NoDerog/E+ via Getty Images

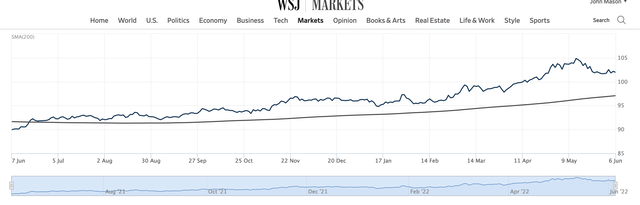

The U.S. dollar has been rising in value for the past year… although it is now down around 2.0 percent from its May peak.

U.S. Dollar Index (DXY) (Wall Street Journal)

The primary reason?

Julia-Ambra Verlaine writes in the Wall Street Journal that some asset managers:

“are now wary that the Federal Reserve might have to slow the pace of expected interest-rate increases.”

“Investors expect the Fed to lift rates by a total of a percentage point in June and July, but what will follow is harder to determine.”

“As a result, traders now contend that the dollar is more sensitive than usual to economic releases on the horizon.

Steve Englander, head of North American macro strategy at Standard Chartered, now claims,

“I think the dollar has topped out.”

Almost everything these days seems to be based on what the Fed might do or what it might not do.

The Fed is dominating market performance.

The Rising Dollar

The value of the U.S. dollar has been rising since June 1, 2021.

At that time, the Fed was still purchasing $120.0 billion in securities outright every month.

But, it seems that at that time, Fed Chair Jerome Powell and the Federal Reserve Board finally convinced investors that the Fed was going to begin tapering its purchases in the near future and would begin to raise its policy rate of interest once the tapering had begun.

Note that tapering did not begin until the end of the year and the first increase in the Fed’s policy rate of interest did not come until March 16, 2022.

The battle during the summer and fall of 2021 was about whether the Fed would begin to taper or not and about whether or not the higher rates of inflation that were being experienced were only “temporary.”

But, traders in the foreign exchange markets seemed to have become convinced by June that the Fed was, in fact, going to taper its purchases and was going to raise its policy rate of interest.

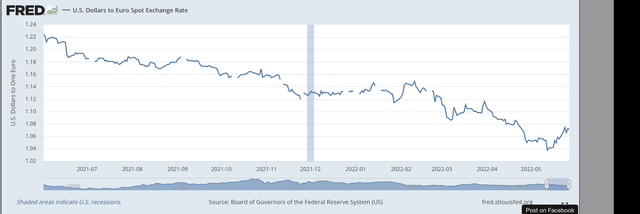

Here is the exchange rate of the U.S. dollar against the Euro. One can see the U.S. dollar began to rise against the Euro around June 1, 2021 and continued into May 2022. (Note, the declining price shows a rising value of the dollar relative to the Euro.)

U.S. Dollar/Euro Exchange rate (Federal Reserve)

One can see that the rise in the value of the dollar was very steady throughout this time period… until May 2022.

Rising Dollar Hurts US Manufacturers

A strong dollar hurts U.S. multinational companies.

The products of these companies rise in price with the rise in the value of the dollar.

Microsoft Corp. has already noted how it expects its profits to be hurt.

Furthermore, JPMorgan analysts are projecting a slowdown in the performance of the U.S. manufacturing sector due to a decline in its exports to the rest of the world.

And, as long as the dollar remains strong, the impact, in the short-run will grow.

Data Watching

These changes, however, have also produced a shift in what analysts are looking for in recent data. That is, analysts are looking for data that will cause the Federal Reserve to back off from further increases in its policy rate of interest.

Just last week, the U.S. Labor Department reported a 390,000 job addition to the jobs market. This was above the 328,000 that was expected by economists.

Furthermore, there are signs that the U.S. housing market may be cooling.

The analysts are looking for any sign that might result in the Federal Reserve backing off its aggressive anti-inflation stance.

Jerome Powell has signaled to the markets during his tenure as the Chairman of the Board of Governors of the Federal Reserve System that he is very sensitive to the possibility of economic shocks that might send the financial markets and/or the economy into a tail-spin.

Mr. Powell has always seemed to want to err on the side of monetary ease, rather than take bigger risks of running into an unexpected shock.

Consequently, the investment community seems to have a concern that Mr. Powell might pull back from the Fed’s policy combatting inflation earlier rather than later.

Good news, even in small bundles, might lead the Fed chairman to postpone efforts to raise the Fed’s policy rate of interest or reduce the size of its securities portfolio.

Thus, pieces of data, like those mentioned above, could encourage Mr. Powell to reduce the size of rate increases, postpone when the rate increases might take place, or, result in the Fed reducing the amount of securities it lets run out of its portfolio every month.

Investors seem very quick to react to even little pieces of good news, believing that it will support Mr. Powell pulling back from the inflation battle too soon.

Ms. Verlaine paints this picture in her Wall Street Journal article.

“Traders say the dollar is sensitive to any scaling-back of the rate path.”

The Future Of The U.S. Dollar

Given Mr. Powell’s past history as Fed chair, who can argue against this concern that he will “back off” from the Federal Reserve tightening?

It is just this concern that will introduce more volatility into the market value of the dollar. This is just something that traders are going to have to put up with.

My own belief is that the Fed will, in one way or another, have to move further along the tightening path because its policy rate of interest is going to have to go higher than a lot of people believe it will have to go at this time.

The Fed may back off here or there, but this will only complicate the battle against inflation and prolong the fight.

On the other hand, as I have written elsewhere, I believe that Fed actions that will support a strong U.S. dollar are a very, very good thing for the U.S. economy.

Yes, it will hurt U.S. manufacturing in the short run. But, history shows, that those nations that support a strong currency result in producing a more productive economy… a stronger and more competitive economy.

This, we all should be for.

Be the first to comment