Dragan Mihajlovic/iStock via Getty Images

Midstream Sector Performance

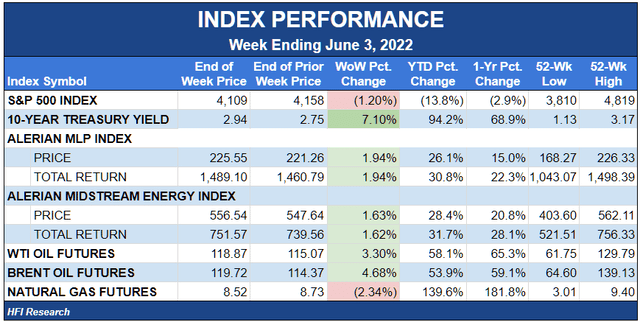

Midstream closed out the month of May up 7.7%, the sector’s second-best monthly performance of the year after January’s 11.1% gain. For the year, the sector is up 30.8% on a total-return basis, a whopping 44.6% over the S&P 500’s year-to-date loss of 13.8%.

For the week, midstream rose 1.9%, again beating the S&P 500’s 1.2% loss. Midstream equities got an assist from oil prices, which increased for the sixth consecutive week.

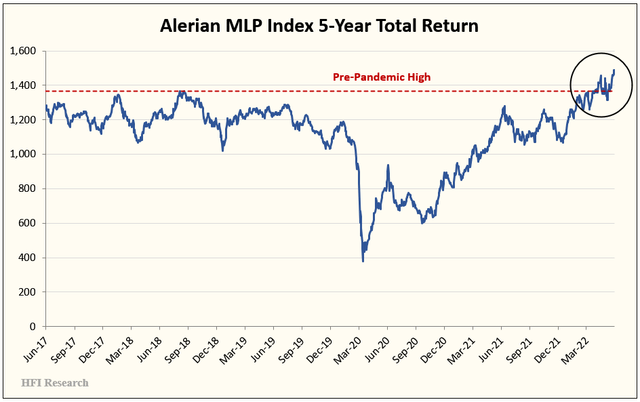

The past three weeks have seen the Alerian MLP Index (AMLP) break out solidly to the upside, buoyed by improving fundamentals and the brightening outlook for increased return of capital to equity owners.

Despite the higher equity prices, we believe most midstream equities are not overpriced and that bargain opportunities are still plentiful.

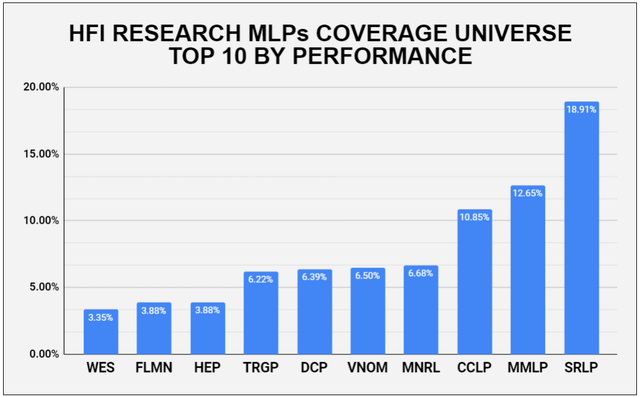

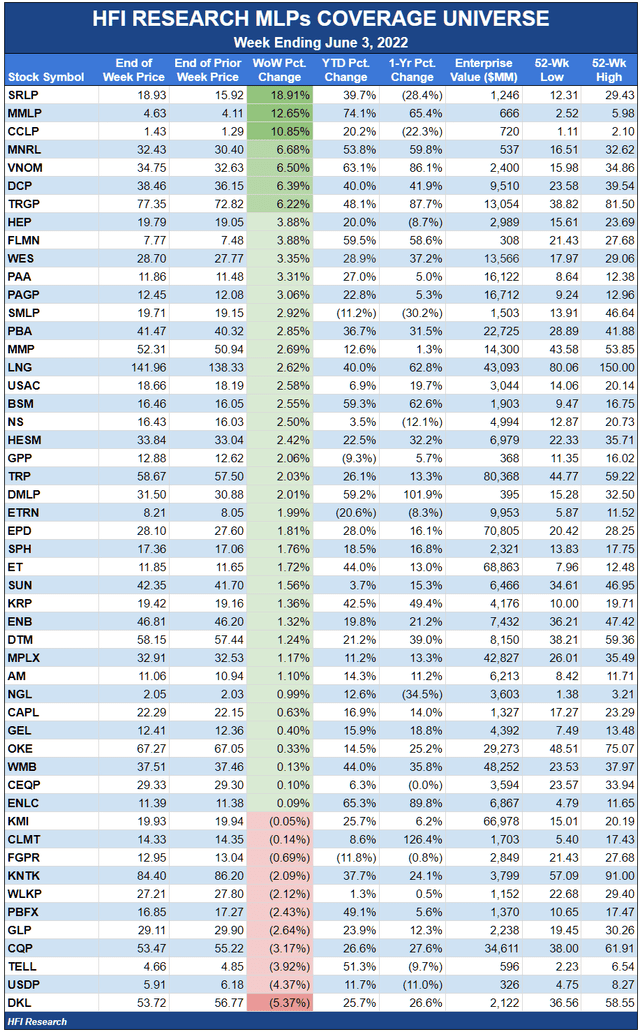

The biggest mover to the upside during the week was Sprague Resources (SRLP), which received a sweetened bid from its sponsor, Hartree Partners, LP. Hartree’s bid of $19.00 in cash was 27.3% higher than its initial bid on January 10. The news sent SRLP units up 18.9% during the week.

There was no particular pattern among the other strong performers. CSI Compressco (CCLP) surged 10.9% higher on no news after underperforming for a few weeks. Commodity-exposed mineral and royalty interest owners Viper Energy Partners (VNOM) and Brigham Minerals (MNRL) were supported by higher crude prices.

There was also no pattern among decliners, with several equities, such as Delek Logistics (DKL), exhibiting weakness after a streak of recent outperformance.

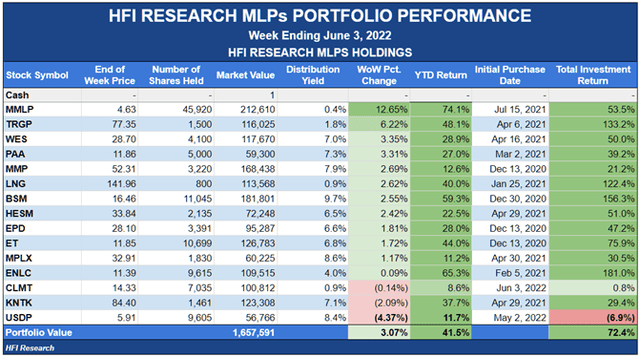

Weekly HFI Research MLPs Portfolio Recap

Our portfolio outperformed its benchmark, the Alerian MLP Index, by 1.2% during the week.

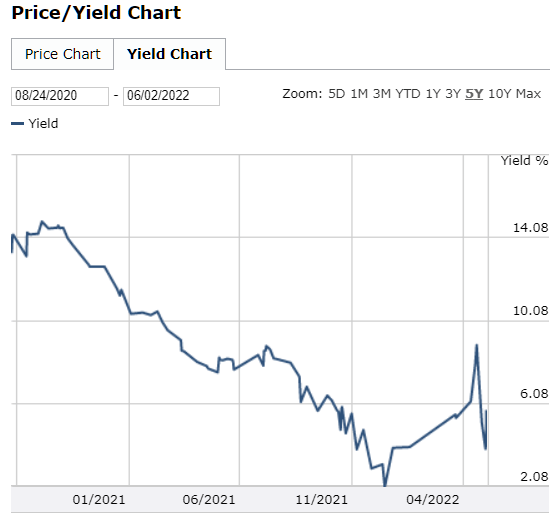

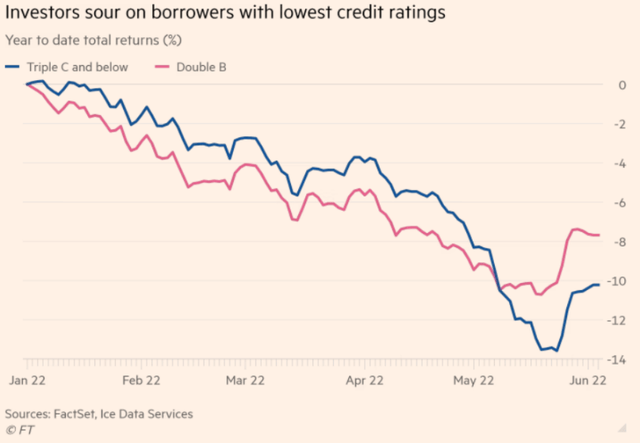

The outperformance was due in large part to Martin Midstream’s (MMLP) 12.7% gain on no fundamental news. We suspect the units received a bid as the high-yield bond market calmed down after a multi-month selloff that pushed yields higher. The price decline accelerated in May, causing high yield issuance to dry up. As the chart below shows, the past two weeks saw sentiment improve and prices stabilize.

Source: Financial Times, “Pressure builds on riskiest corner of US junk bond market,” June 4, 2022.

The general bond market downturn presented a headwind for MMLP to refinance its 2024 and 2025 debt maturities. This was particularly the case during the bond market selloff in early May, which we believe was behind the equity’s weakness. We’d note that the company’s Chairman, Martin Ruben, stepped up his purchases of MMLP units during this time.

The following chart shows the yield on MMLP’s second-lien notes due 2025 surging over recent months before falling back during the past two weeks.

FINRA

We expect MMLP’s Adjusted EBITDA and cash flow generation performance to result in continued de-levering, though we believe the positive leverage trajectory isn’t appreciated in the market. It will probably take a quarter or two of the company demonstrating improving fundamental performance for the market to catch on.

We’re not concerned about MMLP’s ability to refinance its bonds. Hopefully, the high-yield market will cooperate in the near term and allow the company to refinance at attractive rates shortly after its bonds become callable in mid-August.

Targa Resources (TRGP) also contributed to our portfolio’s outperformance, ending the week up 6.2%. TRGP had underperformed over the last few weeks during a bout of insider selling. This week, the company had no news, and we assume its stock’s bounce-back was just a catch-up from recent underperformance.

On the negative side, Kinetic Midstream (KNTK) was weak on no news, while USD Partners (USDP) units traded lower to reflect currently tepid crude-by-rail activity.

At the tail end of the week, we added a new holding, Calumet Specialty Products Partners, LP (CLMT). See our write-up here and our trade alert here. We believe the units offer limited fundamental downside and multi-bagger upside while also diversifying our portfolio away from commodity price exposure.

News of the Week

June 1. New export capacity at Venture Global’s Calcasieu Pass LNG terminal in Cameron Parish, Louisiana, and higher LNG production from Cheniere Energy (LNG) drove U.S. LNG exports to their second-highest monthly rate, according to Refinitiv Eikon. Volume rose from 6.93 million tons in April to 7.29 million tons in May, or 12%, on increasing sales to Europe and South America. As international natural gas demand grows as a consequence of the mad dash to renewables, U.S. LNG exports are poised to grow for years. LNG exports will be a long-term structural driver of higher domestic natural gas production, which, of course, will require more midstream infrastructure. We have positioned our portfolio in favored gathering and processing companies to benefit from this trend. We also hold Cheniere shares and recommend them as a “Buy” for the company’s growth prospects attributable to increasing global demand for LNG.

June 1. Suburban Propane Partners, LP (SPH) announced an agreement with Adirondack Farms in Clinton County, New York, to construct, own, and operate a new biodigester system to produce renewable natural gas. The project expands SPH’s portfolio of clean energy investments under its new Suburban Renewable Energy subsidiary. While we commend SPH for trying to stay at the forefront of the consumer-facing energy transition, it remains to be seen whether its investments will generate satisfactory returns to its equity owners.

June 2. Sprague Resources (SRLP) announced that its sponsor, Hartree Partners, LP, will acquire all the outstanding common units it did not already own. Hartree is offering $19.00 per unit, representing a 27.3% premium to Hartree’s prior offer to acquire all of SRLP’s units on January 10, 2022. Hartree currently owns 74.5% of SRLP units. The transaction is expected to close by the end of the third quarter of 2022.

June 3. The Biden administration is ordering refiners to increase the use of biofuels in the nation’s fuel supply. The EPA is requiring refiners to mix 20.63 billion gallons of renewable fuels into gasoline and diesel in 2020, representing a 9.5% increase over 2021. The measure is aimed at tamping down gasoline and diesel prices but will also have the effect of pushing up food prices. The news is likely to increase the market price of RINs, providing a headwind for certain refiners’ financial performance. The administration also announced that it would provide $700 million through the CARES Act to support biofuel producers “who faced unexpected market losses due to the Covid-19 pandemic.” These policies show the U.S. administration following its European counterparts in prioritizing decarbonization over virtually every other political priority. Our newest holding, Calumet Specialty Products Partners, LP (CLMT), is converting its Montana refinery to renewable diesel production. CLMT’s refinery wasn’t producing biofuels during Covid, so it will not be eligible to receive this latest round of funding. However, the administration’s willingness to dole out taxpayer money in support of renewable fuel operations illustrates a potential financial benefit for renewable diesel manufacturers—such as CLMT—in the future. We’re less bullish on the implications of these policies for the U.S. at large, as the refinery conversions from petroleum to renewables that they incentivize are likely to worsen the ongoing shortage of domestic petroleum refining capacity.

Capital Markets Activity

May 31. Equitrans Midstream announced a private offering of $500 million of senior notes due 2027 and $500 million of senior notes due 2030. The company plans to use the proceeds to tender for its 4.75% senior notes due 2023, its 6.00% senior notes due 2025, and its 4.00% senior notes due 2024.

June 1. Kinetik Midstream (KNTK) announced that it had priced $1.0 billion of senior notes due 2030 at 99.588% of par. The notes pay interest at the rate of 5.875% per year. The interest rate is liked to KNTK achieving “sustainability” targets related to emissions and the representation of women in its executive ranks. KNTK intends to use the proceeds to refinance all its existing indebtedness. The offering is a major step in KNTK’s efforts to refinance its legacy EagleClaw and Altus Midstream obligations to those of a standalone entity. We hold KNTK and think it remains one of the best-positioned gathering and processing operators.

June 1. Tellurian (TELL) announced that it agreed to sell $500 million of senior secured convertible notes, which will bear interest at 6.0% per year and will be convertible on May 1, 2025 to shares of TELL stock at an initial conversion price of $5.724. While the offering brings the company closer to securing the financing necessary to FID its Driftwood LNG project, it comes at a steep price, representing 16% dilution at the initial conversion price. We’ve long been concerned about dilution capping the upside of TELL shares, and we believe further dilution is likely. Dilution risk and execution risk are high enough with TELL for us to recommend avoiding the shares.

Be the first to comment