gguy44

The major market averages grinded higher from open to close yesterday in what seemed to be anticipation of divided government. Early polls showed that the Democrats are likely to lose control of either the House or Senate after today’s midterm elections. According to Wall Street, a split government in which nothing gets accomplished for the next two years is ideal, because it gives businesses more certainty about the economic outlook. It also reduces the likelihood of additional fiscal stimulus, which limits upward pressure on long-term interest rates, as well as the need for more restrictive monetary policy.

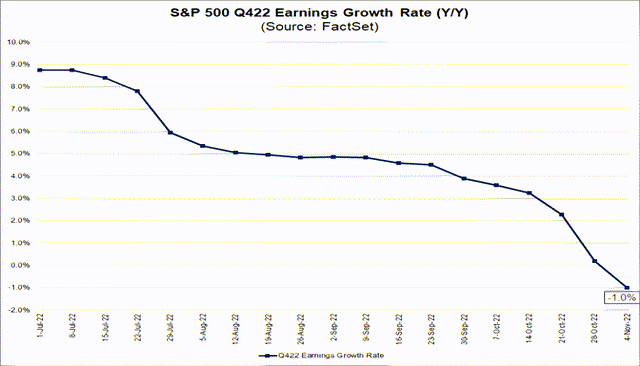

As stocks grind higher, earnings estimates for the fourth quarter continue to fall lower to a level that now reflects the first year-over-year decline in profits (-1%) since the third quarter of 2020. The consensus estimate was for growth of 3.9% at the beginning of the quarter, so the reduction in response to management feedback on earnings conference calls has been sharp. The expectation is that we will return to growth in the first quarter and sustain it through the end of 2023, but that obviously hinges on whether we avoid a recession next year. If earnings do trough in the current quarter, it will be no coincidence that the bear-market low for the S&P 500 was in mid-October.

Most of this year’s most ardent bears have been forced to push out their recession calls to 2023, as resilient consumers would simply not comply, despite a 40-year high in inflation, surging mortgage rates, and an increasingly restrictive monetary policy. I think that what most economists and market strategists missed is that the ongoing recovery from the pandemic-induced recession was fueled from the bottom up, which was a very different response from what we have seen in prior economic downturns. Understandably, some will blame the inflation we have today on that unprecedented fiscal stimulus, but there are several other temporary factors involved. Additionally, that stimulus has been key to prolonging this expansion by allowing consumers to maintain real spending growth in the face of these price increases. I think the temporary spike in inflation is the lesser evil.

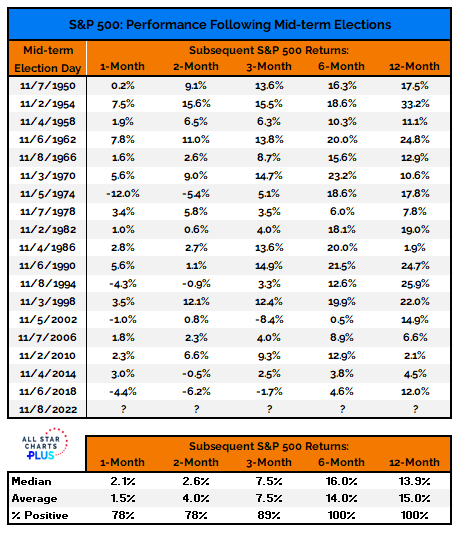

My bullish outlook for both the market and economy in 2023 is based on a more rapid decline in the rate of inflation than the consensus now expects, which results in a return to real-wage growth, leading to a continuation of the very modest real consumer spending growth we have seen this year. That should also lift sentiment, which has a lot to do with retrenchments in economic activity, otherwise known as a recession. Sentiment should improve as inflation abates. My outlook has another strong tailwind in the precedent for S&P 500 performance during the 6- and 12-month periods following midterm elections. Since 1950, the returns for both periods have been stellar 100% of the time. Will this time be different?

Bloomberg

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment