house. Albeit it might also be cheaper for a larger carrier, the benefits decrease with scale.

The largest problem faced by MNDO is continued consolidation among telecom carriers. Carriers need consolidation because fixed investments are high, and fragmentation leads to rivalry. Also, Tier I carriers (the ones that own country or continent sized networks) have incentives to acquire downstream, to get closer to end customers and appropriate more value.

For example, MNDO derives 60% of revenue from European customers. Europe is famous for protecting competition in the telco industry, and for avoiding multinational consolidations. This creates a landscape with small countries with many carriers each, instead of the continent sized carriers in Asia or America. But this situation may change, and it does not depend on MNDO. A Reuters article from February comments on Europe’s changing attitude towards consolidation, hoping to attract investments in fiber and 5G. Some companies like Vodafone are trying to test that changing regulatory attitude by engaging in consolidation.

The risk is not that MNDO is going to find itself out of business in a short period. The company’s business is recurring, with licenses that last more than one year. The problem is that the trend goes towards fewer and fewer clients, that are not replaced by new carriers.

In terms of supplies, MNDO hosts its R&D operations in Romania. This is a price conscious decision, comparing an average $800 salary in Romania with an average of $3.5 thousand for Israeli workers. This has probably allowed the company to remain competitive and profitable.

In search of new business

MNDO’s management repeatedly states that the company is looking to acquire a business in other software segments. The company also stands on top of a $15 million cash reserve that it plans to use for this purpose.

While many companies would have rushed to acquire any company at any price just to promote a new business segment, MNDO has taken things calmly. To me, this signals positive characteristics of management, looking to protect the business’ long-term prospects rather than pumping the stock based on promises.

I think this is related to management’s position in the company. In particular, the company’s President and CEO, Monica Iancu, is the largest shareholder with 16.5% of shares. That means the company’s chief strategist has a lot of skin in the game. This again helps align interests.

The above gives me confidence that when and if MNDO acquires another company, it will definitely be beneficial to MNDO’s shareholders.

As an example, MNDO’s acquisition of two mobile messaging solution developers in Germany, in 2019, proved extremely accretive. Purchased for only $3.2 million, the companies are already generating half of MNDO’s revenues, and as much as 25% of operating income. More information was provided in my article from February.

Recent quarters, calm before a storm?

The information published by MNDO since I published my last article on the company has not changed my understanding of the situation.

The FY21 20-F annual report showed that the telco CRM segment was not losing steam yet, and that mobile messaging was quickly increasing revenue, reaching half of that year’s business. MNDO commented that part of the messaging segment’s revenues were non recurring and therefore a decrease should be expected.

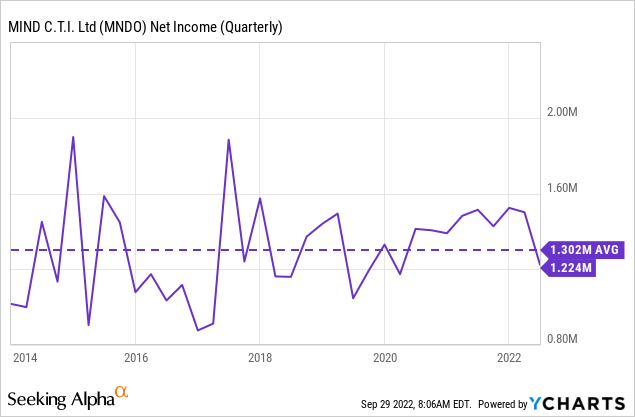

In 1H22 the situation did not change either. Revenues fell a little bit in 2Q22 against 4Q21 (from $6 to $5.2 million), as net income did (from $1.5 to $1.2 million per quarter) but it is not something that is outside of regular business cycles, as the chart below shows. In fact, MNDO was able to renew contracts and upsell licenses to two important clients in the telecom sector.

But this relative calm should not make the investor forget that the real risk, of slow but almost certain client disappearance in the telco segment, is still there. That risk can only be diminished by regulatory actions against telco carrier consolidation (for example in the Vodafone case in Europe) or by MNDO’s growing into different segments.

Another risk, mentioned by Donovan Jones in a recent article on MNDO, is the company’s exposure to Europe. With the continent’s situation showing sign after sign of weakness, one might wonder if MNDO could be affected. My take on this issue is that the messaging business can be negatively affected but that the telco CRM business can actually be favored by a crisis in Europe.

Messaging is moved by advertising and customer interaction, this segment can definitely be affected if there is less money to spend on advertising or customers are less active.

In contrast, the CRM business is moved by the number of subscribers each carrier has, and that is unlikely to fall too much during a crisis. The risk that a carrier will transition into inhouse developed software is also lower, because that transition would require investments in software and training that are less likely in a financially strained situation. The carrier cannot function without a CRM, and therefore it is more tied to MNDO’s products.

Is the price cheap?

Since I recommended a hold rating on MNDO in February, the stock has lost almost 27%, against 17% for the Russell 2000 and 16% for the Israeli TA AllShares.

Today, the company trades at a market cap of $44 million, against average yearly income of $5.2 million. MNDO’s ADR price of $2.21 promises a 9% yearly dividend yield after considering 25% Israeli withholding tax.

Another possible benefit is to participate in the expansion of the company to new segments through accretive acquisitions. The problem with this benefit is that it is highly speculative. While I have confidence that MNDO’s management is judgmental when valuing possible acquisitions, betting on them finding one based solely on good intentions does not appeal to me.

In my opinion, MNDO could very well continue delivering the same level of profits it has been generating for much of the past decade, but that is outside of their control. Their future results depend on Europe not moving towards telco carrier consolidation.

The situation would be different if mobile messaging represented a more significant portion of their business, or if they had diversified towards other segments already.

I prefer to watch from the fences in this case. If MNDO can grow the mobile messaging segment, and particularly if it can strike a promising acquisition, it may become more interesting.

Be the first to comment