blackdovfx

Investment Thesis

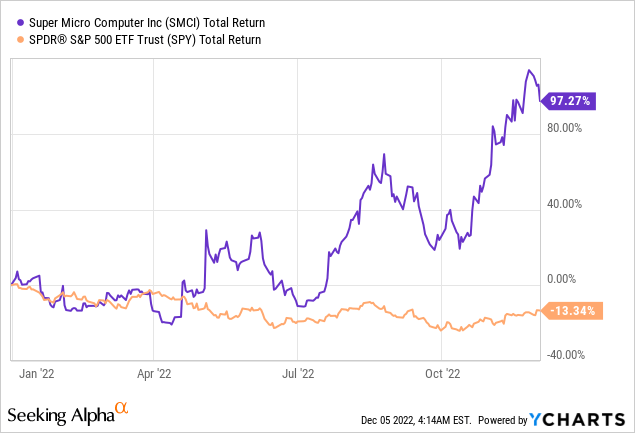

Despite Super Micro Computer (NASDAQ:SMCI) stock’s doubling over the past year, I believe this company still has strong growth potential over the next few years thanks to its prospective operational growth, valuation, and investors’ underestimations.

Quick Business Description

According to the most recent 10-Q filing, Super Micro Computer is a Silicon Valley-based provider of accelerated computing platforms that are application-optimized high-performance and high-efficiency server and storage systems for various markets, including enterprise data centers, cloud computing, artificial intelligence, 5G, and edge computing.

As of September 30, more than 90% of total sales come from the “Server and storage systems” segment [an assembly and integration of subsystems and accessories, and related services], while the other part comes from the “Subsystems and accessories” segment [server boards, chassis, and accessories].

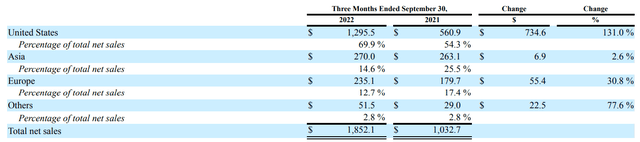

In 2022, the company has shifted its focus even more clearly to the U.S. market and gradually reduced its dependence on the Asian region – apparently, the management sees the greatest opportunities for end-market development in North America, as evidenced by the year-on-year sales growth there.

Financial Analysis

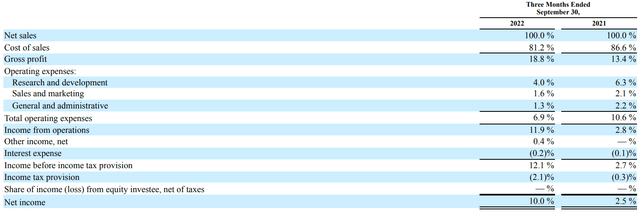

In early November, SMCI reported Q1 2023 results in which it reached its highest point of TTM revenue of over $6 billion. In Q1 2023, revenue was $1.852 billion, up 79.34% from Q1 2022, YoY. At the same time, the company’s gross profit increased by 151.6%, YoY, which was achieved thanks to the low-base effect – last year the cost of goods sold (COGS) was too high due to logistics and labor that had to be retained. This year, despite inflation, the company managed to effectively optimize these costs, resulting in a 540 basis point improvement in gross profit margin, which is a great deal, in my view.

I’m not just talking about COGS optimization here – the company managed to spend relatively less on operating expenses, too (marketing, SG &A, R&D) while increasing sales, which led to an improvement in the EBIT margin of more than 4 times or 910 basis points.

The company had to pay more taxes and interest, but that did not stop it from increasing its net profit margin fourfold in 1Q2023 compared to the previous year:

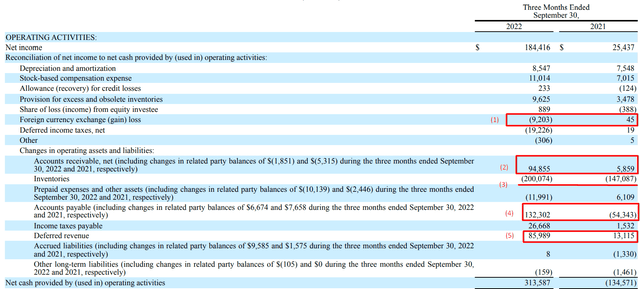

Looking at SMCI’s cash flow statement, I see a lot of quality improvements:

First (1), the company had a cash outflow (about $9.2M) from FX transactions in Q1 2023. I expect SMCI to have lower cash outflow in the next periods due to the revenue shift we saw this quarter (more cash will come from buyers in the US). This will have a positive impact on the level of cash flow from operating activities.

Second (2), we see a decrease in accounts receivable on the company’s balance sheet – this is a good sign that the company is receiving more of its revenue in real money (rather than credit). In my opinion, this is an indirect sign of high demand for the company’s products (its customers prioritize the purchase of SMCI products).

Third (3), inventories on the balance sheet are growing – this is another sign of high demand because the background is an almost 80% increase in revenue and higher margins. The selling prices for products are rising – the company produces more to compensate for the growing demand.

Fourth (4), accounts payable are growing, which means SMCI is spending less money to maintain and expand operations, and its partners are willing to provide it with essentially free capital to do so.

Fifth (5), SMCI’s deferred revenue – its growth on the balance sheet – symbolizes a kind of growth in the backlog. That is, this article speaks of the potential for revenue growth in future periods, which means that a nearly 6-figure increase from the cash flow statement can not help but rejoice.

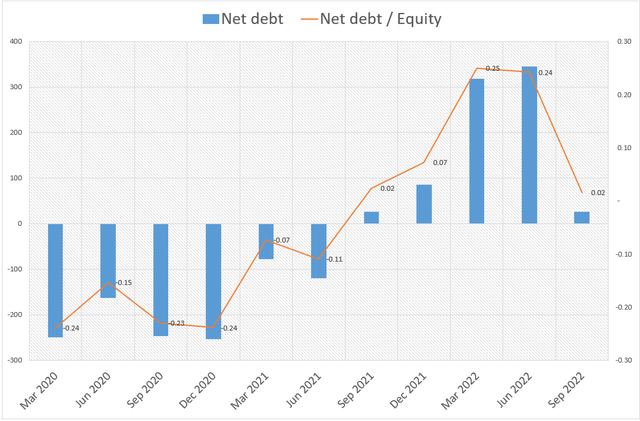

As for the company’s credit risks, these are currently mitigated by a reduction in short-term debt (-77%, QoQ) – this has led to a decrease in the net debt-to-equity ratio to 0.02x, which is approximately the same level as in September 2021.

Author’s calculations, Seeking Alpha data

In general, I like the state of the financial part of the company’s business – SMCI is actively growing, expanding, and at the same time is a very profitable company, with ROE (TTM) at above 32%.

Now let’s take a look at the company’s valuation and how the market views its growth prospects.

Valuation & Expectations

I usually look at the valuation of a particular company in a complex way, answering the following questions:

- How is the stock trading compared to its historical multiples?

- How is the stock trading compared to its peers and the industry?

- What is the margin of safety for potential investors in terms of intrinsic value?

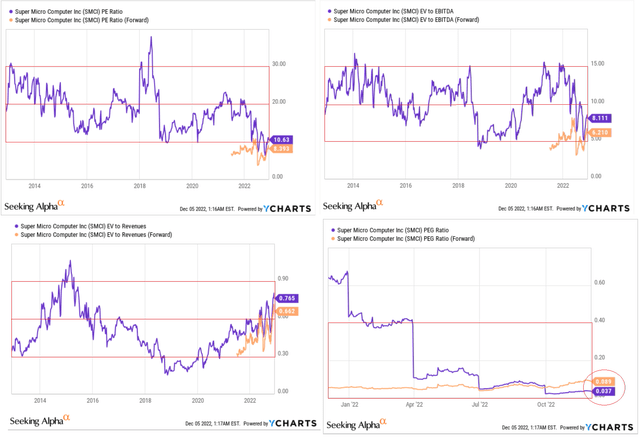

As for the first question, at today’s levels, SMCI looks quite attractive compared to its historical multiples. In terms of price-to-earnings ratios, the last time SMCI looked similarly depressed was in the early months of 2020, when the stock fell 40% off the local high due to the pandemic. The same goes for EV/EBITDA multiples:

YCharts & Seeking Alpha, SMCI stock, author’s notes

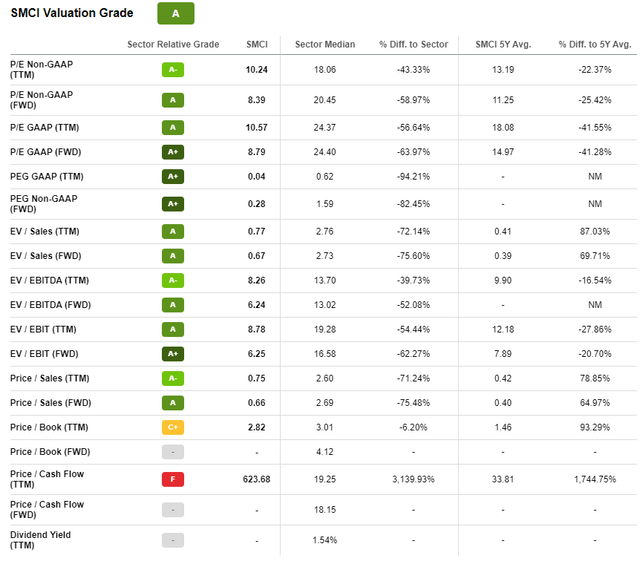

Based on the EV-to-sales multiples, SMCI appears a bit expensive and is approaching the upper end of its historical range. At the same time, however, we see that the PEG ratio (both TTM and forward) is at the lower end of its historical boundaries – meaning that SMCI deserves higher valuation multiples given its current earnings growth, which already shows in the EV/sales ratio but not yet on a EV/EBITDA and P/E basis. In my view, a widening of multiples is on the way once the company proves it can deliver steady growth leaning on end-market growth and a good balance sheet.

As for the company’s valuation relative to the sector, according to Seeking Alpha’s quant grade, SMCI looks like a strong “A” relative to the IT sector as a whole:

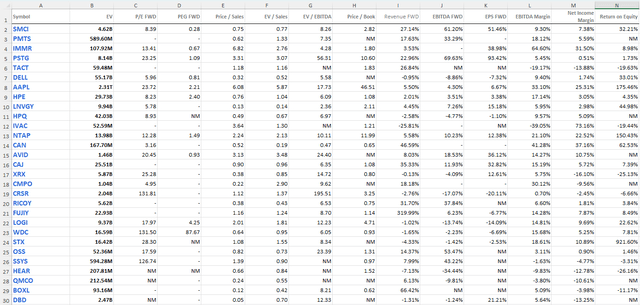

But if you look just at the whole sector, you are comparing apples with oranges, to use a well-known saying. In my opinion, we should look at SMCI and its valuation through the prism of the industry to which it belongs – that is the technology hardware, storage, and peripherals industry. It is good that Seeking Alpha allows us to download all the key figures of companies from this industry (26 in the sample) separately from the general sector. Here’s what the table I got looks like:

Excel table, author’s compilation, Seeking Alpha data

The sample included such large companies as Apple (AAPL), but also such nano-caps as Boxlight (BOXL), which can hardly be compared with the $4.62 billion SMCI. Therefore, I will leave only 10 of the 26 companies and remove 8 companies each from the upper and lower side of the statistical range of the sample (based on the enterprise values).

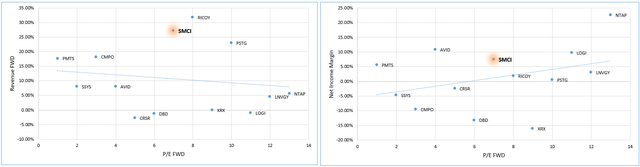

Author’s calculations, based on Seeking Alpha data

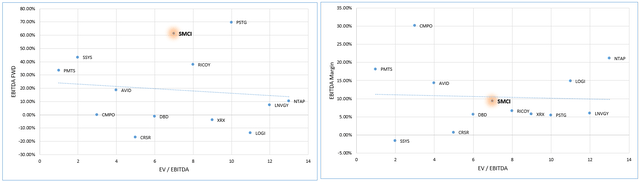

On the left chart above, I have plotted the positions of the remaining companies in the sample by forward P/E multiples (x-axis) and future revenue growth (y-axis). As we can see, SMCI is second only to Ricoh Company (OTCPK:RICOY) in terms of projected revenue growth, while the company is obviously second to none in terms of revenue growth relative to P/E. SMCI’s net margin suggests a fair valuation, and already here the company looks better than RICOY. Let’s make a similar comparison in terms of EV/EBITDA and EBITDA growth/margins.

Author’s calculations, based on Seeking Alpha data

SMCI has one of the highest EBITDA forward growth rates trailing only Pure Storage (PSTG) of the entire sample. But SMCI outperforms PTSG when comparing margin indicators, even though it has relatively average results compared to other industry representatives. Therefore, I conclude that SMCI’s valuation looks attractive on several factors, even after the insane rally we have seen this year.

In light of the above, it should be noted that management is conservative in its estimates of future operating results, which has allowed SMCI to consistently beat analysts’ forecasts (which are based on DCF models with management’s words as the base-case assumptions).

A prime example is how much the actual Q1 2023 EPS ($3.42) deviated from management’s guidance (range of $2.07 to $2.32). This huge variance in actual EPS from management’s forecast is due to SMCI’s “leading designs, innovative products, IT Total Solution, and strong global operations,” according to the latest earnings call transcript. That is, it was not a one-time event that led to such a massive earnings surprise – it was either an initially underestimated guidance or unexpectedly high demand and an accompanying increase in product prices.

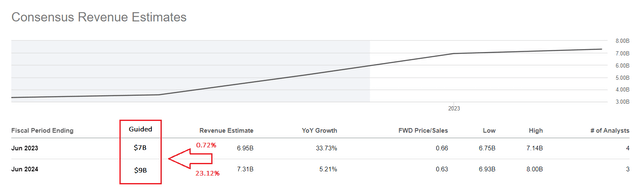

Be that as it may, the CEO Charles Liang gave us another revenue forecast for the December quarter (Q2 2023) and the fiscal year ahead (calendar 2023):

<…> I expect our fiscal Q2 revenue will be in the range of $1.7 billion to $1.8 billion, and our fiscal 2023 should reach $6.5 billion to $7.5 billion. Looking ahead, I anticipate fiscal year 2024 revenue may reach the range of $8 billion to $10 billion considering the current economic headwind may last for many quarters. As we continue to gain IT market share with the best rack-scale Plug-and-Play IT Total Solutions, I believe we will soon become a $20 billion revenue company. Our business model has been optimized, our engineering teams are fully ready, and our worldwide campus production capacity and efficiency are now second to none.

Source: CEO Charles Liang, Q1 2023 earnings call transcript [emphasis added by the author]

How do these forecasts compare with the predictions of Wall Street analysts?

We can clearly see analysts predicting a slowdown in the company’s revenue growth in 2024, with their forecasts differing by more than $1.5 billion (by 23%) from management’s projections. Either management is too optimistic or analysts are too pessimistic on revenue forecasts, and given how easily SMCI has beaten the Street’s estimates in recent quarters, I am leaning toward the second option – in my opinion, new upside earnings estimates revisions are not far away, which should give SMCI stock another round of growth.

The most important factor that should allow SMCI to meet or exceed its goal of becoming a $20 billion company in a few years is the high demand for its products. End markets are currently very strong, and even in the event of a recession, demand for business process optimization will not slow down. The data-oriented measures taken earlier to improve efficiency will become urgent measures for survival soon with the development of AI technologies and data analytics.

The processing of data and its subsequent analysis will continue to drive up demand for server storage. According to Technavo’s research, the server storage market share is expected to grow by $54.68 billion from 2021 to 2026, at a CAGR of 27.49%. Moreover, 43% of the market growth during the forecast period will come from North America.

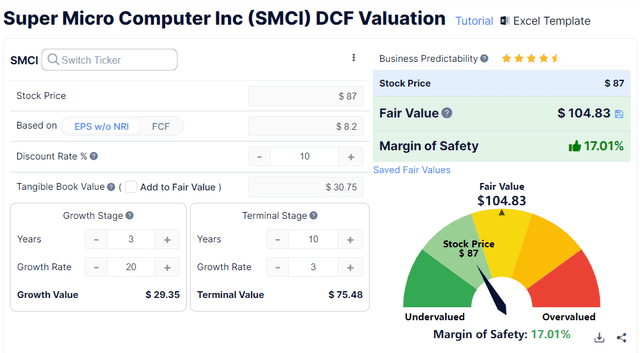

So if you answer the last question about the margin of safety from my framework for valuation (above), then we can say with certainty that SMCI has every chance of growing its EPS by ~20% over the next 3 years. At a terminal growth rate of 4% (10 years post-forecasting ) and a WACC of 10%, SMCI appears undervalued by 17% – assuming we do not see margin expansion in the future, which is entirely possible since a significant amount of debt is already reduced.

GuruFocus, SMCI, author’s inputs

So all of my “internal questions” in valuing a company indicate that SMCI stock is still undervalued despite its insane price performance – the expectations that are currently priced in seem to be off and promise further revisions and/or EPS surprises.

Risks to consider

First of all, you need to understand that SMCI produces products whose demand is highly correlated with the business cycle. The higher the economic growth, the higher the demand for server technologies, the higher the CAPEX, and so on. The same is true otherwise. As I noted in my recent article, “How To Position Your Portfolio For 2023,” I expect a recession next year, which poses some risks, particularly for SMCI.

The second risk, which is on the surface, is a variety of the company’s business relationships with other companies owned by SMCI’s CEO’s family members:

Ablecom and Compuware are both Taiwan corporations. Ablecom is one of the Company’s major contract manufacturers; Compuware is both a distributor of the Company’s products and a contract manufacturer for the Company. Ablecom’s Chief Executive Officer, Steve Liang, is the brother of Charles Liang, the Company’s President, Chief Executive Officer and Chairman of the Board. Steve Liang and his family members owned approximately 28.8% of Ablecom’s stock and Charles Liang and his spouse, Sara Liu, who is also an officer and director of the Company, collectively owned approximately 10.5% of Ablecom’s capital stock as of September 30, 2022. Bill Liang, a brother of both Charles Liang and Steve Liang, is a member of the Board of Directors of Ablecom. Bill Liang is also the Chief Executive Officer of Compuware, a member of Compuware’s Board of Directors and a holder of a significant equity interest in Compuware. Steve Liang is also a member of Compuware’s Board of Directors and is an equity holder of Compuware. Neither Charles Liang nor Sara Liu own any capital stock of Compuware and the Company does not own any of Ablecom or Compuware’s capital stock.

Source: From the latest 10-Q

This fact increases the risk of various conflicts of interest that can only increase the overall risk profile of SMCI.

In addition, a significant part of the business depends on Taiwan – the company is exposed to serious geopolitical risk, which can materialize at any time. This should be reflected in the discount rate – perhaps my assumption of a 10% WACC (above) is too optimistic and SMCI has no margin of safety (the company is fairly valued at 13-14% of WACC).

Bottom Line

Despite the obvious risks I described above, Super Micro Computer seems to me to be quite an interesting and promising business, currently trading below its fair price. At the same time, analysts are predicting rather modest growth rates over the next couple of years – this is at odds with what management said on the last earnings call. So I believe some new earnings revisions and/or EPS and revenue beats are very likely ahead – this will create the necessary conditions for the stock to grow in the direction it has already set for 2022.

I expect SMCI to be able to continue its margin expansions and revenue growth acceleration in 2023 due to increasing demand for its products as well as relief on the freight cost side – recession or not, the stock looks attractive to me for the next 1-3 years.

The stock’s positive momentum has helped it beat the (SPY) in 2022 – I expect 2023 to be no exception.

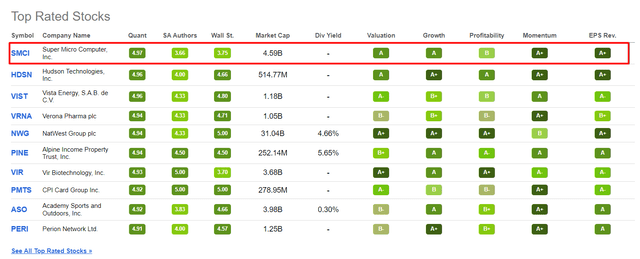

Seeking Alpha’s Quant Rating is aligned with my take, ranking SMCI stock first among the top 41 stocks:

Therefore, SMCI deserves your attention, in my view.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Top 2023 Pick competition, which runs through December 25. This competition is open to all users and contributors; click here to find out more and submit your article today!

Be the first to comment