Avi Rozen/iStock Editorial via Getty Images

It’s been a rough few months for the cryptocurrency market. No chain has been left spared by the carnage that risk assets have broadly experienced as a result of projected monetary tightening from the central bank. Aside from some of the Nasdaq tech darlings one might find in the ARK Innovation fund (ARKK), few assets have declined as deeply and as swiftly as some of the top crypto coins. Broadly, crypto market assets have had almost no reprieve from a market that currently wants to punish froth. Despite my bullish bias for most of last year and this year, I said this in my last Bitcoin (BTC-USD) article from mid-May:

To be clear, this is likely crypto winter. I’ll wear it. I’ve been wrong. I thought we’d see a six figure price tag on Bitcoin this year. I no longer believe that to be the case.

Mister market has a way of settling scores. Models that can sustain themselves in risk-on environments are being tested. Many are now justifiably failing. The collapse of Do Kwon’s Terra (LUNC-USD) ecosystem is a recent example. Now Celsius Network (CEL-USD) is halting withdrawals. Celsius, and the problems it faced, is an idea that I explored with Blockchain Reaction subscribers two weeks ago.

While there has been some speculation online that Michael Saylor and his massive Bitcoin position held through MicroStrategy (MSTR) will be the next dominos in the waterfall of crypto selling, others have pointed to the delays of “The Merge” in Ethereum (ETH-USD) as another possible focal point for bears.

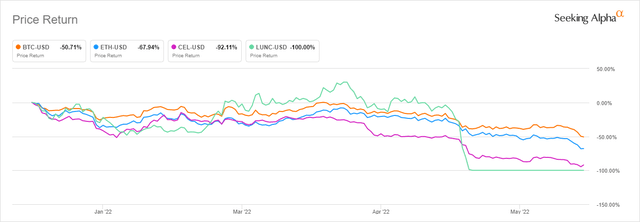

YTD Performance (Seeking Alpha)

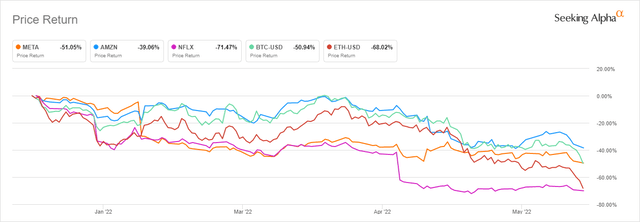

All of these assets have had an abysmal start to 2022, but while CEL and LUNC are down 92% and 100% year to date, both BTC and ETH are probably behaving more like FAANG stocks than failing CeFi platforms or stablecoin projects.

YTD Performance (Seeking Alpha)

In this article, we’ll go over some recent developments in the Ethereum merging saga and take a look at what the price action in Ethereum is telling me from a technical perspective.

The Merge

What is “The Merge?” The Merge is the rebranding of what was previously referred to simply as ETH 2.0. The Merge is a planned move of the Ethereum Mainnet from a PoW (Proof of Work) consensus to a PoS (Proof of Stake) consensus mechanism. The reasons for this change are because of the limitations to Ethereum’s scalability and sustainability under the current consensus mechanism. Right now the newer PoS “Beacon Chain” runs in parallel with PoW Mainnet. The Merge would be the combination of the Beacon Chain and the Mainnet into a single chain. It is described by Ethereum.org in this way:

Imagine Ethereum is a space ship that isn’t quite ready for an interstellar voyage. With the Beacon Chain the community has built a new engine and a hardened hull. When it’s time, the current ship will dock with this new system, merging into one ship, ready to put in some serious lightyears and take on the universe.

On the other hand, some critics in the crypto community have said what Ethereum developers are attempting to do with The Merge is more akin to changing the engine in a plane while the pilot is trying to fly it. Either interpretation should hopefully give readers a sense of the level of difficulty in what the developers are trying to pull off. That level of difficulty is likely why there have been delays in the PoS rollout.

The Difficulty Bomb

While the Beacon Chain is already live, expectations for the merging of the Beacon Chain with the Ethereum Mainnet have been met with delays. The estimate for The Merge is still 2022 according to Ethereum.org but an important milestone leading up to the chains merging was delayed over the weekend. That milestone is called the “difficulty bomb” and it has already been delayed previously.

The “difficulty bomb” is a mechanism that is designed to bring all of Ethereum’s PoW validators into the PoS mechanism. The bomb is a difficulty adjustment that increases to a level that makes it unprofitable to mine via PoW rather than PoS. This is in place to ensure that as many validators as possible migrate over to the new consensus mechanism. The problem with setting off the “difficulty bomb” before the merge is ready is if things go wrong, it could conceivably create a scenario where the network stops functioning entirely. Tim Beiko, an Ethereum developer said this on Friday after a developer call:

In short, we agreed to the bomb delay. We were already over time, and want to be sure that we sanity check all the numbers before selecting an exact delay and deployment time, but we are aiming for a ~2 month delay

The developers are now shooting for an August deployment of the difficulty bomb. While the developers were able to go PoS on Ethereum’s Ropsten testnet last week, until the difficulty bomb happens, Mainnet PoS is seemingly delayed as well. Delays in Ethereum’s PoS rollout are likely not the biggest reason for the weakness in ETH, but I don’t think the delays are helping things either.

Price Action & Network Activity

As we have seen quite clearly over the last 48 hours, the crypto markets can rise and fall incredibly fast with top coins like Bitcoin and Ethereum moving 15-20% in a single session. Given that, I think it’s important to view these coins with a longer time frame in mind.

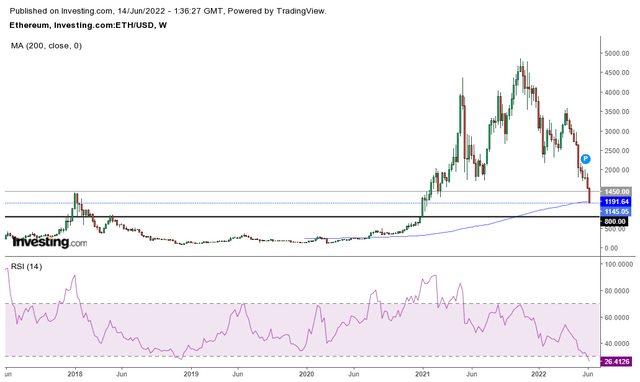

ETH Weekly Chart (Investing.com)

ETH is now trading right under the 200 week moving average. While there is less price history in ETH, the 200 week MA is a level that has previously served has support for BTC. BTC is also slightly underneath that level as of article submission. ETH is more oversold now on the weekly chart than it was when it bottomed after the 2017 bull cycle and more oversold than during the COVID crash. In my opinion, failure to regain the 200 week MA over the next few days could set up a sell off to $800. However, from a network activity standpoint, Ethereum doesn’t look bad.

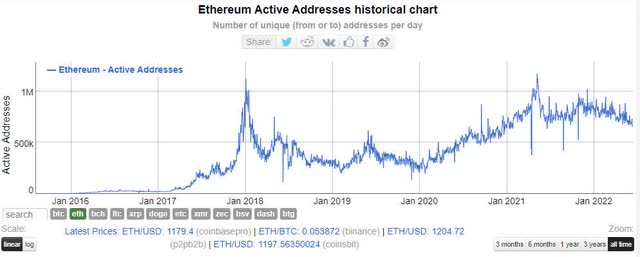

ETH Active Addresses (Bitinfocharts)

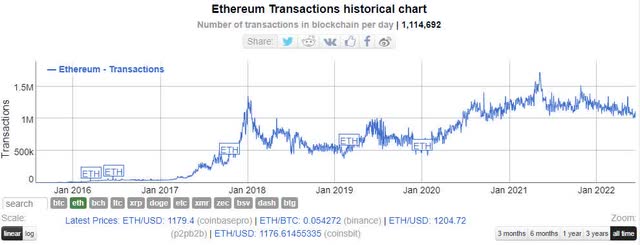

Active addresses are still near cycle highs, average transaction fees have come back down to earth, and transactions per day are still near highs.

ETH Transactions per day (bitinfocharts)

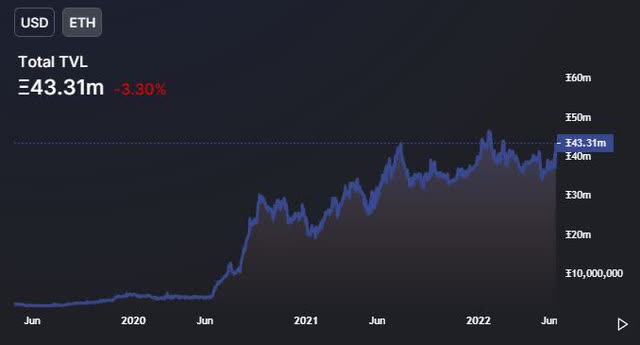

Beyond that, Total Value Locked on the network is up 9% year to date measured in ETH. This means that despite the selloff in crypto prices, DeFi users are still using the network for staking purposes.

Summary

This crypto selloff has been relentless. For Ethereum specifically, bears have been in total control for 11 straight weeks. The macro backdrop is not one that is supporting any risk assets. The Fed’s rate hike announcement still looms this week. The continued drama surrounding Celsius Network is something to keep an eye on as well. But if you dollar cost average into crypto positions, this level might be a good area to add. If you’re a shorter time horizon buyer who likes to flip on rips, you might wait for a more clear indication of a bottom.

Be the first to comment