Michael Vi

Software company Palantir Technologies Inc. (NYSE:PLTR) scrapped its 30% sales growth target in the second quarter amid a slowdown in the commercial business.

Although Palantir just announced that the Department of Homeland Security renewed a major contract with the software company for the provision of software for Homeland Security Investigations, I think that new deals (as significant as they may seem), don’t justify optimism for the stock.

With 3Q-22 earnings just around the corner, Palantir could be in for another earnings miss if the commercial segment slowed throughout the third quarter (which is what I expect).

Changes To Recent Short Position

I am biased in my analysis of Palantir Technologies because I recently opened a short position in the software company via put options. I recently modified my short position because Palantir, in my opinion, faces more downside when it reports third-quarter earnings:

- I have swapped my $6-strike puts for $5-strike puts;

- I have pushed out the maturity of my put options from March ’23 to January ’24.

Both changes reduce my risk and give me a longer time frame for the short position to play out.

Government Contract And Deal Value

Palantir issued a press release two days ago, celebrating a renewed contract with the Department of Homeland Security that has a worth of $96 million.

Palantir has a long-standing relationship with The Department of Homeland Security and, therefore, the deal adds to Palantir’s recent success streak of winning contracts from the U.S. Army Research Laboratory, which had a deal value of $99.9 million.

According to the press release, the contract sets forth requirements for Palantir to work together with Homeland Security Investigations (HSI) to support Investigative Case Management. The total contract value of $95.9 million will be recognized over a 5-year period, as is customary for multi-year service contracts like the one Palantir recently obtained from the Department of Homeland Security.

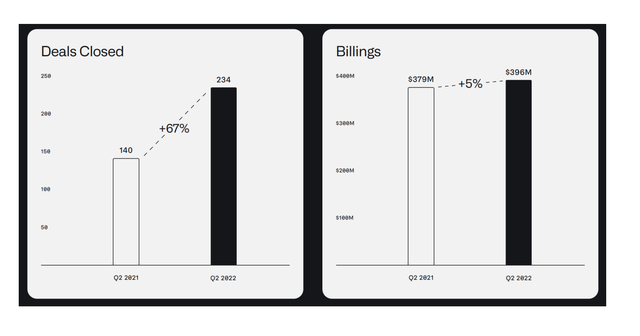

Overall, Palantir’s deal situation appears to be favorable. Besides the announced deal with the Department of Homeland Security and the deal with the U.S. Army Research Lab, Palantir closed a total of 94 small and big deals in the period between the second quarter of 2021 and the second quarter of 2022. However, billings remained relatively stable in the second quarter, increasing by only 5% YoY.

Deals Closed (Palantir Technologies)

The new agreement with the Department of Homeland Security is clearly a positive development for Palantir, which has come under increased scrutiny after abandoning its 30% annual sales target amid a broader slowdown in both the government and commercial sectors.

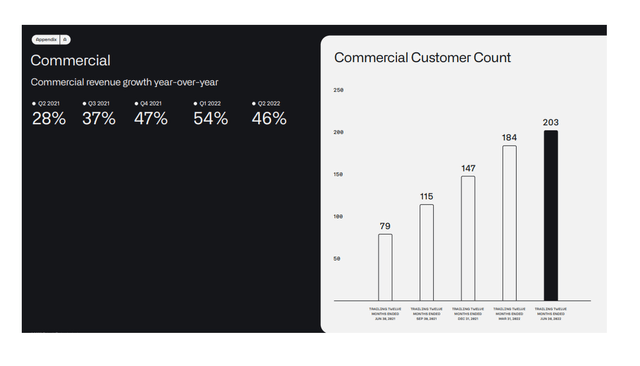

Palantir’s commercial segment unexpectedly slowed in the second quarter, with growth peaking at 54% YoY in 1Q-22 before dropping to 46% in 2Q-22.

Having said that, successful contract bids in the government sector could help Palantir offset overall slowing sales growth, but I am skeptical that this will help the company grow into its enormously stretched valuation.

Commercial Customer Count (Palantir Technologies)

Palantir Remains Substantially Overpriced As It Gears Up For 3Q-22

According to Yahoo Finance’s current earnings estimates for the third quarter, the market expects adjusted earnings of $0.05 per share this year (results of which will be reported in early November).

However, on a non-adjusted earnings basis, Palantir is set to continue its unprecedented streak of incurring losses, and recent contract renewals will not change this. I believe it is reasonable to expect Palantir to report a net loss of $460-$500 million in 2022, which would add another $500 million to the company’s already massive $5.8 billion accumulated deficit.

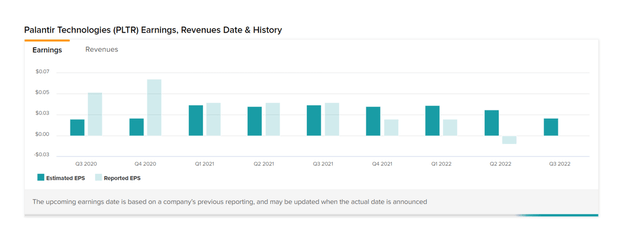

The overall state of Palantir, despite the contract win from the Department of Homeland Security, is a fragile one, particularly if one considers the fact that Palantir failed to meet low earnings expectations in the last three quarters.

The earnings estimate for 3Q-22 is only $0.02 per share, which the company may fail to meet if the commercial business continues to slow during the third quarter.

Estimated And Reported Earnings (Yahoo Finance)

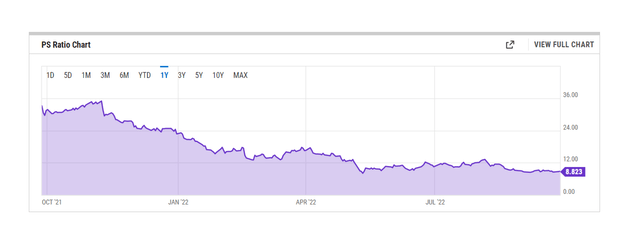

Despite the obvious headwinds and challenges that Palantir faces, the stock is valued at a sales multiple of 8.8x.

Why Palantir Might See A Higher Valuation

In order for Palantir to be valued higher, a couple of things must align, in my opinion. The analytics company must be able to achieve at least some scale with its commercial customers, which is critical for the company’s growth.

Palantir may also need to sign more large-scale contracts with government entities to offset declines in the commercial business. Palantir scrapped its 30% sales growth target in the second quarter of 2022 due to growing macroeconomic challenges, so the chances of this happening are very low in my opinion.

Given that Palantir still has a very high valuation based on sales, and that the company may have seen an ongoing commercial slowdown, I believe that Palantir does not offer appealing upside potential, contract win or not.

My Conclusion

The recently announced contract renewal from the Department of Homeland Security should not distract investors from the fact that the company’s sales growth is slowing and that Palantir may not have reached bottom yet.

The commercial slowdown is concerning, as is the fact that Palantir has failed to beat earnings estimates three times in a row. Despite these challenges, and with no profits in sight, Palantir is trading at a sales multiple that is far too high.

To account for the possibility of continued stock price weakness, I have made two minor changes to my short position to give me more time for the short thesis to play out.

Be the first to comment